The $30 billion investment opportunity in Australia’s power grid

Underpinned by the energy transition, Australia’s energy demand is set to nearly double to 320 terawatt hours (TWh) by 2050, from 180 TWh currently. This is driven by population growth, economic growth, and the replacement of fossil fuel energy sources with electrically-powered equivalents.

New generation capacity

Australia’s demand growth expectations, coupled with federal goals of achieving 82% renewable electricity generation by 2030 (up from about 35% today) and net zero by 2050, require substantial investment in new renewable generation capacity.

Security of supply

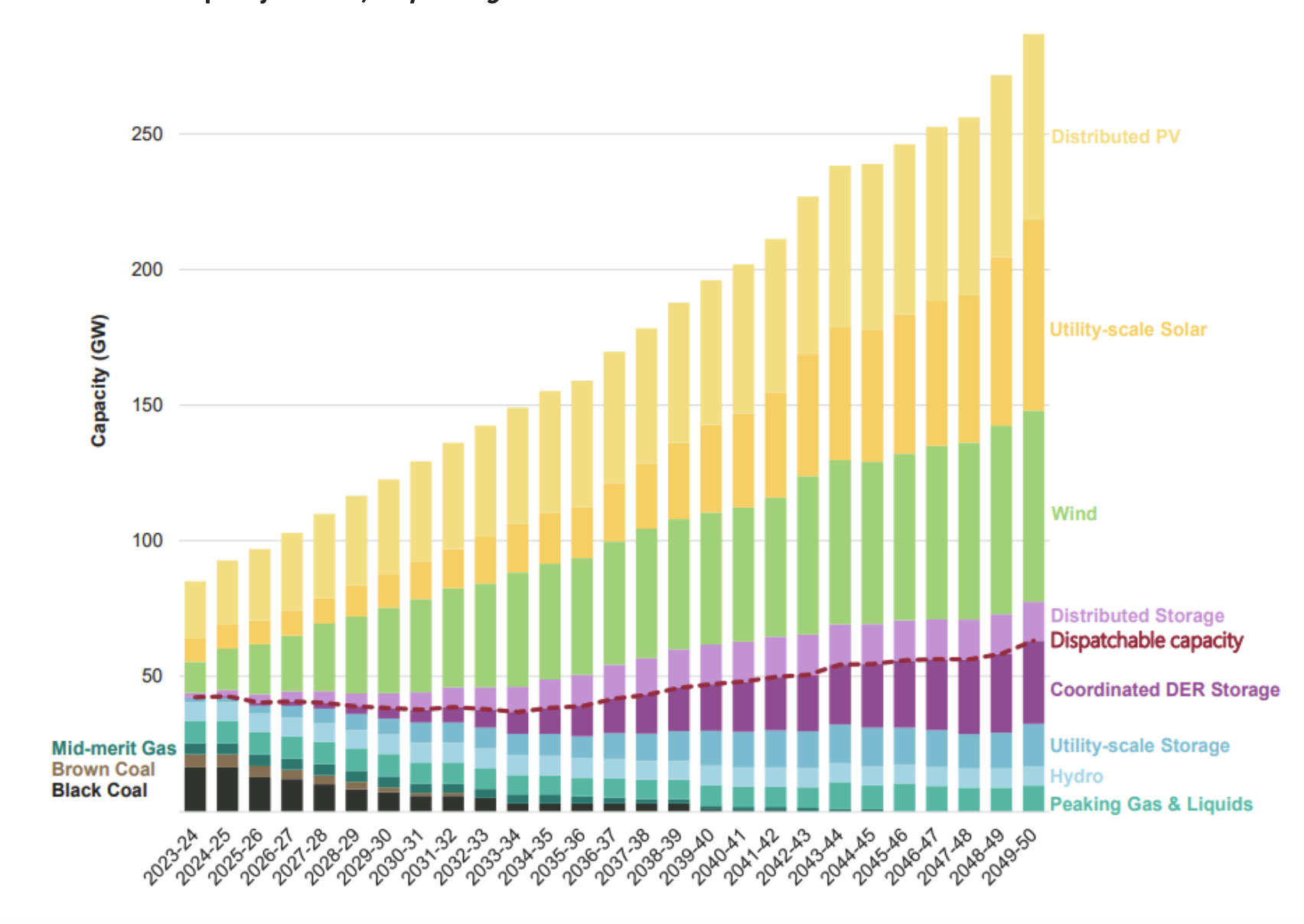

As fossil fuel generation decreases in importance, and intermittent renewable generation starts to dominate, investment in low-emission firming and dis-patchable capacity is also required. Currently, the National Energy Market (NEM) relies on 23 GW of dis-patchable firm capacity from coal-fired generation, 11 GW from gas-fired and liquid-fuelled generation, 7 GW from hydro generation, and 1.5 GW from other dispatchable energy storage.

