The Australian city where house prices could surge through to 2032

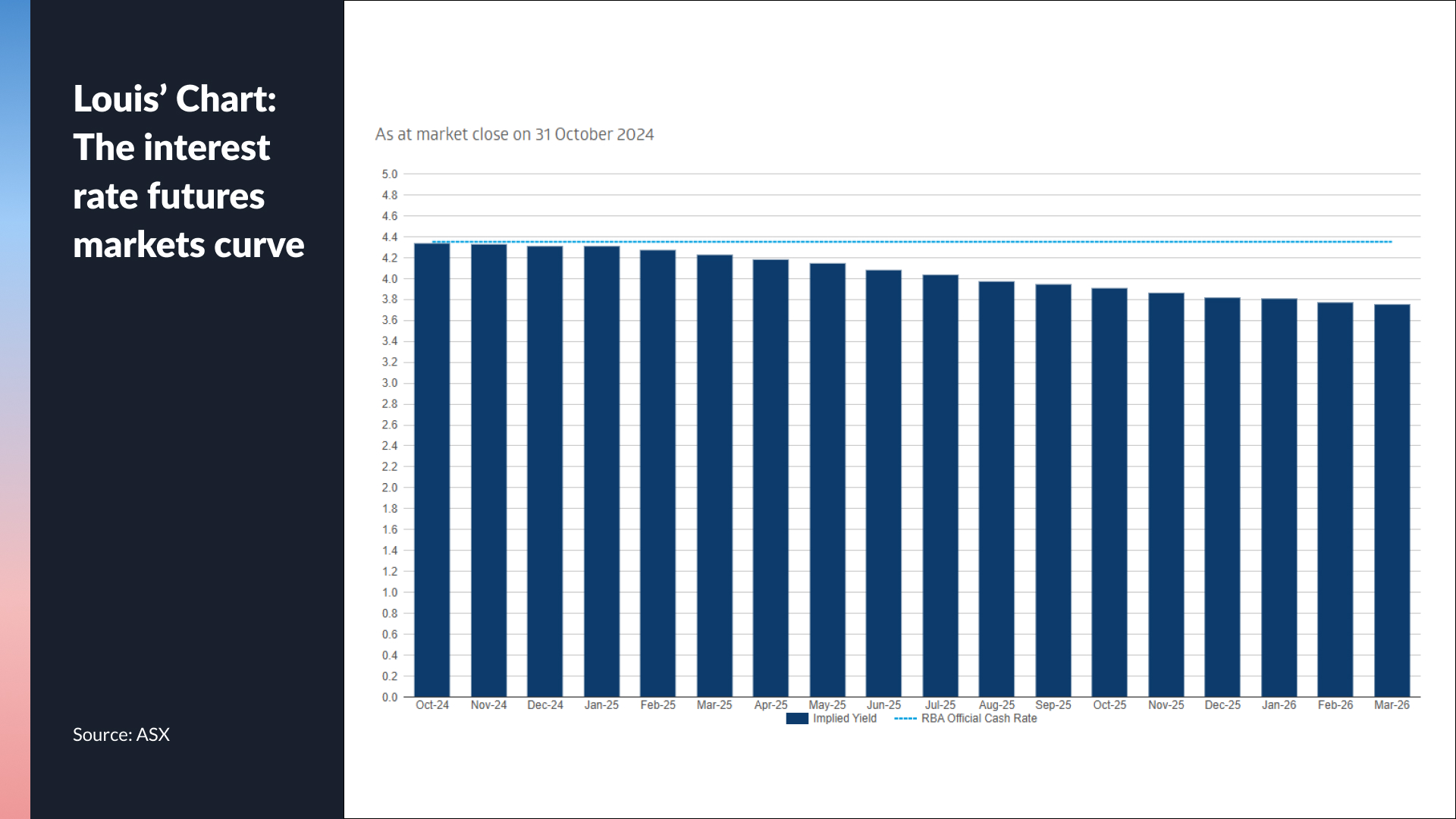

Interest rates have not been cut this year in Australia, much to the chagrin of many investors. Yet despite this, the housing market has continued to remain remarkably strong.

