The 3 traits of a winning small cap (and 10 stocks that possess them)

Once upon a time, a company that produced high-quality earnings, a strong customer book, had little to no debt on its balance sheet, and had a plan to allocate capital back to its investors was a surefire way to see your share price appreciate. Run the business well and the share price will take care of itself.

But while that formula has been muddied by a slew of macro and technical factors in recent years, that doesn't mean there isn't reason to be optimistic, says Tony Waters, Principal and Portfolio Manager at QVG Capital.

"We are now seeing the equity risk premium get back to historical norms ... We are seeing some real opportunities now from a valuation standpoint in the small cap end of the universe," Waters said.

This sentiment was backed up by his colleague Chris Prunty:

"We think some of the headwinds we've faced in the last few years may turn into tailwinds in the foreseeable future. I'll use the phrase 'cautiously optimistic'," he said.

Recently, Prunty and Waters were joined by their colleague Josh Clark for a wrap of the last three months in markets. They discussed some of their successes as well as one big detractor from the last few months. Plus, Clark talked about the alpha that can be generated from shorting individual stocks. We'll also touch on that in this wire.

10 all-cap winners - and the traits they have in common

While the QVG Capital team have a bias toward small and mid-caps, you can't run away from having at least some exposure to large caps. In fact, large companies show up quite often in the QVG Capital Long-Short Fund's top 10 performers (long positions):

The top four of these 10 businesses are all inside the ASX 100, proving that having an all-cap mandate does make a difference. But 8 of the 10 businesses, across market capitalisation, have one important trait in common:

"It's just dripping with sustainable competitive advantage. So, Aristocrat, HUB24, WiseTech, Fisher and Paykel, and Life 360 have all spent a significant amount of R&D dollars on what are now market-leading products. They're reaping the benefits in terms of high returns on capital and high earnings per share growth. PSC Insurance, Supply Network, and GYG also have their own form of competitive advantage, albeit I would argue that has a bit more to do with market position and operational excellence," Clark said.

All of these companies also have two other long-term traits in common, as Waters explains.

"When we talk to companies every day, the focus is on how well they're allocating their own shareholders' capital and how efficiently they're doing that. That should lead to an improved or better return on invested capital with a strong balance sheet," Waters said.

"The culture of management, each and every day, should be coming to work and finding business improvements where they can get ahead of their competition and sustain and increase the moat of their businesses and sustain those returns on capital," Waters added.

But it's not all sunshine and roses

How easy would it be if investing was just green on the screen, bottom-left and top-right charts all the time, hey? Well, for those who have been around the market for more than a few seconds, you work out very clearly that this is not the case.

Prunty highlighted two firms that had a good investment case going in - but were punished upon their results.

One of those was one of QVG's largest holdings by individual stock - Johns Lyng Group (ASX: JLG).

"It delivered a very low-quality result and the second one was an outlook well below consensus expectations. Secondly, the company issued an outlook that was well below consensus, which really confused the market given Johns Lyng had made acquisitions that ought to have contributed to earnings in FY25," Prunty said.

"The way the market is interpreting the result is that the company's level of organic growth is unclear at the moment. That's not helped by a lack of segmental reporting. Our view is that the company has shown a good track record of organic growth in the past. Our understanding is that the acquisitions are contributing, but until Johns Lyng segments that out so we can determine both the performance of those acquisitions and the level of organic growth, the stock is in the sin bin," Prunty added.

The fund still holds Johns Lyng but at a much lower weight compared to pre-result.

Another relative underperformer that the team remain positive on even after a tough result is Hansen Technologies (ASX: HSN). The ex-ASX 300 software company reported a new metric called "underlying cash EBITDA" which one webinar viewer even described as "dubious". Moreover, fresh concerns have been raised about when its acquisition of telco billing business powercloud GmbH will break even.

The first "dubious" question was immediately debunked by Prunty who argued it was a sign that "the accounts will be cleaner going forward."

