The Aussie dollar: A tale of the four Cs

When we last detailed our outlook for the Australian dollar (AUD), in mid-September, we re-identified the fundamentals of our domestic currency’s worth using a well-known framework known as the 3 Cs. We also added a fourth C to the mix: COVID.

- Commodity prices & terms of trade

- Carry: interest rate differentials

- China: their growth and how it influences our growth

- COVID-19: which has driven so many economic relationships of the past two years.

In the following wire, we want to nuance some of these factorial views and the economic influences, as well as provide an update for our AUD trajectory given the market has moved.

Horizon preference

If you’ve ever wondered how and why some factors affect economic outcomes and security prices at times, but not at others, you need to be aware of a concept called “horizon preference”.

The idea is that depending on your sentiment and circumstance, your views of the future will shift between the short and the longer term.

When things are good, we think longer term, into the future.

When things are bad or relatively worse like last year and much of this year, we dwell on the present and think about our immediate safety, our supply of food and water, our ability to pay bills etc.

As countries have emerged from the pandemic and are beginning to transition into pre-COVID levels of economic and social activity, horizon preferences have shifted once again from shorter to longer-term as perception and reality shifts from relatively worse to better.

This change in sentiment regarding the economic recovery is the reason why we’re starting to see a shift in investor preferences and sentiment, and renewed optimism and longer-term strategic thinking.

AUD versus USD

This is important for the valuation of our AUD, as our currency is a global bellwether for economic activity and global trade.

As we’re a relatively open economy with accessible capital markets and a liquid currency, we’re amongst the few preferred proxies for global investors, looking to take advantage of economic reopening and the positive shift in sentiment.

As it stands, the AUD/USD exchange rate is sitting just above 74 cents (as of 15 October 2021) having reached a recent low of 72 cents.

As we forecast in our previous currency update, we expected a near-term low of high 71 cents to low 72 cents as our key support level, which would likely align with peak negativity regarding domestic COVID infections.

Chart 1 – AUD/USD Spot Exchange Rate

Source: Bloomberg, as of 15 October 2021

This investment thesis was validated in September as more than half our national economy was effectively in lockdown restrictions, in a period just before vaccination rates showed we were nearing towards our 70% 16+ threshold.

Carry

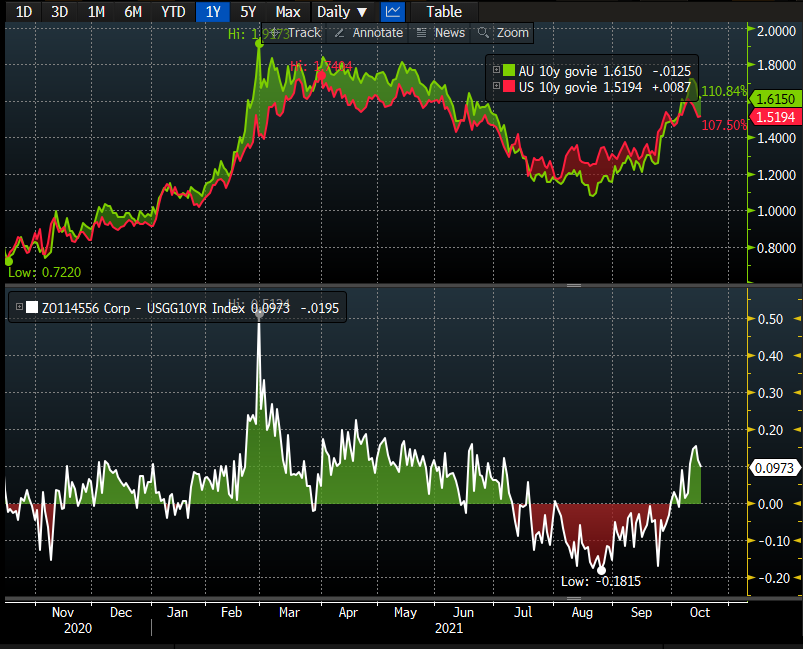

In the past five to six weeks, Australian 10-year government bond yields have risen from 1.23% to 1.62% at the time of writing, where yields are now above the equivalent US 10-year treasury bonds.

The interest rate differential is now more than nine basis points. While this isn’t much, it shifts the marginal demand curve for Australian bonds, as global investors will prefer higher-yielding bonds.

