The Big Four Banks are the last place you want to be

We have written ad nauseam about the pending "mortgage cliff", as borrowers on historical low fixed mortgage rates (>2.0%) roll over into higher current rates (5.75-6.00%) impacting at least 1 in 10 households, so we won't dwell on that.

However, our post-result channel checks with non-bank financial lenders and intermediaries, supplemented by endless post result calls with companies at the consumer coal face, reinforces our confidence in our zero bank stance.

The tsunami is finally coming, and the big 4 Banks are the last place you want to be, given the current bout of irrational and aggressive loss leading competitive behaviour to entice depositors to stay. Worse still, $10,000 up front cash back bonuses, free NBN service sweeteners and 150bps in discounted rates to entice borrowers to switch their mortgages can only end in tears for banking sector NIM's down the track.

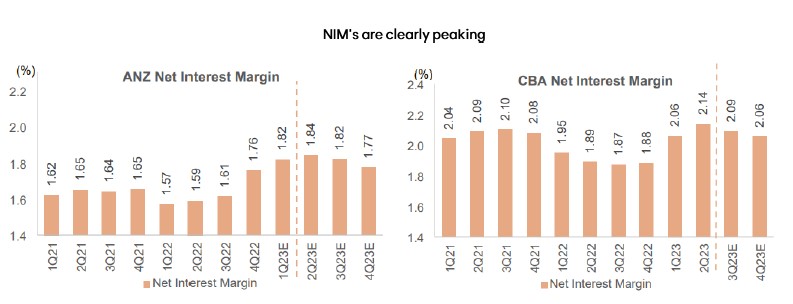

Perhaps the biggest surprise during the reporting season was CBA's proclamation that margins peaked back in October 2022.

At the time of writing, the ABS reported home loans for January (excluding refinancing) fell 5.3%, weaker than expected. Since the record high level in January 2022, home loans are now down by a cumulative 35.0% YoY, the weakest on record (since at least 1992).

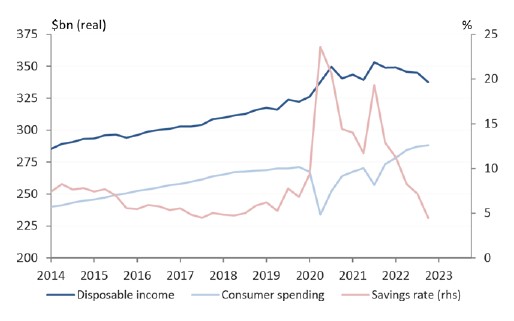

We expect continued slowing in credit growth and in broader economic activity through 2023 as the higher interest rate impacts build. Consumer spending, which slowed again in the fourth quarter of 2022, has slowed further, as evidenced by "canary in the coal mine" Harvey Norman (ASX: HVN)'s surprisingly weak January (like-for-like sales down 10%) Australian trading update.

This pulls forward our softening in household goods demand thesis, as cost-of-living pressures, which have been rising at a staggering pace over the past 9 months now start to bite. Discretionary spend clearly continues to decelerate.

Rising Mortgage Repayments

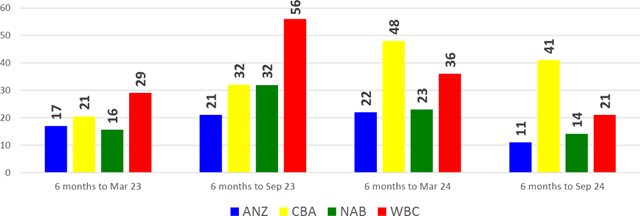

We estimate that rates will increase for >80% of major bank mortgages in the year to September 2023, including ~A$1.1tr of variable rate loans and >A$220bn of maturing fixed rate loans. NAB and WBC data suggest that the monthly repayment will increase by >40% for ~35% of customers.

Major Banks: Maturing Fixed Rate Mortgages

Note: CBA disclosures adjusted to reflect 6 months to Mar-23, Sep-23, Mar-24 and Sep-24, Company Data.

Another data point is that the savings rate has now fallen below average. The level of savings rate has been a key focus point for investors trying to calculate "buffers" and calibrate the impact of tightening conditions. As evidenced by the Q4 GDP official ABS data, the level dropped below average to 4.5% from 7.1% and rather than being a boost to spending, most of the drawdown appears to have been consumed by higher interest costs.

The savings rate has now fallen below average levels, whilst the deceleration in retail spend continues - suggesting that buffers are fast being depleted.

To conclude, Banks are currently seeing a combination of intense mortgage competition, rising deposit rates and restless deposit mix rotation. The recent round of bank results/updates demonstrate that NIMs have clearly peaked.

Further, with the market now pricing a terminal official RBA cash rate of 3.8% and possibly holding at 3.5% until 2025, a moderate credit cycle now appears inevitable, implying a rise in BDD from historic low levels. At the moment, consensus forecasts and bank valuation multiples imply sustained high NIMs and a very benign BDD cycle. We seriously question this.

A different approach to Income

Within traditional income sectors (e.g. Banks, Infrastructure and Telecoms), disruption to business models may erode sustainability of dividends and earnings. Within traditional cyclical sectors (e.g. Materials, Diversified Financials and Consumer Discretionary), improving industry structure, regulation, business models, balance sheets, and focus on profitability potentially means a structural shift towards these companies, which could provide more reliable future income streams. Find out more.

3 topics

5 stocks mentioned

1 fund mentioned