The beginner's guide to bonds: How do interest rates affect the value of bonds?

In case you have not read parts one and two, I highly recommend you do:

We've reached the final and most important part of this series. So far, we have been through how bonds work, why they matter, and the various ways for retail investors to get exposure to the global bond market. Now, it's time to learn how this particular asset class is priced.

As Lazard Chief Market Strategist Ronald Temple once told me, every investor has a choice. And it's not just between stocks, bonds, commodities, cash, and alternatives.

In this wire, we'll look at how bonds are priced and how interest rates affect those prices.

The three factors investors need to consider

Firstly, bonds don't trade like stocks. So if you're trying to price a bond like it's got some sort of P/E ratio, you're not going to get anywhere. Unlike a stock where you are betting on its future earnings potential, the price of a bond is a bet on where interest rates are going, supply and demand factors, and how credit quality is stacking up.

Each bond starts with a face (or par) value. The most important rule you need to remember is that yields operate inversely to price. That is, a higher yield means a lower price and vice versa.

If a bond is trading at a premium to its face value (i.e. the price is going up), then it usually means interest rates are lower than bond's quoted rate. Hence, the bond trades at a higher amount than its face value, since you are entitled to a higher interest rate.

The inverse of this example is what happened during 2022. When bond yields went from less than 1% to nearly 5% in less than 12 months, it meant there was a sharp selloff in bond prices. Hence, why you heard so much commentary around the bear market in bonds.

The second thing you need to consider is term to maturity (also known as the "age" of a bond). Bonds are typically paid in full when they mature. The closer a bondholder (you) are to the maturity date, the closer the price will trade to its original face value. The further away the bond is from maturing (i.e. the bond's maturity is at the long end of the curve), the more interest you should be receiving. That's because the longer you hold a bond, the more risk you are opening yourself up to in terms of interest rate moves.

Finally, and one cannot stress this enough, always look at quality. Firms with lower credit quality will have to pay higher interest rates to compensate investors for accepting higher default risk. And remember, if your issuer defaults, you could lose the lot. In a similar vein, you could have bought a bond from what you thought was a high quality issuer. If the quality were to ever deteriorate, that would also open you up to more of those risks.

How do interest rate moves affect bond prices?

The answer to this question is another inverse correlation. When interest rates go up, yields go up and bond prices go down. This, again, explains why bonds were so heavily sold off in 2022. All those jumbo interest rate hikes happening all at once decimated the value of those assets.

This will also explain why you may have read that the next bull market for bonds will only start at the end of a rate hiking cycle. That's because rate hikes increase those bond prices. And so far in 2023, rate hikes have gone on for longer than the market was initially anticipating. This explains why the comeback for bonds hasn't started yet.

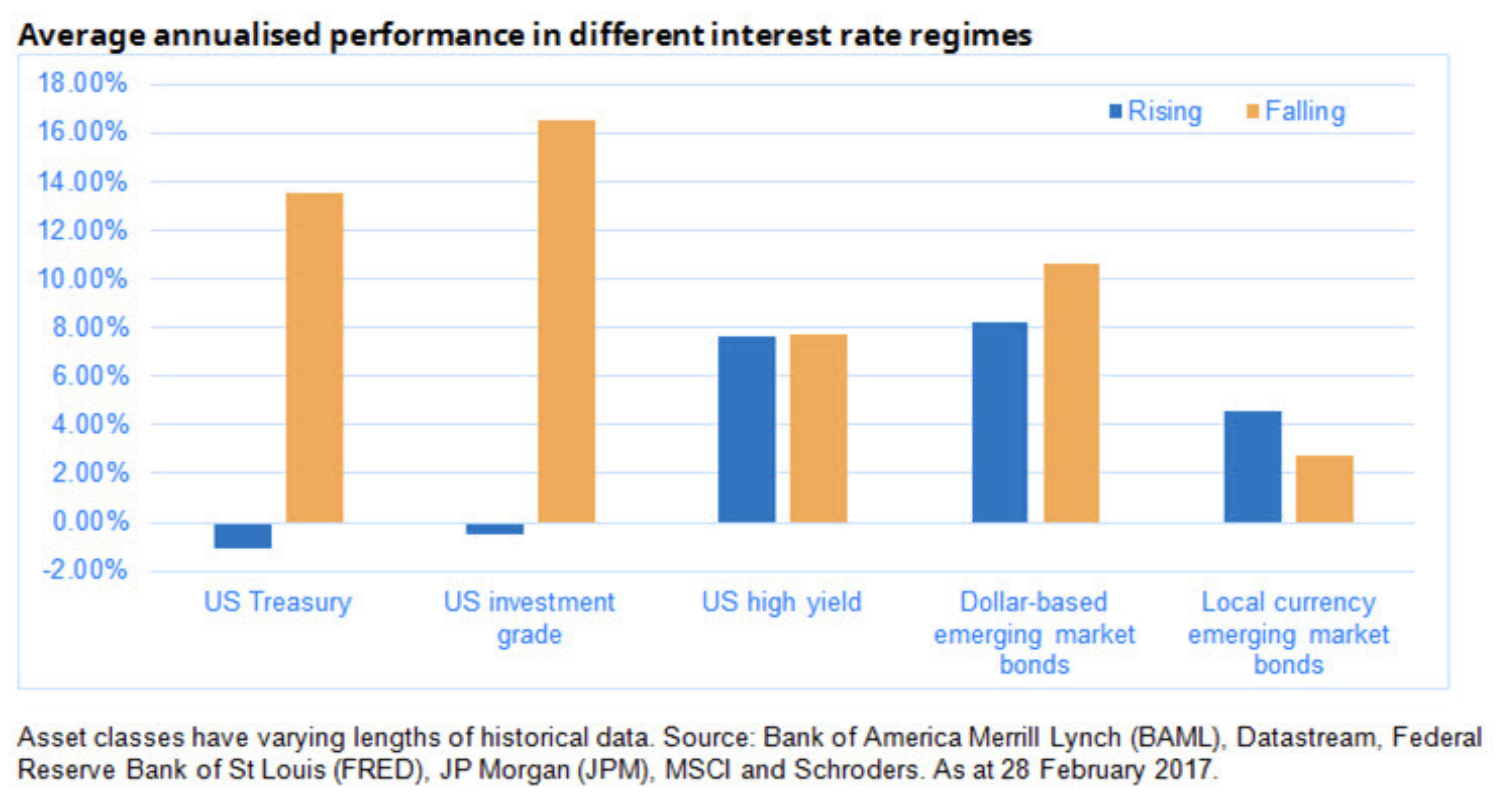

The last thing to recognise is that not all bonds are the same. The above example is most relevant for developed market (e.g. US or Australian) government bonds. In the corporate credit market, the numbers tell a different story.

This ends the three-part series on bonds. If you want another question answered on this subject, let us know and we may do a part four! Until then, check out the new edition of Signal or Noise which covers all these topics and more:

2 topics

1 contributor mentioned