The charts suggesting the ASX could be doomed to repeat history

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead. (And we're back after a few days off - did you miss us?)

MARKETS WRAP

- S&P 500 - 3,693 (-1.72%)

- NASDAQ - 11,311 (-1.66%)

- CBOE VIX - 29.92

- USD INDEX - 113.02

- US 10YR - 3.687%

- FTSE 100 - 7,019 (-1.97%)

- STOXX 600 - 390.40 (-2.34%)

- UK 5YR - 4.048%

- GOLD - US$1644/oz

- WTI CRUDE - US$79.43/bbl

- DALIAN IRON ORE - US$98.89/T

CENTRAL BANK WRAP

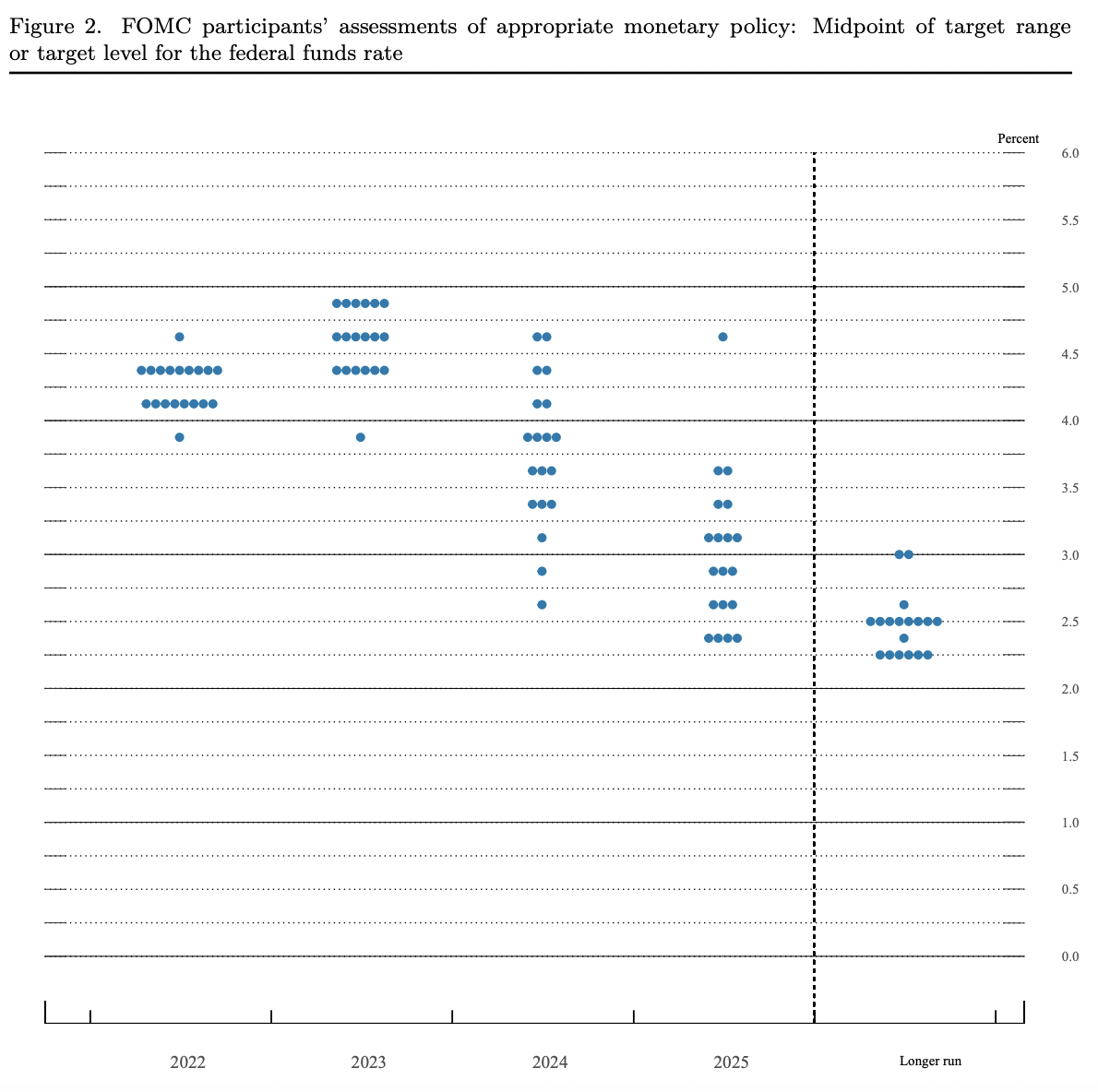

While we were away, a LOT happened on the central bank front. The US Federal Reserve raised its key interest rate by 75 basis points - causing some nervous traders to breathe a sigh of relief that they didn't choose to plump for a 100 basis point rate hike instead. But that breath was shortened when the Dot Plot came out:

The Bank of England responded to its own inflation crisis by raising rates by 50 basis points to 2.25%. What's even more amazing - it was a close call! Of the nine members, three voted for a 75 basis point hike... and one voted for a 25 basis point hike. A 25 basis point hike? When inflation is running at double digits!?

Here are some of the other major moves of the past week (thanks to Jonathan Pain of The Pain Report for compiling):

- Switzerland raised rates by 0.75% to 0.5%

- Norway up 0.5% to 2.25%

- Indonesia up 0.5% to 4.25%

- Taiwan's central bank hiked rates by 0.125% to 1.625% (a little precise isn't it?)

- The Philippines up 0.5% to 4.25%

- South Africa up 0.75% to 6.25%

- And... the central bank of Mongolia raises rates by 2% to 12%

For my money, the quote from the last week goes to Philippine Central Bank chief Felipe Medalla. In response to a question on Bloomberg TV about why they didn't hike rates by 25 basis points instead of the 50 it did, Medalla's summary was quick:

"Well, firstly, 25 is nothing."

THE CALENDAR

It may sound weird to say that next week is a "quieter" week, but that's exactly what is happening next week. There's a whole lot of central bank speak coming up, but what new things can they say? Especially for the bloke speaking on Tuesday at 9:30pm?!

In other news, we'll get Eurozone inflation on Friday night - another (if not obvious) clue the economic bloc is literally heading straight for a recession. The other interesting thing to note is US consumer confidence - released Wednesday at midnight Sydney time. Will consumers say they are feeling better in the run-up to those midterm elections in November?

