The Central Bank Cartel has made microcaps more attractive than ever

Spheria Asset Management

Since its inception in 1792, the New York Stock Exchange has been a witness and barometer of human history. Humanity has had to endure its fair share of setbacks throughout this relatively short time span. However, we have always bounced back.

The stock market has been a leveraged play on human ingenuity and determination. It has survived depressions, world wars and pandemics, and thrived through it all. Over the long-run we will win - we always do.

But is today's market still a reflection of human endeavour?

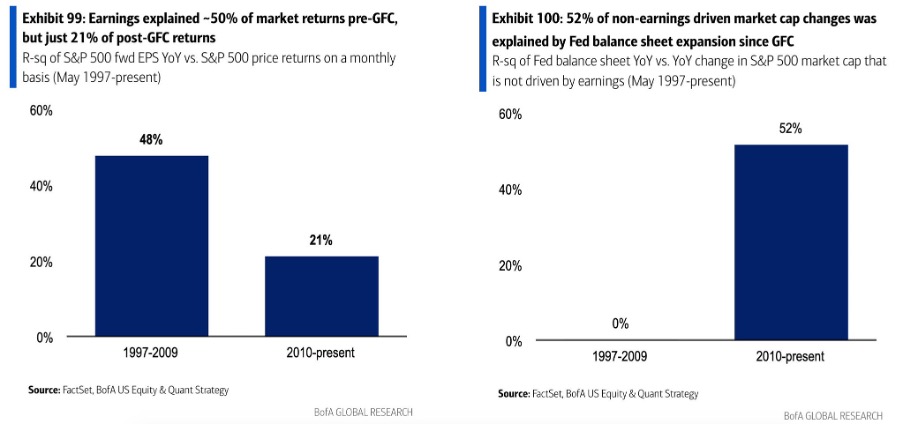

Large-cap returns are not reflecting earnings

Recent research by Bank of America Global Research shows that since 2010, earnings have only explained 21% of S&P500 returns.

So if not profits, what else might be explaining moves in the S&P500?

We can point the finger squarely at the "central bank cartel". Bank of America Global Research estimates that the Federal Reserve balance sheet can explain 41% of S&P500 market cap changes (52% of the 79% not explained by earnings).

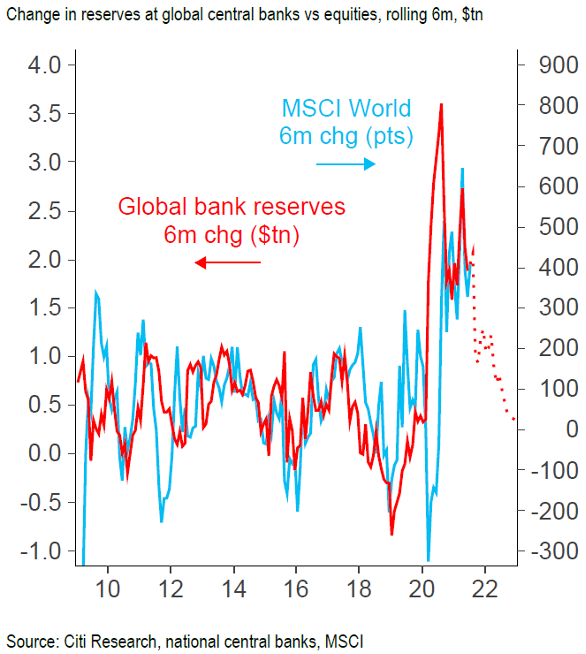

Citi Research shows this even more eloquently and for the broader MSCI Index.

The chart below shows the uncanny relationship between changes in the reserves created by the Central Bank Cartel (in this case BoC, Riksbank, RBA, SNB, BoE, BoJ, ECB, and Fed) and rolling six-month returns for the MSCI.

Where is all the liquidity going?

