The biggest change in mining in 100 years: Miners as Fund Managers

An abundance of copper is a catalyst for global economic growth and our clean energy aspirations.

Copper combines more useful properties (such as its high thermal and electrical conductivity) than any other metal, and is widely used across electrical, telecommunications and building industries. Demand for copper has always been closely correlated with global GDP growth.

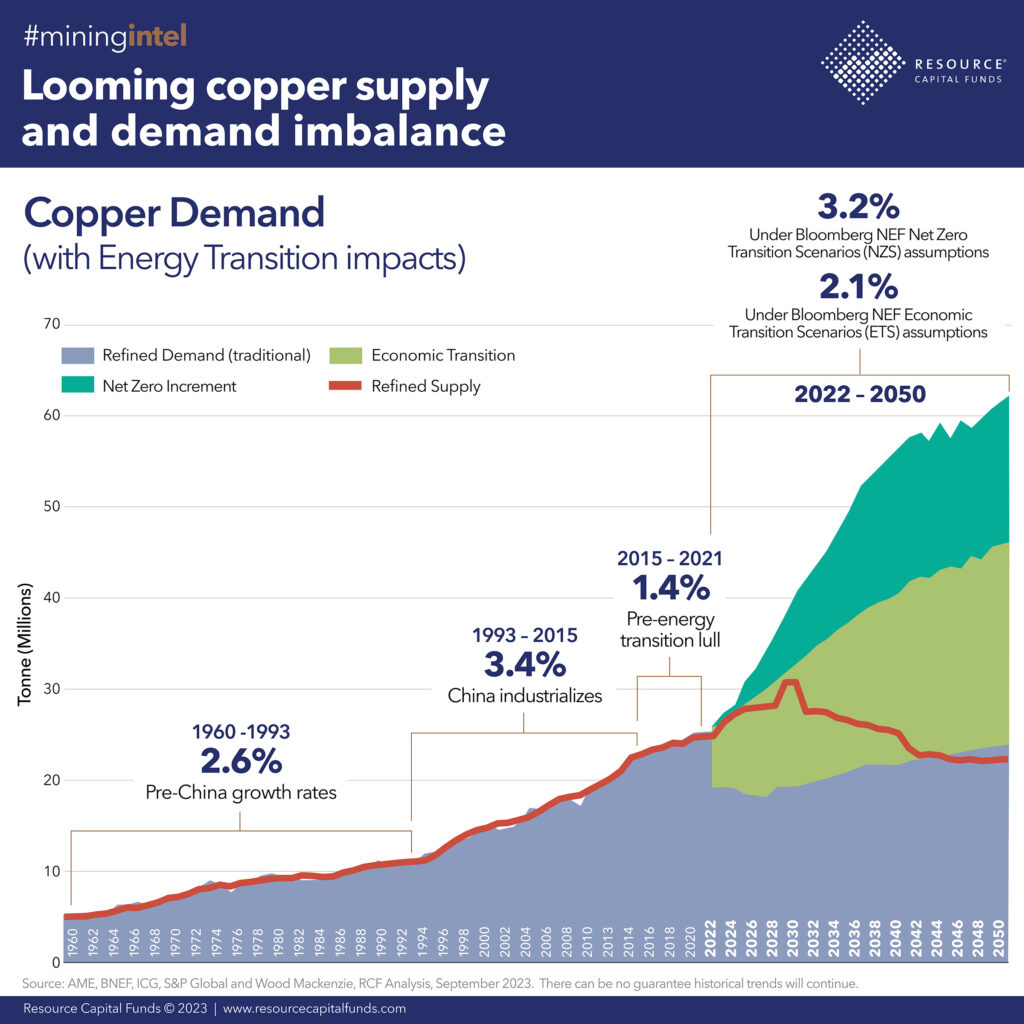

Looking forward, the demand picture is extraordinary. According to S&P, annual copper demand is expected to rise from 25 million tons today to 50 million tons in 2035. Copper is also essential to the expanded and more complex energy grids of the future. Renewable energy systems require up to five times more copper than traditional power generation, and the share of global copper demand from “green” sectors is forecast to double over the next 10 years, from 8% to 16%.

However, a crisis looms. The flipside to this voracious demand growth is a global forecast copper supply deficit of 10 million tones per annum by 2035.

BHP’s pursuit of Anglo American highlights the copper shortage we face. According to S&P, developing a mine in the US from first discovery to production takes 29 years. Yes, 29 years. Therefore the acquisition of existing producing mines takes precedence, over the decades-long journey of building new mines.

