The Dark Horse Cometh: The real test of Quality stocks may just be starting

'Then another horse came out, a fiery red one. Its rider was given power to take peace from the earth and to make men slay each other. To him was given a large sword. When the Lamb opened the third seal, I heard the third living creature say, “Come!" I looked, and there before me was a black horse! Its rider was holding a pair of scales in his hand. Then I heard what sounded like a voice among the four living creatures, saying, "A quart of wheat for a day's wages, and three quarts of barley for a day's wages, and do not damage the oil and the wine!"’ Rev 6:4-6 (NIV)

(A quart of wheat is equivalent to an average person’s daily sustenance needs; for those of more meagre means, three quarts of barley could be substituted to feed a family for a day.)

With recent fires, floods, a pandemic, and war, it seems the Four Horsemen of the Apocalypse are running amok. And, unfortunately, they may not be done just yet. Alas, the black horseman brings with him what Philip Lowe and a cadre of central bankers have been unable to manufacture, despite massive amounts of money printing in the last decade and more: inflation. Of course, inflation in asset prices has been well and truly entrenched for a long time – just ask any prospective first-home buyer in the last few years. But wage inflation, and consumer price inflation, are now coming to the fore.

And along with these, higher interest rates.

The great multiple dispersion starts to converge

With money no longer being quite so free, the greatest multiple dispersion seen in Australian listed company history has started to converge. The burst of liquidity seen through the past two years promoted the multiple afforded high PE firms on the ASX trading from 30 to 50 times earnings, before the recent 20% correction.

Even now and after the correction of recent months, high multiple businesses on the ASX are still trading on multiples well above where they got to during the TMT bubble 20 years ago.

The US experience has been more bifurcated; while the leaders, the so called FAANG stocks, are only 15% off their peaks, the Goldman Sachs Non-profitable Technology Index in the US has seen prices decline by more than 50% through the past year. That the Australian experience with technology names mimics the GS Index more than the FAANG stock experience reflects the relatively poor cashflow generation of most of the listed Australian high multiple, mostly technology, stocks. We still believe that this correction in Australia is nascent, with hitherto unseen multiples still as prevalent as poor business models among many of the fallen angels.

Market moguls

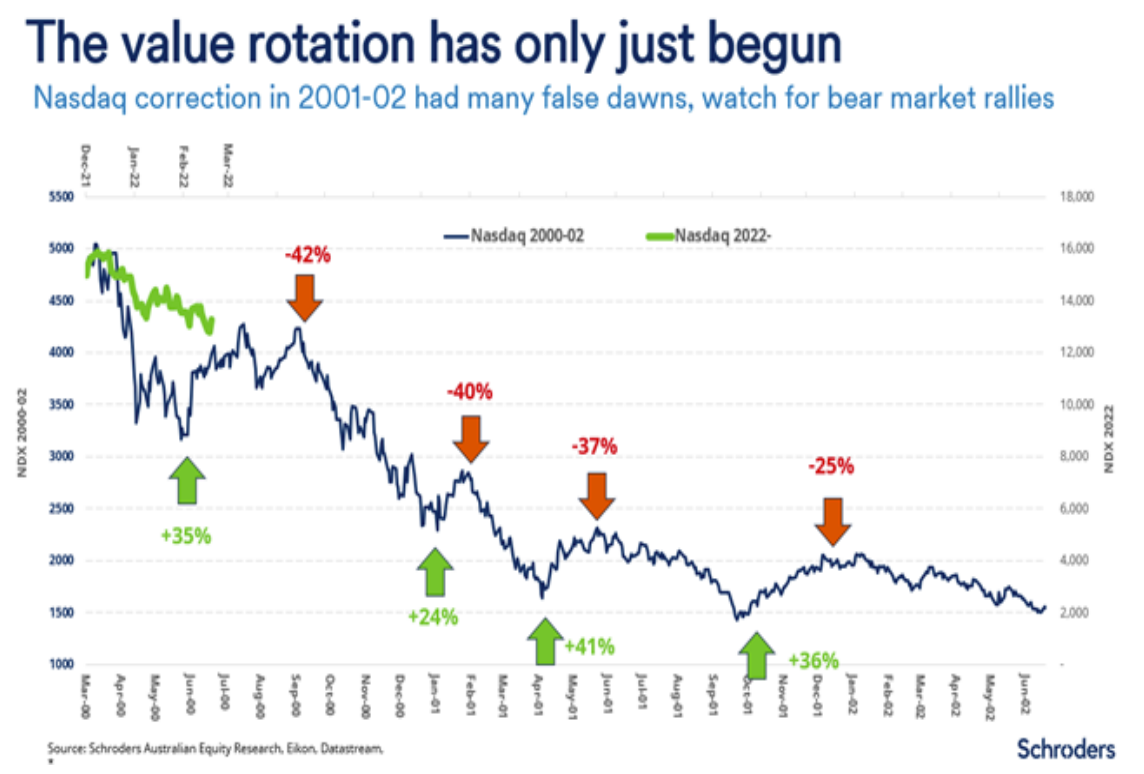

As excesses unwind, it is not unusual to see periodic rallies. Indeed, the Nasdaq corrected by 70% in the year following its March 2000 peak, yet there were four rallies of 24%+ through that unwind and the following couple of years. We saw a similar rebound in March, and yet to the extent that interest rates continue to increase and just as importantly, the Fed continues to reduce its balance sheet, we expect such rallies to continue to be ephemeral. This is for one simple reason: the quality of a business is ultimately reflected in its earnings.