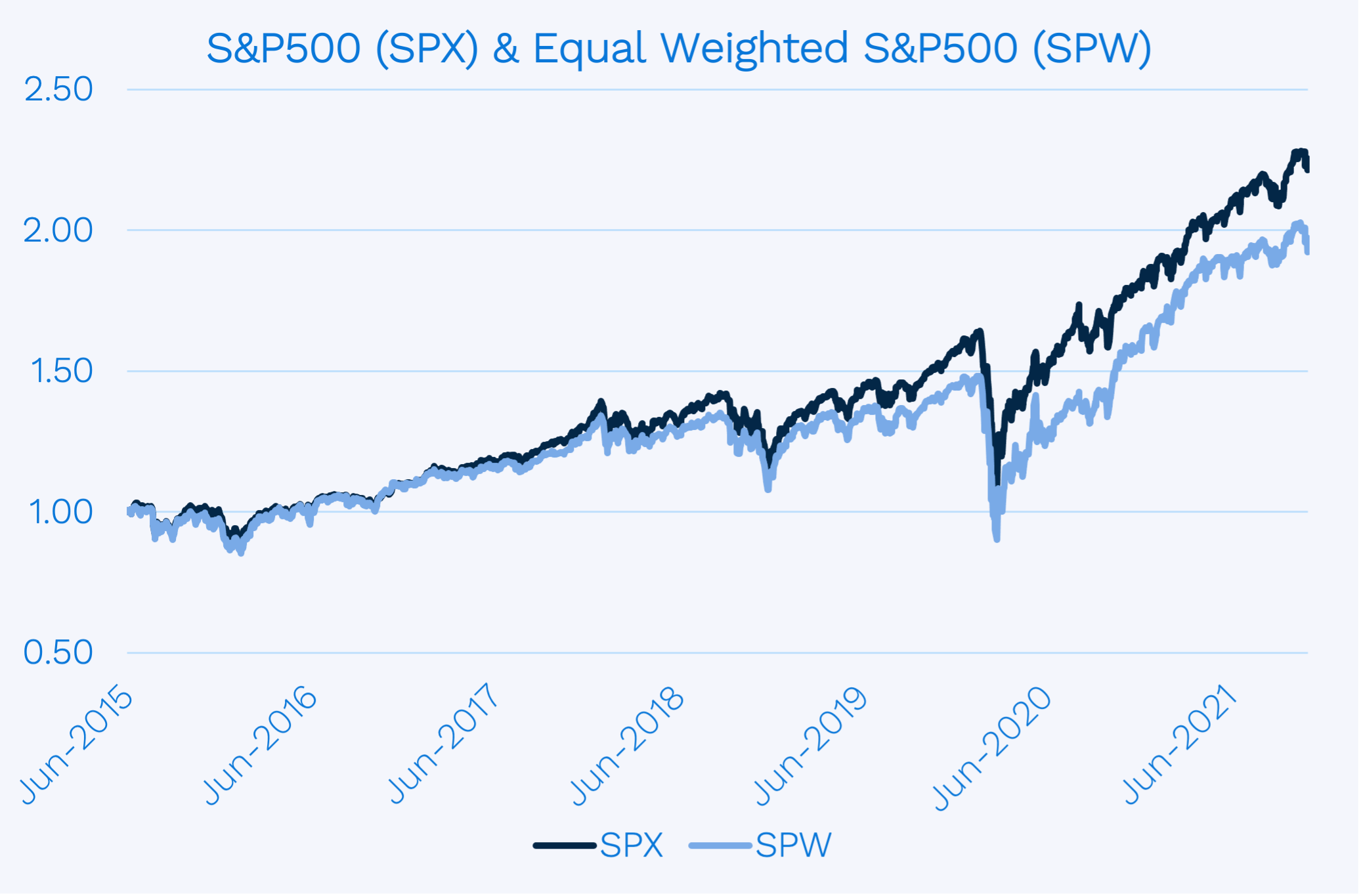

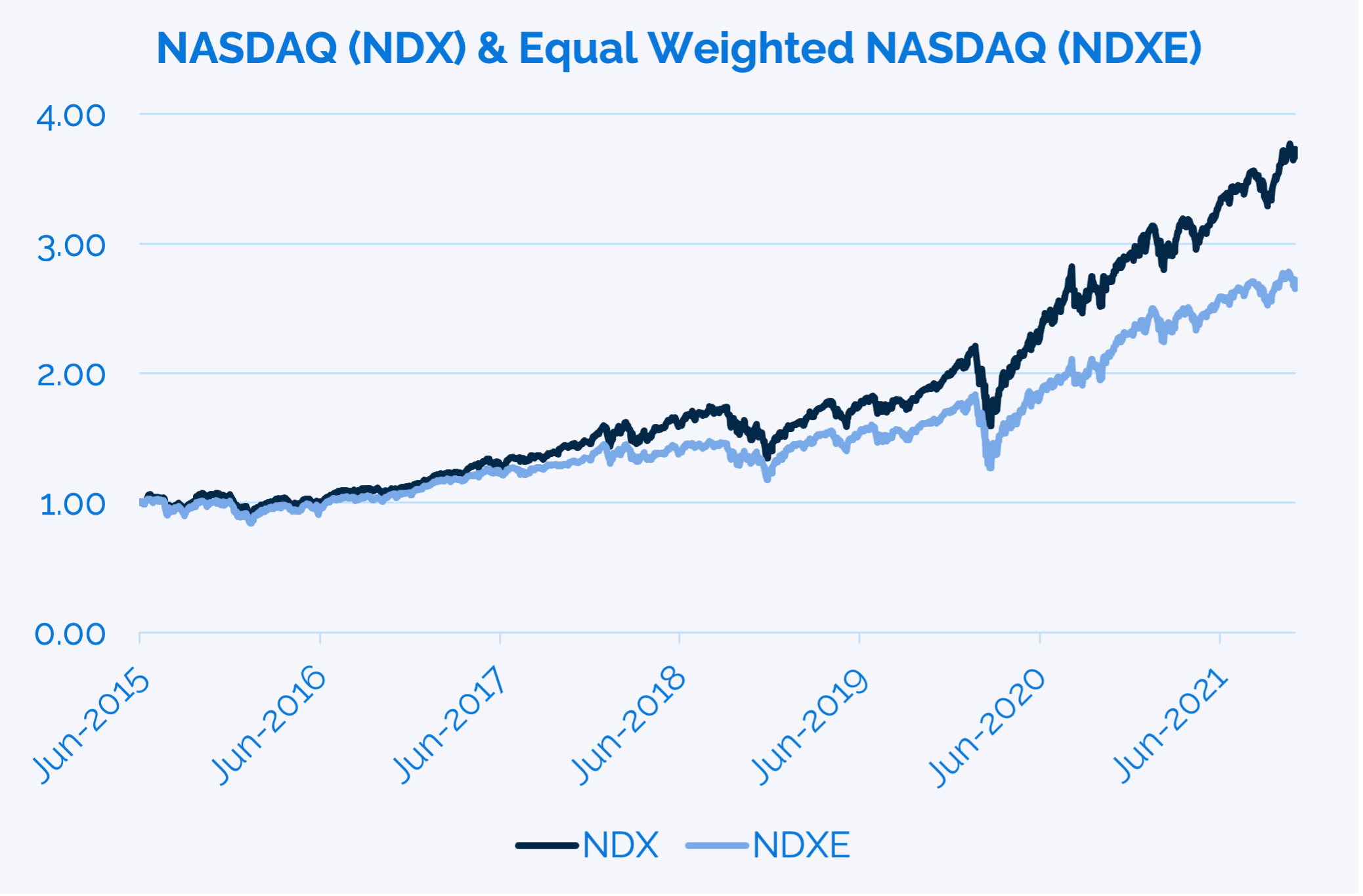

We can confidently say that most of this Central Bank Cartel liquidity has flowed into large-cap equities.

This is illustrated by the widening gap in the regular market-cap-weighted index relative to an equal-weighted equivalent. That is, an equal-weighted index free from passive investment distortions where large stocks mechanically attract more of the inflows.

Source: Bloomberg, Spheria

Since June 2015, the market cap gap between index weighted and equal weighted Indices for the S&P500 is an astonishing $5.3 trillion. Despite being a smaller Index, the NASDAQ shows a gap of $7.1 trillion. This reflects the popularity of passive ETFs in this universe of technology stocks.

Alarmingly, since June of 2020, this gap has widened an additional $4.7 trillion, about the same quantity the Fed has expanded its balance sheet during the pandemic.

With the Central Bank Cartel attaching a fire hose of liquidity to the financial system, it is clear that the outlet has been into large-cap stocks via passive ETFs.

After all, why would anyone sell a Treasury security to the Cartel unless they thought they could earn a higher return elsewhere.

For every dollar of quantitative easing, it implies there is a dollar flowing into a riskier (presumably higher returning) asset.

So, the share market is no longer a play on human endeavour but rather a play on unelected bureaucrats experimenting with financial theory.

The astonishing global microcap valuation gap

Yes, the aforementioned factors do trickle down the market cap spectrum, so global microcaps are not immune.

However, we would make the following points.

