The allocators playbook for this credit cycle

Overview

In our prior piece on the Credit & Distressed sectors , we noted that:

... leverage/excesses build up due to low rates over a long time. The Fed has hiked (this time rapidly) to slow the overheating, and credit conditions have begun tightening, first slowly and now more quickly. The next step is for tighter credit conditions and weaker credit demand to continue to filter into the real economy as corporates and households pull back. This negative feedback loop is typically halted when the Fed finally panics. The risk is that they are slow to do so in this cycle, given their intense focus on inflation. The Fed pivot at the end of 2023 has likely eased the situation, but only prolonged the negative feedback loop stage of the cycle.

Today we will look at an allocators playbook, and how investors might dynamically shift exposure in their portfolios to achieve the best risk-reward profile available, via hedge funds. We cover three areas:

- Current opportunities and potential expressions

- Future opportunities and shifts in the coming 12-18 months

- What if scenarios, and how we would approach them

Liability Management Exercises: the elephant in the room?

Before we can begin, we must first deal with the elephant in the room: the impact of higher rates on fully levered companies has led sponsors and issuers to seek solutions to rationalize their balance sheet. These Liability Management Exercises (LME) have increased 5x since 2022, and can take many forms. This trend of LME is allowing companies to address their maturity walls and/or interests costs, but avoid a traditional in-court bankruptcy process, which is artificially suppressing defaults. These transactions involve groups of lenders coordinating with the company to modify the company’s debt structure and provide new money - and they almost always benefit those lenders which decide to participate, while excluding certain other investors from the benefits of the transaction, giving this trend an apt name of “creditor-on-creditor violence”. A new sub-trend within LME has been “company-on-creditor violence” which is where owners of companies look to increase their equity value by forcing creditors to take a haircut on their debt while retaining 100% of their equity.

LME has been a source of P&L by allowing funds to identify compelling investment opportunities by creating win-win solutions for companies with solid operating profits, and in some instances using aggressive legal tactics to extract value from other secured lenders.

Current opportunities and potential expressions

Across most credit asset classes, valuations on a price and yield basis are reasonable, although convexity remains attractive with performing credits enjoying mid-teens yields. In the portfolio of one of our diversified credit funds (annualised at >9% net of fees since 2000), their performing credit have modest convexity with an average price of 87 and a yield to maturity (YTM) of 14.5%. Currently the fund has identified compelling opportunities, especially in Healthcare given it remains a disrupted sector with challenged capital structures. The manager is able to capitalize with both performing and distressed issuers. Across the Structured Credit space, regulatory constraints are driving US and EU banks to seek solutions for capital relief and balance sheet optimization. Funds like this one, able to source and structure proprietary opportunities, can capture this opportunity. Overall, the fund combines together these various sub-strategies and seeks to provide an all-weather investment into the credit asset class.

With higher financing costs, given today’s higher rates environment, coupled with lofty stock valuations, we expect convertibles, still priced with 0% coupons, will increasingly be an attractive funding options for issuers. This structure allows issuers to reduce interest expenses and capitalize on elevated stock prices, compared to other credit or hybrid structures, most evident in the Technology and Healthcare sectors. As an example, SMCI issued a $1.7bn convertible bond in February, which traded up more than 8 points on its first day, and 22 points over 2 weeks, performing well, alongside other AI-themed bonds. The new issue calendar is expected to bring $100bn+ convertible paper to the market by the end of the year; already we have observed some record deals with large names coming to the market, such as in May when Alibaba raised $5bn by issuing convertible paper.

Convertible arbitrage is another credit strategy well positioned in the current environment, and one of our funds in the sector (annualised at >10% net of fees since 2003), is producing returns via a well-diversified and well-hedged portfolio that limits directional risk and has low correlation to other markets. In addition, the fund is able to extract P&L through LME, closing 30+ deals so far in 2024 with a notional of circa $2bn. With companies buying back short-dated, lower dollar priced paper, whilst issuing new paper, to lock-in attractive funding rates, the fund has seen great opportunities in COIN and MSTR for instance.

Opportunities in 12-18 months’ time

Whilst we believe that the Fed will start to cut rates in 2024, currently the market is pricing 2-3 cuts by year-end, and we believe that rates will remain structurally higher for longer, especially as compared to the pre-COVID era of zero to negative rates policy. With the 'higher for longer' rates remaining, increasingly companies need to tackle their maturity walls, coming due in 2025-26, which will (continue) to create fruitful opportunities in stressed and (increasingly more so) distressed situations. As defaults begin to pile up and reach a peak, we anticipate seeing a shift in the type of defaulting issuers. At the onset of the default cycle, we typically find bad companies with a bad balance sheet, which do not typically make for good distressed investments, and as the cycle deepens we begin to see good companies finding themselves with a bad balance sheet at a cyclical trough. In these situations, a proper restructuring can provide an exit from bankruptcy with a lean capital structure, and outperformance in the cyclical rebound that follows. It will likely take an additional 12-18 months for us to begin seeing these sorts of companies hit a wall and become an opportunity for classic distressed managers. As we see defaults hit a peak, we would seek to transition as much exposure as possible to these types of managers as historically that is the time from which the strategy tends to perform best for the following 2-3 years. We believe there are 3 candidates to increase exposure to as we approach the most fruitful environment for distressed:

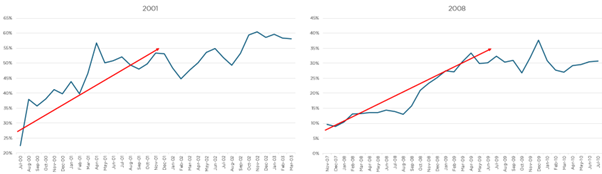

Opportunity 1: Currently the diversified credit fund we referenced earlier has a low allocation towards Distressed, seeing more opportunities in stressed credits. Observing how the fund has reacted in prior Credit Cycles, namely 2001 and 2008, we can see that the manager has shifted net Distressed allocations by +20-30%, leaning into the opportunities presented in these prior historical instances. Today the Distressed exposure is roughly +15%, and we would expect this to increase towards +40-45% by the start of 2026.

Opportunity 2: We allocate to an opportunistic event driven fund (annualised at ~29% net of fees since 2020, with Sharpe >1.2), a small and nimble fund which has a split focus between equity and credit, will be able to capture a Distressed cycle well. Currently the bulk of the fund’s credit names are performing and paying coupons, with an average price in the high 50s and weighted average yield-to-maturity above 30%. Those are the lowest average price and highest average yield figures for the credit book since 2020, which demonstrates that the firm is adept at trading deep discount credits (the PM having done so at their prior firm during the 2008-09 credit cycle). The manager is excited about the opportunity set in credit, and has been increasing the net exposure in the asset class as they expect to observe more bankruptcy/reorganization and distressed opportunities - accordingly they have taken positions across the capital structure to benefit from the volatility and dispersion.

Opportunity 3: Finally, we are looking to add one pure Distressed fund onto the platform in due course, a fund that takes an active role in co-op groups and steering committee during different processes. The fund is focused on in investing in global credit markets, combining deep fundamental research and trading skills to target attractive credit opportunities in distressed and special situations investments throughout the credit cycle. Today this fund has built an attractive portfolio that has the following characteristics: (i) shorter duration, event-driven, and contains catalysts, (ii) high in the capital structure, (iii) positions trading at material discounts to fair value, and (iv) mostly exposed to noncyclical industries. The fund believes it is positioned to take advantage of the high levels of distress in the Healthcare (labor inflation, staffing shortages, regulatory change), Telecom and Technology (over levered capital structures), and Consumer/Retail (supply chain disruptions and demand shifts) industries.

What-if scenarios, and appropriate funds for market scenarios and investor risk tolerance

What-if there is a hard-landing in the economy and markets?

In the event that S&P 500 earnings fall -15%, defaults rise sharply to 5%+ on the HY index and 6%+ in levered loans, CCC widens out to 1500bps in HY, then we should expect funds to protect capital, with a rolling 1 year performance of between flat to -5%. During this time we anticipate funds would de-gross and clean their balance sheet in anticipation of the increased opportunity set, acting also as a risk management tool.

For a low volatility and low drawdown option, avoiding funds which on average, tend to be significantly net long credit; a risk-controlled well-hedged expression is through a fund we've worked with for many years (annualised returns of ~8% since 2006 with vol just over 4% and a Sharpe of ~1.5%). The fund deploys a proprietary 3 lever system which ensures downside is capped, but doesn’t constrain the upside excessively. Today the fund is running roughly 2/3 of their delta-adjusted gross portfolio in Credit dedicated strategies, across the spectrum of the asset class. The firm is excited about the Distressed opportunities and focused on idiosyncratic process driven trades, as well as leaning into the Structured Credit space, seeing value in CRTs and CLOs. They believe that CMBS is a generational opportunity in the real estate sector.

For a higher volatility and potentially higher returns option, our opportunistic event driven fund (referenced earlier) is primed to exploit opportunities in volatile markets, and generally has 150% exposure across credit and equity positions. The fund tends to get involved in credit already trading at deep discounts, avoiding fatigue and often buying bonds in the 40s and 50s whilst the corporate might look to de-lever and repurchase in the 60s and 70s for a prompt realized P&L gain. With the higher net exposure and volatility does come the likelihood of higher drawdowns, a feature we are acutely aware of.

What-if a dislocation event occurs ?

These are typically events which require an objective assessment framework, and adherence to disciplined decision-making, as this is the point when the market, and participants, are most fearful. Past dislocation events would be: Lehman Brothers going under and the complete shutdown of the economy during COVID.

We would look to actively add exposure to Convertible Arb, as during these events convertible bonds tend to experience a liquidity driven mark-to-market drawdown, leading to compelling returns in the coming 12-18 months. For example after Lehman (Sep-08) and COVID (Mar-20) the 12 month returns were +38% and +61% respectively.

As noted, we believe this cycle will create good opportunities for investors and allocators with (available) capital, a plan, and access to the best credit managers - and it's a perfect time to start developing a plan !

5 topics