The 4 investments to buy in the next pullback

The overwhelming consensus we are hearing from the professional investing community is that the volatility spike on August 5th was not so much a scare, but a blip in a long bull market for assets.

Sure, it was the worst day for the ASX 200 in four years and the worst for the Nikkei 225 since 1987. But, to quote from an interview we just completed with Lazard Chief Market Strategist Ronald Temple, it was a "healthy moment" and "a great opportunity to add capital."

But just because there has not been more downside to this story hitherto does not mean there aren't lessons to glean from this experience.

Investors were heavily biased towards risk entering this spike despite the risks around economic growth, equity market valuations, and market liquidity.

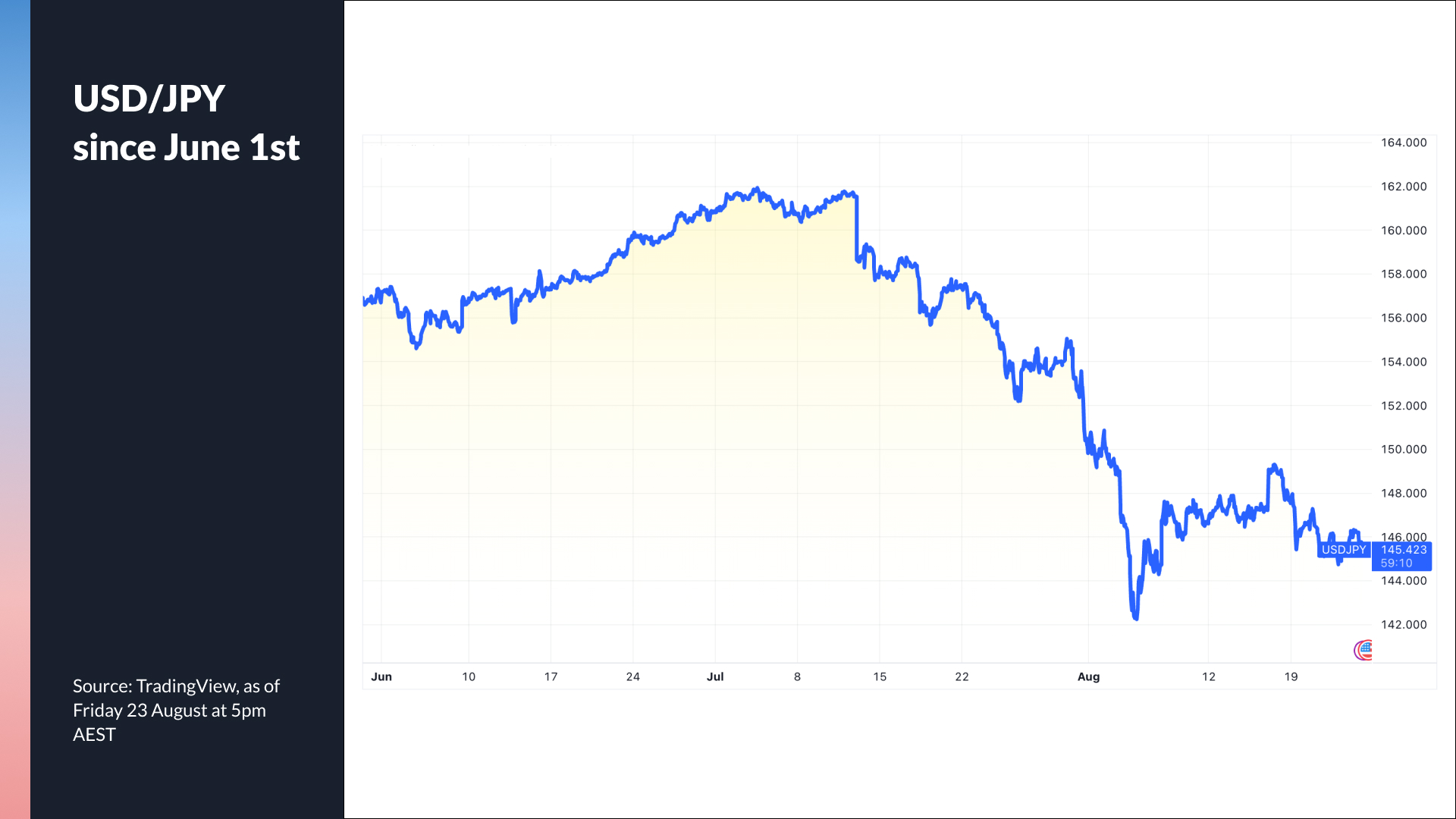

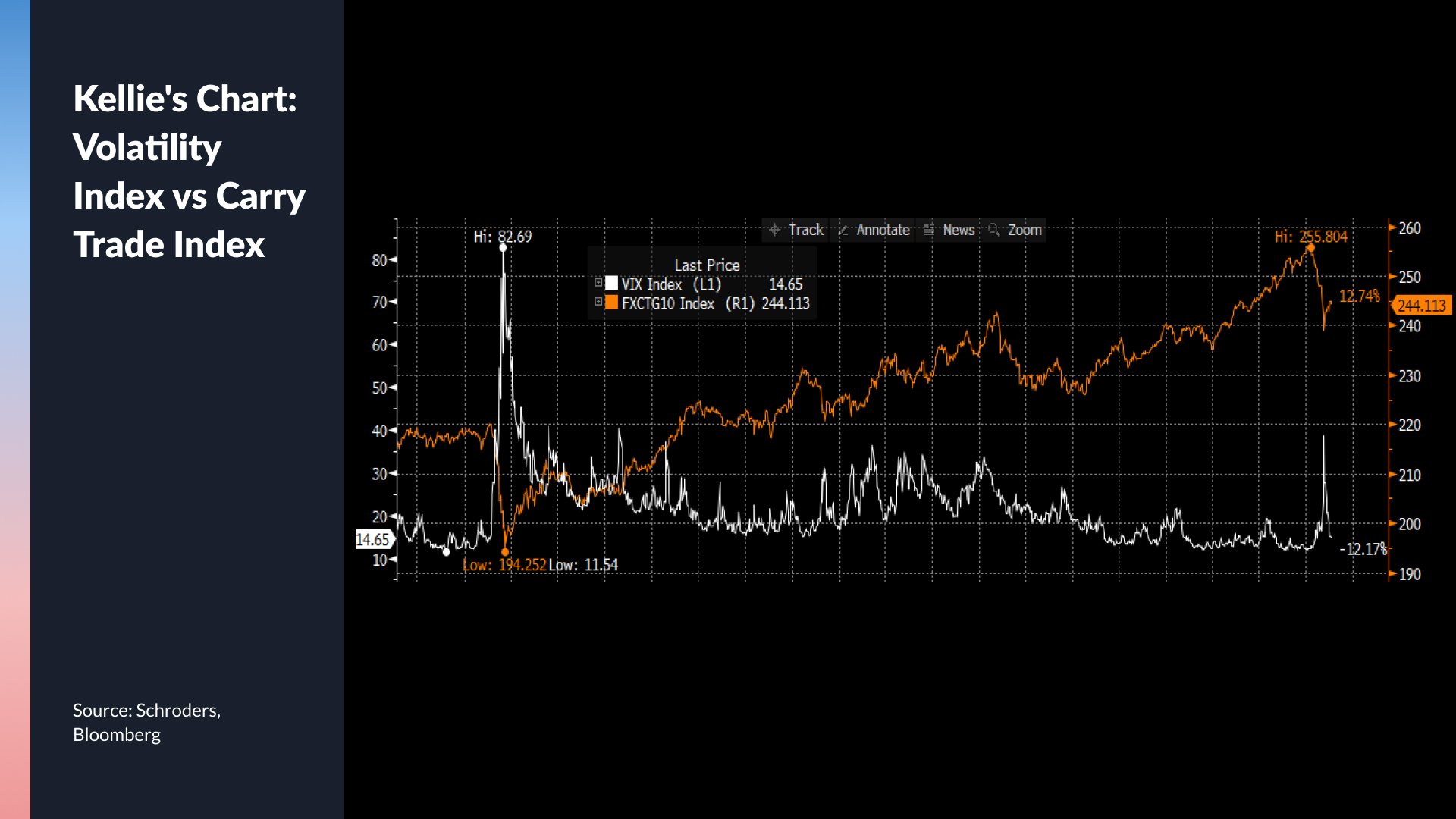

And, as one of our panellists will explain today, some of the key risks created by the breakdown of the carry trade and once-true recession rules remain unresolved.

In this episode of Signal or Noise, we are looking at the lessons from the August volatility spike. Namely, what investors can do to stay focused when chaos is erupting around them and how you can prepare for the next sell-off (whenever it may be).