It is one thing for a business to not report a profit and produce free cashflow because it chooses not to; it is another altogether if it has every incentive to do so and yet cannot.

This year, there is every incentive to produce free cashflow for the fallen angels of the ASX. For those that cannot or do not do so, and we suspect there may be more of these than may currently be imagined, the consequences may be dire. A test of quality in recent years has been the revenue growth able to be generated when capital was costless. The real test of quality, the cashflow growth able to be generated when capital is priced fairly, may just be starting.

Banking bifurcation

The banking sector is not particularly cheap, with underlying profit multiples at 11 times and absolute P/E multiples at almost 15 times earnings (compared to UK counterparts at about seven times). To be fair, performance is divergent; the split between the higher rated CBA (ASX: CBA), Macquarie (ASX: MQG) and NAB (ASX: NAB) against ANZ (ASX: ANZ) and Westpac (ASX:WBC) is as large as it has ever been. Ross McEwen has done a wonderful job of restoring NAB’s fortunes in the three years since his appointment as CEO. However, it is telling that the turnaround in performance and multiple has occurred in this relatively short timeframe, with NAB being the lowest-rated major bank when he joined. This position is currently assumed by ANZ, with their discount to the sector peers being as large as that of any major bank through recent decades.

Operationally, ANZ is currently in a world of pain, with domestic market share losses in mortgages arising due to cumbersome systems and processes, and poor productivity; almost the identical set of issues which confronted NAB three years ago.

For NAB to have been rerated so aggressively in such a short time based on simplifying processes (especially those related to mortgage processing) highlights that leadership matters, a lot, even in sectors that are superficially commoditised. To give this some context in value terms, should ANZ restore its operational performance to NAB’s level and be rerated accordingly, there is a 40% relative performance prize on offer on a price to book basis (or circa $30b in market capitalisation). We are not assuming this occurs, and nor do many, given ANZ is trading at its largest discount to its peers in fifteen years. However, nor were many assuming it for NAB three years ago, before the rerating which delivered $35b in relative alpha for NAB shareholders. For this reason, any improvements in ANZ’s operational performance warrant close attention.

Commodities ablaze

Amid the turbulence of recent months, we continue to see resources on our mid cycle estimates (which assume commodity prices more than halve from spot) at 14 times EBIT, which is below every other sector in the market. Thermal coal, coking coal, iron ore, copper, aluminium, nickel, and alumina have all seen sharp price increases and are trading well above the top of their respective cost curves. And these are all relative sloths compared to lithium which is >10 times its price from two years ago. The excess cashflows generated by extreme commodity price moves are materially accretive to valuations, especially for those projects with shorter lives. Obviously, commodity markets have been major beneficiaries of the great global disruption; not just hard commodities but also soft commodities, which has seen the portfolio’s position in IPL enjoy remarkable appreciation after several frustrating years of low prices and disrupted production.

We continue to have an overweight position in several industrial sectors such as chemicals, where more recent earnings strength has followed a decade of suppressed returns and a consequent paucity of industry investment.

Market outlook

In many ways, the past several years in financial assets have been about nothing but imagination. No forecaster several years ago foresaw the explosion in central bank balance sheets that has been experienced. To be fair, no one could have predicted the pandemic which turbo charged central bank efforts, let alone the war in Ukraine. However, our hope and expectation is that there is no further need to replicate either the social experiences, or the policy responses of the past two years. In that event, as Dr Powell stated, balance sheets are “far above” where they need be, and in recent weeks Ms Brainard has repeated the message for those that hadn’t yet caught the drift. The strong correlation with asset prices on the way up will, we expect, continue to hold as the balance sheet shrinks.

Alas, it is more than possible that the deflationary forces prompted by asset price deflation will not directly impact upon energy price inflation and hence we suspect a stagflationary environment is possible.

It doesn’t much matter if that’s not the case in terms of our portfolio positioning, however, because even a more sedentary unwind of the growth in central bank balance sheets will continue to see an unwind of the speculative excesses which has been spawned by the policy settings of recent years. The highest multiple stocks have started to unwind; however, we believe a further large correction in their multiples is likely unless they quickly start to produce material free cashflow. As an investor, as always, the best form of defence in strained market environments is a higher, cash backed, nearer term, sustainable cashflow. That strategy has proven valuable through the unwinding of every period of market excess in the past, and we fully expect it to continue to prove its worth as this cycle unwinds as well.

If you’re wondering what the fourth and final Horseman of the Apocalypse brings, it’s death. And Hades. Some building companies have already made acquaintance

Learn more about investing in the Schroder Australian Equity Long Short Fund

6 stocks mentioned

1 fund mentioned