The 8 minutes that really mattered at Jackson Hole

In his 8-minute speech at the recent Jackson Hole symposium, US Federal Reserve Chair, Jerome Powell, fundamentally shifted the market outlook. Powell strongly suggested there will be no pivot in monetary policy, and there will be ‘pain’ as the Fed engineers a reduction in demand to lower inflation. The Fed's view on the recent 17% rally in equity markets (S&P500) could not be clearer.

Powell’s reference to the inflationary dynamics from the 1970s and 1980s was telling. It took three Federal Reserve chairmen to get the job done – with only Paul Volcker finally delivering the silver bullet. Inflation in the 70s lasted a whole decade, rather than simply being transitory. Recognising valuable lessons from the past, Powell said,

“These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain."

The rate rise message

We’ve always believed that in order for Powell and the Fed to maintain their credibility, they cannot pivot – at least not at this point. At Jackson Hole, Powell’s message was direct – the Fed wants to make sure that the market forgets any idea of a pivot before it becomes more comfortable with inflation.

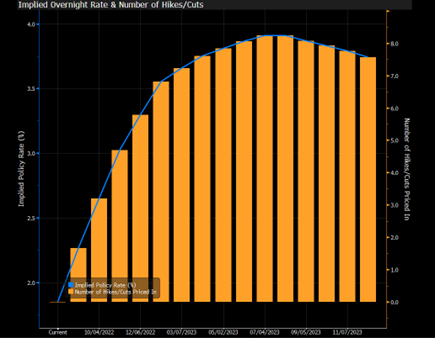

The US 10-year bond yield is starting to again price more hawkish monetary policy, with the yield rising ~60bp to 3.20% at 5 September 2022 (and seemingly heading towards the recent peak of 3.42% seen in mid-June, when the ASX300 Accumulation Index was 7% lower than today’s level). Interest rate futures markets have also become more hawkish.

Source: Bloomberg Australia RBA Cash Rate Future

It’s interesting that the Fed’s governors have lined up post Jackson Hole to reinforce the rate rise message. They are clearly puzzled by the market, and the recent strength in equity markets is seen as unwelcome. Equity market strength is expansionary; the wealth effect bolsters the economy at a time that the Fed is attempting to slow down activity and reduce inflation. There’s conflict, and it’s highly likely the Fed will continue to jawbone the market until its outcomes are met.

Higher interest rates are not the only weapon in the Fed’s arsenal. It remains to be seen whether the Fed has the will to embark on quantitative tightening, but this may well be the tool that is required this time around. Quantitative tightening has been spoken about but not implemented yet. The Fed is due to start in early September by reducing its $9 trillion balance sheet by US$95 billion every month. Markets will remain apprehensive, as it’s another ‘unknown’ which deserves caution.

The return of the Powell pivot

We think it’s unlikely the Fed will allow a disorderly correction in asset prices, but it may not have full control in the short term. If this were to occur, we think Powell would quickly pivot by halting QT, and making dovish commentary about the future path of interest rates. This is an ever-present risk to our short book, and a key reason why we tend to take profits along the way in a market environment where everything seems to be driven by the Fed.

Making money in this environment

In response to the environment, we’ve cut our net exposure to the market aggressively and are now net short (both cutting the size of our long book and increasing the size of our short book).

Within the long book, we are also positioned more defensively, with key exposures being healthcare, energy, and stocks that do well when interest rates rise. Our short book positions are dominated by high multiple or lossmaking stocks that do poorly when the discount rate rises, with the most shorted sector being technology. We’re also short some consumer discretionary names, which we believe will come under pressure if the Fed is successful in putting consumer demand to the sword.

With such volatility, multiple turns in markets are highly likely before the year is up. We expect to remain defensively positioned, but are also highly alert to opportunities to acquire quality businesses at cheaper prices in any market sell off. We’re looking to add our exposure to the high cash flow energy sector, and we’ll also look to add resources exposure to the portfolio in the event of a more comprehensive stimulus program in China. At the same time, we’ll likely take profits in more defensive ‘recession proof’ holdings that are beginning to look expensive.

3 topics