The data challenge

It’s been nearly 18 months since we wrote about the benefits of standardisation in ESG data[1]. Since then, the formation of the International Sustainability Standards Board (ISSB), with the purpose of developing a global baseline for sustainability disclosures, signified a historic moment for the future of ESG data reporting[2].

The data challenge

Sustainability considerations continue their move to the forefront of investment decision-making and reporting, spurred on by inexorable advances in ESG regulation and client requirements. The need for transparent and comparable frameworks and methodologies is intensifying.

At the same time, we notice some interesting challenges when we review company reports, NGO materials and sustainability databases when writing our research reports.

With all this in mind, we’ve therefore spent more time with our sleeves rolled up, to better understand various data sets, providers and costs. The process has yielded a number of important takeaways, some obvious, some less so.

1. Different conclusions from different providers

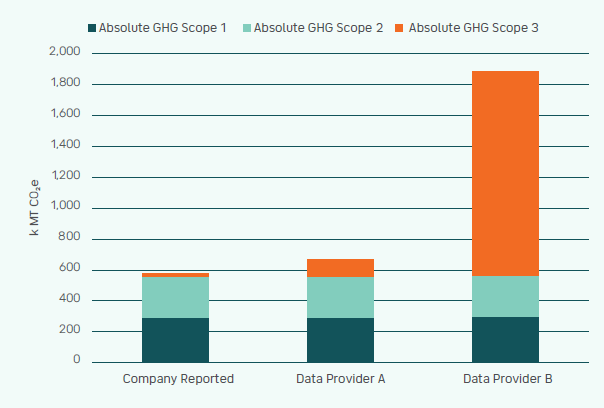

The lack of consistency and quality can be stark and is a reminder that these data points are generally estimates, usually based on separate and distinct approaches. For example, Figure 1 below shows the wide range of estimates in Scope 3 greenhouse gas (GHG) emissions for Universal Robina. Timeliness and freshness of data here is also a constraint, with the level of precision very different from what we have become accustomed to in traditional financial statements. In both cases, monitoring strategic change to business models is crucial.

2. Emerging markets have some material ESG data gaps that will probably persist

Whether it’s a function of resource or hesitation, we find some emerging markets businesses slower to meet the rising bar of ESG reporting. As a boutique business, we appreciate the limitations of time and resource. That said, large economies like China and India have yet to fully embrace reporting standards as seen elsewhere[3]. Considering their impact on global emissions, a lack of data is akin to flying blind.