AEMO’s optimal development path calls for the NEM’s firming capacity to increase to 63 GW by 2050, including the replacement of coal-fired generation. This translates into approximately 43 GW of new firming capacity.

Forecast NEM capacity to 2050, Step Change scenario

There are several challenges that are key to Australia’s evolving power grid, including:

Capacity constraints – Congestion occurs when overloaded transmission lines are unable to carry additional electricity flow without exceeding thermal, voltage and stability limits designed to ensure reliability and maintain the integrity of the system.

Technology evolution – Newer renewable energy projects, especially large-scale ones, often operate at higher voltages than the existing transmission network was designed to handle, resulting in suboptimal utilisation of power outputs.

Interconnection – The decentralisation of renewable resources and an increasing composition of renewable capacity to the generation fleet heightens intermittency risk. We’ve seen multiple examples of this, including earlier this month, when severe weather damaged transmission lines in Victoria, which prompted the 2.21 GW Loy Yang A power (which generates approximately 30% of Victoria’s power requirements) to drop offline. More than 500,000 customers were impacted and left without power. At the time of the outage, Victorian wholesale power prices increased to $16,600/MWh, compared to $60.39 in Queensland and $299.98 in NSW.

Other challenges include:

- Topography – The vast geographic dispersion of renewable energy sources to demand centres and to existing transmission infrastructure, and

- Ageing infrastructure – Our ageing network must also be upgraded or replaced, at the same time as new infrastructure is built.

How big is the investment opportunity?