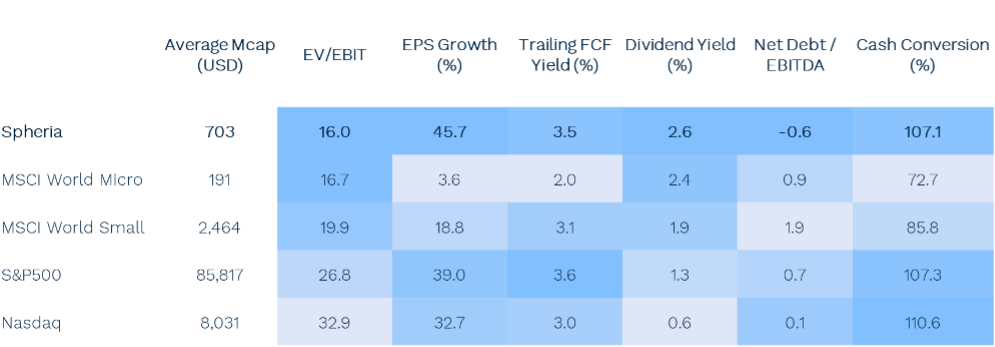

Firstly, the valuation gap is now quite astounding. With all that liquidity flowing into large caps the earnings multiples are looking increasingly egregious. Within global microcaps, we can construct a portfolio with similar growth and stronger balance sheets but at a fraction of the price (16x EV/EBIT relative to the S&P500 27x EV/EBIT).

Secondly, and getting back to the markets most compelling attribute, its reflection of human ingenuity and determination, the global microcap market is still the best place to see this dynamic in action.

Nowhere will you find a universe of stocks with greater insider ownership, often founder-led businesses with the entrepreneurial spirit which makes equities so successful over the long run. Insider ownership in the MSCI World Microcap Index is currently just above 10%. MSCI World Smalls is 5.3%, while the S&P500 is just 1.7%.

Time to consider an allocation to global microcaps?

We remain concerned about the distortions we are seeing from ultra-low interest rates, quantitative easing and passive investing.

For these reasons, the benefits of global microcaps as an asset class are arguably more attractive than ever.

Not only has this large and undiscovered universe of stocks delivered returns of 3%-6% in excess of large caps over history, but it can provide powerful diversification benefits to an equity portfolio.

One global microcap to watch in 2022

Inogen (NASDAQ: INGN) - Achieving where ResMed (ASX: RMD) failed

As fundamental investors, we have to accept that the share price does not necessarily reflect the underlying health of a business. Inogen is a spectacular example of this.

Bring up a share price chart of Inogen, and one would think this is a business in decline. However, let’s dig beneath the surface to give you a sense of why we continue to think this stock is a fantastic opportunity for our investors.

Inogen is the global leader in Portable Oxygen Concentrators (POCs), a mobile alternative to tanks for those on long-term oxygen therapy.

