The cheapest technology company on the ASX

What if I told you there was an ASX-listed SaaS revenue generating technology company with the following attributes:

- Return on equity: 33%

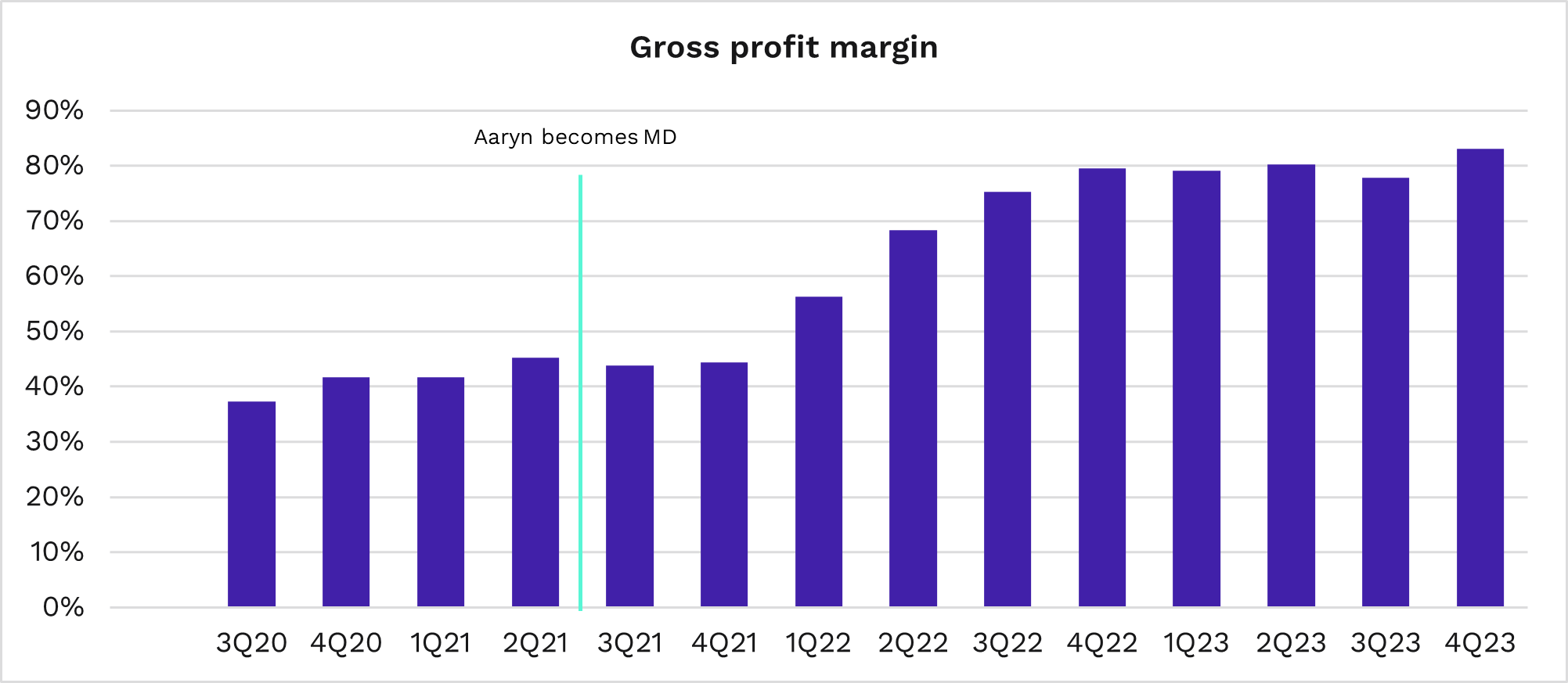

- Gross profit margin: 81%

- Last-twelve-month revenue growth: 74%

- Last-twelve-month earnings per share growth: 850%

- Net liquid assets as a proportion of market cap: 41%

- EV to EBIT: 4.9x

- EV to maintainable EBIT (removing growth spend): 1.4x

In the world of high-flying technology companies where spectators can often marvel at the compound annual growth rate of annual earnings per share losses, there exists a highly profitable and growing company. Yet, perversely, unlike many of its peers that trade on more than 5x revenue (with no profits), it is trading on less than 5x earnings.

The company in question is Connexion Telematics (ASX: CXZ).

So, what’s the catch?

Overview

CXZ generates USD recurring SaaS revenues by offering fleet management software to car dealerships participating in courtesy transportation programs (CTPs) for car makers (OEMs). Think Midwest Americans taking their Buick to the local General Motors (GM) dealership for a biannual service. GM stipulates that dealers must offer their client a brand-new Buick as a courtesy car. This is seen as a marketing opportunity. CXZ provides the software that is mandated to manage the fleet of all the courtesy cars in GM’s 4,000-odd affiliated dealerships in the US.