We'll be doing this with a panel consisting of three of the Asia-Pacific region's most experienced and respected investors:

- Thomas Poullaouec, Head of Multi-Asset Solutions, APAC at T. Rowe Price (ex-BNP Paribas, State Street Global Advisors)

- Kellie Wood, Head of Fixed Income at Schroders Australia (ex-UBS, AMP Capital)

- Arvid Streimann, Head of Global Equities at Magellan Financial Group (ex-RBA, UBS, and Morgan Stanley)

Tune in to also hear about how these investors handled the August 5th spike - and what they would love to buy in the next sell-off.

Note: This episode was taped on Tuesday 27 August 2024. You can watch the show, listen to the podcast, or read our edited summary below.

Other ways to listen:

EDITED SUMMARY

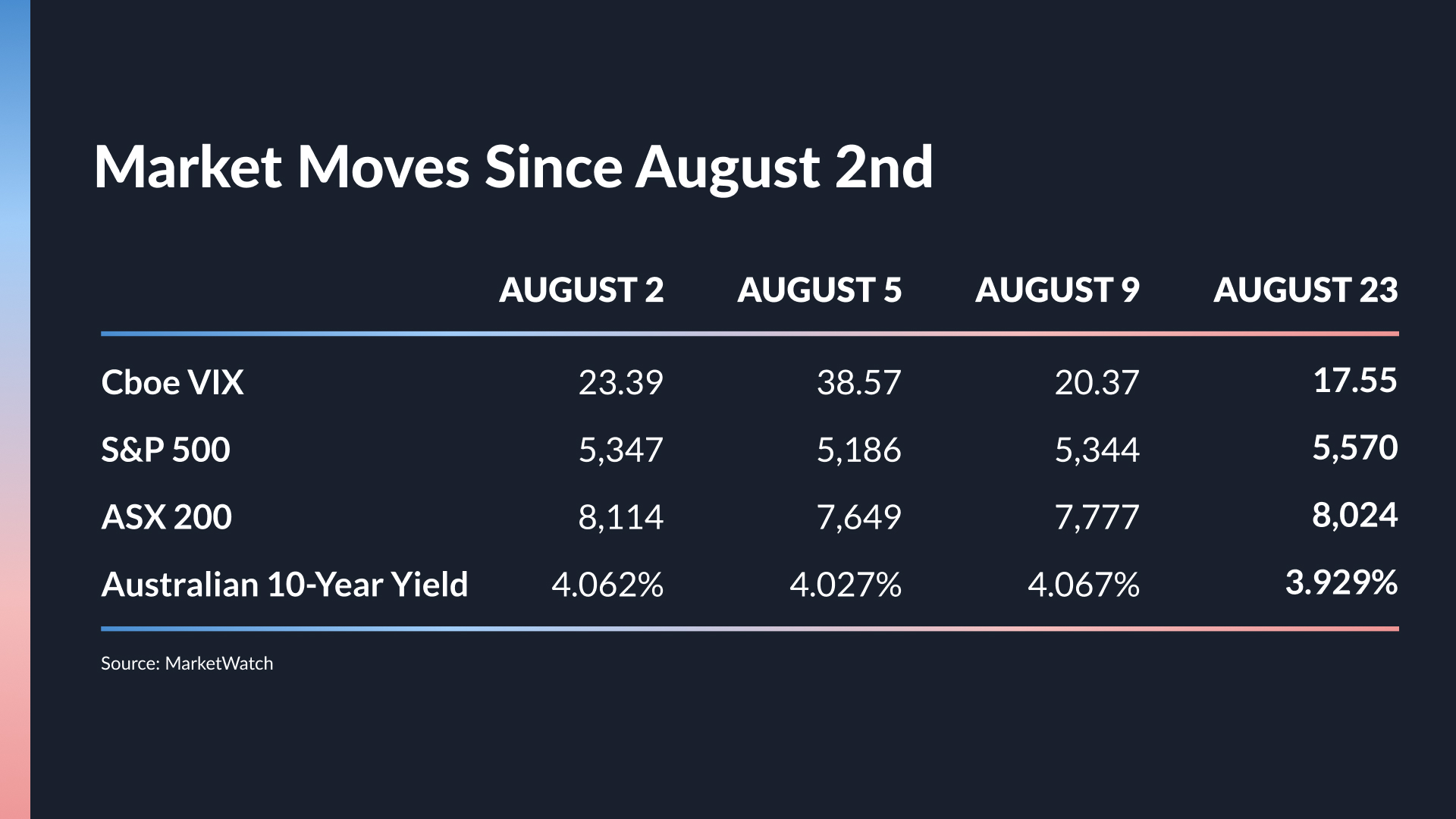

Topic 1: What signals did the August snap sell-off and rebound leave investors?

