The best of the worst bunch: Morgan Stanley re-rates the ASX banks

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

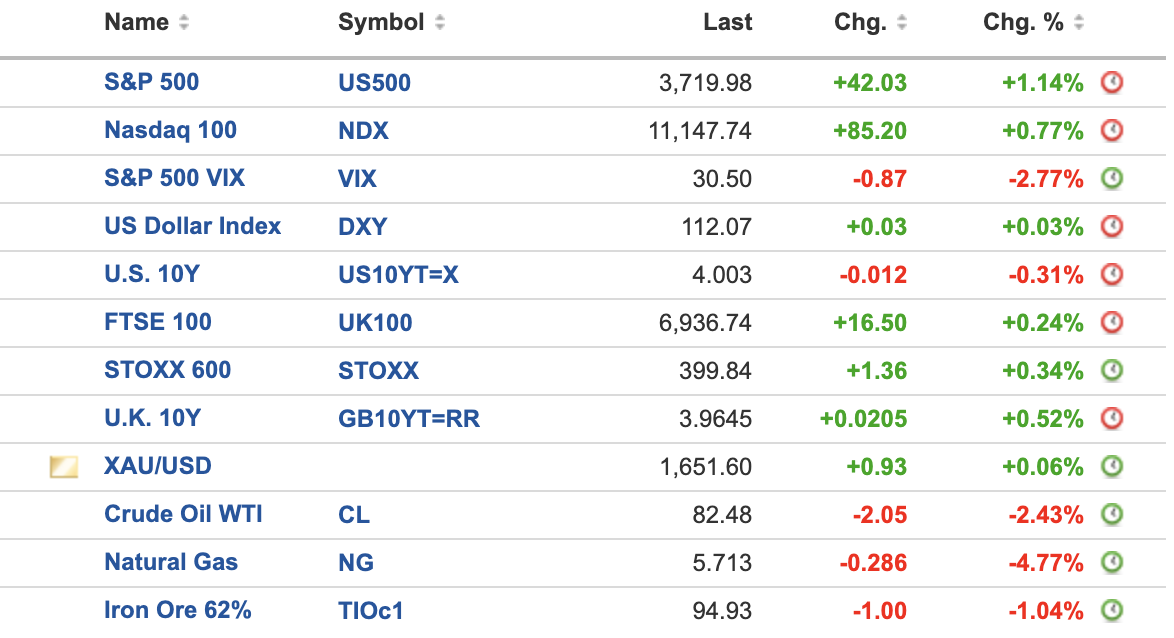

Source: Investing.com

THE CALENDAR

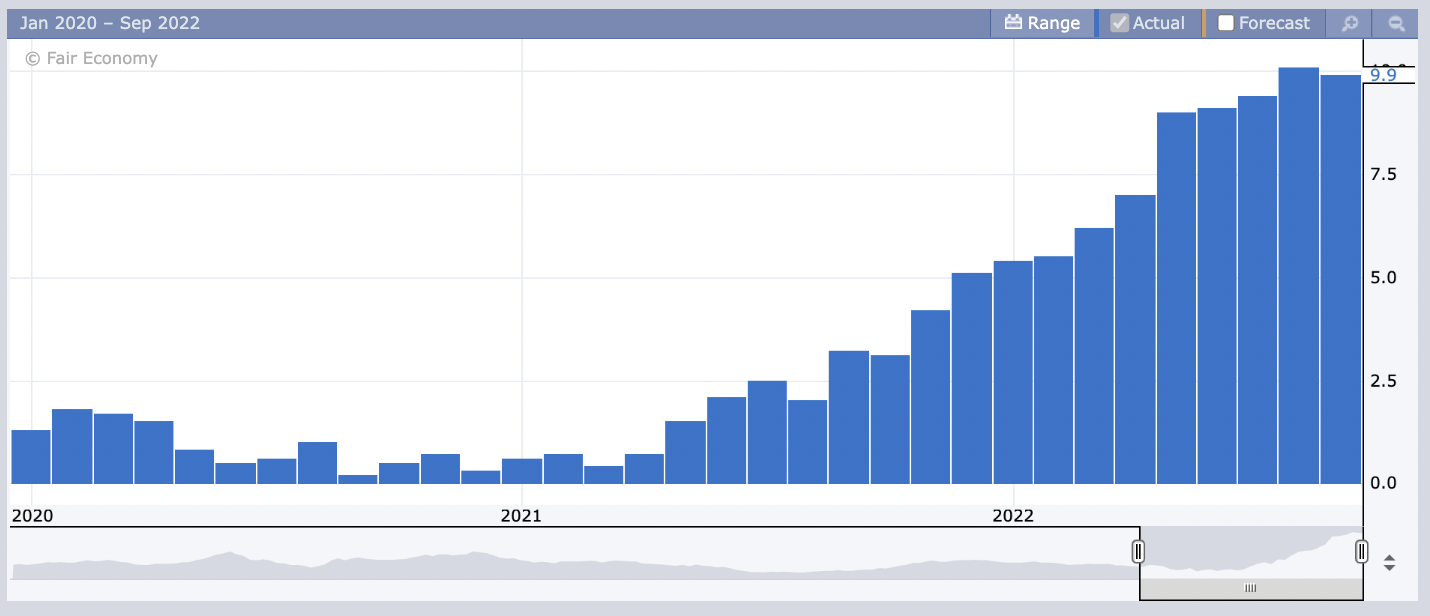

If you thought NZ CPI was hot (more on that below), then there are at least one, maybe two more hot inflation reads that are coming. The Canadian inflation print should