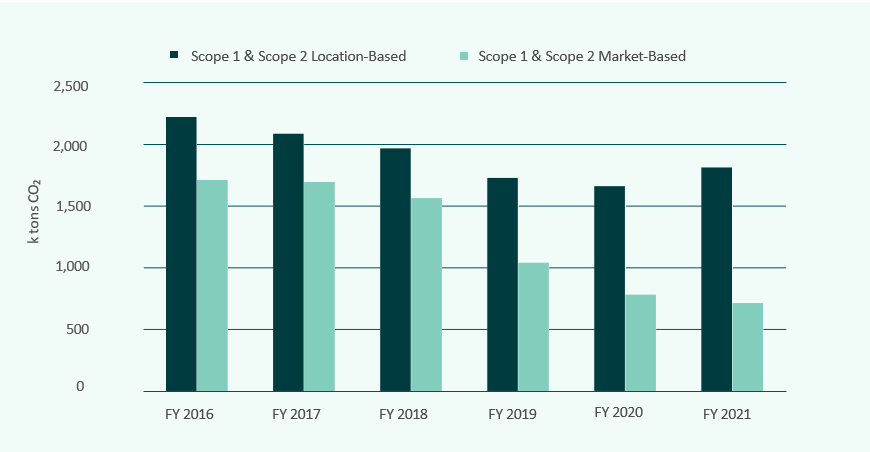

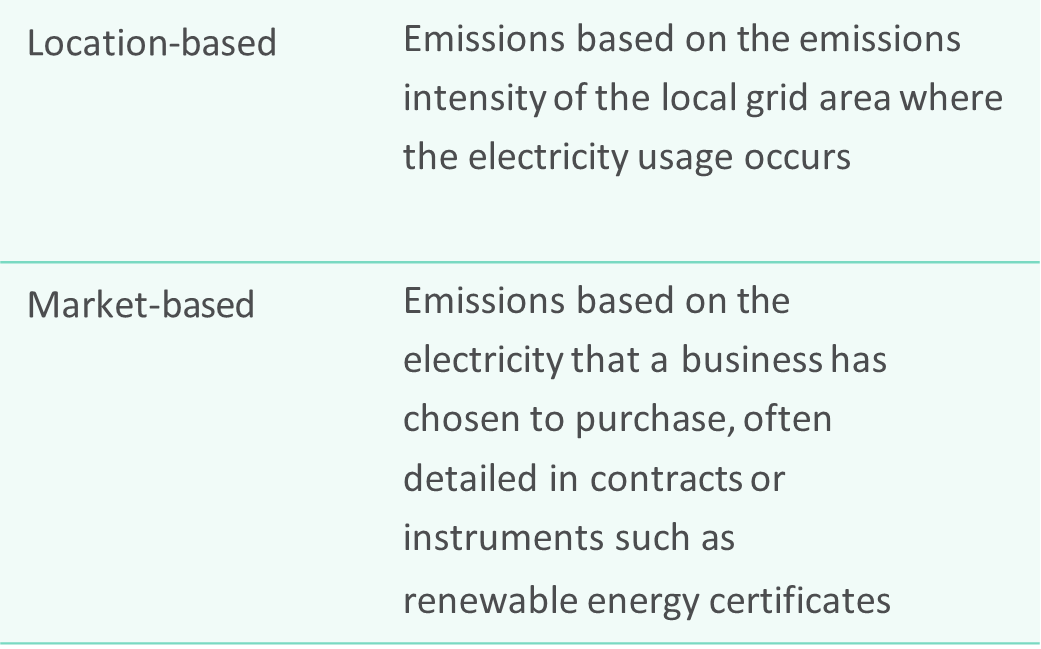

3. Lack of control over indirect Scope 2 emissions

The defining of and action to reduce Scope 2 emissions from power consumption is of particular concern relative to most manufacturing businesses throughout emerging markets. Unfortunately, this is often outside the control of business owners beholden to local grids and regulation. By comparing location-based and market-based Scope 2 emissions we can better understand the position on emissions as a result of geography and those within company control. This is further illustrated in the chart below detailing the relative demarcation and trend in Unilever’s emissions on a location and market basis between 2016 and 2021 (Figure 3).

