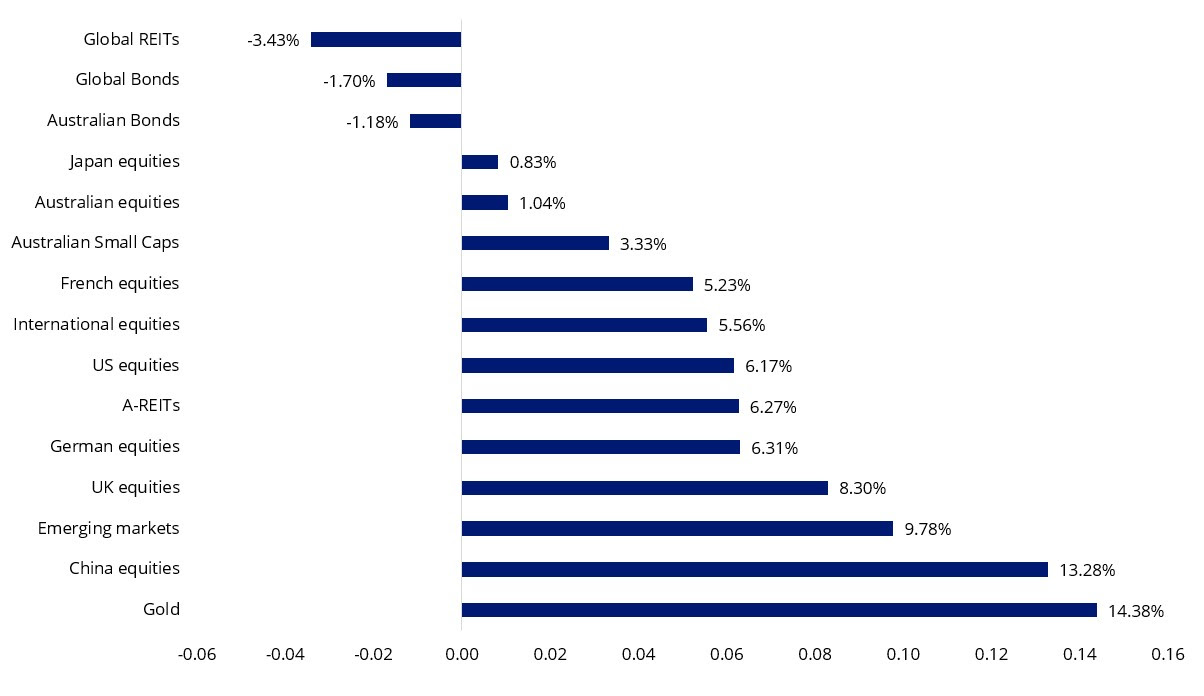

The best performing equity market of the past three months

Since the beginning of the year, the market has been repricing the probability of a Fed rate cut. It’s been a negative for some markets and a positive in others. Gold, for example, has benefitted tremendously, but investors may also be surprised to realise the shift has benefitted China.

Source: Morningstar Direct, to 30 April 2024. For full sources, please see disclaimer section.

While investors have steered clear of China in recent years, change is afoot. While there remain geopolitical concerns, investors should bear in mind that an allocation to China is important for diversification, given it is fast becoming the largest global economy, is Australia’s largest trading partner, and is also positioned differently to other developed market economies.

In this wire, I’ll explore the shift in sentiment towards Chinese equities and why it merits a closer look.

The market shift

Investors are starting to take note of China’s change in fortunes. Data from the People’s Bank of China (PBOC) on net foreign portfolio investment in Chinese equity securities showed that foreign investors bought a net of US$44bn in February and March 2024.

Domestic A-share companies in the consumer, healthcare and technology-related sectors, which source the bulk of their profits and revenues from the domestic market, have been benefitting from the shift in sentiment.

While some of this shift in sentiment comes from the market pricing in the impact of a Fed rate cut, there are also positive signals in the Chinese economy that are a benefit to Chinese A-shares.

One of these relates to the Chinese consumer.

The world has been awaiting the return of the Chinese consumer since China finally reopened from lockdowns. After remaining significantly below pre-COVID levels, tourist numbers and revenue started trending upwards in late 2023 and data as recently as the weeklong Labour Day holiday (May 1-5) saw levels rise high above 2019 levels. While a benefit locally, international destinations like Australia will be watching this as a positive sign that the Chinese consumer will start to travel and spend again.

