The Easter egg for your investments (but better for your waistline)

Gold has grabbed headlines during the COVID-19 situation, as investors have raced to safe-haven assets. While gold is valued as a hedge against short term volatility, it can also hold a long-term role in a diversified portfolio given its defensive and growth qualities. Gold can represent 2-10% of a portfolio, depending on an investor’s needs or strategy, but many investors are missing this allocation. For these investors, it has become a question of why not? Could gold be your Easter gift to your investment portfolio (without the chocolate impact to your bottom line)?

Gold as a safe-haven

Gold has both defensive and growth qualities, which has led to its position as an investment safe-haven in times of volatility. It can act as a store of value, as well as holding the potential to grow.

There are two key reasons for this.

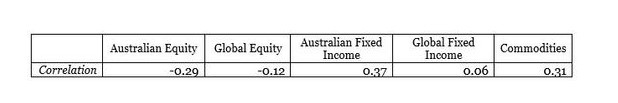

1) Gold has a low, and at times, negative correlation to other asset classes. That is, it performs differently to other asset classes and its performance is not necessarily associated with what is happening in other asset classes. This is shown in the table below:

Table 1:

Source: Bloomberg data as at 31 December 2019. Correlations are calculated monthly over 20 years in Australian dollars. Australian equity is represented by the S&P/ASX200 Total Return Index. Global equity is represented by the MSCI World Total Return Index. Australian fixed income is represented by the Bloomberg AusBond Composite 0+ Yr Index. Global fixed income is represented by the Bloomberg Global Aggregate Total Return Index. Commodities are represented by the Bloomberg Commodity Total Return Index.

This relationship allows gold to be used as a diversifier against all asset classes, ideal in a range of market conditions.

1) Gold has the ability to offer positive performance in a range of market conditions, including periods of volatility. For example, if you consider the Global Financial Crisis, gold prices rose 26% while the S&P 500 fell 56%. Even in the current COVID-19 situation, between 19 February and 26 March 2020, gold gained 12.4% compared to the S&P 500 which fell 14.1% and the S&P/ASX 200 which fell 27.8% (all in AUD terms). You can see the performance of gold against other major asset classes in the chart below.

Chart 1:

Source: Bloomberg, ETF Securities, as at 26 March 2020

This ability to perform in a range of markets comes down to gold’s position as a consumer-driven and investment-driven asset. From a consumption perspective, while around 50% of its use is in jewellery, gold is also heavily used for other purposes such as electronics or even part of medical and diagnostics equipment[1][2].

COVID-19: gold price falls and rises

Given the facts around gold as a safe-haven asset, investors may therefore wonder what happened when gold prices fell across the week starting 16 March 2020 and how gold has performed across the COVID-19 situation to date.

On the whole, gold has seen increased interest and flows during the COVID-19 situation, but markets did see price falls across the week commencing 16th March 2020. It is worth understanding why this happened, as it was less related to any concerns about gold and more related to other activities.

Gold can be vulnerable to financial deleveraging – that is, investors needing to free up cash for a variety of reasons. Equity markets were hit simultaneously by the COVID-19 situation and a price meltdown in oil markets. This affected investors with leveraged positions who would have needed to sell other assets to free up cash to pay their liabilities.

What this looks like is as follows. An investor using their own money and borrowed money to purchase investments is required to maintain the investment account at a certain value – this is a leveraged position (also called a margin loan account). If the total account falls below that value – generally because the investment itself has fallen in value, then the investor will need to ‘top up’ the account with their own cash to restore the account to its minimum value (this is a margin call). As markets fell across the week of 16 March 2020, many investors would have needed to top up their accounts and will have sold other liquid and performing assets, such as gold, to do so.

This has occurred in the past too. During the Global Financial Crisis, gold was briefly sold in October 2008 to meet investors’ cash needs for liabilities from the equity market sell off but then recovered and returned 45% in US dollar terms from its October 2008 low into March 2009, compared to the S&P500 which fell 30% in the same period.

Source: Bloomberg, ETF Securities

Since then, gold has recovered, reaching seven-year highs on 25 March 2020 of A$2746.32 per ounce.

The outlook for gold

There are a few factors to suggest gold may continue to hold value across the current crisis.

1) Market volatility from COVID-19

While China has begun to reopen after its COVID-19 lockdown, other countries are either in the midst of it or commencing stages of lockdown. From that perspective, investor concerns and volatility may continue for some time yet. The panic has been swift but recovery could take some time. Some sectors, like technology, are in theory well positioned for both crisis and recovery but investor confidence is a different matter. Other sectors, like retail and travel, will struggle during this period and may find ramping up post the crisis takes some time. From this perspective, many investors may continue to look for defensive assets like gold. They won’t be alone. Even central banks may bulk up their stores of gold across this period.

