The ASX tech firm delivering 35% revenue growth (and tipping another 30% upside)

You don't hear too often of companies making acquisitions right before handing down an earnings result but that is exactly what Wisetech Global (ASX: WTC) has done. In the last half, WiseTech acquired US-based software logistics company Blume Global for US$414 million and transport logistics firm Envase Technologies for another US$230 million.

That's over half a billion US Dollars in purchases just confirmed in the last six months.

Then came today's numbers. A 35% increase in revenues, leading to a 40% increase in profits. The uptick in earnings comes just six months after net profit at the company soared 80% in the full-year result.

But key questions remain - among them, is this the last good result for big tech names listed locally? Or will Wisetech avoid the layoffs and margin compression seen in the recent US Big Tech earnings season?

To discuss the report and much more, we sat down with John Guadagnuolo of Antares Equities.

Note: This interview was conducted on Wednesday February 22 2023. WiseTech is no longer a top holding in the Antares Ex-20 Australian Equities Fund. The stock was last held in 2021.

WiseTech (ASX: WTC) H1 key results

- Revenues up 35% to $378.2 million

- NPAT up 40% to $108.5 million

- Earnings per share up 40% to 33.2c/share

- Final dividend of 6.6c/share, up 39%

- FY23 revenue forecast of between $790 million and $822 million

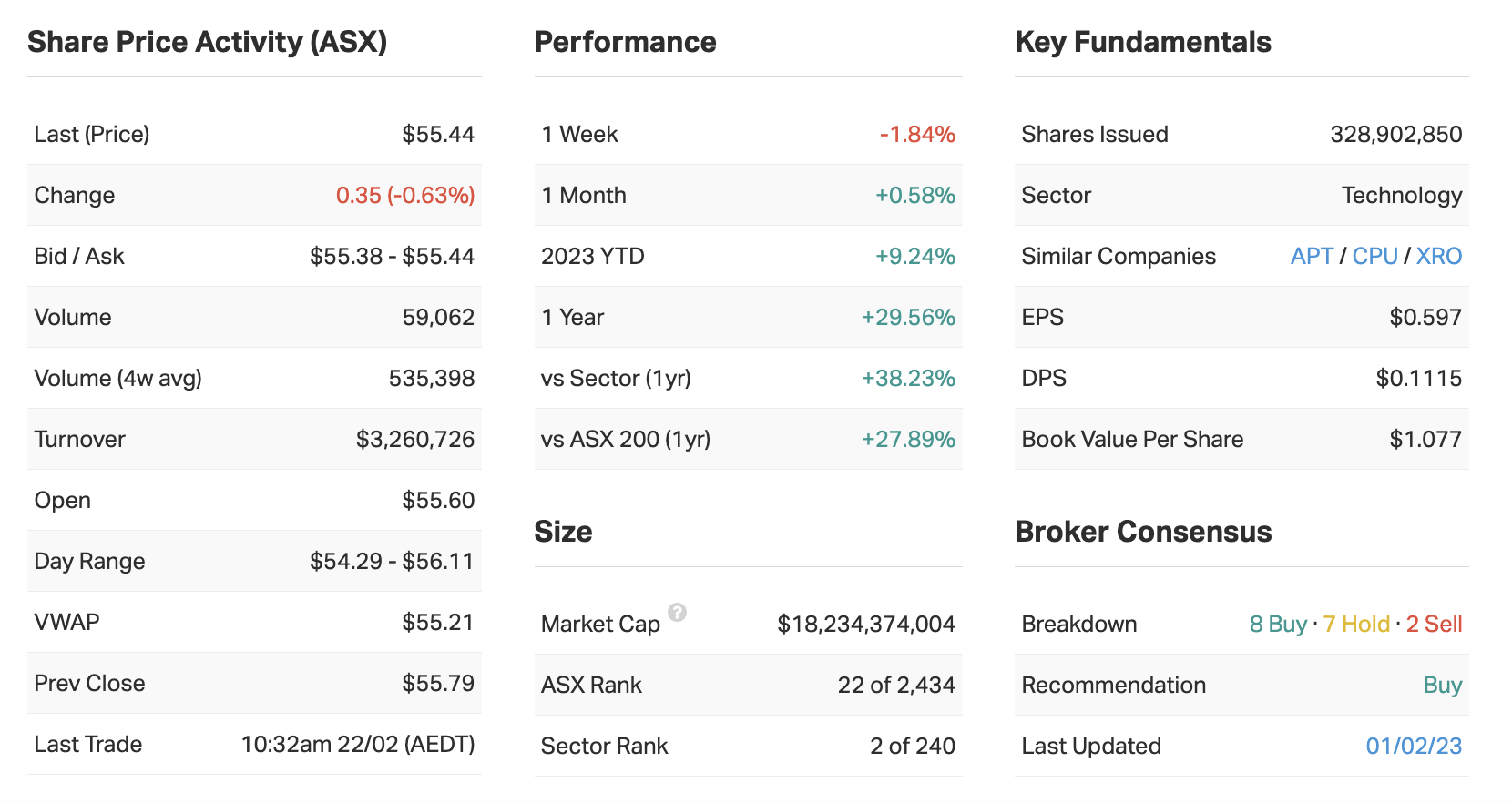

Key Company Data

MarketMeter

WTC was ranked eighth in the ASX 100 for companies that have a sustainable competitive advantage. For more on our coverage of MarketMeter's institutional research, click here.

What were the key takeaways from this result? What surprised you the most?

It was a good result with some interesting strategic developments. I was surprised by the organic revenue growth in the half if I'm being honest, and I think the company was as well. It's interesting because it points to something the company has said in the past. We know that freight volumes have declined in the past six months.

In theory, there should be a connection to Wisetech's revenue lines because of declining volumes but it seems the opposite has occurred because the companies that use Wisetech have used it more over the last six months and are more open to using it to offset the costs as volumes have declined.

What was the market’s reaction to this result? Was this an overreaction, an under reaction or appropriate?

