The 6 most interesting charts from the Commonwealth Bank result

Earlier this week, I wrote a wire about the importance (and relevance) of gleaning macroeconomic commentary from the outlook segments of company reports. I've intentionally left out one major earnings report until it was released.

The Commonwealth Bank (ASX: CBA) earnings report always provides a plethora of interesting information about its consumers at a high level. The bank is not just Australia's largest - but it holds the lion's share of retail customers (35%), and young adults (46%), and gains the majority of new migrant customers as well (62%).

While I could talk to you about the higher dividend, the negligible fall in cash profits, or its valuation for the 'nth time, you could just read those insights in my colleague Kerry Sun's Reporting Season write-up piece.

Instead, this wire looks at the six most interesting macroeconomic charts and findings from its presentation. And while these charts only encompass CBA customers, they reveal some hard truths about the bifurcated state of the Australian economy.

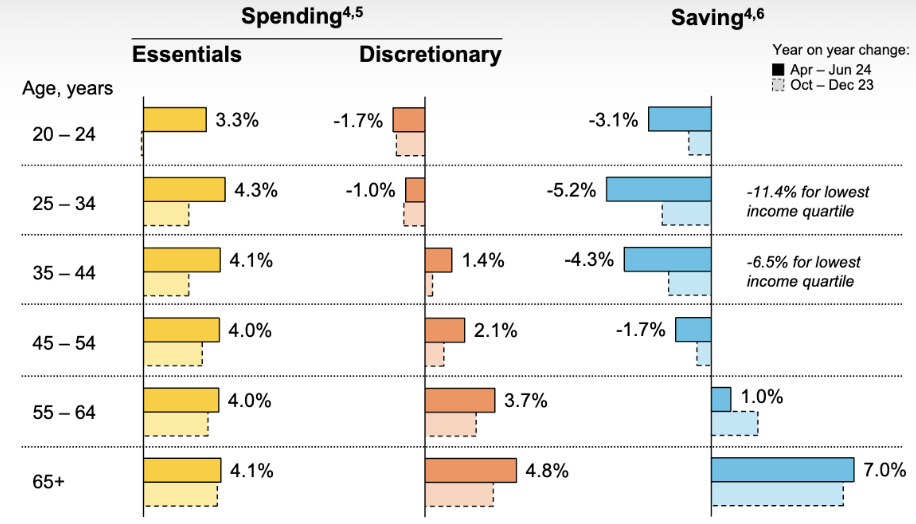

1) and 2) It's been even tougher for young people - and even better for older people

One of the major conclusions of this post-COVID economic cycle has been how bifurcated the Australian consumer has become. But if the last six months have been anything to go by, young people have been hit even harder than they already have. 20-34-year-olds are cutting back even further on discretionary spending while CBA customers are saving even less well into their mid-50s.

Looking at the "saving" chart, you'll also notice that consumers who have already struggled with saving are now saving even less. For customers aged between 25 and 44 who earn the lowest incomes, the impact is particularly brutal (note a respective -11.4% and -6.5% for lowest income quartile.)

In fact, the only people who are increasing spending and saving are the over-65s. I guess life is good when you retire!