The market seems to overlook CXZ due to its revenue concentration in GM. However, it is generating significant free cashflow, which is being used to reinvest into the business and expand the company’s software offering to diversify its customer base and product offering.

CXZ has begun trialling new revenue lines in the form of toll management systems and courtesy program alternative transport systems (ride hail comparison and reimbursement automation). Its goal in the medium term is to build a meaningful marketplace of software offerings for dealers.

This is in a context of dealerships historically spending less than 1% of rooftop costs on software with market research projecting this to expand materially in the coming years.

CXZ was a perennial underperformer in its early days, plagued by ever-widening losses and limited revenue growth. New management entered in 2020 and focused operations on the key profitable CTP software solution, while reinvesting free cash into software development.

Recent history

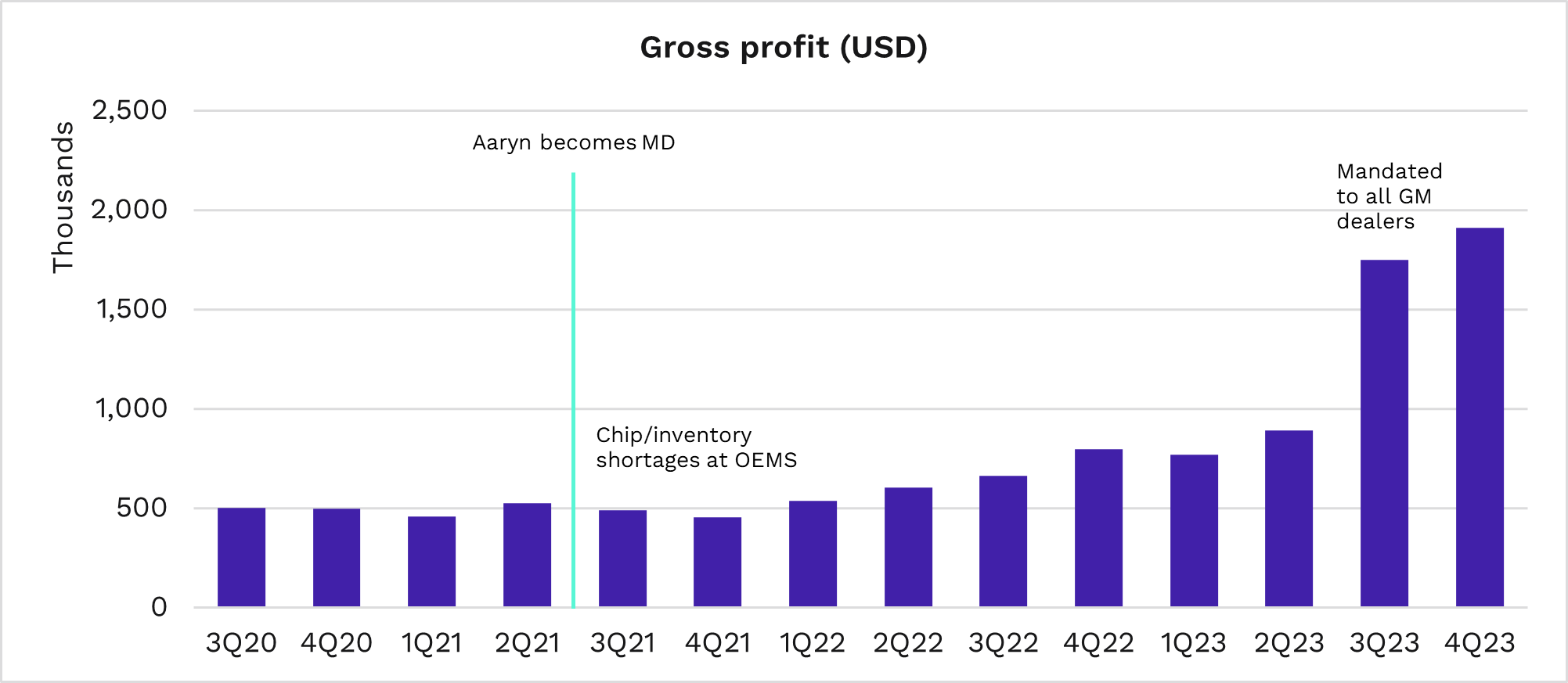

In January 2023, CXZ was mandated to all GM-franchised dealers as the exclusive provider of CTP fleet management software, materially improving revenues and free cash flow. This was an expansion to the original GM deal signed in 2018 and renewed in 2021.

Additionally, CXZ recently won its first two non-GM dealerships (Volvo and KIA). Both were using a larger competitor. In June 2022, CXZ also received approved-vendor status from Ford and Lincoln for their CTPs; however, no dealerships have yet been signed.

The company has committed to disciplined capital allocation, comprising closely monitored ROI-driven reinvestment and an on-market buyback. Regarding ROI, management targets a > 25% return at the GP line on “growth spend” (which is defined as R&D and sales & marketing in the income statement).

