The anatomy of a scam: Australians lost $2.74 billion in 2023

According to the ACCC, Australians lost over $2.74 billion to scams in 2023, down from $3.1 billion in 2022. However, Australians lost the most to investment scams, with $1.3 billion lost last year (down from $1.5 billion in 2022).

There have been some massive investment scams in Australia in recent years - some of which have managed to escape the financial world and capture the attention of the mainstream media.

Take Melissa Caddick's $23 million Ponzi scheme, for example, which saw her defraud dozens of her clients, friends and family. Using someone else's financial services licence, she was able to produce mock financial statements, use new clients' money to pay off older ones and fund her extremely lavish lifestyle - that is, before she disappeared off the face of the Earth and her severed foot washed ashore the coast of New South Wales.

Or Hamish McLaren's at least $7.66 million swindle, which saw him defraud 15 victims (although likely more), including fashion designer Lisa Ho. Using romance and multiple identities, Hamish was able to rip his victim's lives apart. He was arrested in July 2017 and was sentenced to 16 years in prison. His parole comes up in 2029.

While these cases captured widespread attention, scammers have been busily working without much public notice.

Take former Sunshine Coast financial adviser, Brett Gordon, who recently pled guilty to nine counts of fraud totalling $652,500 - using these funds for personal debts, expenses and his business's expenses - and was sentenced to six years imprisonment.

There's also Perth-based financial adviser Mark Sebo, who was recently permanently banned by ASIC after it was found he stole funds from his client's superannuation funds.

ASIC has also investigated Tasmania-based property developer Anthony (Tony) Silver, who has been sentenced to more than eight years of jail time. Between 2008 and 2010 - he raised $9 million from investors and transferred $1.815 million of these funds to his personal bank account. Many of Silver's investors were pensioners. Some borrowed against their homes to invest.

All of this is to say that there are still plenty of scammers alive and well in Australia - I, for one, receive at least one scammer's text or call daily. But how can investors spot the scams before it's too late?

In this wire, we'll explore that very topic.

How to identify a scam

Investors should be sceptical of anyone who offers them easy money - like promises of high returns on an investment with little to no risk. Unfortunately, if it sounds too good to be true, it likely is.

There are three main types of investment scams, according to ASIC's Money Smart website. These include:

- Fake investment offers,

- Scammers who pretend to offer legitimate investment opportunities, but they run off with your money, and/or

- Scammers who pretend to work for a well-known company offering legitimate investments, but they don't.

These scammers can use professional-looking websites or apps, impersonate legitimate companies, use fake financial services licenses and more - meaning, it is incredibly hard to spot a scam.

Today, thanks to artificial intelligence, it's a whole lot harder still, with some fraudsters using deep fake videos of celebrities to spruik their investment schemes. You may be able to identify that a video is a deep fake if:

- The person speaks with an unusual accent, pauses or at a strange pitch,

- Their mouth isn't moving in time with their words,

- Their facial expressions don't match the tone of the video, or

- The video is low resolution (blurry).

Typically, scammers will entice investors with "guaranteed" or quick and easy returns, and sometimes tax-free benefits. Whether it's shares, real estate, cryptocurrencies or bonds, all of these investments will boast "high returns". There's no such thing as getting rich quick - if someone is offering this opportunity to you, it's probably a scam.

There's also a chance a fraudster may convince you to use a fake trading platform to trade currencies, options, futures or gold. Or, you could be convinced to sign up others to help build their client base (this is often referred to as a Pyramid Scheme).

Often, according to Money Smart, investors will feel the opportunity is "low risk" as scammers will convince them they can sell at any time, or get a refund if the investment doesn't perform as expected.

Sometimes, fraudsters will convince investors that these transactions are "guaranteed" or insured, or that they can swap one investment for another if the "investment" isn't performing as expected. They also may offer inside information on upcoming IPOs or discounts for early investors, impersonating real companies to suck you in.