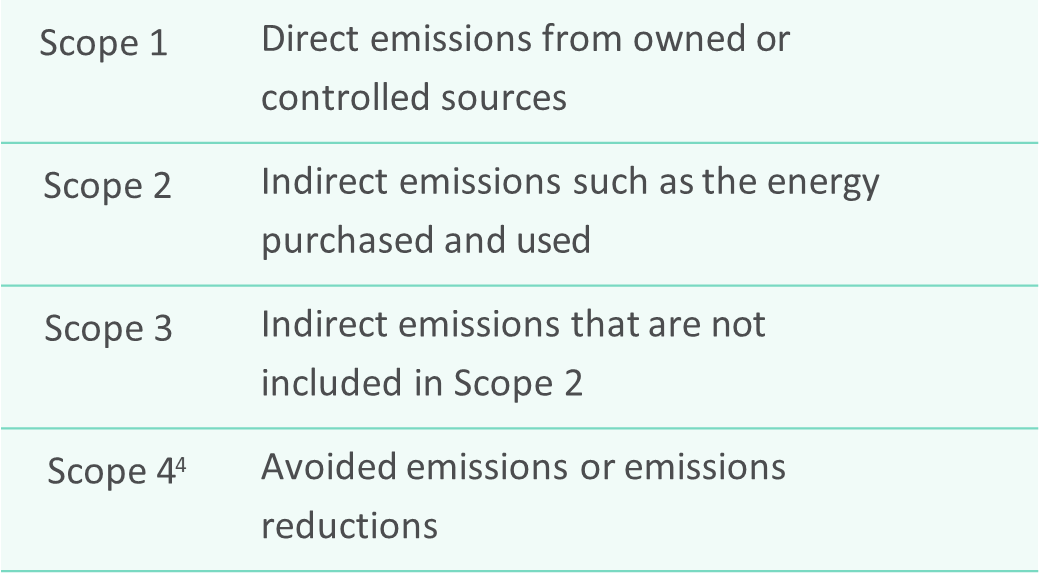

GHG emissions

Figure 2: GHG emissions by scope

NB: the popularity of Scope 4 reporting is growing despite the complexity in its methodology

"These data points are generally estimates, usually based on separate and distinct approaches."

4. Corporate actions can cloud ESG reporting

Just as we are familiar with the impact of corporate actions on financial reporting, the addition or subtraction of resource-intensive businesses reduces the usefulness of track record analysis. Here remains a big opportunity for greenwashing. Examples could include the divestment of carbon-intensive upstream operations in favour of outsourcing or procuring materials. Actions like this can shift emissions between different scopes and give the appearance that goals have been met more quickly than may actually be the case.

5. Proprietary data sets run counter to the spirit of goals

We highlighted in our previous note that these data providers are more than willing to summarise conclusions for stakeholders through the use of proprietary scoring system [5],[6]. The results often praise companies who don’t always look sustainable to us, and often conflict with other providers’ views.

Unfortunately, the relative infancy of regulated disclosure requirements provides a market opportunity for such companies for the time being.

We have no issue with ratings providers selling a value-added service, but the value-add remains suspect. Over the longer term we hope some of these providers open their data sets up in the spirit of collaboration and progress. If the stakes are as high as they seem, regulation should hurry to reach common disclosure by companies.

6. Reliance on pending innovation

With a stronger appreciation for what is required and a fair understanding of human behaviour, technology is the obvious leveller in this war of change. The economy and most behaviours as they stand are insufficient to deal with the problem we face. A recent meeting with a steel company demonstrated the need for a yet-to-be- proven hydrogen-based production technology to meet long-term carbon-neutrality goals. Many companies are probably in the same situation. Technology and businesses that facilitate investment in a solution are now more valuable. Companies’ resilience has also grown in importance in our view.

Scope 2 emissions

These factors show that aggregated top-down tables and easily digestible graphics can at times give an overly simple and potentially untrustworthy representation of a portfolio’s true sustainability positioning without the disclosure of the strengths and weaknesses of the underlying data.

The addition or subtraction of resource- intensive businesses reduces the usefulness of track record analysis.

Far-sighted and fair-minded

Skerryvore Asset Management is a boutique of BennBridge, the UK arm of Bennelong Funds Management. The team are fundamental, bottom-up investors seeking to create high conviction portfolios of reasonably valued, high-quality companies that are exposed to, or operate in, emerging markets. For more insights, visit Skerryvore's website.

Footnotes

1. Skerryvore. (January 2022). Raising the Standard. (VIEW LINK)

2. Liikanen, E. (2021). IFRS Trustees Chair Erkki Liikanen announces ISSB at COP26 [recorded by IFRS Trustees]. Glasgow, UK. (VIEW LINK)

3. Osborne Clarke. (January 2023). How the ESG agenda is shaping international supply chains in Asia. (VIEW LINK)

4. Agenda (FT). (11 July 2022). Measuring Scope 4 emissions – what boards need to know (VIEW LINK)

5. The SustainAbility Institute. (5 October 2022). Rating the raters yet again:

6 challenges for ESG ratings. (VIEW LINK)

6. EY.com. (21 March 2023). How ESG data markets have evolved for financial services (VIEW LINK)

2 topics

1 fund mentioned

1 contributor mentioned