It could be argued the second-half guidance for revenue growth could be perceived as weaker than what the market thought given the strength of the first half result. But underlying revenue growth and guidance was maintained, allowing for the acquisitions that have been made. Over time, I think the market will come to like this result.

Would you buy, hold or sell WiseTech on the back of these results?

Rating: BUY

We would be buyers of WTC on the back of the deal announced for its customs module with a major freight forward company based in Switzerland. The deal they have done is for a customs module and it's a complex area for forwarders to navigate because there are all sorts of restrictions, requirements and rules about what you can and can't ship out. It's like when you fly in from overseas and there are all of those different rules but it's on a boat. It's an interesting and unexpected development from my perspective at least.

It gives us food for thought but we struggle with the valuation of Wisetech to an extent. But on the other hand, we recognise it's a very good business and if they are able to add these modules in with such regarded customers, then clearly the runway for growth is a lot longer than people anticipate.

While the valuation gives us food for thought, the strategic implications of the announcements today are material in our mind.

What’s your outlook on WiseTech and its sector over FY23? Are there any risks to this company and its sector that investors should be aware of given the current market environment?

The clear driver of the tech sector is going to be interest rates and within that, some companies will perform well and some won't. As interest rates go up, the valuation of these longer-duration equities is more adversely affected than other types of companies because the growth you pay for is more heavily impacted due to the higher interest rates feeding into your discount rates.

On the other hand, because rates have been going up for the last 6-12 months bringing to an end the cheap flow of funding enjoyed by the tech sector, many companies in the tech space have been forced to reconsider their business models and to focus on cash generation and efficiency. Hence emerging with higher margins and better businesses, not unlike the mining sector following the China infrastructure boom.

So the outlook is interesting. You're wrestling with companies that are focusing on efficiency generally have high barriers to entry in what they do and generally solve problems for their customers in ways that others can't. But you're wrestling with an environment of rising rates and rising capital which can adversely affect their valuations.