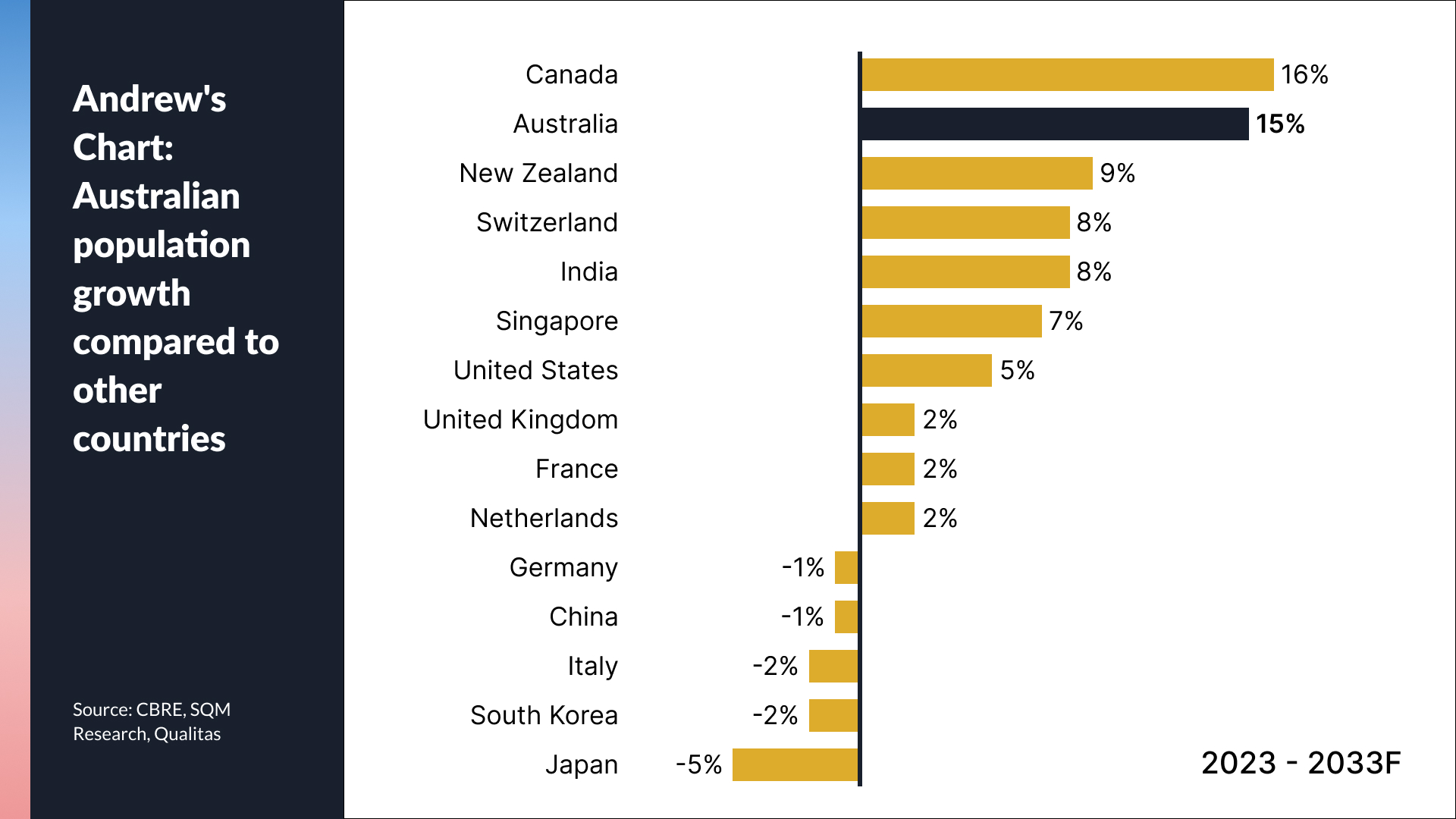

While central banks still impact the performance of the housing market, it's clear that the bigger factors this cycle have been immigration, labour shortages, and the increased cost burden on builders to finish these projects. All this is to say increased demand and decreased supply, means there is no lasting solution in sight unless the federal government specifically pulls at least one of these levers.

The other thing that has become apparent in this particular housing cycle is the mixed performances across the major regions of Australia.

On the one hand, the price gap between Sydney and Melbourne is widening. Melbourne house prices, when compared to Sydney's, are now the cheapest in a decade. On the other hand, the other three major capital cities of Adelaide, Brisbane, and Perth are seeing house and unit prices surge by double digits in tandem. In Perth alone, the year-on-year increase is 25%. That's a lot better than iron ore's performance over that same time frame!

