The compelling ideas QVG is finding in 'crazy expensive' markets

The QVG team has punched well above the index by sticking to its knitting of identifying quality small caps and shorting companies facing sustained earnings downgrades like electricity and gas retailer AGL.

At a recent webinar, Principals Tony Waters and Chris Prunty sat down with investors to discuss the secret sauce they use to pick stocks on the long side and where they’re seeing opportunities emerge despite what Waters says are “crazy expensive” markets.

Meanwhile, Portfolio Manager Josh Clark shares an interesting approach he uses to find short candidates ripe for the picking.

Watch the full replay of the QVG webinar or read a summary of their views on market valuations and best ideas below.

‘Crazy expensive’ markets

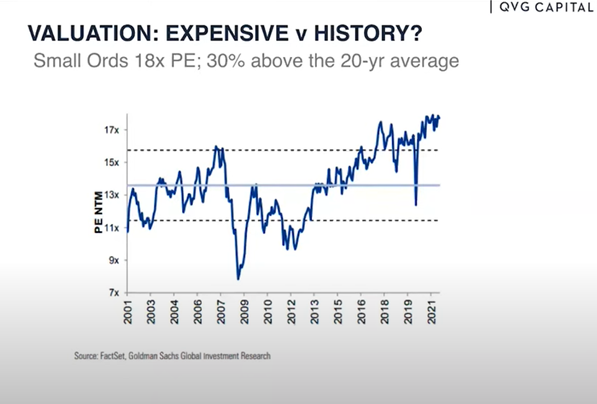

When setting the scene about why small caps enjoyed a strong 30% run in the past 12 months, this slide from Waters stands out. Not only is the asset class expensive, but it’s been trading above its 20-year price/earnings (P/E) valuation average for more than half a decade.

"If you’re looking at it through purely a P/E prism, then absolutely the market is crazy expensive," Waters says.

"It’s continued trading at record highs from a P/E point of view for quite some time and in fact, you would consider small-caps have been expensive based on historical standards since 2012 onwards. But if you avoided equities on that basis, it would have been significantly costly to you as an investor."

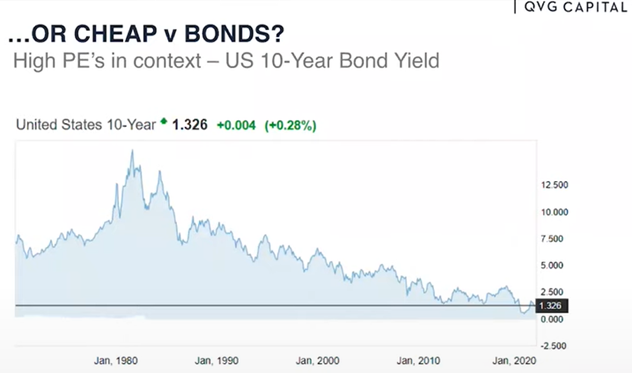

That’s why Waters encourages investors to think about small-caps in the context of bond yields, the demise of which has lit a rocket under nearly every asset class, including property, global equities and cryptos.

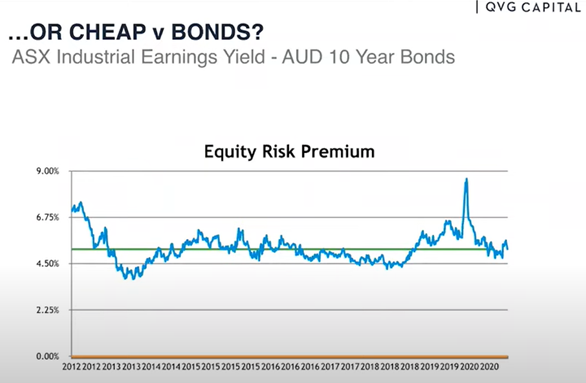

A better way to measure the value of equities in the current environment is by comparing ASX earnings to bonds, as shown in the next chart.