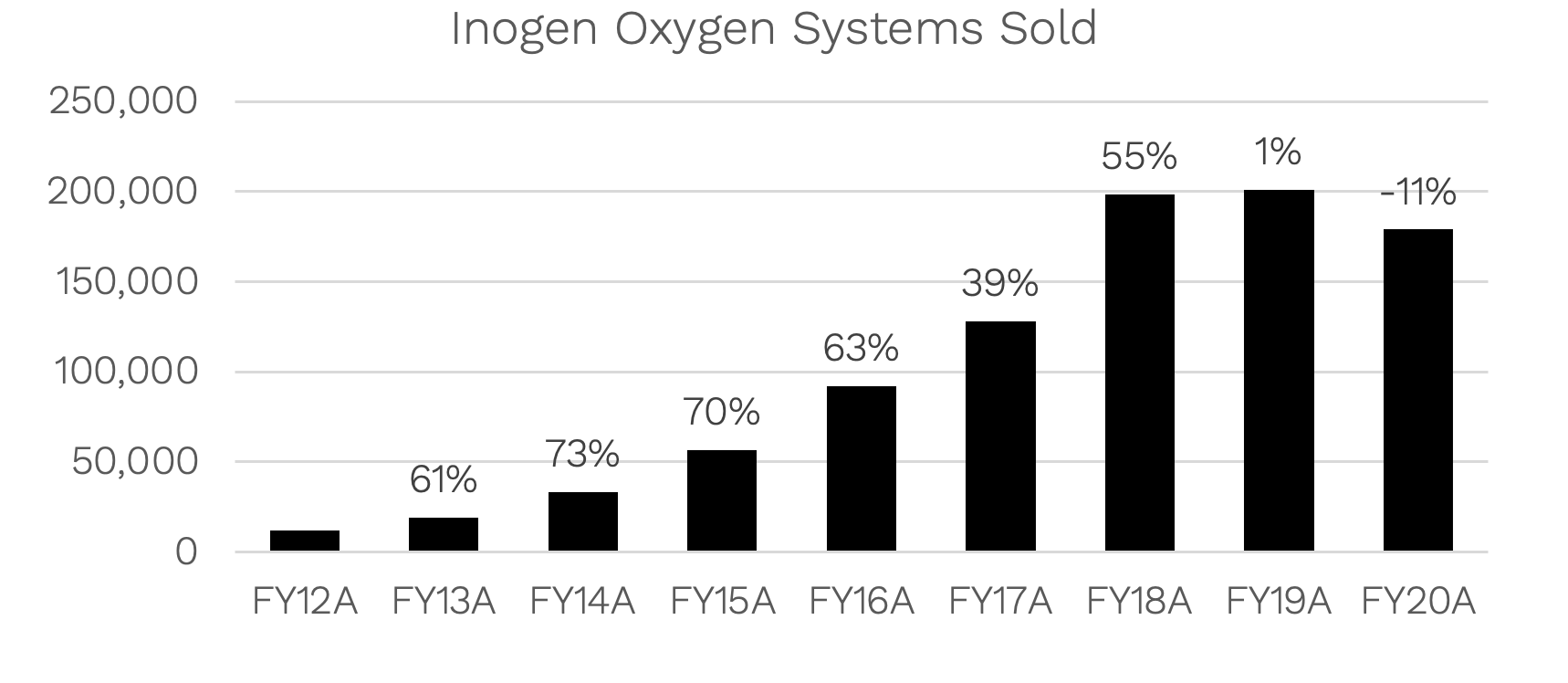

Firstly, let’s zoom out and take a look at how this business has done over the long run. The chart below shows the number of oxygen systems sold since FY12. You'll notice the exceptional growth of this business off a low base, averaging 60% growth from FY13 to FY18. FY19 was impacted by the loss of a large home medical equipment customer and some disruption to the sales force. The dip in FY20 is understandable since Inogen's users are elderly mobile patients confined at home during COVID.

The company estimates that penetration rates for Portable Oxygen Concentrators (POCs) are only 21%, leaving significant room for further growth. Given this ongoing penetration upside, industry growth remains strong. While the market for oxygen therapy is a low single-digit growth market, the POC market should continue to grow at a double-digit rate. However, in the short-term, growth will overshoot this because of a significant catch-up phase following the trough of COVID.

Pleasingly we have seen a solid rebound to date with second-quarter system growth of 23%. Unfortunately, semiconductor chip shortages constrained the third quarter, so system growth was a more moderate 6%.