In terms of WiseTech, the company probably enjoys the benefits from a slowing environment because it does save its customers material amounts of money when it comes to processing freight forwarding requirements. To give an example, they can do an enquiry on a system in a matter of moments that would have otherwise taken a person an hour to do manually.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or are you cautious on the market in general?

Rating: 3

It's because of the outlook. Valuations don't look overly stretched but we're seeing cost inflation rise in companies' bases and that's impacting margins. Therefore you can foresee earnings being brought down by margin contraction. Inflation obviously hurts consumers because they can buy less therefore there is fewer sales while your cost base goes up. This risk occurring has manifested in the past reporting season so far. A lot of companies have talked about the rising costs they are dealing with but having said that, multiples don't look overly stretched.

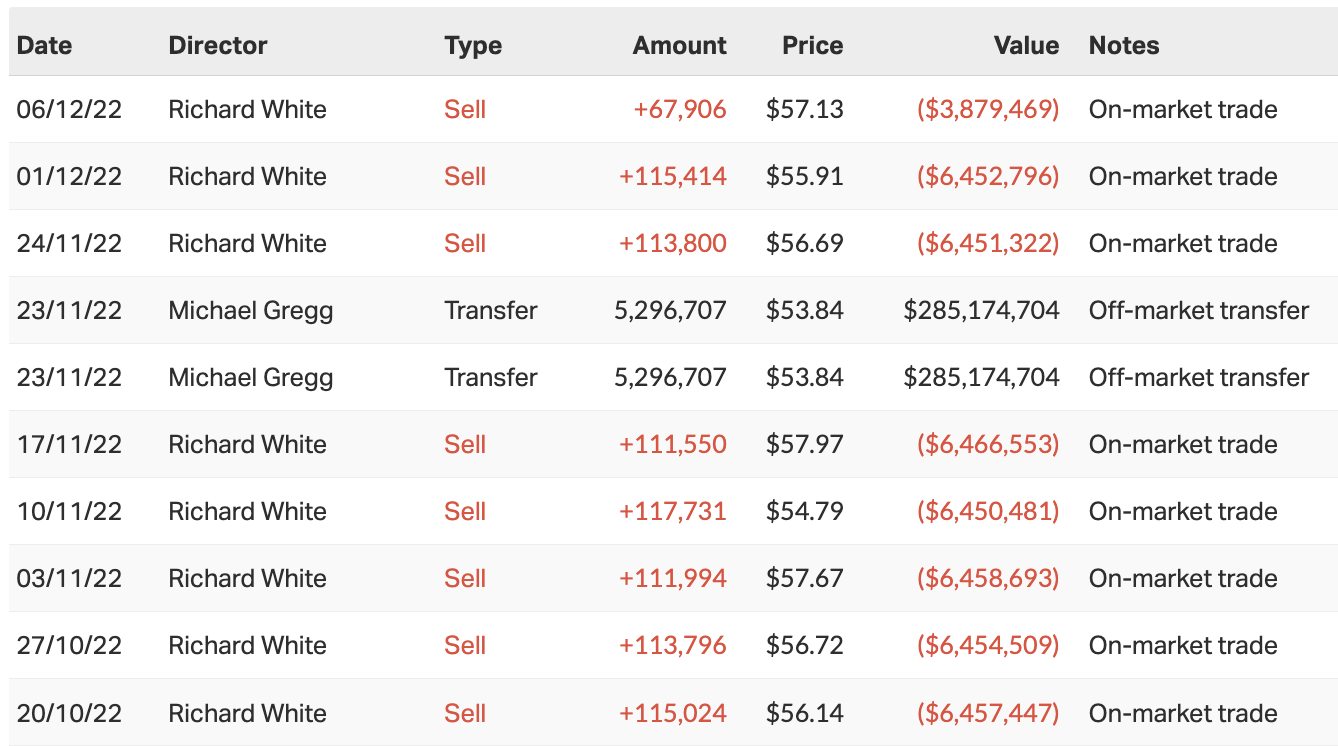

10 most recent director transactions

Catch all of our February 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

3 topics

1 stock mentioned

1 fund mentioned

1 contributor mentioned