“The key point to make is that since 2012, ASX earnings have traded in a relatively narrow band on an equity risk premium relative to Australian dollar bonds," Waters says.

"It’s been in that 4.5-6% range since 2012 onwards, other than during moments like the pandemic. Today we sit in the middle of the band, so I don’t consider the equity market cheap or expensive."

However, Waters warns that rising interest rates would change the equity risk premium dynamic significantly and could lead to a market correction.

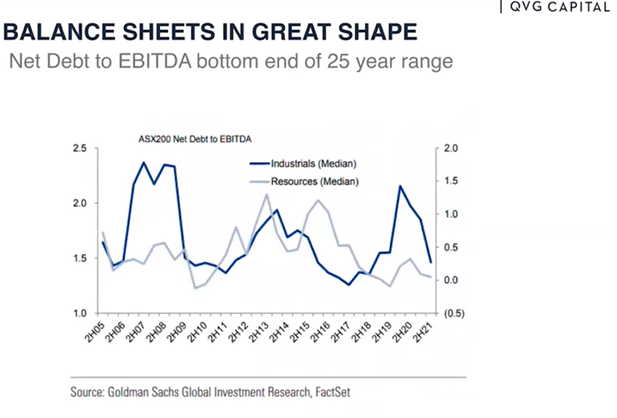

Credit crisis unlikely

Even if interest rates were to rise, Waters says Australian corporate balance sheets are in the best shape they’ve ever been.

Companies have benefitted from record low rates, capital raisings and surprising profit spurts driven by strong domestic spending as people have been stuck at home. However, QVG expects earnings growth to moderate from double-digit rates.

“The next correction won’t be because of a credit crisis among Aussie corporates," Waters says. "In fact, balance sheets are still in great shape and you’re seeing that lead to more mergers and acquisitions. You’re also seeing a heightened period of buybacks and increased dividends, which is good for income investors."

Small caps winning offshore

Waters points out that small-caps’ strong earnings are also being underpinned by expansion into offshore markets.

“More small caps are making money offshore compared to 10-15 years ago," he says. "Half the companies in our fund have significant offshore revenues and the fall in the local currency has helped the translation of those earnings in Australian dollars.”

That doesn’t mean investors should buy small caps blindly. Even in an environment where the rising tide of stimulus and low rates are lifting many boats, stock selection is the key to making serious money – as the QVG Capital Opportunities Fund has done, delivering 45% in the past 12 months and nearly 150% since its September 2017 inception.

