The 7 zombie companies lurking on the ASX 300

The media has been circling WiseTech Global's Richard White and Mineral Resources' Chris Ellison in recent months. White has stepped down while Ellison plans to step down from his post within 18 months. Both were the result of investigations and intense scrutiny.

Although there are red flags surrounding both these companies, Plato Investment Management's Dr David Allen suggests these are not the only companies in the ASX 300 that investors should be taking notes on.

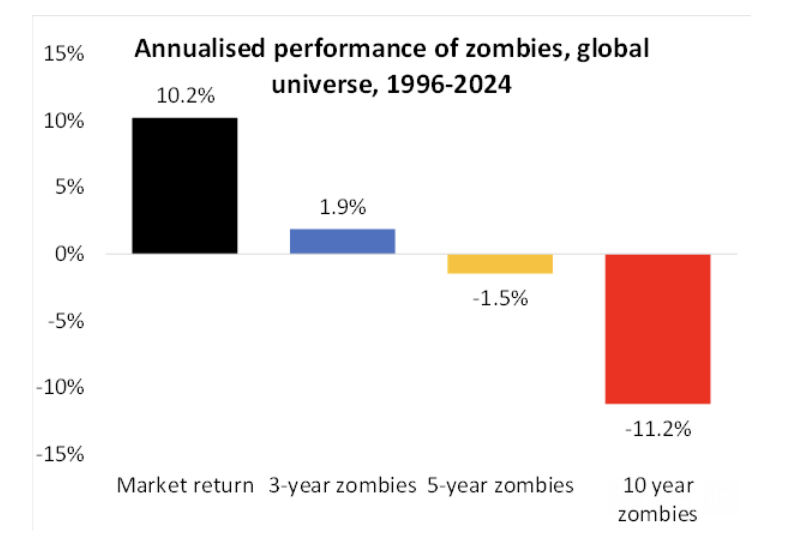

Zombie companies are defined as businesses where their interest costs or debt repayments exceed their cash flows over long periods of time, say three years or more. Usually, they trade at high multiples and have a captivating story that sees investors take a punt on these profitless or hardly revenue-generating companies - like a junior mining business sitting on a very large pot of gold, or a biotech with plans to revolutionise healthcare.

"If a company's got negative operating cash flow and it can't even cover its interest cost, they're going to have to keep tapping the market to get financing just to stay afloat. Their core operations are value-destroying," Allen says.

"When you look at that as a red flag, a company that is a zombie, they perform horribly on average. It's often the case that they're companies that have a bit of a lottery profile where they could be 10 baggers."

So, which seven businesses are zombies on the ASX? In this wire, you'll find out.

How Plato's Red Flag process works

While many investors and fund managers will use red flags to inform their investment decisions, Plato has fully systematised it. Using an automated system, the Plato Global Alpha team can assess up to 150 red flags across 17,000 global companies, and instantly see what they should be worried about.

These span everything and anything from forensic accounting to corporate governance to remuneration structures and the history of executives (like whether they have been involved in misconduct in the past). It also takes into account the activity of the hedge fund community, the short positions in the company, related party transactions and director buying and selling - anything that might give you pause.

"We'll test it using 20-25 years of data across tens of thousands of companies to demonstrate that those red flags actually do predict underperformance," Allen says.

The process came about when Allen was invested in a Spanish tech company back in 2014 - a company that had, up to this point, been a 10-bagger for the team. One day, its share price had plummeted to zero. Its CEO had been indicted.

"It was accounting fiction. So, to ensure we never went through that again, we tried to see what we missed. And one of the biggest things that we missed was the auditor was obscure - no one else in Europe was using them at all," he says.

"That actually seems to pop up repeatedly in accounting manipulation cases. It's almost as if companies that are pushing the boundaries of the accounting rules will intentionally gravitate towards a lighter-touch auditor."

One red flag is a valuable insight, but the magic number that screams run (or short) is typically eight, Allen says.

"Over the course of the last 10 years, we've looked at every corporate failure and fraud we can get our hands on and built up that red flags model," he says.

"So, looking at companies like Enron, the poster child for special purpose vehicles, and related-party transactions. We've looked at the big banks like Morgan Stanley and Lehman during the GFC. We borrow a lot from the forensic accounting literature, which has some tremendous techniques that are almost unknown in the fund management sphere."