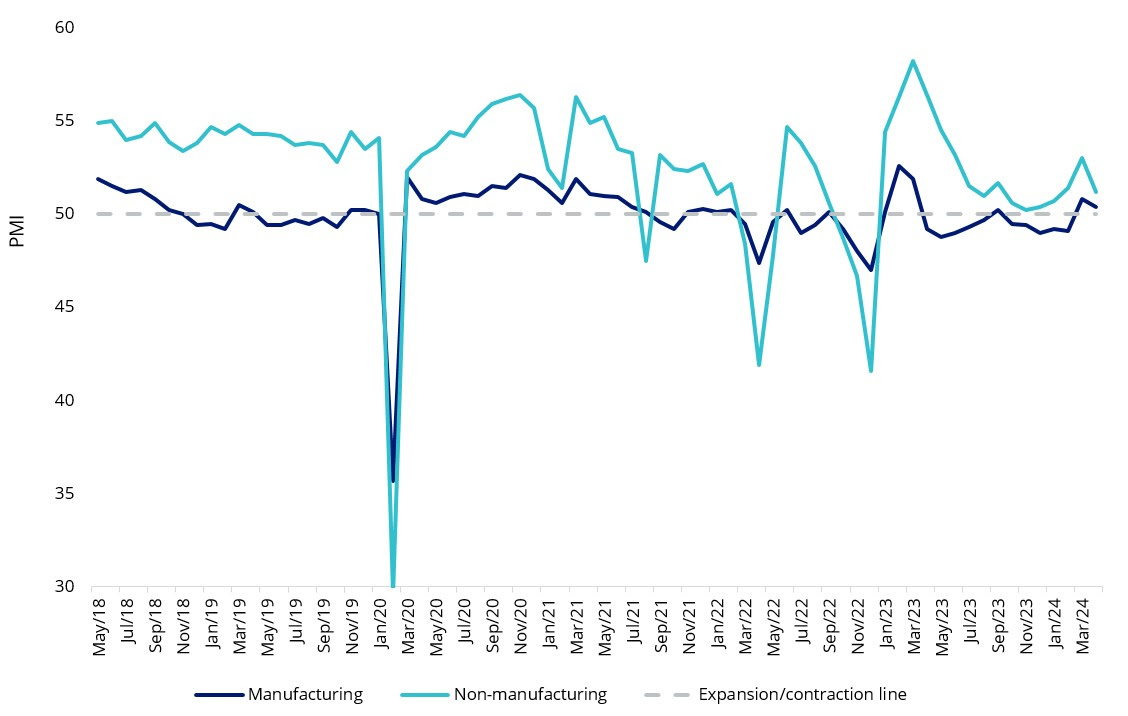

The second signal to watch is the China Purchasing Managers Indices which provide an indication of economic activity in the manufacturing sector.

You can see in the data below, the manufacturing PMI has broken through 50 which suggests China is in expansion mode again. It’s a boon to spend domestically – but also to trade partners like Australia.

.jpg)

Why investors should take a closer look at China

1. Diversification

Stepping back, one of the reasons investors diversify globally is to gain exposure to different economic cycles than those experienced domestically. With Australia and the US facing higher rates for longer as central banks manage inflation, China’s economy has different economic fundamentals. The IMF is expecting China’s GDP growth to exceed 4.5%.

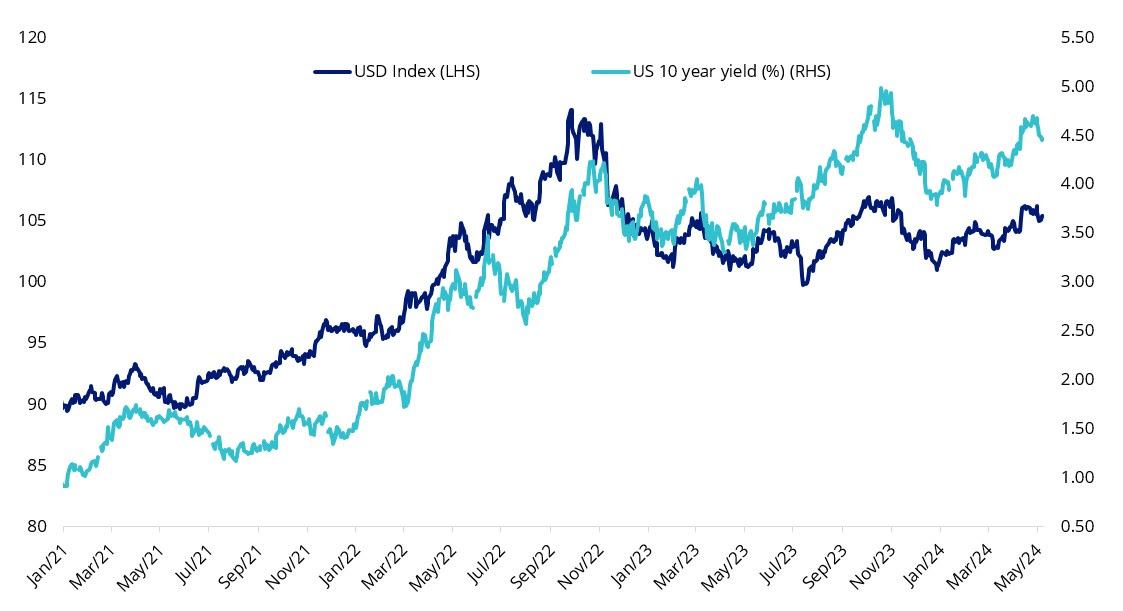

Recently, US dollar and treasury yields have pulled back from April 2024 highs, and they are much lower than October 2023 highs, which is good news for China, as dollar strength has been part of the tightening conditions. Further falls could be good for China's equities.

