The ASX dividend dilemma

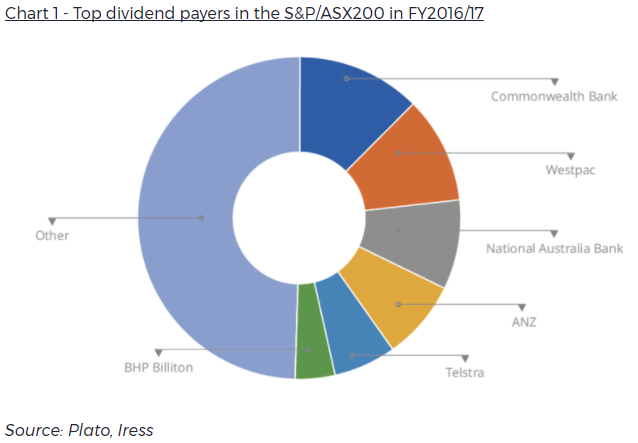

Telstra and the banks are mainstays of any Australian income-focused portfolio and make up nearly half of the dividends paid out by ASX companies in FY17. However, all five are down year-to-date, and Telstra recently announced an approximately 30% cut to its dividend.

Historically, the ASX has been viewed as a stable source of income, but is this is changing? To answer this, Livewire reached out to three specialist income investors, Plato Investment Management, Vertium Asset Management, Merlon Capital Partners, for their views. Read on for full commentary, including how BHP’s increase in dividend this year has already more than made up for Telstra’s future cut.

Question:

"The ASX has been viewed as a stable source of income, do you believe this is changing?"

Banks and miners will compensate for Telstra

Dr Don Hamson, Plato Investment Management

The yield on the ASX/S&P200 has been remarkably stable over the years, and while Telstra has already announced a large cut in next year’s dividend, BHP’s increase in dividend this year has already more than made up for Telstra’s future cut. In fact, resource stock dividend increases were a highlight of the August reporting season.

As for the banks, we believe their dividend prospects are currently pretty good. While the bank levy is a drag on the earnings of the big four banks, interest only loan repricing has largely offset the cost of the levy. Despite recent share price falls in CBA associated with the AUSTRAC issue and governance concerns, CBA increased its final 2017 dividend by 4%.

ASX remains a stable source of dividends

Jason Teh, Vertium Asset Management

Given the dividend imputation system is a permanent feature of the Australian financial landscape, on average, ASX-listed companies should continue to deliver a stable source of income from dividends.

However, individual companies may cut their dividend. In recent years, we have witnessed quite a few large companies (such as BHP, ANZ and Telstra) cutting their dividend. The dividend cuts are very much due to stock-specific reasons as opposed to what is happening in the broader financial landscape.

Dividends must be sustainable

Neil Margolis, Merlon Capital Partners

Dividends should be set with reference to sustainable free cash flow, which in aggregate, is stable and growing. However, in a growing number of instances, company directors have over-distributed relative to the sustainable free cash flow. This is done by borrowing money to pay dividends, cutting back on necessary capital expenditure and basing dividends on unsustainably favourable short-term conditions.

Some property and infrastructure stocks are examples of companies borrowing to pay dividends, while some mining stocks have cut back too far on CapEx and are paying dividends based on commodity prices that are inflated on most long-term measures.

Question:

"Do you expect the breakdown of top dividend payers in the Australian market to change dramatically?"

Only a crisis could stop the big four

Dr Don Hamson, Plato Investment Management

We would expect the big four banks to continue to dominate the top dividend payers in the Australian market. It would take a significant banking crisis, which we are not predicting, to materially change the make-up of the top dividend payers in Australia.

However, we believe Telstra is in danger of dropping out of the top 6 dividend payers with BHP and Wesfarmers likely to usurp Telstra next year, given Telstra’s pre-announcement of a 29% fall in dividends from this year’s 31c fully franked to 22c fully franked next year.

Differing challenges for the major players

Jason Teh, Vertium Asset Management

In 2016, BHP aggressively cut its dividend by 75% when its balance sheet was under stress with collapsing commodity prices. To ensure the balance was protected going forward, BHP changed its dividend policy from historically being progressive to a target payout ratio. Hence, in the future, its dividend will vary based on movements in commodity prices.

In 2017, Telstra cut its dividend by 30% to 22 cents per share. Its historic dividend was highly unsustainable because of the substantial earnings hole post the NBN migration and they historically had a dividend payout ratio of 100%.

Out of the big four banks, ANZ had to cut its dividend in 2016 because it had the weakest capital position at that time. Barring a recession, the big four banks’ dividends are sustainable given all four have a clear path to reaching APRA’s target common equity tier 1 capital ratios of at least 10.5% by 2020.

Concentration creates unique risks

Neil Margolis, Merlon Capital Partners

The ASX index is heavily concentrated in a handful of banking and mining stocks which poses unique risks given both sectors are dependent on favourable macro conditions beyond their control.

We are not as bearish on the banks as some commentators, but our non-benchmark approach means we always have a lower weight than the index and will only invest when they are undervalued. Outside of a recessionary environment, we view bank dividends as more sustainable than mining companies’ due to the favourable industry structure which reduces competition and allows banks to increase pricing when bad debts rise. The banks are also well capitalised in an historical context.

2 topics

8 stocks mentioned

3 contributors mentioned