Thomas' SIGNAL: Fundamentals still matter, with this sell-off being primarily driven by technical indicators like extreme positioning and poor liquidity.

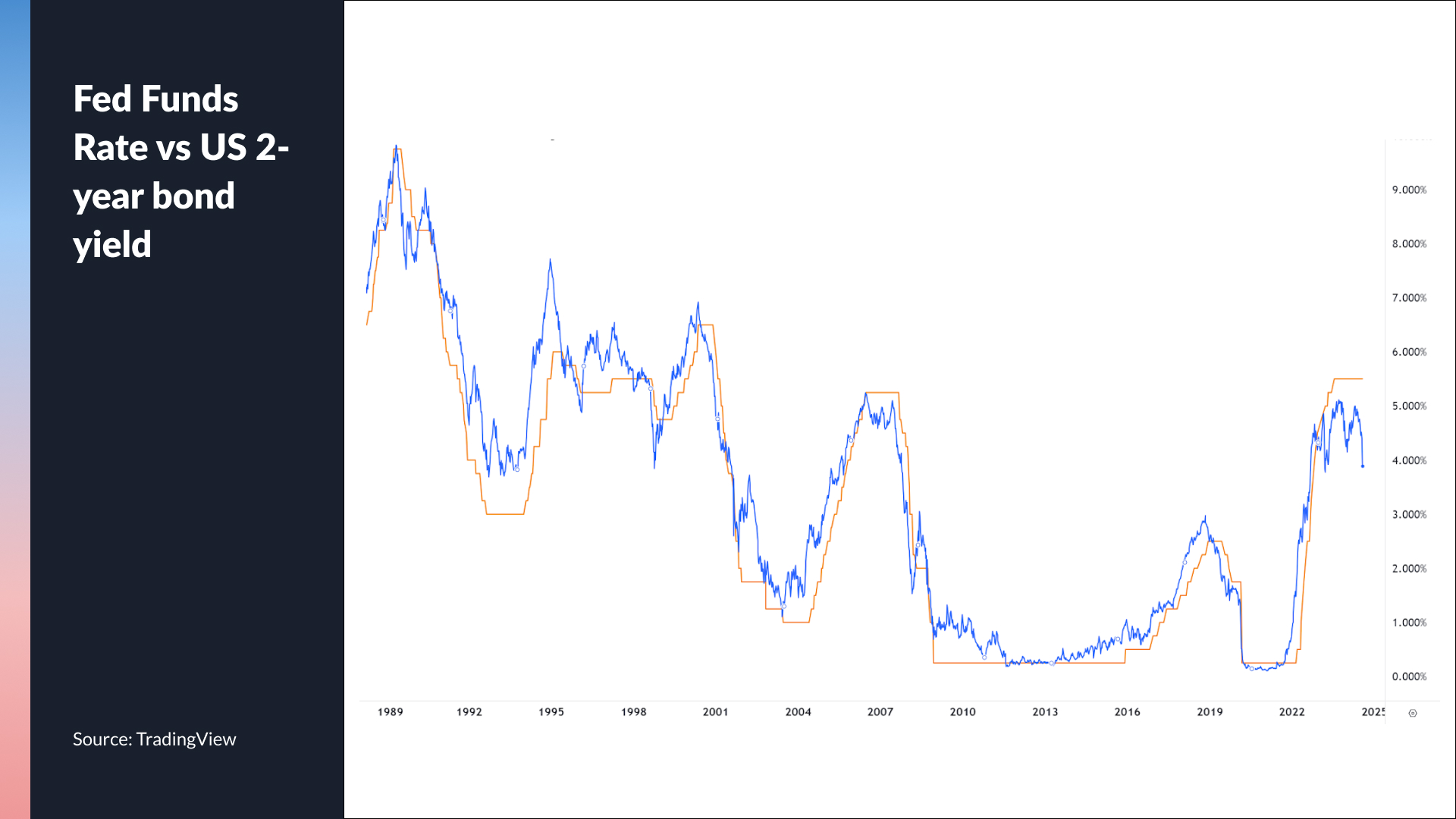

Kellie's SIGNAL: The emergence of the carry trade now threatens financial stability - and therefore, the low volatility environment we have all gotten used to.

