The asset combining the best of both equities and bonds

Against a backdrop of economic and geopolitical uncertainty, rising inflation, and interest rates, Australian investors are searching for investments that can benefit from evolving market conditions. With credit spreads at attractive levels, we think now might be the opportune time for exposure to hybrids and credit.

Due to the complex nature of hybrids, where debt and equity characteristics between securities can vary widely, historically, investors haven’t embraced the potential opportunities or understood where they fit in a portfolio. It begs the question of whether now is the time for investors to invest in hybrids.

Decoding hybrid securities

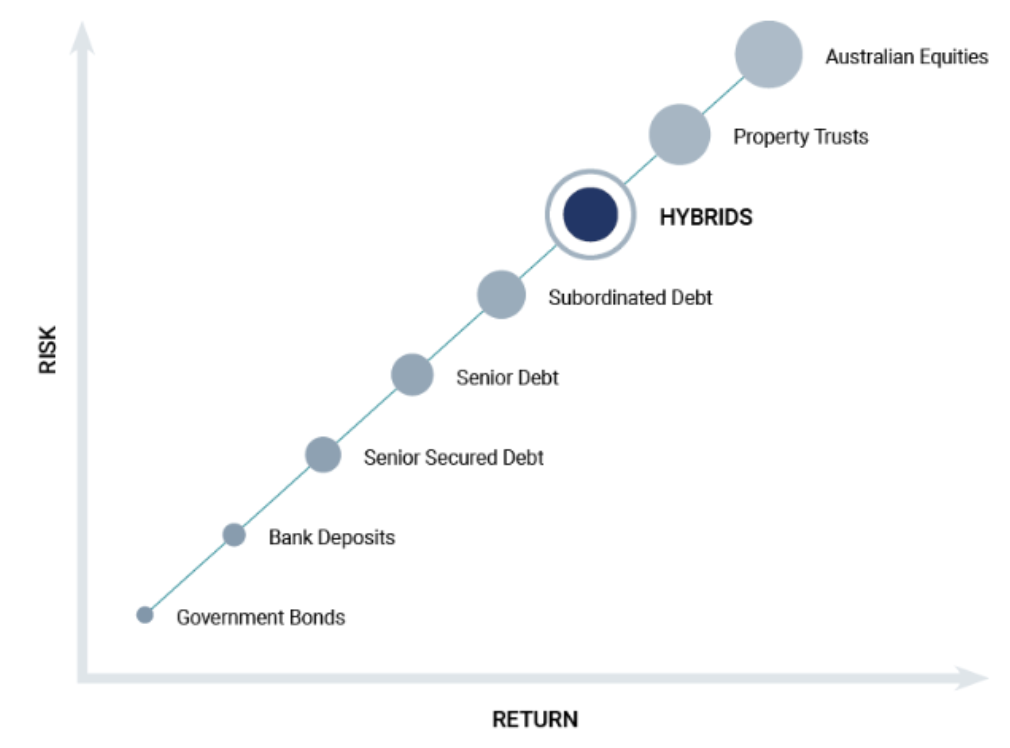

Let’s take a step back. Hybrids are an investment that combines elements of debt and equity. They are typically riskier and offer a higher return than traditional debt investments, such as bonds and term deposits, but are less risky and offer a lower return than equity investments.

There is a wide selection available, ranging from simple convertible debt securities to sophisticated financial instruments, each with its own terms and conditions.

Risk vs return

Hybrids are a blend of equity and debt. Some behave more like equities, and some like debt. They can be broadly grouped into three categories, each having different characteristics making them more or less volatile.

Firstly, convertible debt securities, give the investor or issuer the option to convert their principal plus accrued interest into an equity investment, usually ordinary shares, at a future date. Secondly, preference shares, provide regular income payments, but unlike ordinary shares, the income is paid as dividends with a rate that can be fixed or floating.

Like a bond, they can be converted to cash at maturity. And finally, capital notes, which include perpetual debt, subordinated debt, and knockout securities. These instruments pay regular interest until the note is redeemed at which time the principal is repaid to the investor.

To risk or not to risk?

Like any investment, there is a trade-off between risk and returns. Hybrids generally offer a higher yield than traditional fixed income investments, such as bonds, but there is usually a higher level of risk too, including:Liquidity risk: hybrids are generally less liquid than investments like ordinary shares, so they may not be able to be traded quickly enough to prevent a loss.

Credit risk: there is a possibility that the issuer of the hybrid is unable to satisfy the requirements under the terms of the security, e.g., defaults on payments.

Length to maturity: the longer the maturity, the greater the chance that the company could default on its obligations.

Conversion risk: if the security converts to shares, they may be worth less than the initial investment.

Not guaranteed: unlike bank accounts, hybrid securities aren’t covered by the Australian Government deposit guarantee.

Lastly, depending on the security, you could be last to be paid if the company is wound up

Balance sheets you can “bank” on

Australian banks are the largest issuers of hybrids domestically, with balance sheets in generally good shape and capital ratios at historically high levels. COVID-19 provided Australian banks with access to cheaper funding via the Term Funding Facility (TFF), which provided them with a degree of funding certainty and lower funding costs.

Following the withdrawal of the TFF in 2021, new bank issuance is coming to market at attractive credit margins, providing an ideal environment for active credit managers to identify the most positive risk-adjusted opportunities.

Aside from banks, insurance companies and other financial institutions offer access to hybrids on the ASX.

Why 2022 could be the year of the hybrid

Rising inflation, above-average GDP growth, and the unwinding of quantitative easing (QE) in 2022 have seen financial markets reprice interest rate expectations.

The rising rate environment will likely push the outright return on hybrid securities higher, without having a material impact on spreads given the strong economic backdrop. Given most hybrids are floating rates, investors will likely benefit via higher income from these rising short-term rates.

Generally, the higher the running yield of an investment, the greater the protection it offers investors from adverse movements in credit margins.

Based on an average portfolio maturity of ~3 years, we’d likely need to see an extreme move wider in credit margins to wipe this out. However, given the robust economic backdrop in 2022, we expect credit margins to remain relatively stable, adding to floating rate credit’s income-generating credentials.

This benign outlook contrasts with the capital losses currently being observed in traditional fixed income due to the reset in interest rates and real yields. Usually, a rise in real yields impacts the value of everything long interest rate duration, from traditional fixed income to most equities. That’s not the case with floating rate credit since its short duration generally offers protection to portfolio valuations from rising interest rates.

Getting exposure to hybrids

Investors can access a small selection of hybrids on an exchange, but not the entire universe of securities that are available through secondary markets.

The hybrid market can experience low levels of liquidity compared to equities listed on the share market. This means that investing directly via an exchange can be more costly for retail investors because the bid-offer spread (the difference between the market price that hybrids are bought and sold for vs. the share price for the same security) can vary enormously on any given day.

For an active fund manager, their buying power means they can access liquidity in the professional market or trade in the over-the-counter (OTC) market, which experiences greater volumes than a retail investor can access on the ASX. They can also trade directly with other financial institutions, which generally offer better terms and a tighter bid-offer spread.

Access to regular, stable income

The Yarra Enhanced Income Fund seeks to deliver higher returns to investors than traditional cash management and fixed income investments. Learn more by visiting our website.

1 topic

1 fund mentioned