.jpg)

2. Australia’s trade relationship with China

Australia’s fortunes are strongly linked to China as Australia’s largest trading partner. While recent tensions between the governments have been in the news however investors, irrespective of the geopolitical views, that do not have a China exposure do so at their peril, we think.

3. Valuations

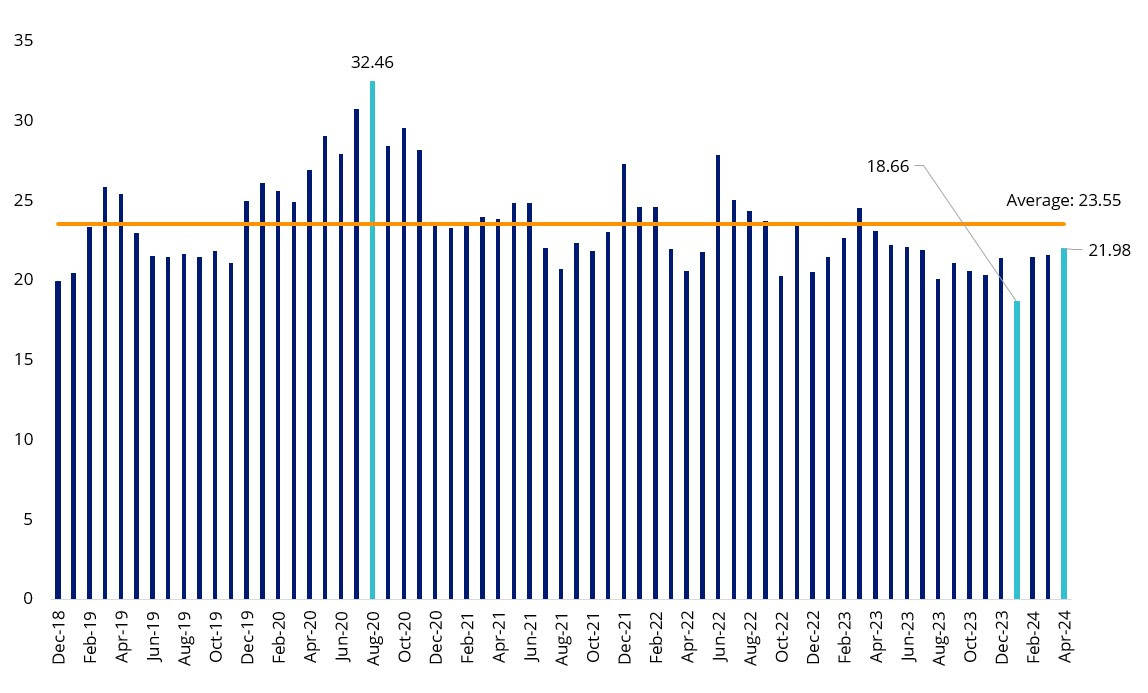

Valuations for Chinese A-shares remain cheap at this point.

If you use the VanEck China New Economy ETF (ASX: CNEW) as a proxy, the constituents traded at a median trailing P/E of 21.98x at the end of April, below its average. The current valuation represents a 32% discount to CNEW’s valuation in August 2020 (the peak following a massive post-COVID run-up).

.jpg)

Sources: MarketGrader, FactSet, 30 April 2024.

Some of the sectors we believe are most compelling in China as it continues on its trajectory to become the biggest global economy sit in the growth engine of the services sector, in consumer services and IT. Investors will need to be selective about how they approach this market though.

How Australian investors can find exposure to China

There are limited ways through which Australian investors can acquire shares in Chinese companies. While some, such as Alibaba or Trip.com can be accessed through listings in US share markets, to the most part it is extremely difficult for retail investors to access Chinese A-shares. Generally, using managed investment options, such as ETFs like CNEW, are the main option available to investors.

With a positive shift in sentiment, now could be the time to take a closer look at China. In any case, investors should be aware of the opportunities and risks in the second biggest global economy.

For more information on VanEck’s CNEW ETF, click here.

1 topic

1 stock mentioned

1 fund mentioned