The company that clocked up five broker "buys" after an earnings upgrade

Alan Joyce was obviously keen on delivering an early Christmas gift for investors, despite the Qantas CEO being one of Australia's most controversial business leaders.

Wednesday's trading update from the Flying Kangaroo forecasts a $150 million increase to its expected 1H23 underlying profit range, now expected to come in between $1.35 billion and $1.45 billion.

Net debt, which has been a thorn in Qantas' side for years, has also been revised down to between $2.3 billion and $2.5 billion by the end of 2022.

But why is this such a big deal and why now? In this wire, I'll take you through the update that has taken the market by storm and some of the broker verdicts that have been published on the back of this.

Why is this a big deal?

The last trading update was only six weeks ago when Qantas also upgraded earnings expectations. For this update, the consensus initially expected 1H23 underlying profits to come in between $350 million and $600 million.

But when push came to shove, Qantas delivered a profit forecast of between $1.2 billion and $1.3 billion. The boost put a fire under its share price - up 8.7% in just one day.

The forecast caps a remarkable comeback for one of the COVID-19 pandemic's biggest losers. It was not all that long ago when international and domestic travel was heavily restricted, leading to shambles inside Qantas and the airline industry.

At one point, Joyce even admitted: “They were 11 weeks out from bankruptcy.” Today, international borders are steadily reopening and domestic passenger activity is back to 88% of pre-COVID levels in August 2022. Business passengers are also surging and leisure travel revenues have surpassed pre-COVID levels.

Most importantly, the investor return is clear as day, as the next chart shows.

Take off

To illustrate Qantas' recent share price momentum of late, if you had bought Qantas shares on October 12th (before the first trading update) and didn't sell, you would have made a 21.3% nominal return in just 43 days.

Why the brokers are buying

But if you thought the price action has been interesting, just take a look at the massive reversal in opinion from the brokers. Of the six brokers covered by FNArena, five of them are buyers - Goldman Sachs, Morgan Stanley, Ord Minnett, Macquarie, and UBS.

All five shared the same basic theme - the industry is making a structural comeback from the lows of the pandemic and the gains are coming primarily from increased pricing, as any passenger or Ord Minnett could tell you:

"...with the benefit of the cost-out, self-funded fleet renewal and capital management we see ongoing earnings growth and call out Qantas as cheap trading on 3x EBITDA & 6x P/E on an FY24 basis. This is more than a 20% discount to pre-COVID levels despite being a better business..."

Reasons to be bullish

Elevated prices and increased customers

Load and yield is the story of Qantas' comeback, says UBS. A large part of this is simply the result of a surge in passenger numbers and the surge in fuel costs. Crude oil has remained above US$100/barrel for a large part of this year, and a strong US Dollar does not help alleviate import costs. When put together, both factors will still weigh heavily on its next earnings report.

“Fuel costs remain significantly elevated compared with FY19 and are expected to reach approximately $5 billion for FY23” – Qantas

But the beauty of Qantas' dominant position in an oligopoly is that it can pass on those price increases to consumers. In August, the airline said it would increase domestic airfares by 10%, and international fares by even more. The ACCC did not fight back, admitting the price rises would continue through the rest of 2022.

And that gives Qantas all the more reason to charge more for the privilege of flying.

On dividends and buybacks

And with increased fares come increased profits, dividends, and maybe even buybacks. In their previous trading update six weeks ago, Qantas also flagged the return of dividends after more than two years in the wilderness.

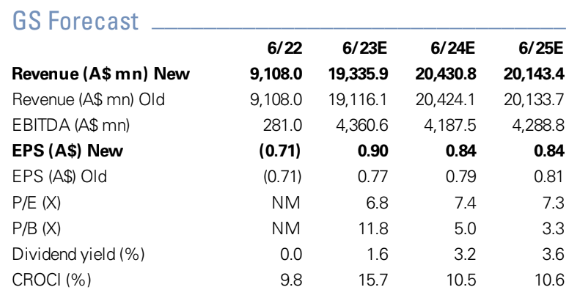

With this in mind, Goldman Sachs is forecasting the dividend payout ratio to increase to 3.6% by the end of fiscal 2023.

All the brokers also flagged the possibility of fresh buybacks, even as soon as the first quarter of next year. The airline itself is part of the way through its current $400 million share buyback, but comments in this week's earnings release flagged more could be on the way.

Credit Suisse analysts think it could come as early as February 2023's earnings season. UBS expects Qantas to announce additional share buy-backs of A$300 million in the second half of fiscal 2023 and A$500 million more in 2024.

If this all comes to fruition, that's $1.2 billion in share buybacks coming over the next two years - remarkable given it was weeks away from collapse just two and a half years ago.

But there are reasons to be cautious

The main concern shared among the brokers relates to the sustainability of Qantas' strong revenue. One reason for this is the inevitability that as Qantas improves its capacity (i.e. increase supply), this would translate to lower airfare prices and lower revenue per unit. Goldman Sachs pointed this out in its report this week.

"We note 2H23e unit revenues assumption is ~10.5% below 1H levels as capacity accelerates" - Goldman Sachs

At the macro level, inflation and rising interest rates will impact discretionary spending and travel. While there are no signs of a slowdown yet, Macquarie analysts correctly pointed out that passenger number trends will be worth watching. And those rising rates will have an impact on how much people can spend - especially if they will have to move more money towards paying off the mortgage.

"We are aware that around $275 billion of fixed rate mortgages are expiring through 2023 which when refinanced will see higher mortgage repayments, possibly impacting discretionary spending." - Macquarie

Summary

Post-pandemic, Qantas has definitely seen some lows but recent developments suggest the airline is finally getting some positive attention. Supported by pent-up demand from travellers emerging from long periods of COVID lockdown, the above commentary highlights the upbeat attitude on the ground, and how a company can be flying high with shareholders even as it cops a battering from customers.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.