be interesting in that we are all curious about whether the downtrend will actually stick - as this chart shows:

Unfortunately, UK CPI is also today. And well... I'll let the chart speak for itself:

THE CHART

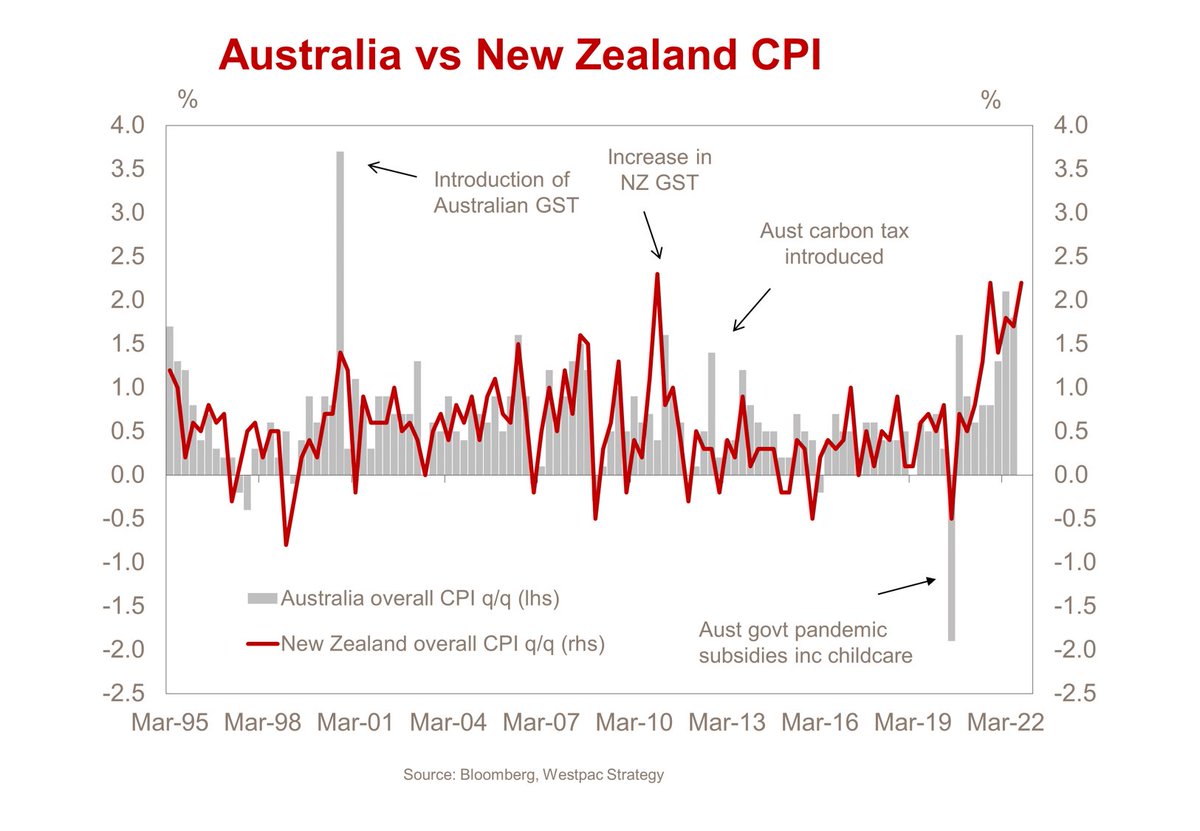

It's always worth comparing us against our friends in Aotearoa, so here's a chart from Westpac's Sean Callow putting the two together. Pretty amazing, no?