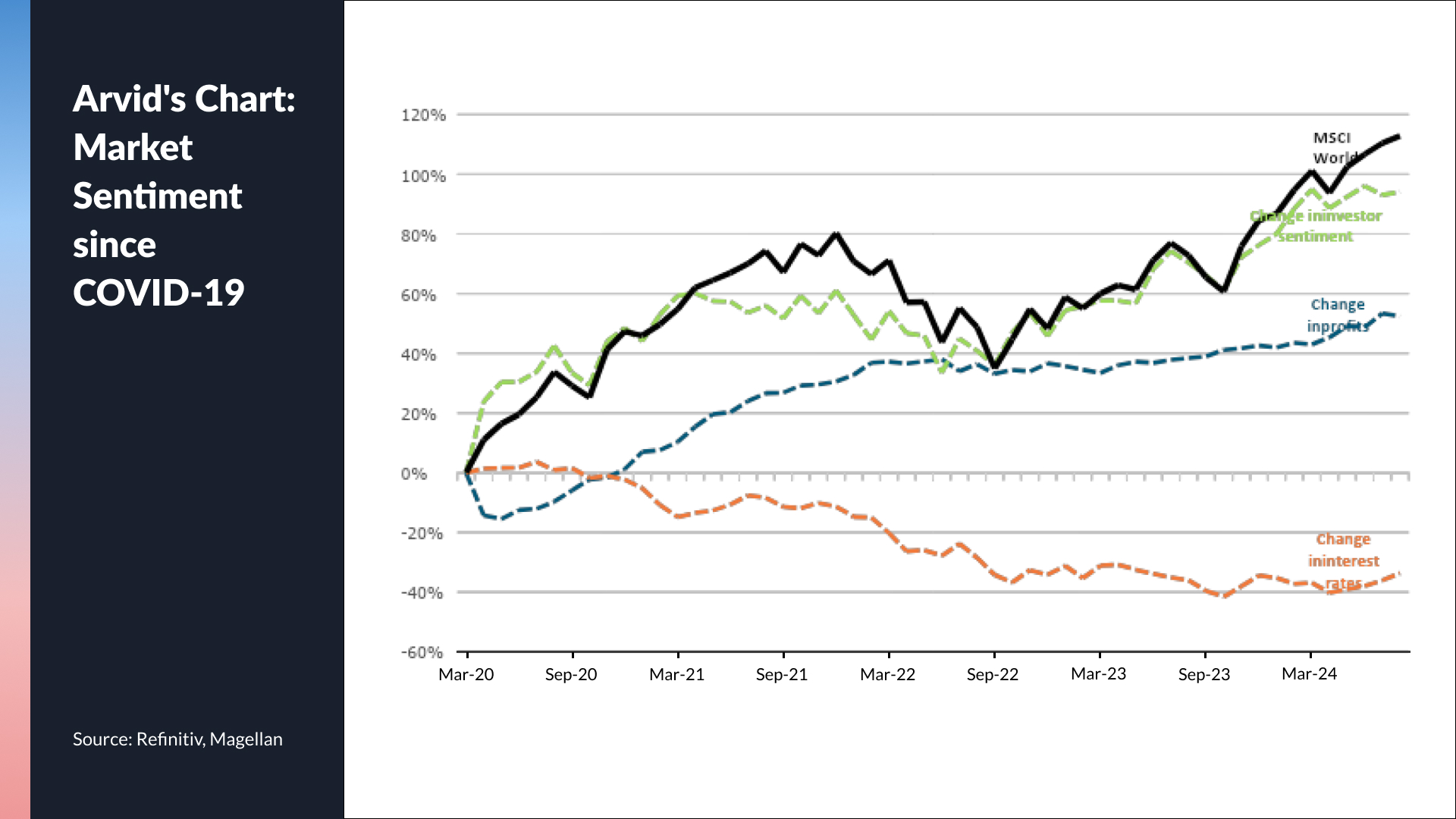

Arvid's SIGNAL: Sentiment is very high and in situations like the one we saw in August, the shift in sentiment wasn't caused by a huge change in fundamentals. So, it creates a dip buying opportunity more than a scare.

Arvid's Chart: Sentiment vs fundamentals vs stock prices

Kellie's Chart: The carry trade vs equity market volatility

What did each investor do and what do they want to buy in the next sell-off?