The secret sauce for picking small caps

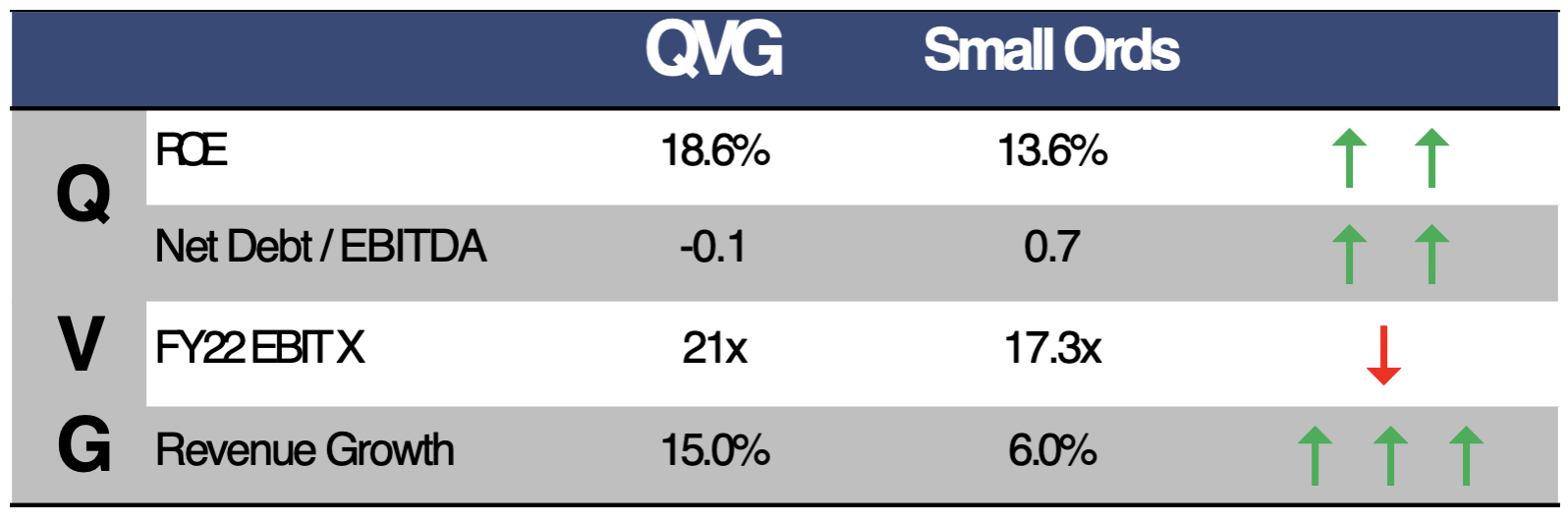

For QVG, the principles of selecting stocks are rooted in not being tied to one style. Instead, their process applies a quality, value, and growth lens to all stock ideas. Delving a step further, Prunty and the team screen for companies exhibiting the following characteristics:

- High or improving return on equity

- Net cash or deleveraging rapidly

- Double-digit earnings growth

See how the QVG portfolio stacks up on those metrics versus the small cap index below.