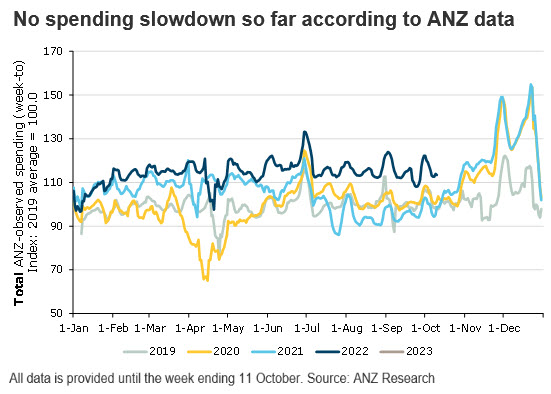

And while we're at it, one of the largest and most crucial parts of inflation is the strength of the consumer. And ANZ's Adelaide Timbrell works right at the coal face of this important economics beat. Her data concludes there is still no spending slowdown in Australia yet. That's great news for the retailers, GDP, and the Reserve Bank. But inflation may have something to say about this:

STOCKS TO WATCH

The title of today's report is a little confusing but it's the most succinct way we could think of to describe this list. It's the best of the worst bunch - the best picks if you happen to be wed to the worst sector on the ASX.

The broker is Morgan Stanley and the sector is ASX banks.

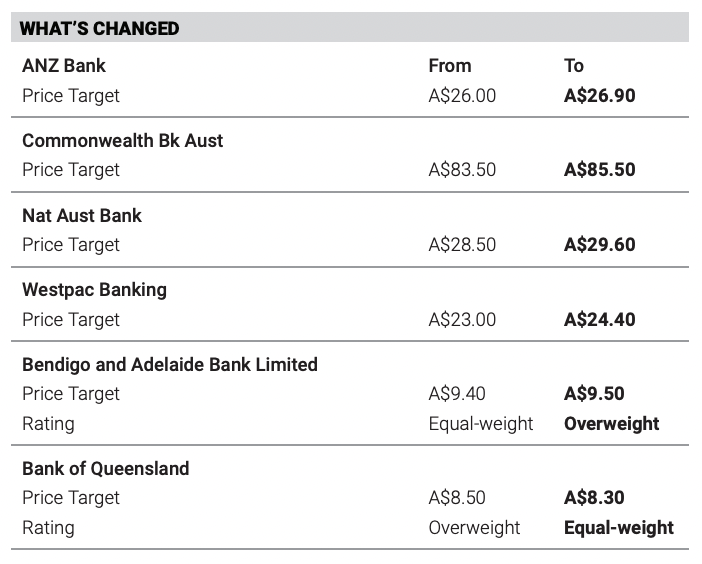

And now that we've probably upset more than a few feelings, some context. The team recently upgraded its margin forecasts for the major banks (alongside JP Morgan and others fresh off the Bank of Queensland result). They say the benefit of earlier and larger rate hikes and favourable deposit pricing should comfortably offset mortgage margin headwinds in the near term.

That's where the good news ends. Unfortunately, there is also appetite (according to a survey they did of bank customers) for switching mortgage providers, and the dominance of the Big Four (in particular, CBA) may very well be challenged.

With that said, here are their top picks in order of preference.

But here's the caveat - the banks are also Morgan Stanley's least favourite sector - as they revealed in their latest investor pack:

Ultimately we think that a realization that both RBA tightening and fiscal consolidation will prevail for longer than hoped will mean portfolio positioning still needs distancing away from the risks that are building for the domestic outlook. Our model portfolio positioning remains overweight Healthcare, Energy, and Diversified Miners. We are underweight Banks (in line with analyst order of preference), Real Estate, Housing Linked, and Consumer (stocks).

They're such positive people, aren't they?

the quote

Come to think of it, Hunt "had (markets) at "good-bye" (to Truss' tax cuts). The lesson is not all mavericks are celebrated.

If you think economists are boring, I invite you to meet Vishnu Varathan of Mizuho Bank. He's equated Jeremy Hunt's accession to his new role as Liz Truss' second Chancellor of the Exchequer as a slew of Tom Cruise films.

Think about it - the markets had him at hello (Jerry Maguire), the Bank of England has to feel the need for speed (Top Gun), and the Pound's struggles against the US Dollar are perhaps a sign that the government "can't handle the truth" (A Few Good Men).

Can you guess the Mission: Impossible quote he referenced?

Hans Lee wrote today's report.

GET THE WRAP

If you've enjoyed this edition, hit follow on this profile to know when we post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

3 topics

6 stocks mentioned

1 contributor mentioned