The 5 bulls (and 3 bears) you'll meet in 2022

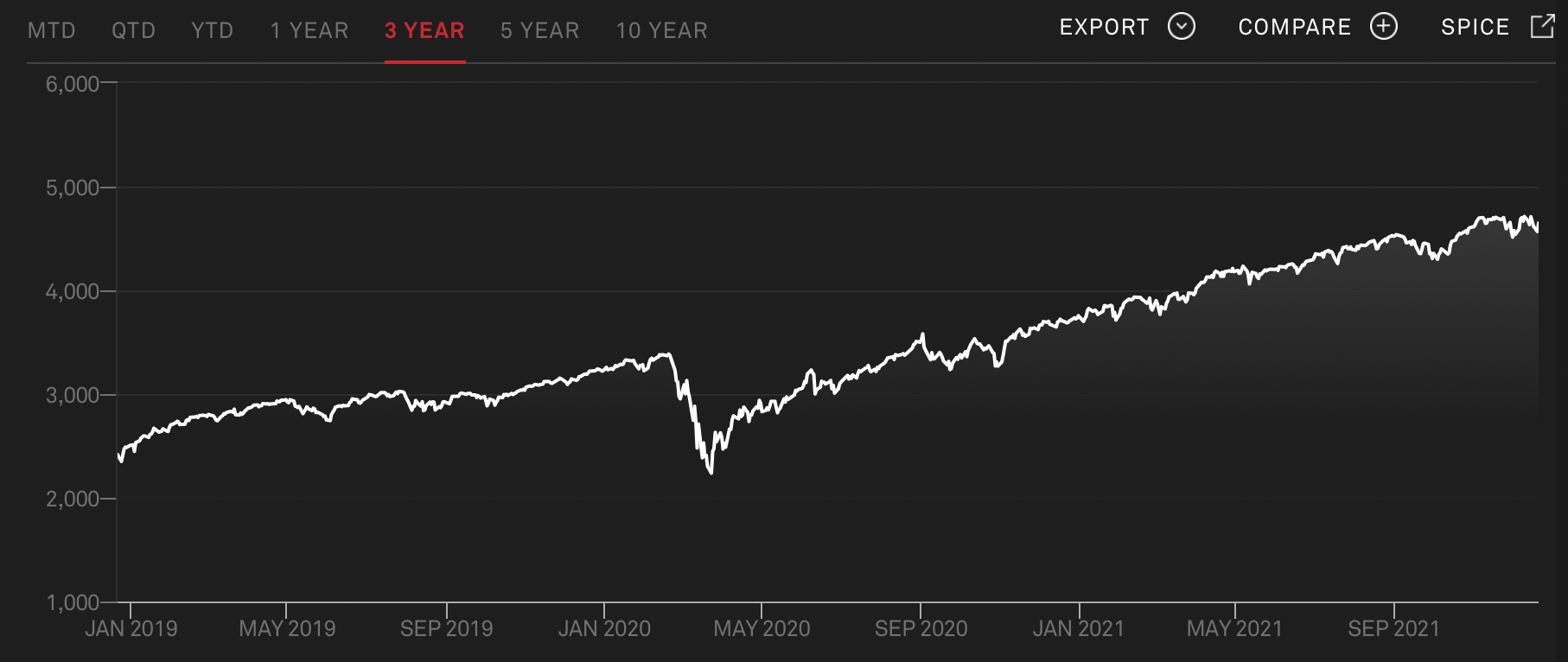

2021 was undoubtedly a year for the bulls. If you were fully invested in the S&P 500 on January 1st, you made a very handy return of almost 22%. And remember - that’s after having already recovered the losses of 2020.

Source: S&P 500

2022 will be more of the same according to most of our fundies.

Of the nine we interviewed, five were bullish and three were bearish. And, as you'll see below, Chad Padowitz made one call for the US markets and another one for Europe, Japan and parts of Asia.

Nick Griffin is the hardest charging bull.

“We’ve thrown inflation, reopening, shortages, COVID, massive stimulus, massive central bank printing, and we still can’t get the long-term interest rate above 2%,” he says.

“That’s your risk-free alternative, and ultimately that’s going to encourage you to take risk.”

There were more sombre forecasts for the year ahead, however.

Nick Pashias is sceptical of the margins companies will be able to generate given the market is forecasting earnings growth and revenue growth of 3% alike, coupled with supply-side cost pressures.

“The other thing you have to think about is the multiple. Clearly, we’re all talking about interest rates going higher, and that, all else being equal, has a dampening effect on the multiple.”

Scroll down to read or watch the full interviews where our fundies explain why they're a bull or a bear, optimist or pessimist.

Note: This vision was shot on the 8th and 14th of December 2021.

Edited transcript

Ally Selby: Hello, and welcome to Livewire's 2022 Outlook Series. I'm Ally Selby, and today we'll be sitting down with some of Melbourne's best fundies to see if they're bullish or bearish for the year ahead. And this year, we have a no fence-sitting policy.