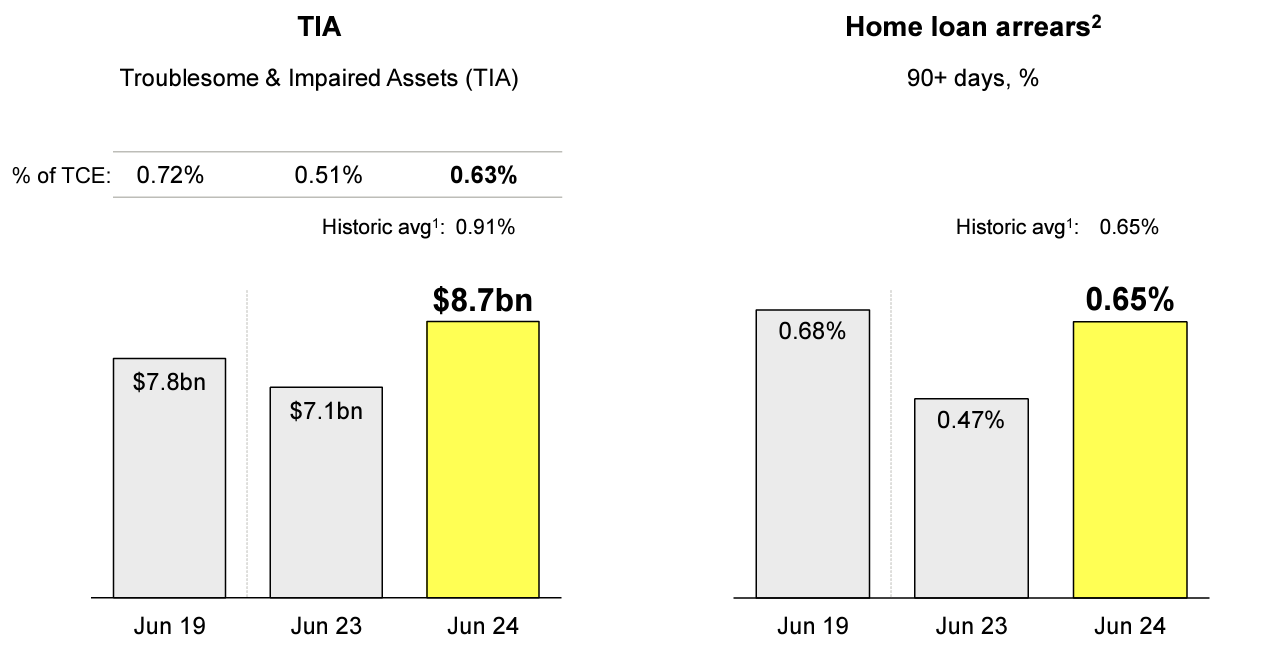

3) and 4) Arrears are ticking up ...

While the bank's management may say that the portfolio is well-positioned, this is an important slide in charting how consumers are dealing with their liabilities. The percentage and figure for troublesome and impaired assets (TIA) have climbed in the last six months, in line with the time it has taken for rising interest rates to hit consumer wallets. The rise in the TIA may also be driven by increases in the construction and commercial property sectors - both of which have struggled with rising raw materials and labour costs as well as the soaring cost of debt servicing.

At the consumer level, 90-day home loan arrears have shot up by 18 basis points in the last 12 months. Home loan arrears identify consumers who have taken 90 days or more to settle their existing mortgage payments. While the 0.65% figure is the historical average, this increase is noteworthy - and will likely rise if the Reserve Bank's hand is forced into a second round of interest rate hikes.

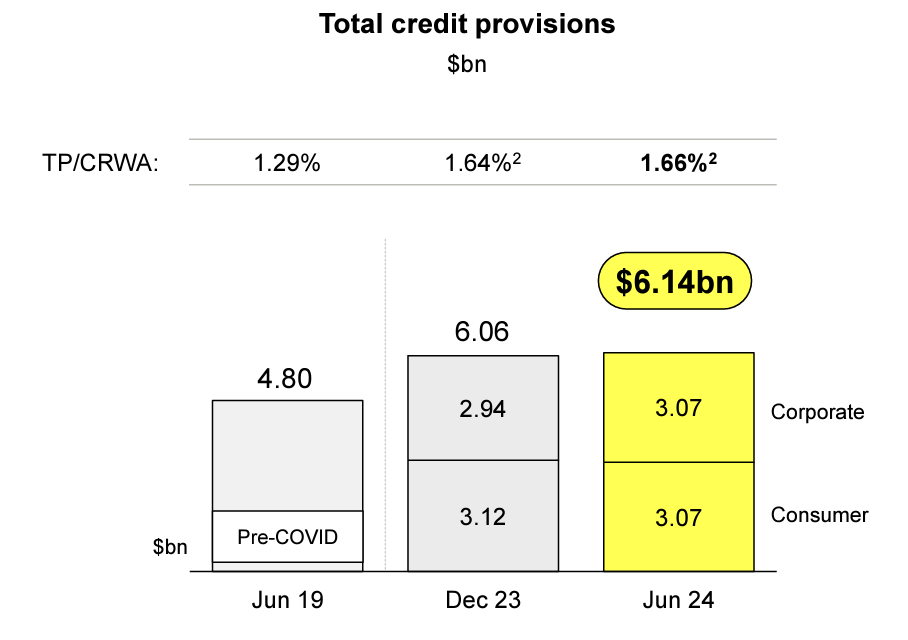

5) ... and rising provisions suggest the bank has its concerns.

Next up, the $6.14 billion provisioning figure represents a slight increase from this time last year. Provisioning is important because it tells us how the bank is guarding itself against a major downside scenario or black swan event. The slight increase, both nominally and as a percentage of its loan book, suggests the bank is a little more worried about the economic outlook than they were 12 months ago.

6) Home loan applicants can now borrow more

Finally, this is an interesting look at the housing market. The publicly available data says what we've known for a long time - rents are abnormally high, house prices defying significant interest rate hikes, and a chronic undersupply is creating a crisis affecting both cities and regions.

But this chart indicates that recent adjustments to individual income tax rates and thresholds have increased borrowing capacity for many applicants. However, given there was also commentary in the earnings report about higher savings and repayment buffers as well as the fragile state of the Australian economy, it's also probably clear that almost all customers don't want to push their luck (and their borrowing capacities) to the brink.

2 topics

1 stock mentioned

1 contributor mentioned