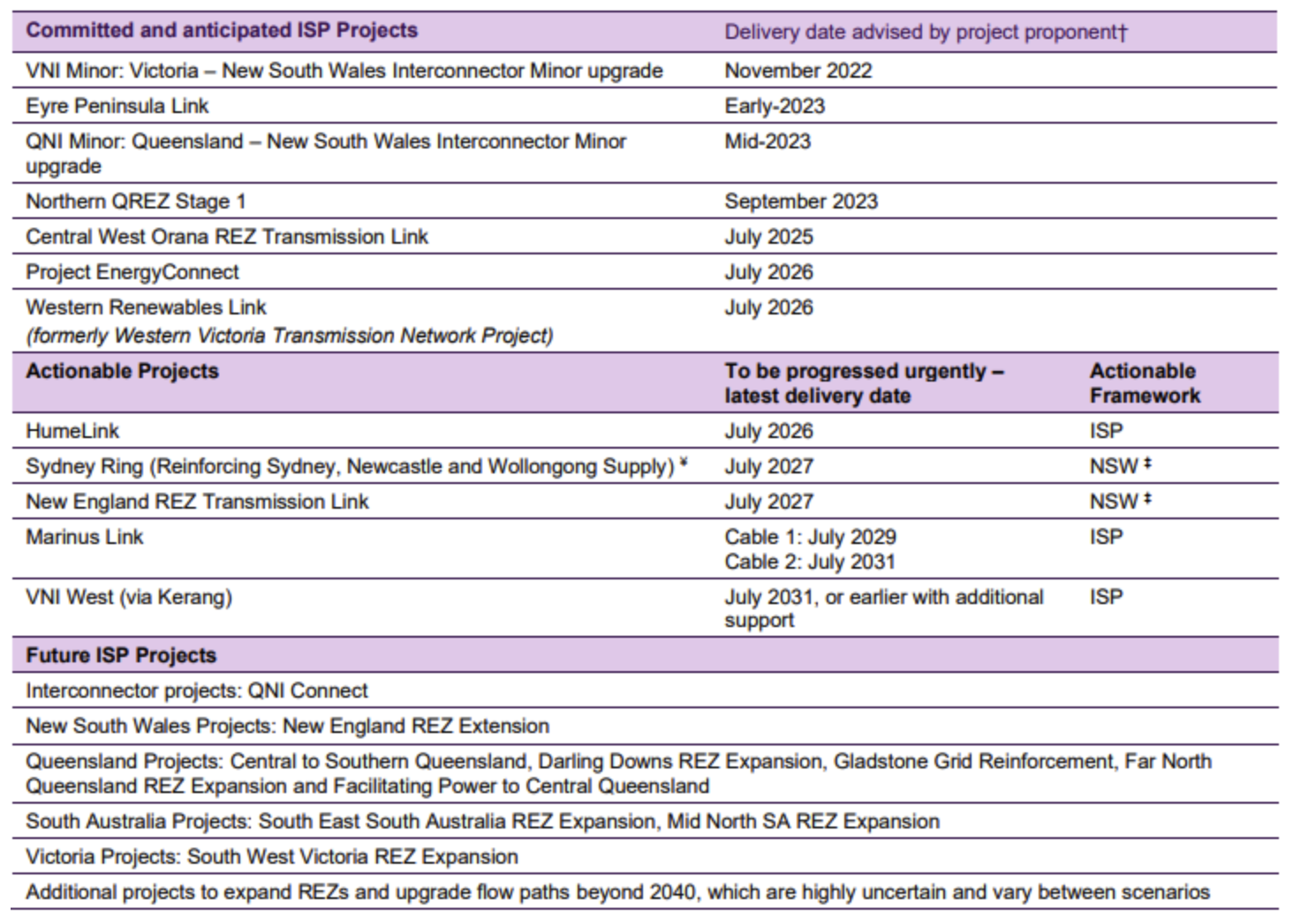

Australia needs to invest approximately $30 billion in transmission infrastructure out to 2050, according to AEMO’s optimal development path within the 2022 ISP. While this represents just 9% of the total A$320 billion forecast investment required in the electricity system out to the same period, it’s essential to ensure that the rest of the system targets can be realised.

These new lines would represent around 25% of the length of the existing transmission network today and are more than twice the distance across Australia at its widest point (4,000 km).

Five key transmission projects in NSW, Victoria and Tasmania

Collectively, these projects will cost around $14 billion, however, are forecast to deliver net market benefits of A$28 billion (returning more than two times their cost), enable energy transition by unlocking over 20 GW of new renewable generation capacity, and manage key risks identified above.

- HumeLink is 360 km of new transmission lines and new or upgraded infrastructure which will connect Wagga Wagga, Bannaby and Maragle. The project is estimated to cost around A$3.3 billion[1]. HumeLink will provide capacity for circa 2.6 GW of additional renewable generation to connect to the network.

- VNI West (Victoria to NSW Interconnector) is a proposed new 500 kV double circuit transmission line connecting New South Wales and Victoria. The final route for the New South Wales section of the VNI West is yet to be finalised, however, the total length of the project is expected to exceed 800 km and cost approximately $3.5 billion[2]. The project will support upwards of 3.4 GW of new renewable generation capacity.

- Marinus Link is a $5.1 billion, 340 km electricity and telecommunications inter-connector between Tasmania and Victoria. Marinus Link will support 1.5 GW capacity, equal to the power supply for 1.5 million Australian homes.

- The Sydney Ring is a $1.5 billion proposal to link New South Wales’ coastal load centres with the state’s various renewable energy zones. The project will link EnergyConnect, HumeLink and VNI West via new 500 kV transmission lines from Bannaby into the Sydney western suburbs connecting to the ‘inner’ 500 kV system, increasing transfer capacity by approximately 5 GW.

- The proposed $1.3 billion New England Transmission Link aims to support the delivery of the New England Renewable Energy Zone (REZ) in the New South Wales New England region. The REZ has an intended network capacity of 8 GW and is expected to deliver up to $10.7 billion in private sector investment.

Conclusion

Efficient and timely investment in transmission networks is essential for unlocking new renewable capacity and is a key enabler of other areas of the energy transition and the ultimate electrification of Australia. A concerted effort from government, regulatory bodies, private investors and communities towards developing transmission infrastructure is required, as the cost of inaction will compromise achieving more affordable, reliable, and cleaner energy for all Australians.

At 4D, we’re following this closely. Without viable investment timelines, global renewable operators in Australia may look at risk and utility (renewable and network) opportunities elsewhere, which looks much more attractive.

To read more about the investment opportunity presented by energy transmission infrastructure, including some of the potential solutions, download the full 4D Infrastructure report here.

3 topics

2 funds mentioned