"For the first time in their history, they acquired an unprofitable business, albeit did so at what we think will be less than 1x revenue, which is a bargain for these sorts of businesses. The challenge for them over the next 18 months is to get that business to break even and beyond and we have a high degree of confidence that they'll do so," Prunty said.

Waters added:

"We think it's a great position to be buying Hansen and we have [been over] the last 12 months."

The value of short positions - when done correctly

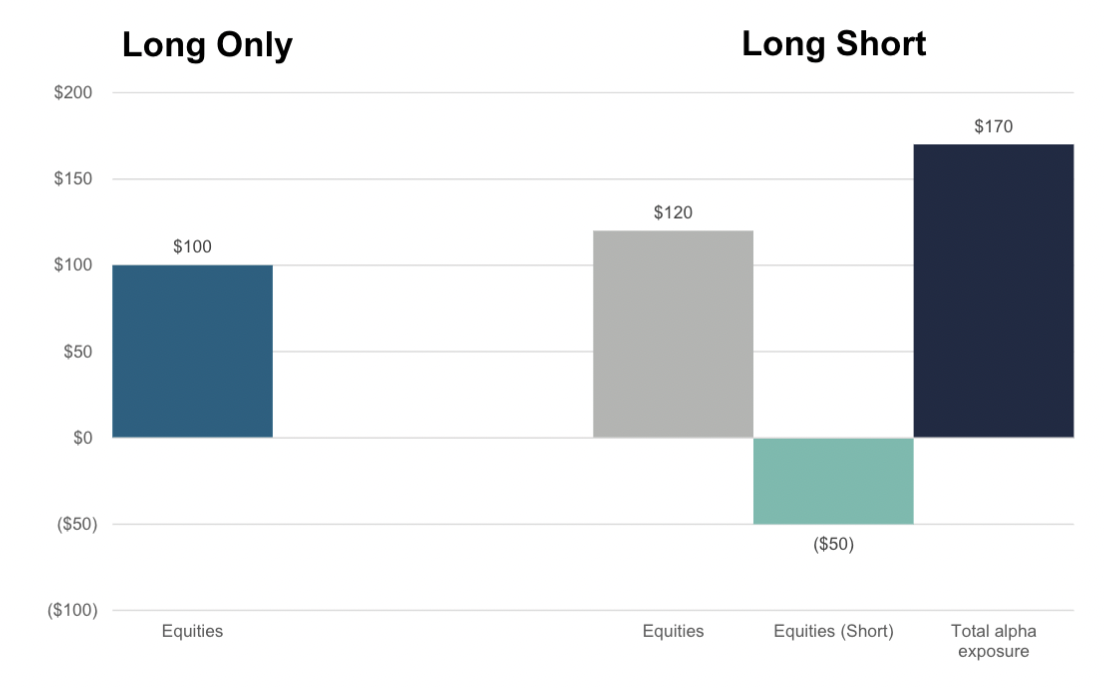

Of course, going long and big on your best ideas is not the only way to make money in this market. Shorting companies that you think don't have quality earnings or are about to be met with bad news is also a highly profitable (albeit much riskier) method of generating alpha.

But when done right, shorting particular stocks could net you a lot of extra alpha, as the following chart shows:

One such short example that has paid off is Cettire (ASX: CTT). The high-end fashion retailer has been the subject of a lot of press over corporate governance concerns. Media reporting questioned whether the retailer was paying duties on all its imports, its US tax arrangements, the security of its supply chain, and even its ability to declare its earnings on time at all.

"Where there's smoke, there's fire," Clark said. "Sometimes, you come across a business model where there are just so many question marks around the sustainability of that business model. That's certainly how we felt about Cettire, and ultimately, we just followed the lead of the founders by selling stock in that one," he added.

You can read more about the Cettire story in this piece written by my colleague Ally Selby.

Other short positions that paid off this quarter were in Weebit Nano (ASX: WBT), which Clark described as a "concept stock" and Tabcorp (ASX: TAH) where concerns over its balance sheet and CAPEX have led to some question marks about its future.

13 stocks mentioned

2 contributors mentioned