The Australian tech story - from little things big things grow

Globally, and particularly in the U.S., technology companies have been the driver of equity market returns for the last 10 years, with a rotation away from traditional equity heavyweights like energy, banks and ‘bricks and mortar’ retailers. The growth story for these stocks has been their ability to use technological advances across a range of industries to drive efficiency, move faster than old world incumbents, and harness the internet, artificial intelligence (A.I.) and network effects to develop deeper customer relationships, often on a global scale.

For a long time, the Australian equity market lagged the global technology trend, with a historical skew towards mature banks and resource companies that offer little exposure to secular growth. The Information Technology sector still makes up only 3.2% of the S&P/ASX 200 – but the sector is picking up momentum and the potential is huge.

The S&P/ASX All Technology Index

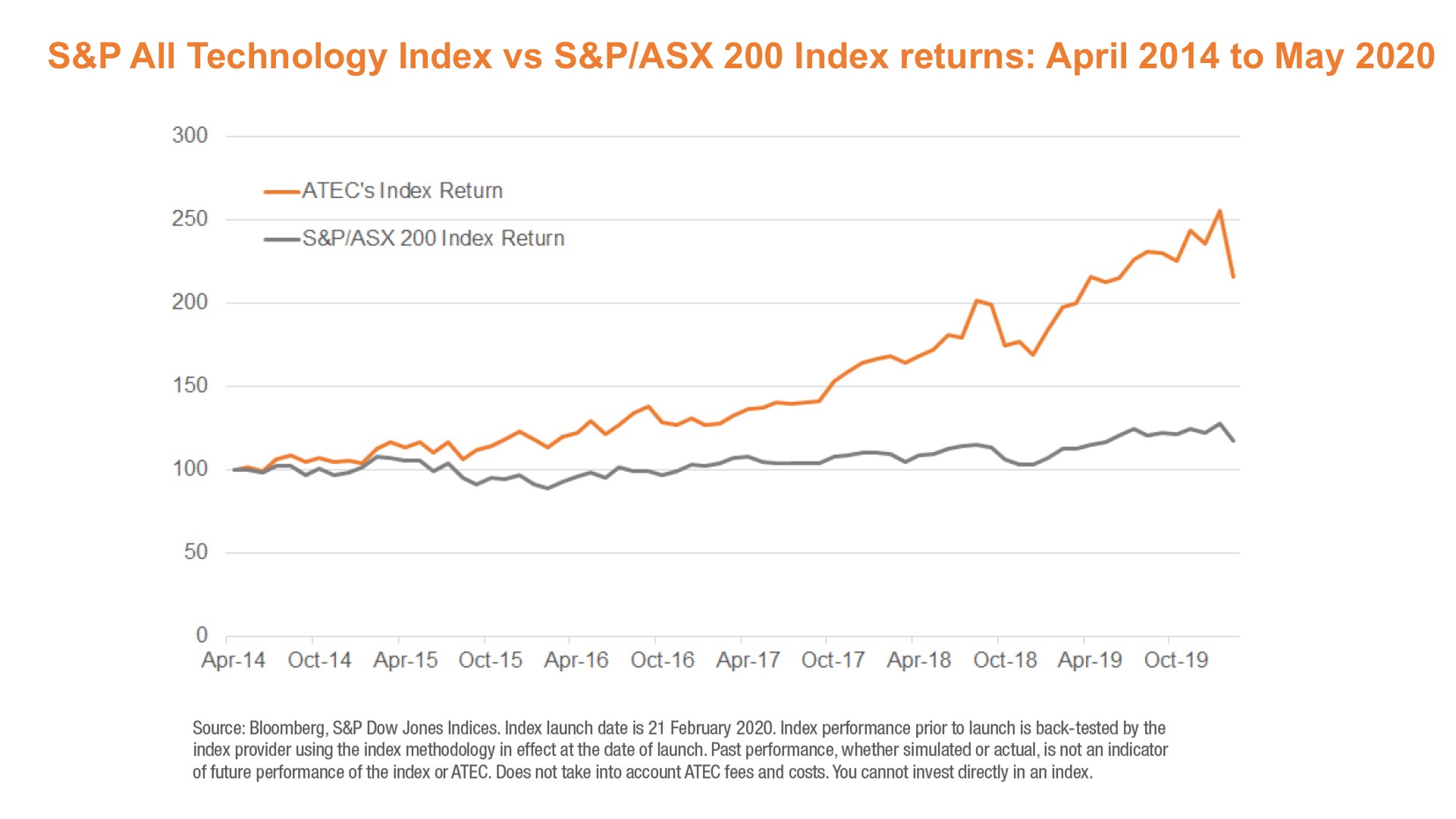

ASX-listed technology companies have experienced substantial growth and a marked increase in investor awareness over the last five years. The S&P/ASX All Technology Index (XTX) was launched in February 2020 to provide a comprehensive benchmark of these ASX-listed technology companies and to facilitate investment in the fast-growing sector.

