The clearest trends worth talking about

Fidelity International

You can’t step twice into the same river. Stock markets are in a state of constant flux but there are currents that can persist over long periods. Think of the fund manager as navigating a river which is constantly twisting and turning, sometimes calm and sometimes perilously turbulent. At times, one can be positioned in the sweet spot, finding oneself speeding ahead for a while but then, as the river changes course, left behind in an eddying backwater.

We see this in the measurement of “momentum” effects in markets. As long as “momentum” is working, stocks that have performed well in earlier periods have a tendency to outperform subsequently. This appears to have been the case around the world for a very long time (with the notable exception of Japan).

However, the measurement of the momentum effect really only captures shorter term effects. It says little about persistent trends since today’s momentum stocks may be quite different from those of a year ago. So trying to follow a purely momentum-driven strategy would involve a frantic level of portfolio turnover. And occasionally there is a sharp anti-momentum move which will catch out the trader on the way in and the way out and cause huge short-term losses.

Far better then to try to tap into more persistent effects – long term momentum, if you like. Fortunately, at least with the great benefit of hindsight, trends often mirror fundamental earnings power (relative to market averages) and are initially supported – and eventually checked by – relative valuations. Such trends seldom move in a straight line but a manager that sticks with a multi-year theme through thick and thin can appear to be inspired.

Three clear themes have driven markets post-crisis

There are a good many examples of historic mega-trends that have propelled the careers of fund managers. Think of the heroes of the last decade that successfully focused on emerging markets between the end of 2001 and 2010. The MSCI EM Index returned over 300% in GBP terms over those nine years against only a relatively modest rise in developed markets - but over the next five years saw double digit declines as the developed world steadily appreciated. Or, in the middle of that period, the fad for basic materials that fuelled the fantastic growth of China causing, for example, Rio (thanks to its leading position in iron ore) to sharply rise before giving it all back in the second half of 2008.

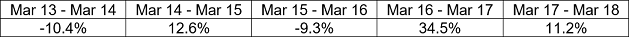

MSCI Emerging Markets Index performance table

Source: Datastream, 31 March 2018. Total return in GBP

With this in mind, we need to ask the question about the recent areas of market leadership – have we seen the best of these trends?

In a series of articles over the coming weeks we will look at the three clearest trends that are worth talking about - Quality, Technology and Growth - and assess whether these areas are now showing signs of fading or reversing. We start the series with Technology.

How much is too much?

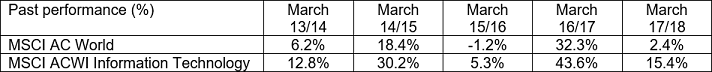

With last year’s amazing performance of technology stocks, people have rightly asked whether this is an overvalued area. Here the answer is not straightforward. Technology cannot be narrowly defined, and now permeates every industrial sector to a greater or lesser extent. It is rare to see a single sector stand out to the extent that technology did last year. However, aggregate technology profits were also much stronger than for the market as a whole.

Thus the sector’s relative valuation based on forward earnings estimates barely shifted. If we want to ask whether this is an overvalued area, we need to find other angles to look at because - in sharp contrast to the state of affairs in the tech bubble of 1999/2000 - earnings-based valuations are not polarised compared to other sectors.

One of the key problems within technology is the concentration of market value in the biggest beasts within the sector (Facebook; Amazon; Netflix and Google (FANGs) and Baidu, Alibaba and Tencent (BAT). These companies all saw strong earnings growth and share price rises last year and thereby became far more significant weights within broad market indices. For these stocks it is probably best to test reasonableness on a case by case basis.

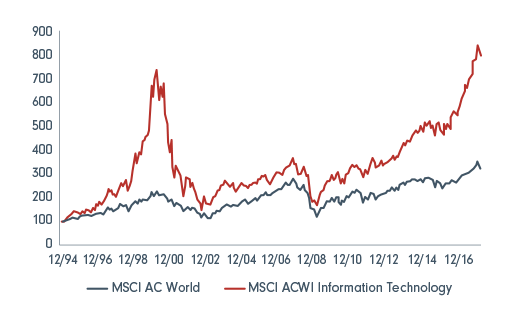

MSCI AC World vs MSCI ACWI Information Technology

Source: Fidelity International, Thomson Reuters Datastream, 31 March 2018. Indices rebased to 100 as at 1 January 1995.

For example, the market value of Alphabet (Google) and Facebook, both of which derive their revenue from and dominate digital advertising, is around US$1,200bn - which compares to an estimated total global advertising spend of around US$500bn. Amazon has a market value of around US$700bn. Walmart has far bigger sales and historically better margins but you pay around US$3.9 for a dollar of sales at Amazon and a little over 50 cents at Walmart.

We know it is fair to pay for growth - but we have to keep asking how much is fair to pay for it - can these companies justify their value in terms of the profits they will eventually earn when they are fully mature? It is worth observing that high growth companies often see sharp de-rating in their shares when their growth rate slows, even if they are still growing faster than the broad average

Further insights

To read more analysis from the team at Fidelity International, please visit our website.

2 topics

1 contributor mentioned

Jeremy Podger joined Fidelity in February 2012 to manage the Fidelity Global Special Situations Fund (OEIC) and, subsequently, took over the management of the FF World Fund (SICAV) in June 2014. He has been managing global funds since 1990.

Expertise

Jeremy Podger joined Fidelity in February 2012 to manage the Fidelity Global Special Situations Fund (OEIC) and, subsequently, took over the management of the FF World Fund (SICAV) in June 2014. He has been managing global funds since 1990.