What QVG is buying and selling

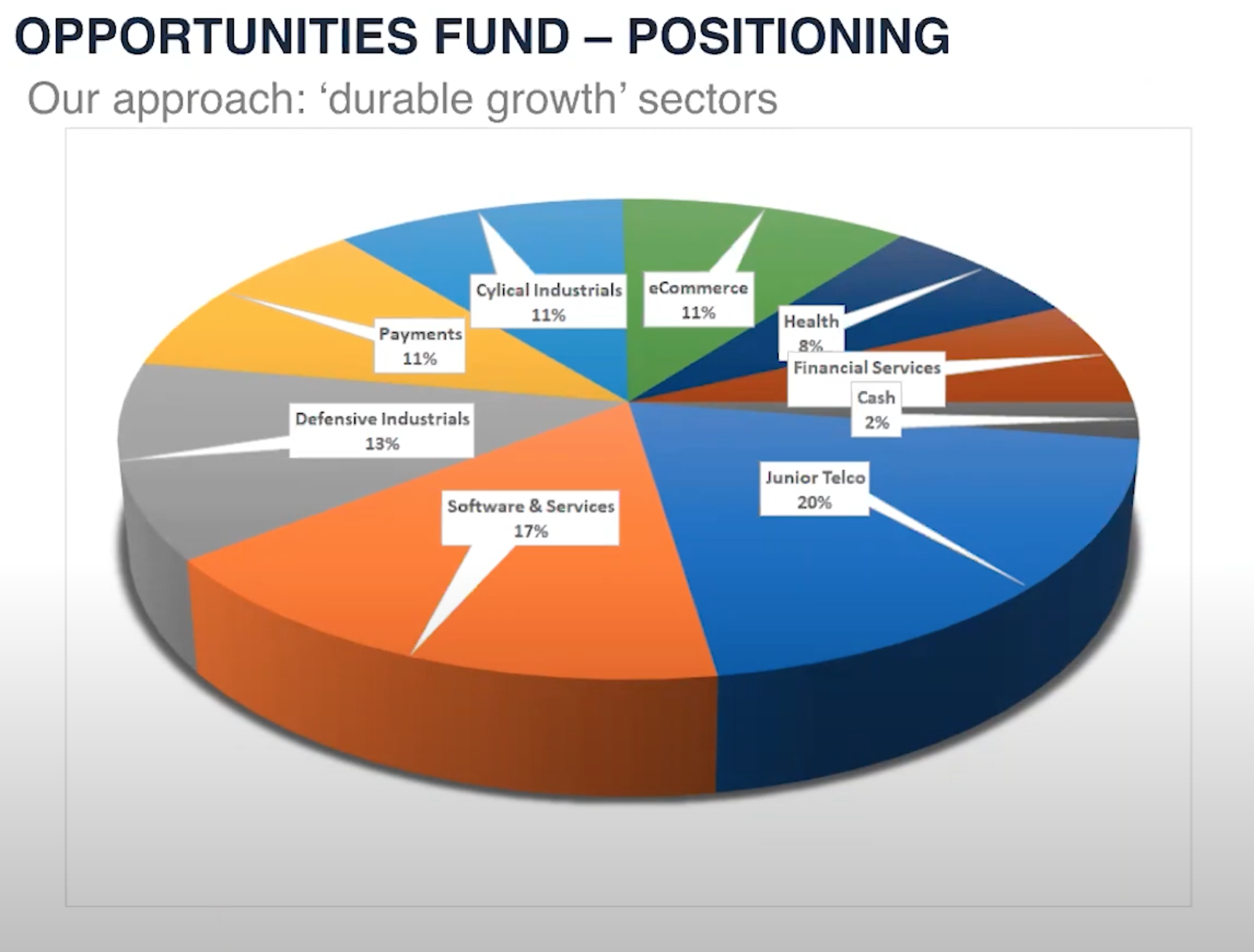

Turning to the underlying portfolio, Prunty says that another guiding mantra for QVG has been to not be tempted by thematic trades such as iron ore stocks up until the recent price reversal.

“We don’t rotate from growth to value or jump on ‘flavour of the month’ trades," he says. "Even though you can make a lot of money if you’re right in chasing thematics, you have to be doubly smart. You have to nail the timing on the entry and then you have to be smart enough to time the exit and capture those profits."

This pie chart shows the company is positioned across sectors and stocks enjoying “durable growth” or earnings likely to endure regardless of the macroeconomic backdrop.

QVG has exited or reduced holdings in software companies Codan (ASX:CDN) and Pushpay (ASX:PPH), and agribusiness stock Elders (ASX:ELD). It’s redeploying the proceeds to billing systems developer Hansen (ASX:HSN), internet company Aussie Broadband (ASX:ABB) and scientific products innovator Trajan Group (ASX:TRJ).

Prunty highlights this part of QVG’s philosophy of always looking for better companies and not being wedded to companies just because they’ve performed well in the past.

“We’re selling high-quality businesses for even better ones," he says. "Part of that is also because we want to own a tight portfolio of 30 stocks. We don’t want a Noah’s ark where we own two of everything."

Top stock pick - Uniti Group

QVG’s biggest position is Uniti Group (ASX:UWL), which competes with the National Broadband Network in laying fibre across households and businesses. Citing acquired competitors such as Vocus and Amcom, Prunty says the Aussie small cap market has had a long and profitable history with fibre assets.

“The market loves these assets because not only is it an essential service, but because the cost of adding customers onto the network is very low but the incremental returns on capital and margins are high,” Prunty says.

QVG sees two key drivers for Uniti’s shares:

- The company’s capital is largely funded by customers. Property developers pay Uniti to install the fibre – which Uniti owns – and leases to companies like Aussie Broadband.

- Earnings growth is very high compared to typical infrastructure companies.

“Given the quality of Uniti's business and its growth potential, we think they can double or triple their earnings over the next five years,” Prunty says.

This slide shows QVG’s top five stocks:

The framework for shorting

Before diving into shorting ideas, it’s worth exploring how QVG thinks about this strategy in its Long-Short product.