Aaryn Nania is the CEO and MD of Connexion Telematics and has been a Director of the Company since 2018. He owns 5% of CXZ, having purchased c. $120k on market over the last year and received the rest through performance rights.

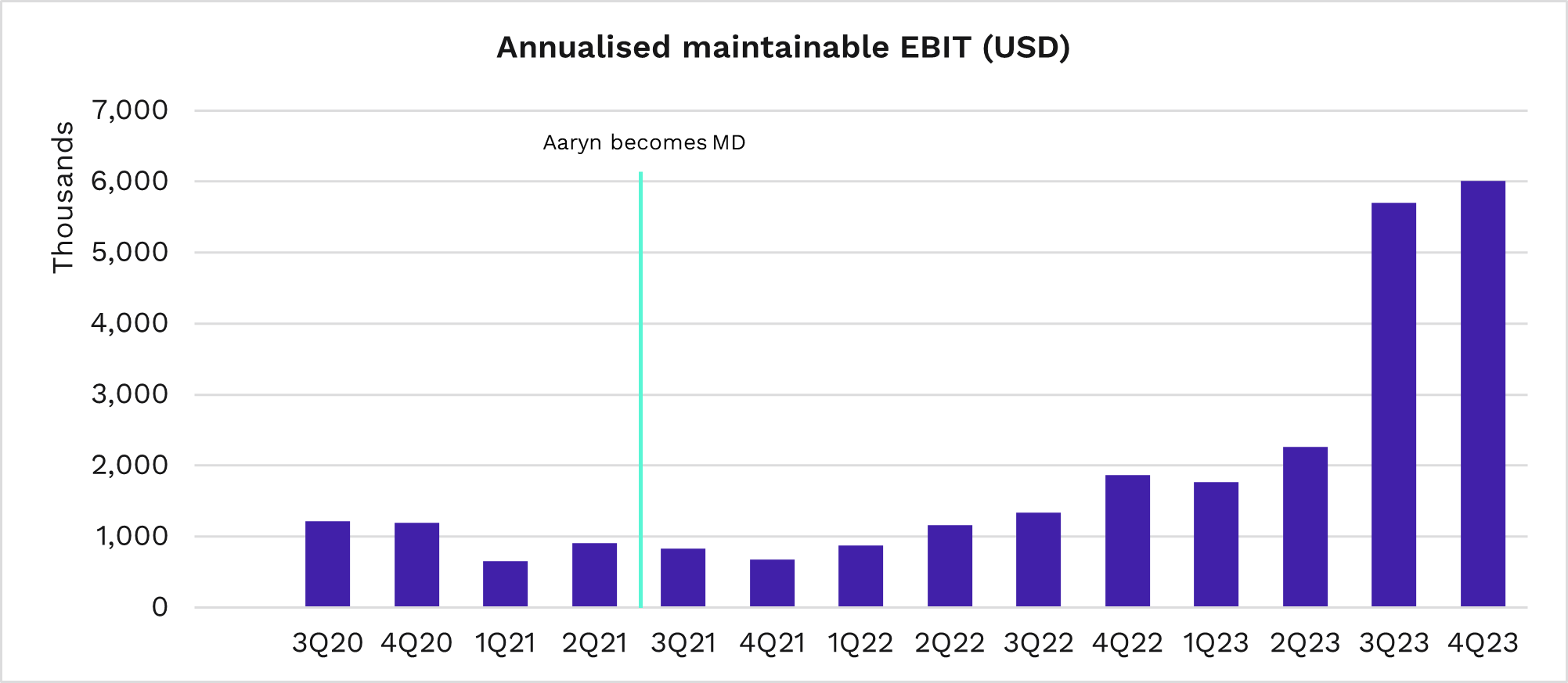

To date his stewardship of CXZ has helped build shareholder value.

Thesis

The company is a genuine SaaS revenue business trading at a low multiple of 4.9x EV to EBIT based on FY23’s reported figures. However, on a forward-looking basis, CXZ is trading on a 1.4x EV to maintainable EBIT. This is calculated by annualising the last quarter’s EBIT and stripping out the discretionary growth spend. The figure demonstrates what the pre-tax free cashflow the company would generate in run-off mode. Shareholders would receive their money back in less than a year-and-a-half!

CXZ is a highly profitable technology company being priced more cheaply than an oil company operating a single well. We believe this is partially due to the baggage of previous operators overpromising and underdelivering as well as the concentration risk in GM.

Yet with 41% of the company’s market cap backed by net cash and receivables and enough contracted cashflow to reinvest into growing the business, the outcome is asymmetric, with limited downside and upside that is multiples on the current valuation.

We are happy to back the MD, Aaryn, who has invested his own cash into the business and proven he has a rare combination of operational and capital allocation skills. He has capably managed the strategic GM relationship, conservatively reinvested cashflow to generate new business, and bought back stock at attractive prices.

4 topics