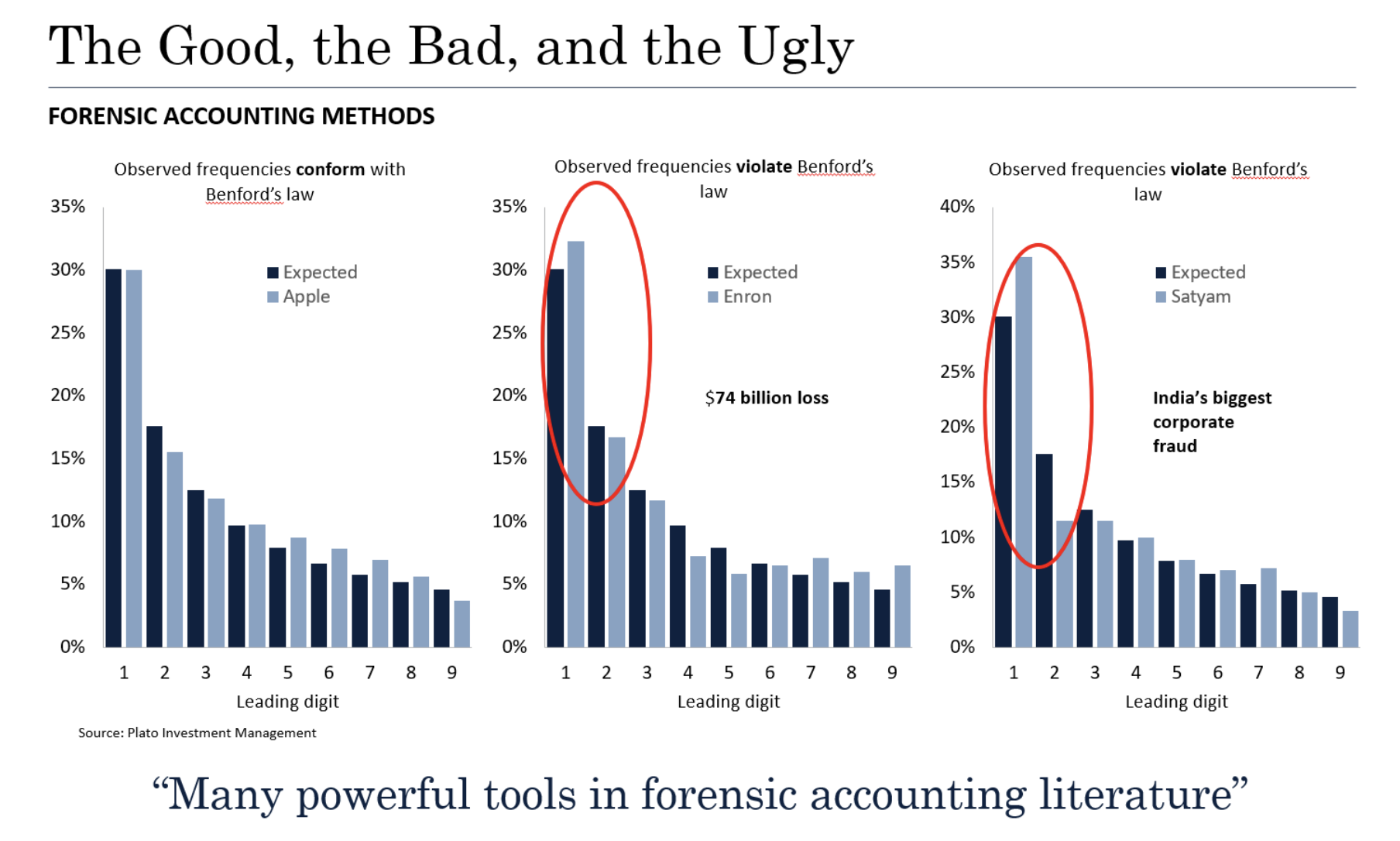

Take Benford's Law, for example, which allows investors to identify potential cases of financial manipulation.

"You go down the P&L, the cash flow statement and the balance sheet and see how common each of the leading digits are one through nine," Allen explains.

"You think it'd be random, that it's just all over the show, but if the numbers have been arrived at organically and naturally then you'll find you get about 30.1% ones and 4.6% nines.

"So, that's something that we have used to analyse every line item in every company in the world over the last five years. We generate what the distribution looks like for that company. When there are big deviations then it's indicative that something is potentially being manipulated."

Red flags for Mineral Resources (ASX: MIN) and WiseTech Global (ASX: WTC)

Mineral Resources (ASX: MIN)

Despite the obvious management red flags in Mineral Resources, given that Chris Ellison has recently been fined $8.8 million over accusations that he failed to disclose revenue generated by overseas entities to tax authorities - and also reportedly used company resources and employees for his own benefit, the red flag that Allen points to here is the company's use of an unusual or small auditor.

Mineral Resources used RSM Australia up until 2022. According to Factset data, not a single ASX 100 company uses RSM as a parent auditor. In fact, not a single company in the ASX 200 uses RSM.

"This is not to say there is anything wrong with RSM, they do some very fine work, just that they are not auditors of choice for large listed Australian companies," Allen says.