Over the past five years:

- Information Technology has had more ASX IPOs than any other sector

- Looking at the XTX index itself, the number of constituents has nearly doubled, and the index’s total market capitalisation increased more than fivefold to $92B.

Some of the companies included in the XTX index would be well-known to most investors, who may also be users of their services – companies with B2C business models such as:

- Afterpay, a global Fintech leader which recently signed strategic partnerships with Visa and Tencent

-

Carsales.com and REA Group, which have changed the way we buy and sell cars and houses.

But there is also a host of lesser-known B2B companies that are global leaders in their fields, for example:

- Appen, which provides data services to help global technology companies and governments build out their A.I. and machine learning capabilities

-

WiseTech Global, whose end-to-end logistics cloud-based software is used by 15,000 logistics organisations round the world.

“Like never before, this is a real opportunity for Australia to become an export industry in a lot of these different areas, and it’s an exciting time.” Anthony Eisen, Afterpay CEO

The Australian tech sector has some true global leaders, and is poised to become an increasingly large part of the Australian equity market and an important growth thematic for investors.

Insights into the XTX index

Understanding emerging and complex technologies and then picking individual tech stocks presents a significant challenge to investors. The XTX index provides broad exposure to a portfolio of technology stocks. S&P and the ASX collaborated on the design of this index.

Going beyond simple sector labels:

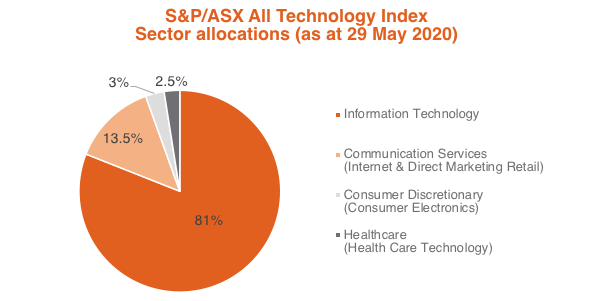

In order to fully capture technology-driven businesses in Australia, the scope of the index goes beyond the GICS Information Technology sector to include innovative, technologically-focused companies across industries such as health care technology and companies operating online marketplaces.

Source: S&P Dow Jones Indices

Maximising opportunities for growth:

The index also includes emerging technology companies from outside the ASX300, and recent IPOs can be added at each quarterly re-balance date. This has the potential to capture more upside before a small emerging stock becomes a widely-held ‘market darling’.

The advantages of Market Cap weighting in an emerging sector

In a dynamic sector such as technology, stock price momentum can be a powerful force, so holding a portfolio based on market capitalisation weights – as is the case for the XTX index – can be advantageous.

Rather than trying to actively pick winners, market capitalisation weighting with regular re-balances is an approach that effectively lets the market decide which companies should be included in (or excluded from) the index over time.

A further advantage of market capitalisation weighting is that it substantially reduces portfolio turnover, thereby reducing the drag of transaction costs for an investor seeking to track the index. This is particularly important for Australian technology stocks that are yet to reach the same liquidity levels as larger companies in the S&P/ASX 300 Index.

2020 Performance -Coronavirus recovery

Despite a peak to trough fall of over 40% in February and March, the XTX index rebounded strongly and is now positive for the year, unlike the S&P/ASX 200 Index.

Re-balancing information

The first quarterly re-balance took place on Friday 19 June, with some well-known stocks being added to the index:

- SEEK Limited (SEK)

- Tyro Payments (TYR)

- Temple & Webster Group (TPW)

- Nitro Software (NTO)

- RPMGlobal Holdings (RUL)

The re-balance also saw Over The Wire Holdings (OTW) removed. Overall the number of constituents has increased from 46 to 50, with approximately $10 billion added in market capitalisation, indicative of the growth in this sector.

By using a market capitalisation weighting approach, the index has naturally benefited from the recent momentum in stocks like Afterpay and Appen without having to adjust their portfolio allocations on re-balance dates. Since trading at a low of $8.01 just three months ago, Afterpay has gone from strength to strength, and now has the largest stock weighting in the index, at 15%.

“There is an ecosystem here that is starting to form, and we need to push that ecosystem - founders, entrepreneurs, investors, government and everybody involved - in understanding how powerful and how important for the Australian economy that tech sector is going to be.” Richard White, Wisetech Global CEO

The creation of an Australian technology index is not only good for investors. By lifting the profile of the industry it’s hoped there will be increased capital investment in home-grown technology and innovation, and that can only be a good thing for the future of this country.

Learn more

ETFs are one of the fastest growing investment vehicles in the Australian market. For a full range of products available to investors, please visit BetaShares website.

4 topics

10 stocks mentioned