So, how is Australia's housing market really doing? Are there any decent policy proposals that are going to move the needle on the supply question? And what does the investment opportunity for housing look like today?

If you want answers to these questions and many others, look no further than the Signal or Noise Property Show for 2024. Joining me and our resident economist, Diana Mousina of AMP are two of the country's best property commentators and investors:

- Louis Christopher, Founder at SQM Research

- Andrew Schwartz, Group Co-Founder and MD at Qualitas

Note: This episode was taped on Monday 4 November 2024. You can watch the full episode, listen to the podcast, or read our edited summary below.

Other ways to listen:

EDITED SUMMARY

Topic 1: Does the structural housing crisis present a signal for an investing opportunity?

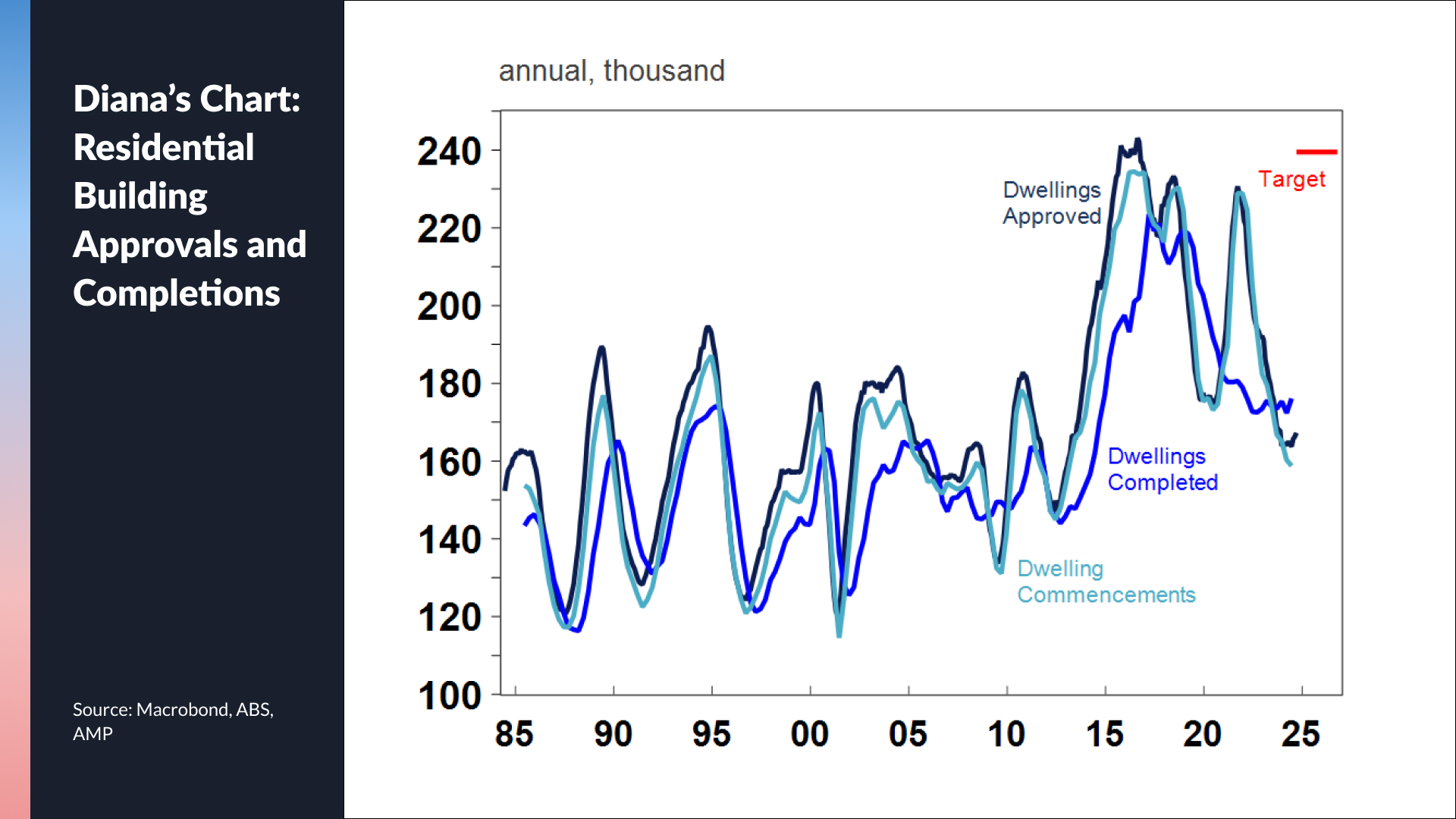

Diana: SIGNAL - This is a signal, but how much a signal it is will vary by investor type. If house and unit prices are going to grow at a slower rate now than they have in previous decades, then that will also reflect in the expected returns. Furthermore, if returns are expected to slow in the medium term, then the government may need to step in to subsidise some of these companies' home-building and investment projects. Otherwise, it won't make good business sense.

Diana's Chart: Residential building approvals and completions

Andrew: SIGNAL - Given Australia has a supply-based issue for housing, there is a massive imbalance and as a result, it creates a fantastic investment opportunity.

Louis: SIGNAL - The opportunity presents a medium-term signal, but it does not negate the possibility of house price falls in the short term. SQM's data shows some modest falls coming for the Sydney and Melbourne housing markets in particular.

What makes residential property such a compelling investment opportunity to Andrew?

The Qualitas team feels they get a lot of comfort from the fact that real estate values are generally underpinned. As a real estate credit investor, it's about making sure that values don't fall by too much. Qualitas also have a large build-to-rent project in its book. They believe they can see a strong opportunity for institutional investors who want to invest in long-term projects that are likely to have escalating cash flows and diversified tenant pools.

Topic 2: Two new policy proposals being offered in the residential property debate

Andrew: SIGNAL - It's a continuing signal, and governments are doing what they need to do to help out with policy to facilitate new supply coming into the market. It is, however, only one part of the equation. You need purchaser demand, revenue to be at the right cost structures, and the builders available to make it happen.

Andrew's Chart: Population Growth

