The ASX's dividend champion might soon be on the hunt for bargains

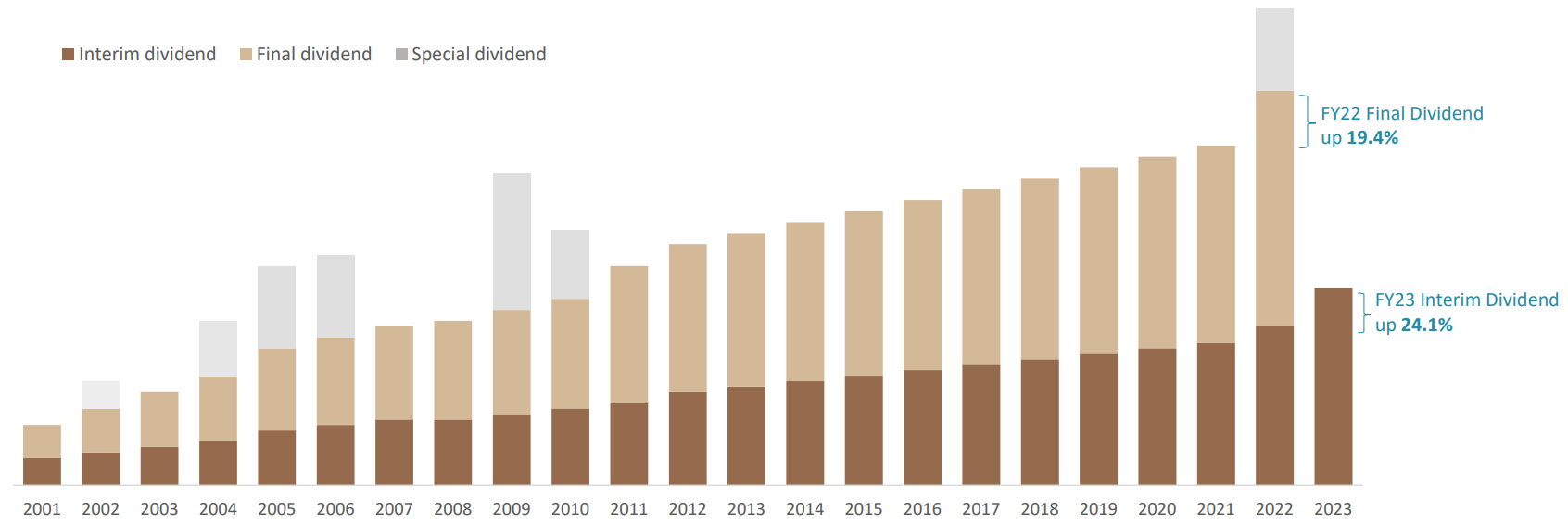

Washington H. Soul Pattinson (ASX: SOL) (WHSP) is one of the only Australian companies that can proudly say they’ve never missed a dividend payment since 1903 and on-track to mark a 22nd consecutive year of dividend growth.

Such consistent long-term performance reflects discipline investments in high quality, cash generating investments that perform throughout the cycle.

As it currently stands, WHSP has major shareholdings in companies with robust cash generation such as TPG Telecom (ASX: TPG), New Hope (ASX: NHC) and Brickworks (ASX: BKW). The ‘Strategic Investments’ division accounts for roughly half its $10.6 billion portfolio.

The conglomerate is currently reducing the size of its Australian Large Caps (~26% of the portfolio) and focusing on defensive companies in sectors such as Financials, Healthcare and Staples.

When we asked about what opportunities lay ahead, Robert Millner – executive chairman of Washington H. Soul Pattinson, reiterated that they were in no rush for more exposure or acquisitions.

It was all about patience.

“We’ve got a very large nest egg that’s sitting in the bank … We thought we might’ve had some attractive opportunities by now … [But] we’re quietly confident we can start to see some bargain hunting coming in the next few months or early in the new year. We’re certainly well positioned for it.”

Millner recalled a situation from a couple years back when “we had over $1 billion [in cash] for 5-6 years. People kept pestering me about ‘What are you going to do with 1 billion?’ Eventually, we bought the second lowest cost producing coal mine, Bengalla in NSW, at the bottom of the market.”

“We’ve always been patient investors.”

In this wire and video, you’ll learn more about WHSP’s diverse portfolio as well as Millner’s view on the current business cycle and M&A outlook.

2 topics

4 stocks mentioned