"We are also wary of companies that are paying a very small audit fee relative to revenue. In 2022, Mineral Resources paid just $743,000 in audit fees which is just 0.02% of revenue. To put this into context, microcap cap minnows EML Payments and Zip Co spent $2.18 million and $2.6 million respectively for audit fees in the same year. Of note, Mineral Resources’ audit fees have since jumped to $5.9 million."

When Plato initiated a short position on 31 January, the company had six red flags. Its share price has fallen around 38% since then.

WiseTech Global (ASX: WTC)

While Richard White isn't leaving the business like Chris Ellison is, he has stepped down from the CEO role following a dispute with a former lover in the federal court, and several allegations that he bought houses for his lovers and invested in their businesses in exchange for sex.

In addition, the Plato team also employs a proprietary model that identifies companies with an above-average probability of having to restate earnings.

"WiseTech ranks in the top 5% of companies globally based on this model. This is, of course, not conclusive, and we're not saying that earnings are being inflated," Allen says.

The 7 zombie companies on the ASX

1. NexGen Energy (ASX: NXG)

- Market cap: $5.55 billion (CAD)

- Revenues: $0

- Zombie status: 5, 7 and 10 years

- Number of Red Flags: 6

- 12-month share price performance: 20.11%

NexGen Energy is a Canadian company focused on developing its Rook I Project into the largest, low-cost producing uranium mine globally. It has 10 red flags and is the only business on the ASX that has been a zombie company for the last five, seven and 10 years. That said, if the world does transition to nuclear energy and uranium prices go through the roof, this could be an incredible investment given it is sitting on a very large uranium deposit.

2. Mesoblast (ASX: MSB)

- Market cap: $1.52 billion

- Revenues: $5.9 million

- Zombie status: 5 and 7 years

- Number of Red Flags: 12

- 12-month share price performance: 259%

Mesoblast is an Australian biotech using its proprietary technology platform to develop and commercialise innovative allogeneic cellular medicines to treat complex diseases resistant to conventional standards of care and where inflammation plays a central role. If that was too complicated to understand, it develops cellular treatments to treat inflammatory diseases.

Its cell therapy has been rejected by the FDA twice. They also had to settle a class action lawsuit over a COVID treatment where they reportedly misrepresented the benefits of the treatment. Mesoblast has been a zombie company over the last five and seven years.

3. Immutep (ASX: IMM)

- Market cap: $422 million

- Revenues: $0

- Zombie status: 5 years

- Number of Red Flags: 5

- 12-month share price performance: -3.33%

Immutep is a clinical-stage biotechnology company at the forefront of developing novel LAG-3 Immunotherapy for cancer and autoimmune diseases. It has faced some delays in getting its drugs approved. Immutep has been a zombie company over the last five years. Its share price hasn't really gone anywhere over that period. It has zero revenue.

4. Novonix (ASX: NVX)

- Market cap: $353 million

- Revenues: $8.1 million

- Zombie status: 5 years

- Number of Red Flags: 19

- 12-month share price performance: -8.86%

According to Novonix's website, the company is a leading battery technology company revolutionising the global lithium-ion battery industry with innovative, sustainable technologies, high-performance materials, and more efficient production methods.

Despite these big claims, it's been a zombie company over the last five years - and its share price has cascaded more than 93% after peaking in November 2021.

5. Ioneer (ASX: INR)

- Market cap: $538 million

- Revenues: $0

- Zombie status: 5 years

- Number of Red Flags: 10

- 12-month share price performance: 35.29%

It's been a zombie company over the last five years and has zero revenue.

6. Adriatic Metals (ASX: ADT)

- Market cap: $846 million

- Revenues: $0

- Zombie status: 5 years

- Number of Red Flags: 6

- 12-month share price performance: 17.33%

Adriatic Metals is a precious and base metals explorer and developer that owns the Vares silver project in Bosnia & Herzegovina and the Raska zinc deposit in Serbia. Despite its lack of revenues, its share price has soared around 305% over the last five years - during which time, it has been a zombie company.

7. Boss Energy (ASX: BOE)

- Market cap: $1.32 billion

- Revenues: $5.5 million

- Zombie status: 5 years

- Number of Red Flags: 14

- 12-month share price performance: -25.98%

Boss Energy (formerly Boss Resources Limited) is a minerals exploration company focused on the Honeymoon Uranium Project in South Australia - its market cap is truly astounding when put into context with its revenues.

Its share price has lifted a whopping 5,266.67% over the past five years - all the while being a zombie company.

One last thing is worth noting - all of these companies and their share prices may possibly have significant upside. But Plato's research shows that zombie names do tend to underperform on average.

Please note that a correction has been made to this article: It previously stated that WiseTech's CFO recently departed, which is factually incorrect. Andrew Cartledge has moved from CFO to Interim CEO, and Caroline Pham is the Interim CFO.

5 topics

9 stocks mentioned

1 fund mentioned

1 contributor mentioned