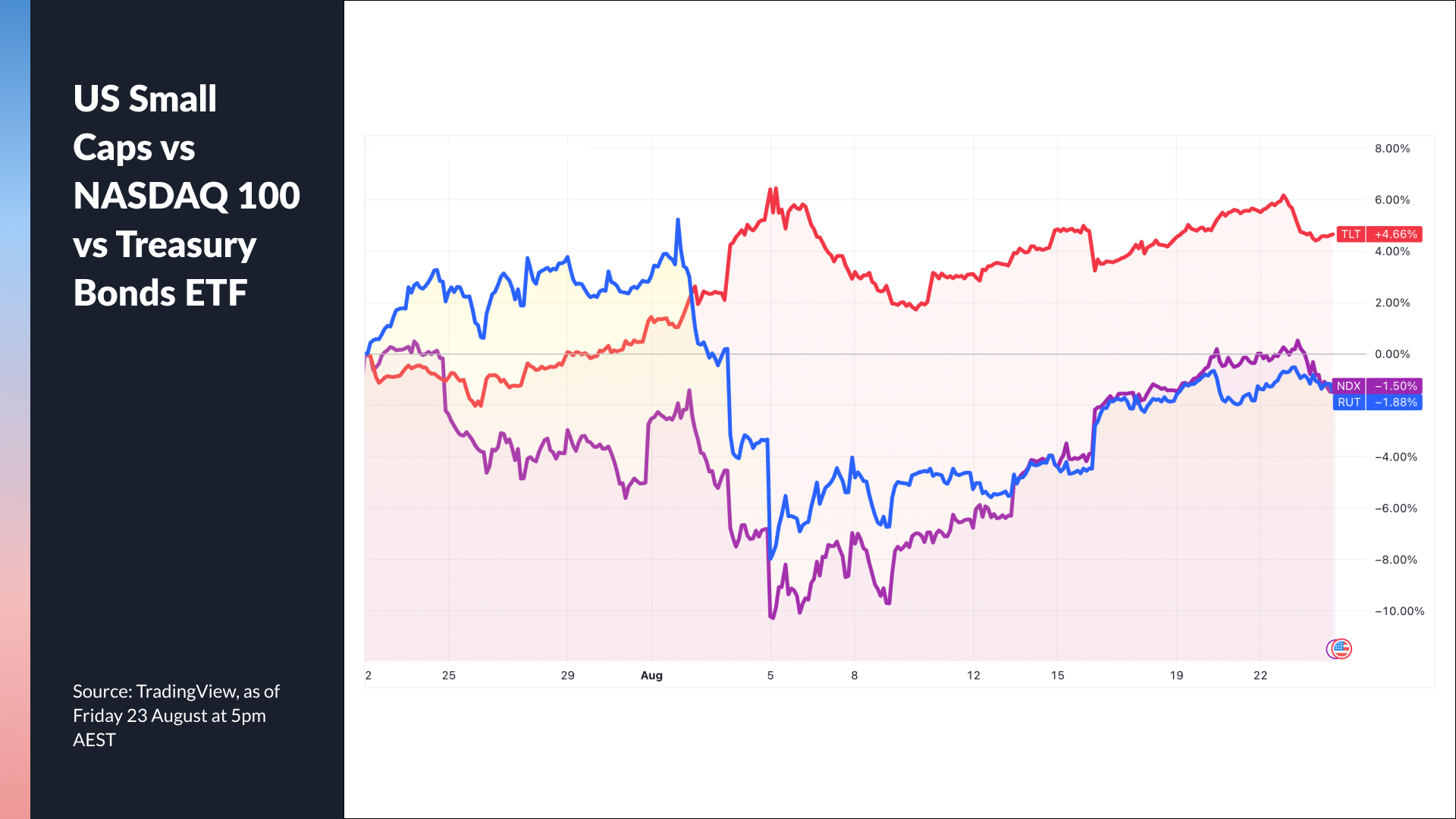

Thomas did nothing, given the fundamentals did not change and therefore, T. Rowe Price's positioning didn't have to change. But in the next sell-off, Thomas would love to add long-duration bonds to portfolios as a way to bolster protection.

Kellie, in contrast, did a lot! The Schroders team took profits on their short-duration government bond positions while adding to long-duration bond positions, as well as US corporate credit (high yield and investment grade).

Arvid and the Magellan team were not in full-risk mode before this big volatility spike. As a result, they had some spare cash and chose to "lean in" and buy the dip. In the next sell-off, he'd love to see quality companies become cheaper.