It’s also worth noting the Australian government bond are rated AAA, and our 10-year "guvvies" are among the highest yielding in the world.

This factor starts to re-establish the carry trade, where foreigners will buy AUD in order to buy Australian bonds.

Chart 2: - Australian 10y Government Bond versus USA 10y Treasury Bond (top panel), and spread between the two yields (bottom panel)

Source: Bloomberg, as at 15-October-2021

Commodities

Part of the catalyst for writing this note has been the sudden surge in industrial commodities, another sign of economic activity.

In the trading period between Monday and Thursday last week, the London Metals Exchange (LMEX) gained 5.9%, which was deemed to be a sudden strength in demand for commodities, in contrast to the supply side issues that have plagued natural gas, coal and oil markets, as of late.

This was also reflected in the S&P500 index on Thursday, where the biggest equity market movers were the materials industry, up +2.5% on the day, after a +3.5% jump in copper spot prices, and +3.7% for zinc as well.

All-in-all, the Bloomberg Commodities Index continues to move from strength to strength this year. This coincides with many nations pledging large infrastructure spending packages as a stimulus to create jobs and enhance future productivity – a time when demand outstrips supply.

Chart 3 – Bloomberg Commodities Index

Source: Bloomberg, as at 15-Oct-2021

COVID and central banks

One of the strongest long-term, real-time indicators for Australian dollar gains has been our terms of trade, referring to the net change of exports relative to imports.

Economically, as we export more relative to imports, our net exports increase, and our terms of trade is higher.

As we export more and more commodities, miners tend to repatriate some to all of their USD receipts back into AUD, which can see the AUD rise.

Thus, a rising "terms of trade" has historically been associated with a rising AUD/USD exchange rate, where the USD side of the equation is far less volatile than the AUD side.

The cycle would usually happen in this way:

- Foreign countries purchase more Australian exports.

- Exporters repatriate their foreign currency (usually USD) trade proceeds back to AUD.

- Financial markets would also be predictive of this relationship and purchase AUD on the expectation of a move higher for the currency.

- The increased purchase of Australian exports would see prices shift higher, which would be inflationary, as would the increased monetary velocity.

- Inflation expectations would rise, and bond yields would trend higher as additional compensation required for investments as mitigant against inflationary risks.

But due to COVID’s impact on our economy, the increasing terms of trade was not met with higher bond yields and inflationary pressure as:

- corporate earnings tended to be saved rather than spent or reinvested; and

- the RBA maintained its Yield Curve Control policy, pegging our 3-year government bond yield at 0.1%, equal to the Overnight Cash Rate.

So, the terms of trade effect was muted and our AUD/USD exchange rate (green line) decoupled from commodity prices (orange line).

Chart 4 – AUD/USD (green) Compared to Bloomberg Commodities Index (orange)

Source: Bloomberg, as at 15-Oct-2021

Looking forward

As we know, the RBA has begun to taper its bond-buying program and will review in February 2022 whether it can taper it again.

Moreover, the RBA has also opted not to extend its three-year interest rate peg beyond the April 2024 guvvie. This implies it considers the conditions may be appropriate to begin hiking interest rates in and around the second half of 2024.

As this interest rate peg rolls off and as the QE program is curtailed, more of our bond supply will be able to freely float. This means we will likely see Australian bond yields outstrip other comparable global bonds again, such as US and UK sovereign bonds, at various points along the yield curve.

This will allow increased marginal capital flows as more investors seek carry trades within government bond markets – certainly a market where investors are starved for yield.

We expect this to start happening in the coming months, at a time when China also starts to spend money building facilities for the 2022 Winter Olympics - having also experienced provincial lockdowns due to a new wave of COVID infections, from which it is slowly emerging.

In recent weeks, there has been increased Chinese economic activity – boosting its demand for iron ore, steel, copper, and bitumen to name just a few key commodities. This should also benefit Australian exporters of natural resources.

Conclusion

In combination, this means we can consider the AUD/USD has begun its ascendency, likely moving higher, towards a fairer value of between 75 and 78 cents.

Carry has turned positive, commodities have become more positive, China is less negative and more neutral, and COVID influences are less negative - all-in-all creating a positive backdrop for our AUD.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

Expertise