2) The low interest rate environment and prospect of quantitative easing

Gold traditionally performs well in periods of low interest rates, with investors using it rather than cash. Interest rates have been low for some time but have dropped further in the current situation. Australian rates have reached lows of 0.25% while the US has dropped to a range of 0-0.25%. Many countries, including Australia have announced fresh rounds of quantitative easing too.

3) Temporary shortage

At the same time as increasing numbers of retail investors seek to purchase physical gold bullion, supply chains have been disrupted by COVID-19[1]. Refineries in Europe, particularly in Italy, have been unable to keep up with demand forcing traders to move into wholesale markets. While refineries in normal circumstances would be able to manage the surge in interest, lockdowns over COVID-19 may continue to place pressure on supply, in turn pushing prices higher.

Accessing gold using an ETF

The traditional forms of access to gold were either through physical holdings or an indirect exposure by owning shares in gold mining companies. Both had their challenges – physical holdings namely through prohibitive costs and indirect exposure by opening to assorted company risks. Generally speaking, physical holdings offer a more pure exposure.

The first gold-backed ETF was launched in 2003 by ETF Securities, it still trades today as ETFS Physical Gold (ASX:GOLD) and held $1.65 billion in assets as at 27 March 2020. Gold-backed ETFs are literally as described, where physical gold is purchased and stored by a fund manager as part of a trust and investors buy units in the trust for exposure to the market movements of gold.

Using an ETF for gold exposure has several features and advantages over the physical holdings.

Cost tends to be a foremost consideration.

Investors in physical gold may need to consider aspects like freight, storage and insurance, as well as the volumes available through their broker of choice. For example, some brokers may sell by the ounce which may be cost-prohibitive for some retail investors.

Units in gold-backed ETFs tend to have management fees that are often cheaper than the costs for individuals to store and insure their own gold

The liquidity and ease of use of gold-backed ETFs compared to physical gold is another consideration. Investors holding ETFs may be more easily able to adjust their holdings to reflect activity in the market, buying or selling small quantities when needed compared to those holding physical holdings which may have higher minimum trading quantities and take longer to transact. This can be a challenge for some investors depending on their size and horizon of their investment.

ETFs are also typically easier to use compared to physical gold holdings, requiring as little as a trading account to get started and can be done anywhere. It can be less intimidating for many investors who may not be aware of even where to start for physical purchasing and trading.

Understanding the risks

As an investment tool, ETFs are subject to a range of general investment risks, such as market risk or counterparty risk.

Market risk relates to loss of value due to movements in price. Changes in the price of gold relative to an investors purchase price create gains or losses.

Counterparty risk is the risk that the other party to your investment defaults or mismanages your assets. For example, the risk that the custodian holding the physical gold (whether for an ETF or individual investor) has not securely stored the gold and it is stolen or lost. Custodians of assets in managed funds, like ETFs, typically use major international vaults to store the physical assets which offer highly sophisticated security arrangements compared to personal safes or small storage companies. Another example of counterparty risk might occur at the time of investment purchase if the trading tool or company doesn’t actually use your funds to buy the selected investment or asset. Using established and credible companies to purchase investments can be an important way of managing this risk.

There can also be variation in the way that gold-backed ETFs are managed, so investors should research their options. One crucial difference to watch for is whether the ETF uses allocated or unallocated gold. Allocated gold means you own the physical gold based on your unit holding. In the event of a default by the custodian, your holding is unaffected. ASX: GOLD uses allocated gold and you can redeem your units for the physical gold.

Unallocated gold means your cash investment is ‘backed’ by the physical gold holdings of the issuer still providing you with exposure, but these holdings remain the property of the issuer. This form of gold-backed fund has additional credit risk for investors. Should a default occur, you don’t have ownership over the physical gold so your claim is considered and paid alongside all other parties of the issuer who might also have a claim. Unallocated gold is used in many gold-backed ETFs so it is worth investigating the structure and management before you decide to invest.

Both physical holdings and ETFs can also be subject to liquidity risk. Liquidity risk is the risk that the physical holding can’t be sold quickly or at a fair price in the market.

Investors will need to weigh up all these risks before deciding to buy physical gold or a gold-backed ETF.

Why aren’t you investing in gold?

While events like COVID-19 and the Global Financial Crisis provide a clear demonstration of gold’s defensive qualities, investors should consider their longer-term strategy. Offering diversification, growth and stability over time, gold can be a suitable inclusion for many investors. In turn, gold-backed ETFs can offer liquid, cost-effective and easy to access exposure all using your existing trading platforms.

Maybe gold is the new chocolate?

[2] https://www.gold.org/goldhub/gold-focus/2020/03/golds-hidden-role-diagnosing-disease-covid-19

[3] https://www.ft.com/content/81d915e2-6cef-11ea-89df-41bea055720b

4 topics

1 stock mentioned