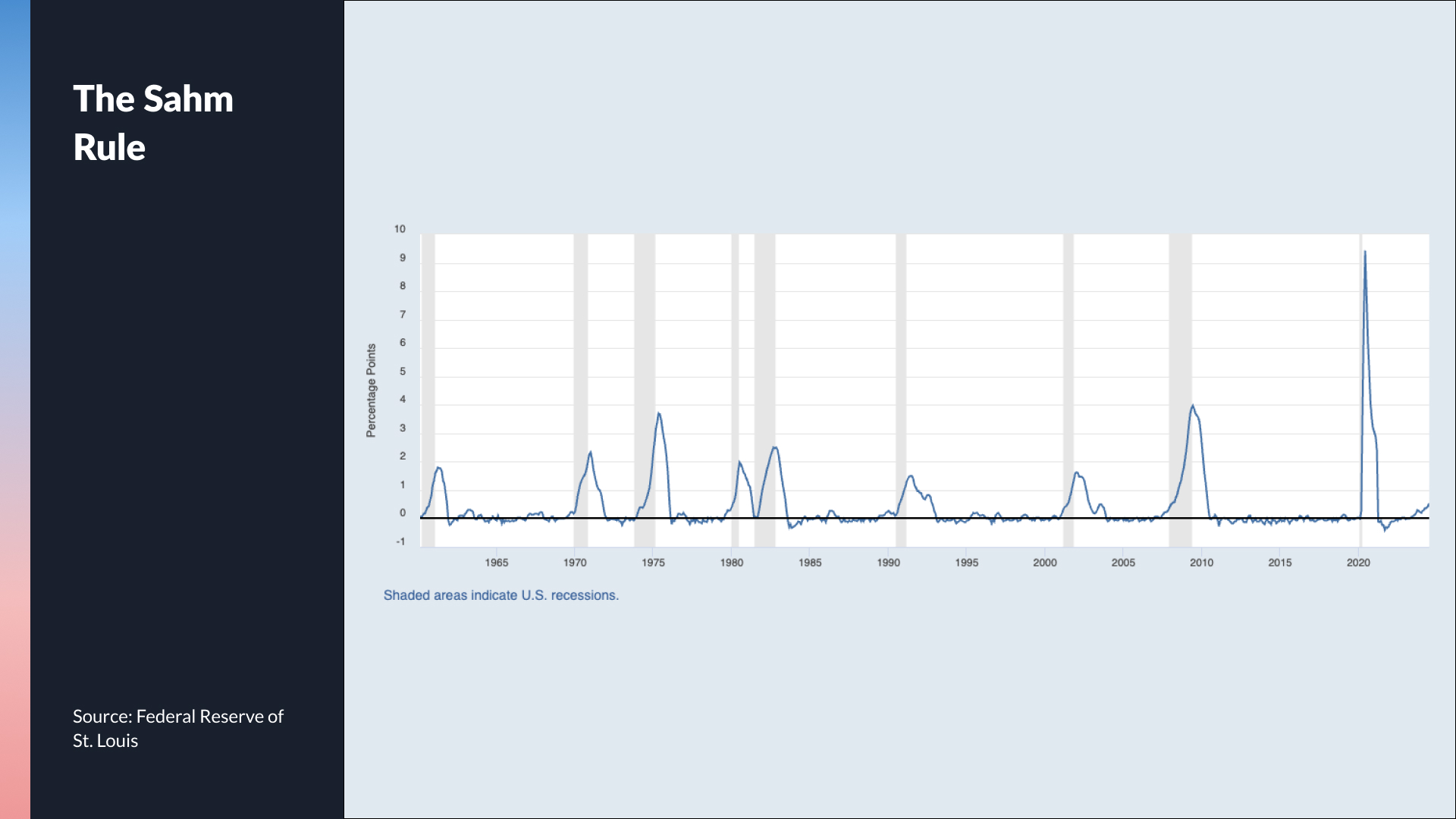

Topic 2: Two key recession rules were triggered

Kellie: NOISE - If you zoom out to the bigger picture, the Sahm Rule may have been triggered but the US economy is a) still creating jobs and b) the employment-to-population ratio is positive. Finally, the unemployment rate is a classic lagging indicator. In her view, the 2024 economy resembles the 1990s more than any other time - meaning they will achieve the soft landing.

Arvid: NOISE - Markets can "get over their skis" at times. The rules, while they should be respected, do not always necessarily need to be obeyed.

Thomas: NOISE - Recessions are quite rare and what needs to happen generally is the collapse in industrial production and consumer spending. Neither is happening at the moment and this scenario proves that rules cannot be followed blindly.