Richard Ivers: We tend to be bullish on the markets and tend to be a little bit pessimistic on stocks. Over time, markets do pretty well and by being pessimistic on stocks you can actually try and avoid the downside, which is what we do. We try and pick quality businesses. But if you force me to be really clear on the outlook, I'd be bullish and that's because of the economic rebound we're seeing.

The Australian economy is supposed to do very well next year with lockdowns in Victoria and New South Wales stopping and the reopening happening, and we've got an election early next year and a Budget that's in better shape than expected, which means we'll probably have cash handouts combined with a household sector that has good balance sheets. And a corporate sector with good balance sheets also means there's a good tailwind for economic growth next year.

Nick Griffin: I'd just point investors to one thing and one thing only, which is that the long-term interest rate, despite everything we've thrown at it, can't get much above 2%. We've thrown inflation, reopening, shortages, COVID, massive stimulus, massive central bank printing, and we still can't get the long-term interest rate above 2%. And for every investor I know, that's your risk-free alternative. Ultimately, that's going to encourage you to take risk next year. So, that makes us bullish.

The equity market is a beautiful thing because it's full of these amazing companies that can grow structurally over time, produce wonderful cash flows, and they're just, quite frankly, such a better alternative than a risk-free rate at 2% today. I know people are concerned about rates backing up and all these different things, but if you just look at that one number, that says you should stay bullish on equity markets into 2022.

Michael Steele: Clearly bearish at this point. I need to clarify that in the sense that I'm not calling for a major bear market but more that equity markets will be flat or declining by single digits, from a total return perspective. There's been a lot of talk about inflation but our concern is that's becoming much more embedded in forward expectations. And there's a real risk that, as we go forward, inflation is higher than expected. That's a major concern.

Mark Landau: I'm feeling bullish in the short term. I think there are enough drivers between central bank liquidity, strong corporate earnings, consumers are cashed up, and a huge M&A cycle. I think that'll be really good for the market in the short term, but as we get through 2022, my enthusiasm wanes. So, don't expect me to be bullish for the whole of 2022, but I think for the first part, things look pretty good.

Adrian Martuccio: I think it always pays to be an optimist. You've got to be positive. The market's actually not that expensive. It's only about 19 times when we look at the global equity space. Where we see a huge opportunity is the small- and mid-caps. Really an excellent growth cohort down there, and they're trading pretty much in line with global benchmarks and they're normally at a 25%, 30% per premium. So I think there's going to be a big catch up there.

We look at how small- to mid-caps have performed out of other economic crises and they've really done well over a one, three, five-year period. So we're pretty optimistic for the next 12 to 18 months on small- and mid-caps.

Nick Pashias: Overall, you've got to keep in mind that the market this calendar year is up almost 20%, so that's a pretty good return. Looking forward to '22, the market's expecting about 3% earnings growth. But what concerns us is that's on the back of 3% revenue growth. That implies flat margins, which just seems pretty hard to achieve given all the cost pressures out there. Overall, it might be a good outcome if the market generates a modest single-digit positive return for '22.

Selby: Well, what do you think that could be? 1% to 5% or 5% to 10%?

Pashias: Yeah, I'd say one to five.

Selby: Oh, no.

Pashias: Because the other thing you have to think about is the multiple, and clearly we're all talking about interest rates going higher. And that, all else being equal, generally brings the multiple down. So, if interest rates are going to be a headwind, that's going to lead to potentially a lower return.

Dean Fergie: It's always a difficult one. I hate it when people ask me at the start of the year, "What will the market do this year?" But I think the main factor behind the market is momentum, and there's a huge amount of that. Interest rates are not going to rise anytime soon. I think there will still be money flowing into the system, which will create its own momentum. So I think, overall, I'm probably more bullish than bearish in the coming year.

Steve Black: It's going to come down to what your view on inflation is. Where you can keep inflation in the box and the interest rates don't rise, investment returns will inevitably fall. If rates do rise, I'm going to be somewhat bearish. But the very fact that we're talking about this as a binary outcome I think should be evidence to investors that you do need to look beyond the short term.

Chad Padowitz: Generally, we think the challenge for next year is quite significant because of inflation, weaker monetary policy support, high starting valuations, index concentration. All of those things create a very difficult backdrop for next year. However, there are regions and sectors like Europe, like Japan, or sectors that are not crowded where we do see significant opportunities.

Selby: So bearish on the US, but bullish on Europe and Japan and some of Asia?

Padowitz: Certainly, that's correct.

Are you charging like a bull into 2022 or are you bearish? Let us know in the comments section below.

Be sure to catch the rest of our 2022 Outlook Series

Hit the ‘follow' button below for our fundies’ number one picks for the year ahead and other great content from our 2022 Outlook Series. Hit ‘like’ to let us know or click the button below to view all the content on the dedicated landing page.

3 topics

3 contributors mentioned