The Australian asset class offering "very good value" right now, according to JPMorgan AM

There is no shortage of narratives to be caught up in financial markets right now. On the one hand, Chinese stocks are still, arguably, undervalued despite a raft of stimulus announcements. Markets want to see more and if they don't get more, the result will likely be another sell-off in those assets. Meanwhile, central banks around the world have started interest rate-cutting cycles in what they hope will end up being a rare soft landing.

On the other hand, the US election is such a coin toss at the moment that the JPMorgan Asset Management team have 10 scenarios planned for November 5th and the weeks following voting day.

"It does feel binary to a certain extent, and it does make it quite difficult to think about positioning more broadly," admitted Kerry Craig, Global Market Strategist at J.P. Morgan Asset Management.

So where do professional investors like these position themselves against this backdrop? Find out in this wire.

"Moderate your expectations"

Right off the bat, Craig emphasised that investors will need to moderate their return expectations, especially in equities. After all, we are in the midst of a single-digit economic growth picture.

"It's still a relatively benign outlook," Craig said, adding that the current consensus expectation of 15% earnings growth next year is rich.

"We are still leaning into risk assets but moderating some of the return expectations, given the returns we've seen in equity markets and acknowledging the fact that valuations have moved a lot across most asset classes," he said.

Where does the best value lie at the moment?

Chinese equities are one area where the team is seeing some value at the moment, but they also believe that Beijing will need to provide more.

"We want to see an improvement in the economic data and we want to see more details around the fiscal stimulus before we make a decision about whether there is going to be a durable improvement in the market and equities can continue the rally," Craig said.

If they had to pick an equity market for alpha, they would still choose the US, given it's a "high-quality market," adding that cash flow generation among the world's largest companies "is still a reason to own them." Ex-US, the team says the structural story for Japanese equities (corporate governance reforms mixed with renewed earnings growth) remains strong.

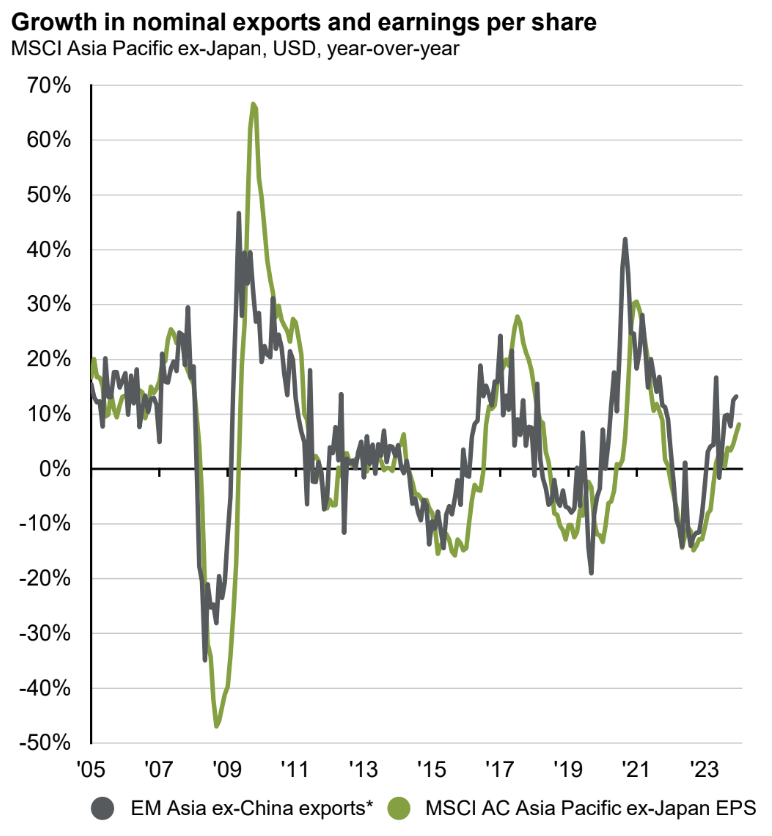

Emerging market assets also make a case, given that fundamentals are trending in the right direction. The chart below, direct from the team's presentation, shows how rising exports tend to correlate with rising earnings per share. And as we all know, it all comes back to earnings at the end of the day.

Craig and his colleague, Arjun Vij, portfolio manager on the Global Aggregate Strategies team and manager of the JPMorgan Global Bond Fund (and active ETF JPGB), see value in core bonds given the bond-equity correlation is back to where it traditionally should be. As the following chart demonstrates, the return to a negative bond-equity correlation implies that bonds serve as a good hedge should a downturn occur.

"If we return to that [pre-GFC] world, bonds are very cheap. If we're not returning to that world, then bonds are priced fairly," Vij said.

...and more specifically, Australian bonds.