Considering the world's largest mine produces 1 million tonnes of copper annually, we have more chance of finding leprechaun gold buried in our backyards than we do of our copper ambitions being realised.

Absent technology breakthroughs or substitution, the world's abundant clean energy aspirations are jeopardised by a shortage of future copper.

So how are we addressing this?

Our major listed miners own great portfolios of copper mines across Australia, Chile, Mongolia, Peru and the US. However, more than half of the world’s copper produced today is from nations categorised as “unstable” or “extremely unstable”. And much of the world’s future copper is likely to be mined in Afghanistan, Argentina, the DRC, Indonesia, Pakistan, Panama and PNG. Experience in navigating investment risks in these emerging countries is not a sought-after skillset for the board rooms of our large listed miners.

Listed equity markets have an unforgiving history with flawed investment in new geographies, and are not the lowest cost nor best source of capital for developing nation investment.

And our major listed miners, our cashflow kings, are, for the foreseeable future, prisoners of these public markets.

The key institutional shareholders require liquidity. The cash balances of Australian super funds rose by $51 billion during early Covid as members switched out of less liquid investments. The super funds today own 38% of the shares on the ASX. It's interesting that Australian Super does plan to grow its private equity investments, from 5% of portfolio to 9% over the next 4 years, perhaps a hat-tip to the future.

Maintaining a listing gives companies “currency” to participate in future M&A.

And attempts to privatise giant miners, “national champions”, are exposed to the vagaries of political populism.

So whilst the large listed miners have retreated from high risker geographies, the enormous risk capital required for copper development in these countries relies on sovereign balance sheets from China and the Middle East.

How do we feel about this?

Our “western” global multi-hundred billion dollar asset managers quite rightly allocate capital as rational fiduciaries. These institutions are not “extremely myopic, driven by instant gratification” (as described by the CEO of a large copper/gold company). The legislated performance benchmarks of super funds prioritise top quartile short-term performance, and the sovereign risk of many copper jurisdictions diminishes investment appetite.

Goldman Sachs believes that copper “is in the foothills of what will be its Everest”, however the “market” – which absorbs every forecast of a supply crisis – has not yet sent sustained incentive price signals to encourage sufficient investment.

The incredible technical capabilities of some of our best global mining companies are not being fully utilised in addressing the geology, metallurgy, altitude, and, ultimately, social licence challenges of mining development in frontier geographies.

And our lack of investment in copper processing surrenders more geopolitical dependency and supply chain resilience.

Where is the generational thinking to deliver our children's abundant energy future?

There is a better way. Here is my alternative.

Firstly, a more uniting narrative must emerge. Copper’s key role in the “energy transition” is widely understood, and the speed and cost of the energy transition is a source of divisive political debate.

However, the core demand story for copper, and the correlation between the availability of copper and global economic growth, are less well understood.

When was the last AGM interrupted by someone dressed as a thirsty energy grid strangled by a lack of copper? Where is the activism of aspiration and abundance?