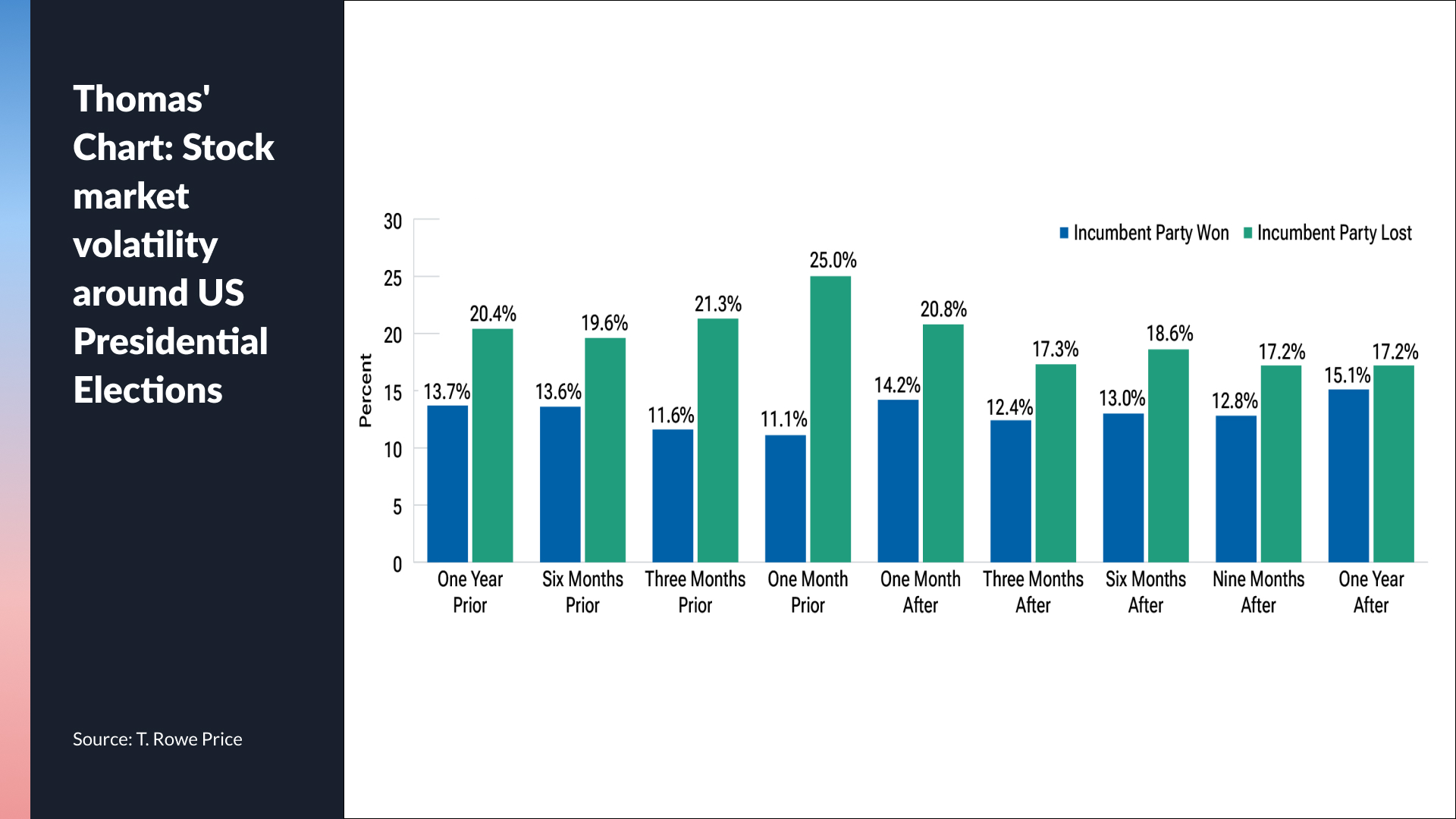

Topic 3: Was the “Great Rotation”/Trump Trade not all that great after all?

Arvid: SIGNAL - The data has slowed but it's not signalling a hard landing (Magellan thinks there is a 70% chance of a soft landing). In that environment, bonds will benefit the most but all asset classes benefit from lower interest rates and debt servicing costs. From a stock perspective, Arvid says these are the biggest signals for cyclically sensitive economic stocks and commercial real estate.

Thomas: Small Caps (NOISE), Value vs Growth (SIGNAL), Bonds (NOISE - but it will ultimately become a SIGNAL if recessionary fears come to the fore)

Thomas' Chart: The political impact on equity markets and timing your investments

Kellie: SIGNAL - It's game on, in Kellie's view. The market has oscillated between concerns over the past 18 months but now that growth is starting to roll over, this is the signal that Kellie needs to become particularly bullish on bonds.

The panel's 5 tips for nervous/scared investors

- Stay invested

- Stay diversified

- Think long-term

- Respect the new regime of higher volatility. Be more dynamic in your asset allocation

- Have a strong investing framework

Signal or Noise returns at the end of September.

5 topics

6 contributors mentioned

_106.jpg)