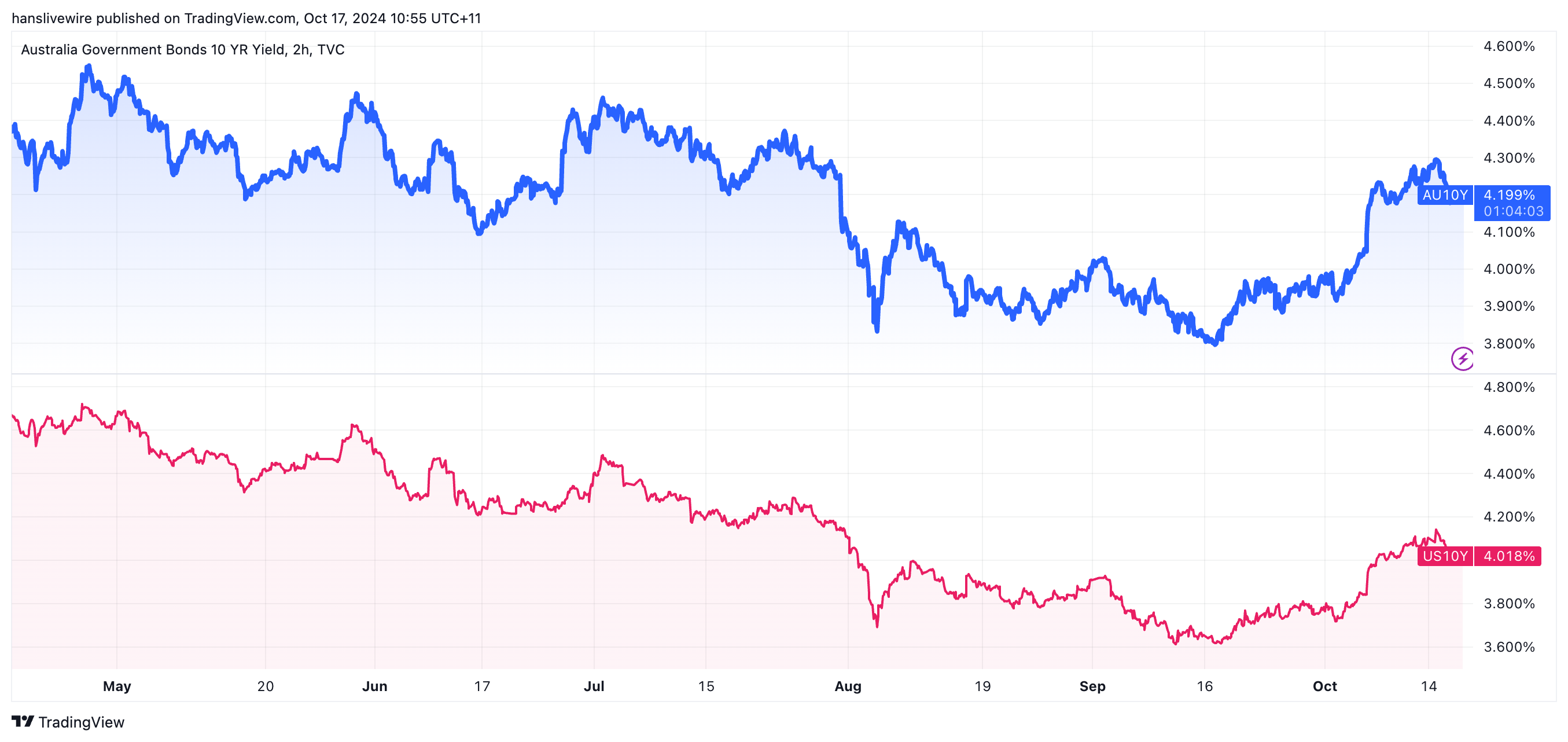

"Longer term, the Australian bond market offers very good value."

"There are a couple of reasons we like it. One, it's the steepest developed market yield curve, except Japan. Japan is a market that we are underweight while Australia is a market that we will eventually go long in a relative sense versus other developed markets."

"The other thing to keep in mind is it's all level-contingent. We think the Australian 10-Year government bond represents value when it trades 25 basis points above the US 10-Year Treasury yield. So for these reasons, we remain positive on Australian bonds relative to other opportunities but we are still cautious as we wait for further signals from the RBA."

"While valuations are attractive we are waiting on the fundamentals to show progress, in particular we want to see Australian inflation fall closer in line with the RBA’s guidance," Vij added.

Will the rotation out of the ASX banks into miners continue?

Craig added that Australian investors should not raise their hopes too much, saying Chinese stimulus announcements may not have the same fundamental effect as they did on the Australian share market in 2008.

"In the long run, we wouldn't expect it to have the same effect on the Australian economy. What's had a bigger impact on Australia over the last few years is Australian government spending in terms of the growth outlook," he said. "I think the assumption that it's going to have the same impact as it has had in the past on markets like Australia is probably not correct."

"Initially, that rotation is entirely plausible ... [but] I think that rotation would continue with or without China. For us, that doesn't mean selling the miners. It just means that the valuation in the Australian market is more positioned towards miners [upside]," Craig added.

4 topics