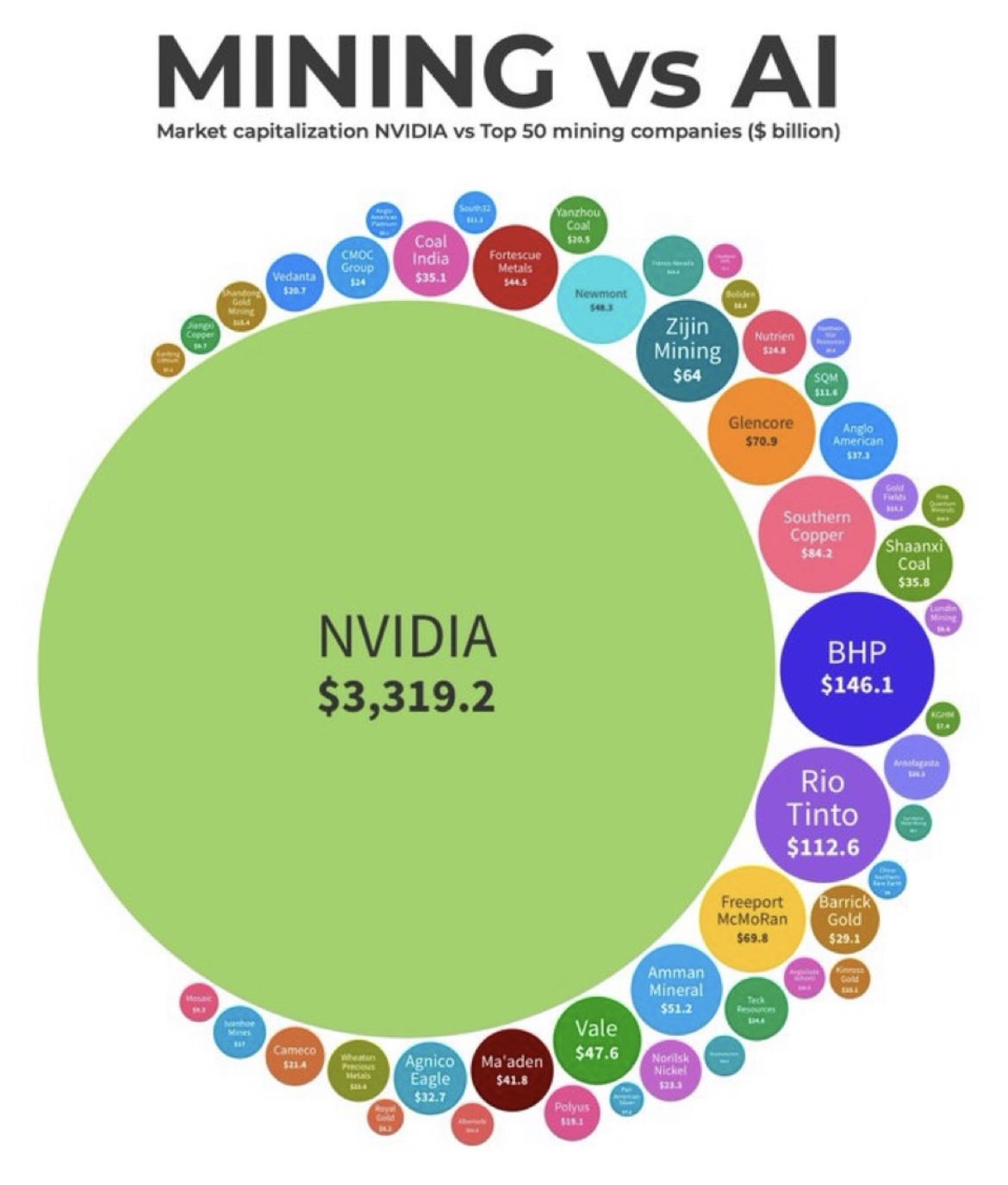

The world’s US$2+ trillion tech giants (Apple, Google, Microsoft) are leading investment in ambitious energy technologies (including fusion and geothermal), given the extraordinary energy demands of their ruthless AI capex arms race. Mining’s opportunity is to capture the adjacent narrative - copper as a scarce but critical link in the world’s clean energy abundance supply chain for economic growth. Capital can then follow.

Secondly, the world needs perhaps $30 billion per annum of additional copper investment. This is an enormous opportunity for global investors to deploy capital.

The Brookfield CEO, Bruce Flatt, recently predicted that within the next 10 years, more than 30 institutional investors around the world – each with more than US$1 trillion in assets – will prefer private markets over public markets. “The sums are so vast that they won’t want the distractions of the public markets on a day-to-day basis for all their capital.”

This is the unrealised capital pool for global copper investment, once the signals for investment sound loudly.

Finally, western governments must inevitably tilt incentives and regulations in favour of major institutional investors sponsoring copper development. Governments must play an outsized role in attracting long-term patient capital, to invest in assets whose gestation takes 20+ years but whose cashflow then blossoms for 50+ years.

We must replace the divisive debates over energy policy, with new multi-nation, bipartisan investment alliances for copper. This is a grand challenge for humanity.

Just like a Taylor Swift tour, pandemic prevention and space exploration of the future, our greatest achievements unite us and transcend borders.

Looking ahead

This is the future our major miners can position for: when giant pools of institutional capital inevitably demand increased investment in new copper, to take advantage of market signals and Government support.

This is the new mining company, as a dual-strategy fund manager. The mining company to continue to own its assets in “safe” jurisdictions. And simultaneously, the mining company as an operator of copper projects in “riskier” jurisdictions, whose development is funded by a global coalition of private capital.

Together, the world’s largest capital allocators bring enormous de-risking capabilities. For these institutions, allocating long-term capital across a portfolio of developing nation exposure - an investment in global energy security – is also a macro portfolio hedging strategy.

Miners, after a decade of penance for mistakes of the past, to once more emerge as rigorous stewards of risk capital.

Mining companies earning free-carry. Not risking the balance sheets on higher-risk singular investments. Delivering outsize equity returns, reducing earnings volatility and enjoying the long sought-after valuation re-rate.

As Victor Hugo wrote, “No army can stop an idea whose time has come.”

Hope is not a strategy. Let's get building.

5 topics