LET'S DISCUSS CURRENCIES

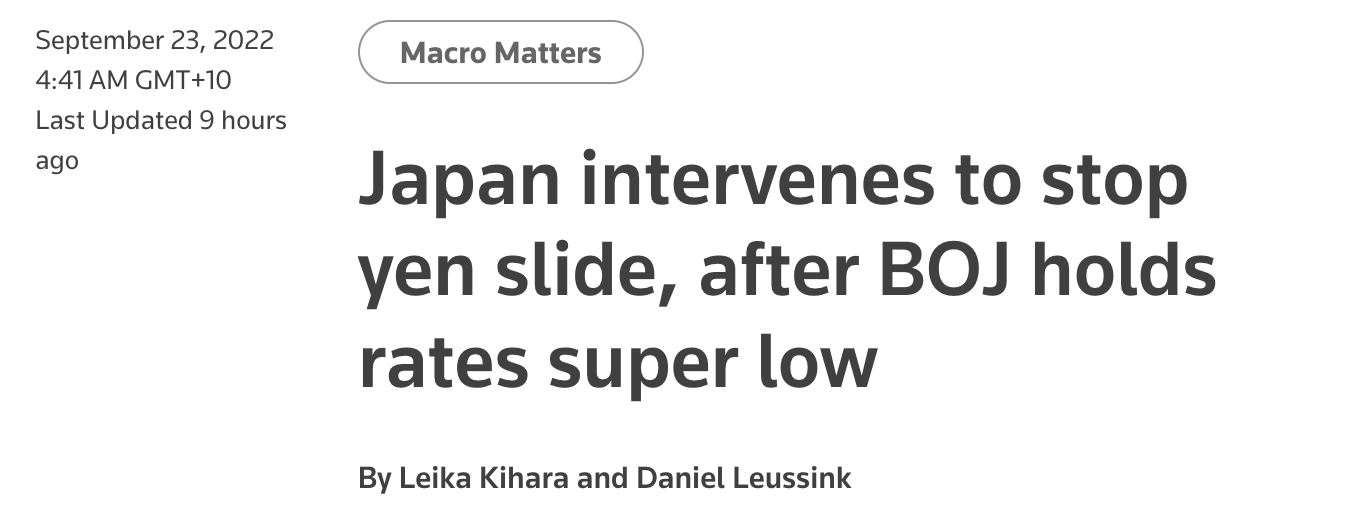

OK, I hear you. Hans, come on. I don't wanna read about currencies! But you need to stick with me through this because something very important is happening right under most people's eyes. Late last week, this headline crossed the professional newswires:

So why does this matter? Put simply, it's the first time that has been done since 1998. The Japanese Yen is trading at lows not seen since that time. In fact, as of writing, one Australian dollar can buy you 94 Japanese Yen - that's the highest it has been since mid-2001.

In the meantime, the US Dollar Index is also trading at highs not seen since the turn of the century. At one point in the Asian session on Friday, it had a 111 handle - unprecedented in the modern era.

All this is a way of saying two things:

- Central banks have a huge impact on the way you invest - even if you don't realise it. The Bank of Japan is the only major central bank not raising interest rates (one of two if you count the People's Bank of China) and it's showing in their currency performance.

- If you feel like markets have been rough this year, why not book a holiday in Japan? You're getting more for every dollar now than at any other time in the past 20 years!

For more on the currency situation, Janu Chan wrote about it on Friday - you can read that here:

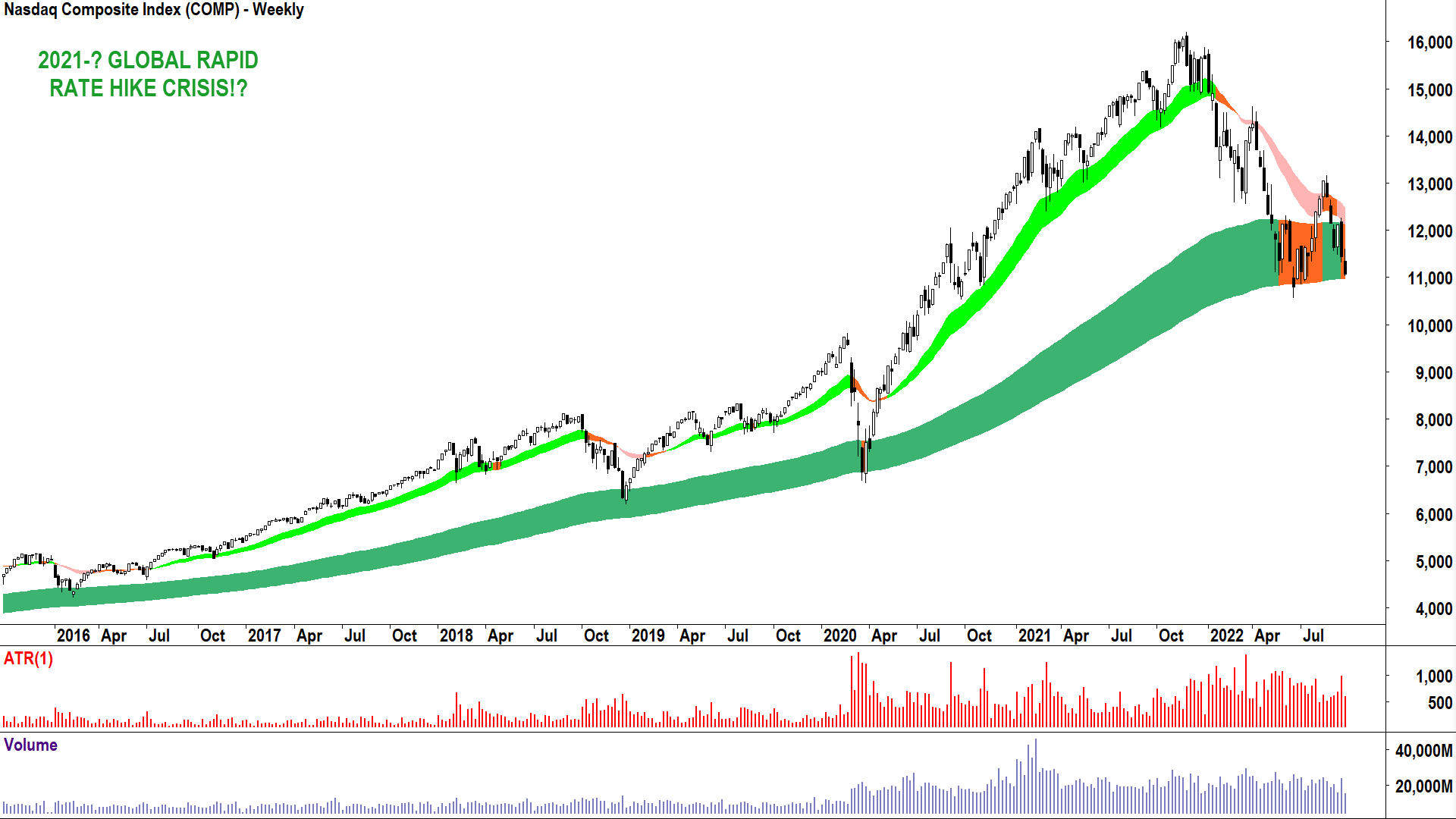

THE CHARTS

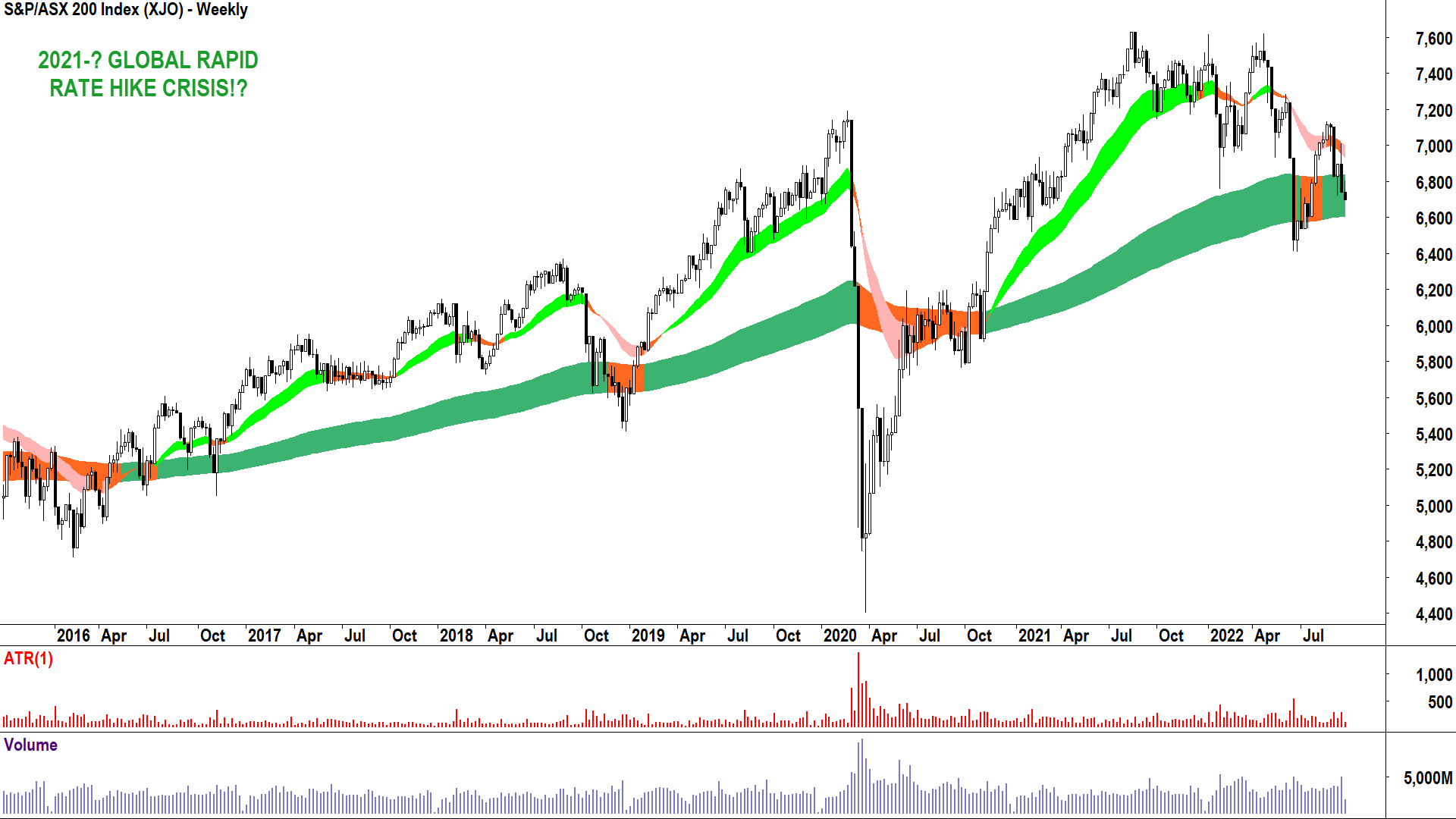

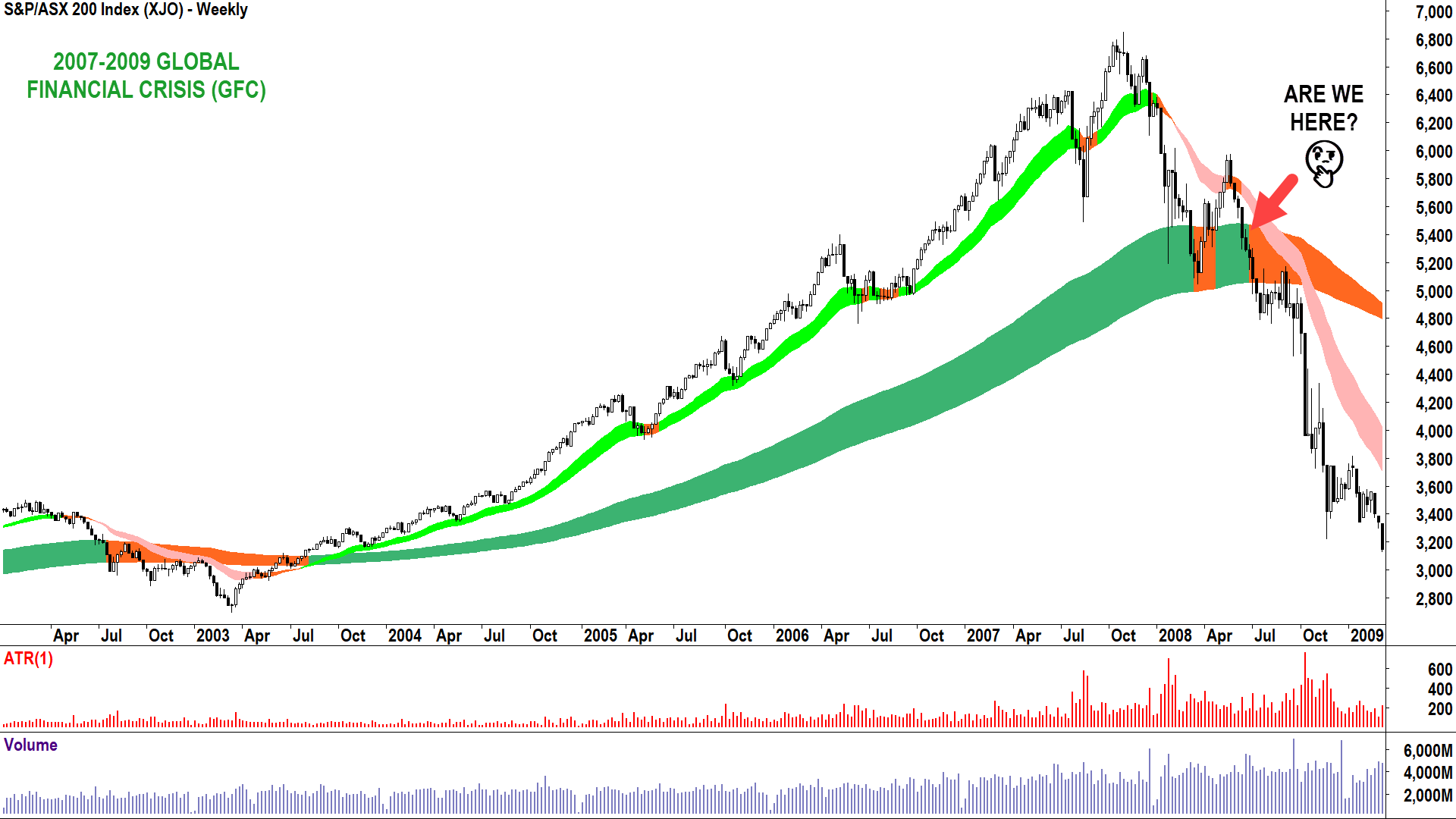

Our charts segment for the report comes to us from Carl Capolingua at ThinkMarkets - and it's a case of history repeating itself.... possibly. Consider the ASX 200, and in particular, the way the chart looks between the current market and the market of 2008.

versus...

As you can tell, the two charts are quite different - and to be fair, so are the circumstances that led to each situation. But Carl's chart does bring up a good point - if history doesn't repeat, will it rhyme? Or put it another way, do the technicals suggest there's another larger leg down incoming?

If you look at the US chart (the S&P 500), you might find something eerily similar.

versus...