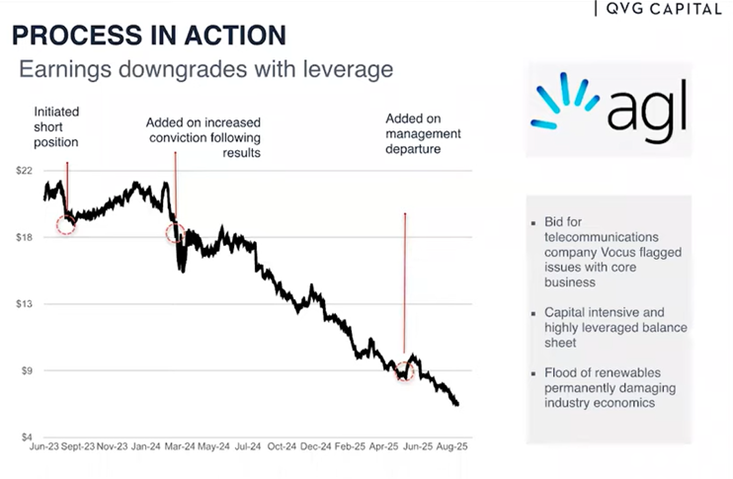

Clark says the fundie’s “bread and butter” on the short-side is to target companies with high debt levels who are losing money or are expected to see significant profit erosion, such as AGL, which is seeing earnings collapse amid competition from renewable energy providers.

“AGL is seeing earnings decline to a permanently lower base," Clark says. "It’s a capital-intensive business that can’t use its cash flow to improve its balance sheet and, on top of that, it is highly leveraged now and in the past. Add to that management couldn’t do much to respond to the changing environment in the energy market.”

As the chart below shows, QVG initially shorted the stock at about $20 and added to this position at $18 and again at $9, Clark stresses that the team isn’t passive about the process.

“We’re looking for evidence along the journey – whether it’s the numbers or on a qualitative basis – to build our conviction and add to our position along the way down, as we did with AGL," he says.

Spicy and speculative - shorting candidates on the rise

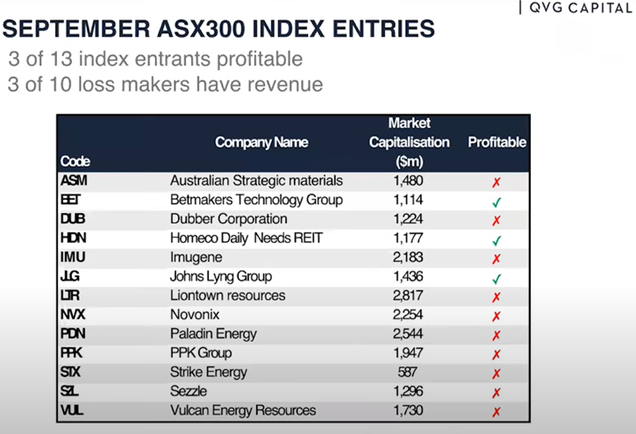

Turning to candidates on QVG’s hit-list, Clark points to recent S&P/ASX 300 Index entries as a fertile hunting ground.

Not only are most of these companies not profitable, but the majority don’t even have revenue, yet they command a market value of $1-2 billion. That suggests to Clark there may be far too much “inherent optimism” in businesses whose models and ability to execute are unproven.

“We know through probability, statistics, and experience that if you take a basket of loss-making companies with very optimistic assumptions in their valuations, and you were to short that basket, you skew the odds in your favour and are likely to make money over a long enough time horizon,” Clark says

About QVG Capital

QVG Capital manages the QVG Opportunities Fund and the QVG Long Short Fund; ‘Best Ideas’ Funds with a bias to small and mid cap companies

Visit the QVG Capital website for more information.

3 topics

20 stocks mentioned