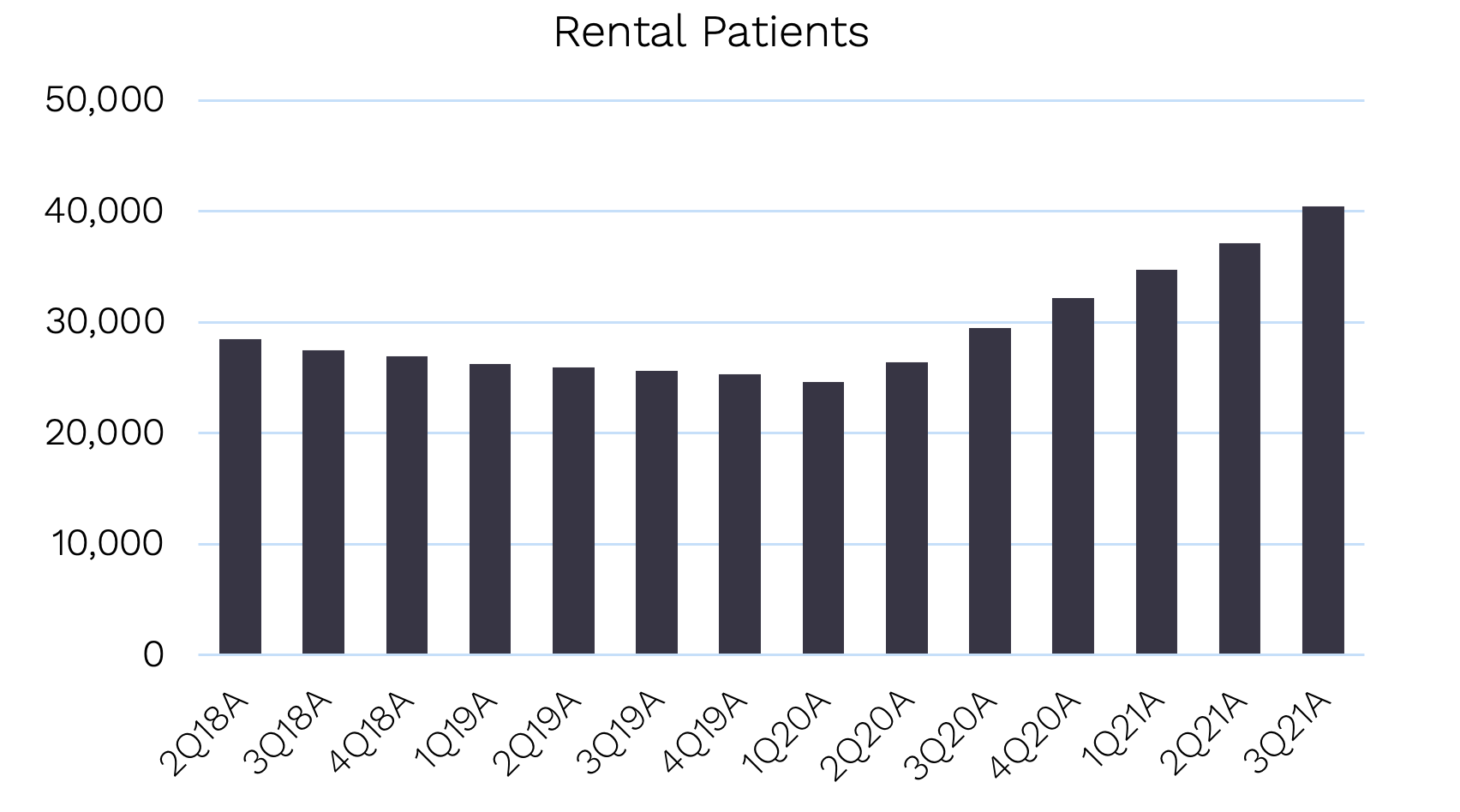

The other positive takeaway from recent results is the success of the rental sales model. In the past, Inogen used a mix of home medical equipment distributors, direct to consumer sales, and direct to consumer rentals where patients rented the device for a period rather than buying it outright. Analysis by the company has revealed that the rental model has a higher conversion rate with customers and robust economics. As the chart below shows, with a renewed focus on this business model, Inogen has shown strong momentum.

Further to this, reimbursement has become a tailwind for the company. Average rental revenue per patient has increased from $243 in the third quarter of 2018 to $342 in the third quarter just passed. This price rise flows directly through to gross margins with an increase of over 6% on last year.

With a market capitalisation of US$736 million and a net cash balance sheet of US$218 million, the company can be bought for only US$518 million.

Interestingly, ResMed, a company with a market capitalisation of $38.7 billion, tried to enter the market for POCs and failed miserably.

This is from ResMed's 25 October 2018 earnings call:

"The issue here on these POC devices is really getting the right balance of features that make it the most usable product. So we've got a really good battery life, we've got a great weight, and a really good oxygen output, that let's people be mobile and to use the device with confidence…We'll talk to you in 90 and 180 and 360 days about how the Mobi rollout goes, and I think we'll start to see that really pick up."

The updates never came. Perhaps ResMed will try entering the market via some other route?

Finally, but not least of all, the company is one of the better US companies we have discovered for its ESG initiatives. Recently, we spent an hour with the company CFO exclusively discussing ESG issues.

The company’s awareness and response on a range of ESG factors was impressive and gave us greater confidence in the sustainability of the business. This forward thinking view of ESG issues wider reflects management’s long-term and disciplined approach to building shareholder wealth. We remain confident investors will be rewarded by this holding.

Discover more about how global microcaps can improve your investment portfolio

Watch Gino Rossi (Portfolio Manager of the Spheria Global Microcap Fund), share further insights in this highlight from a recent Spheria webinar. Or find more insights on the Spheria website. |

2 topics

1 stock mentioned

Expertise