Conclusion? Be careful what you wish for if you're buying this dip. 2008, in many respects, was not as long ago as you might think.

STOCKS TO WATCH

Not much happened in the way of equities news while we were away but Coles Group (ASX: COL) did seal the $300 million sale of its fuel and convenience business to Viva Energy (ASX: VEA). To make that easy for consumers, that means "Coles Express" is now owned by Viva Energy. Comprende?

Anyway, every broker has an opinion on this deal. While there were no moves made in the wake of this deal, it certainly created a buzz among the houses.

Citi is happy to see deal go through - saying that the proceeds will probably be reinvested into its more profitable businesses of supermarkets and liquor.

Macquarie called the price "underwhelming", but at least it rids an extra $800 million-plus from its balance sheet.

Finally, UBS characterised the sale as one of "certainty" and "materiality". However, it did say the move was better for VEA than COL - arguing the transaction gives the fuel refining company a little more leash and options for revenue sourcing.

TODAY'S TOP READ

The small cap stairway to heaven (Livewire): You had me at Led Zeppelin. But to keep you reading beyond the sentimental song title, Adrian Ezquerro has proposed seven stocks with the earnings potential to go from small cap to mega-cap.

Hans Lee wrote today's report.

GET THE WRAP

If you've enjoyed this edition, hit follow on this profile to know when we post new content, and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

3 topics

2 stocks mentioned

3 contributors mentioned