Louis: SIGNAL - The targets for slowing down migration may be there but the real numbers, up to June 2024, are saying otherwise. In his view, the Treasury has significantly underestimated the impact of migration and how many migrants are coming to Australia. That means pressure will continue, particularly in the short-term rental market. In addition, we will likely fall as many as 100,000 dwellings short of the government target.

Louis' Chart: Interest rate futures

Diana: SIGNAL - While it's positive to see the government institute more supportive policies for supply, Diana's not entirely sure or optimistic that it will create a genuine, long-term change. You can have all the plans you want but you've got to have the builders wanting to build more.

If you became housing minister for a day, what would you change and why?

- Louis: Replace stamp duty with land taxes, limit migration

- Diana: Limit migration, encourage government support of building projects

- Andrew: Invite the government to start underwriting homebuilding projects

For their full reasoning, watch the video or listen to the podcast.

Topic 3: Is the slowdown in the auction market seasonal or structural?

Louis: SIGNAL - As someone who has watched this market since 2000, it is a "very reliable" indicator in picking turning points for the housing market. But he does note that preliminary numbers are often very lofty. He also notes it's different by city - Sydney and Melbourne clearance rates are a) well off their highs and b) tend to be more reliable than the clearance rate figures in the other major cities. This is simply due to the size of the auction market available in those cities.

In terms of the nuance, Louis provided these insights:

Perth is up 25% year-on-year, while Brisbane and Adelaide are up by about 18% year-on-year. Louis calls these three cities the "tiger" cities. He is particularly bullish long-term on Queensland and Western Australia and adds that the Brisbane market could outperform the other major capitals until the Olympics (which are in 2032.) In contrast, Melbourne is down about 1% year-over-year and Hobart is also moving lower.

Diana: SIGNAL - The clearance rate lines up with all the other major housing data we are getting at the moment. It all correlates and housing affordability measures are now gaining the upper hand, especially in the major centres and at the very top end of these high-growth markets like Brisbane.

Andrew: SIGNAL - While it's a signal, clearance rates are a double-edged sword. On the one hand, a softening in clearance rates has a certain effect on individuals' balance sheets, but on the other hand, a major turnaround in the housing market is usually earmarked by interest rates. The RBA, in his view, watches clearance rates closely, given how elastic house prices are, especially in interest rate-cutting cycles. Avoiding the creation of a bubble would be foremost in central banks' minds especially if it is caused by monetary policy.

Signal or Noise returns in early December with our Outlook 2025 show.

4 topics

2 contributors mentioned