How to protect yourself

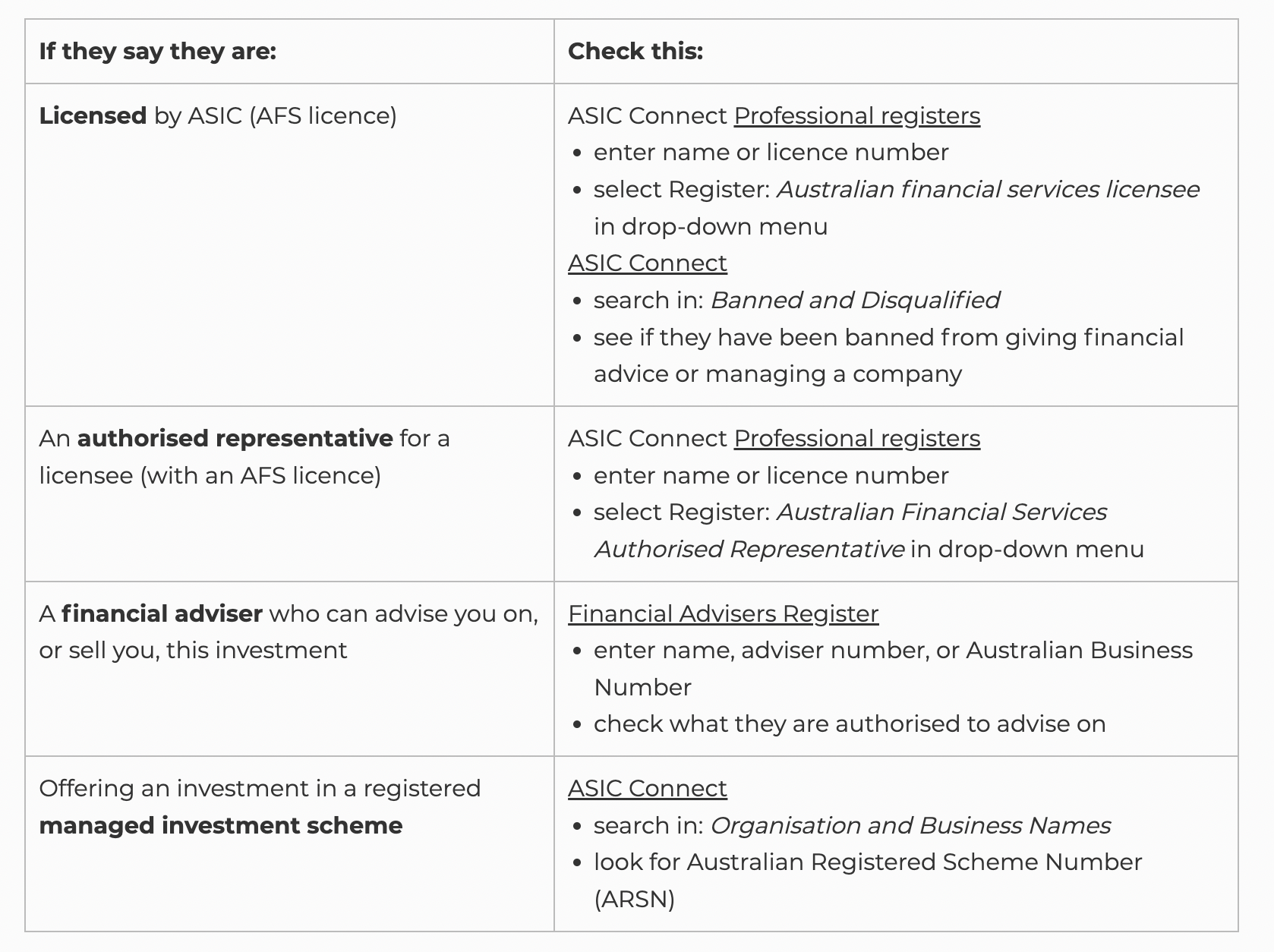

Always, always, always check a financial services provider's license before investing. You can check the legitimacy of firms using THIS PAGE and you can check that a financial adviser is registered HERE. Check out the below for more guidance on licenses:

Money Smart has developed a list of companies that are targeting Australians, do not hold current Australian financial services (AFS) licenses or Australian credit licenses from ASIC, or are not allowed to offer investments in Australia. You can check out these companies and websites HERE.

It's also important to make sure you understand what you are investing in. Read a prospectus or a product disclosure statement before investing - and if you don't understand it, it's probably worthwhile getting a financial adviser to read over the documents for you.

You can complain if someone goes wrong if a company or individual is licensed. That becomes a lot harder if these individuals or companies are not regulated by ASIC - like crypto, direct investments in real estate, precious metals or international investments offered by brokers or individuals overseas.

Be safe out there, my friends. It's the Wild West at the moment.

3 topics