The Fed is about to make a major decision. Here's what it means for your portfolio

No one seems to have any doubt in their minds that the world's most consequential central bank, the US Federal Reserve will begin its latest interest rate cutting cycle next week. After all, you can't get much clearer messaging from Chair Jerome Powell than:

"The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks."

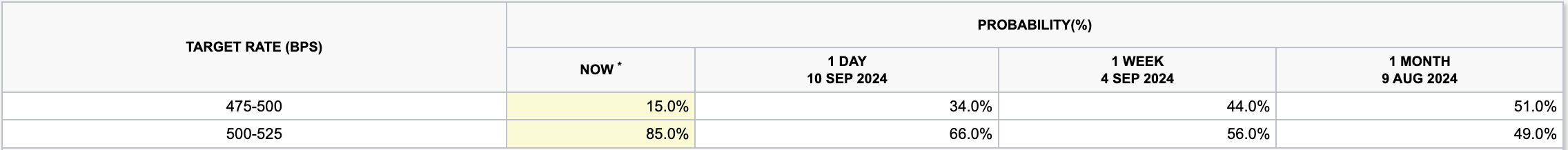

What is less clear - and being hotly debated in markets right now - is whether the Fed should cut interest rates by 25 basis points or 50 basis points. One month ago, it was a coin-flip in markets as to whether it'd be a 25 or 50-basis point cut. But subsequent data prints seem to have given the market a more certain footing.

In this wire, we'll summarise some of the cases that have been made for either move and try to glean some investable signals with the help of a suite of economic experts.

The case for a regular (25bps) rate cut

- Inflation is down but the key core figure is not where markets want it to be: This is most clearly evidenced by last night's CPI print which came in above expectations and at a three-month high. More importantly, as Josh Jamner of ClearBridge Investments summated, "further signs that inflation may be a bit stickier than previously thought would likely result in a slower and shallower cutting cycle."

- The jobs market is holding up, against all conventional wisdom: "[The data] didn’t provide conclusive evidence of a deterioration in labour market conditions. These data reduce the likelihood of the Fed starting the easing cycle in a forceful manner," explained ANZ's Tom Kenny and Arindam Chakraborty.

- There is no recession to worry about - yet: "This time is different so far because there has been no credit crunch and no recession. This time the Fed is aiming to avert a recession, which is likely to require fewer rate cuts to accomplish," says Ed Yardeni of Yardeni Research.

- Reducing interest rates is not the Fed's only tool to slow the economy: As Lazard's Chief Market Strategist Ron Temple told me in his recent appearance on Views from the Top, the Fed has withdrawn US$1.8 trillion worth of assets from its balance sheet. Withdrawing liquidity through quantitative tightening (QT) also slows down the economy.

- The market is telling them this is the right call: Traders in the US swaps (derivatives) market have almost fully priced in (85% chance) a 25bps reduction at next week's meeting. Surprising the markets with a 50bps cut may lead to all kinds of chaos.

For the record, most of the guests who appear on Livewire's platform seem to be in this camp, including VanEck's Head of Investments and Capital Markets Russel Chesler who told me:

"We do not believe that we will see a 50bps cut at the FOMC meeting next week. There is no need for a 50bps point cut at this stage and we expect that the US Fed will proceed cautiously."

"We envisage that the US Fed will make a 25bps cut next week and then one more this year. This is in contrast to the market which is estimating 100bps reduction by the end of the year," Chesler added.

The case for a jumbo (50bps) rate cut

- Although inflation is lowering, the US interest rate is still the highest in the G10: "I think there is a solid rationale for doing [a 50 basis point cut]. And the rationale is that 5% to 5.5% is a really high Fed Funds rate. It's the highest policy rate in the G10. It is despite the fact that the US has actually seen more progress on inflation than most G10 economies," Jan Hatzius, Goldman Sachs Chief Economist told Yahoo Finance.

- The jobs market is loosening - and maybe faster than the Fed is expecting: "The Fed always "does what it takes" to support the labour markets if there is a downturn. In the event of a recession, we would expect cuts of at least 50bp per meeting and a very accommodative terminal rate," wrote the Bank of America economics team last week.

- There are parts of the real economy that are experiencing a serious slowdown: Last week's ISM Manufacturing PMI print was the fifth consecutive fall. Although that manufacturing number has been in contraction territory (a score of less than 50) for most of the last two years, the declining productivity in this part of the economy could spell trouble yet.

- Just because it is not coming in September doesn't mean you can rule out jumbo cuts later this year: "The labour market will remain the dominant concern and we continue to expect 125bp of rate cuts this year with 50bp cuts in November and December," writes Andrew Hollenhorst, Chief US economist at Citi.

- Being too gradual may cost the Fed later on: As Isaac Poole, CIO at Ascalon Capital wrote in his latest wire, "I think the Fed needs to get on with it. A 0.50% rate cut, followed by further rate cuts in the next few months, will likely be necessary to help prevent a harder landing. A 0.25% rate cut and a 'steady as she goes' approach will materially lower the likelihood we get a soft landing.

If the Fed did choose this option, there is also a question of whether it would be putting its credibility on the line with markets. While there is an urgent need to reduce rates, there is also such a thing as "too urgent".

"If the Fed were to cut by 50bp in September, we think markets would take that as an admission that it is behind the curve and needs to move to an accommodative stance, not just get back to neutral," writes the Bank of America team.

After all, central bankers cannot afford to make a second grave mistake - as EFG Bank Chief Economist and former Central Bank of Ireland deputy governor Stefan Gerlach explained in an interview I did with him in early February.

But as Chesler also correctly points out:

"Implementing a 50 basis point reduction could induce unnecessary market panic and exacerbate economic weakness, as such a move may be associated with an impending recession. This could result in significant volatility in equity markets and result in falling long-term bond yields."

What asset classes benefit from the first interest rate cut?

Rate cuts are, first and foremost, good for the government bond market. When interest rates fall, prices of existing bonds tend to rise meaning that yields fall. The caveat to this theory is that bond traders have priced in 10 (yes, 10) rate cuts before the end of 2025. If they don't get all or most of these 10 cuts, they may be left disappointed.

If they can complete this interest rate-cutting cycle without experiencing serious wear and tear in the economy (e.g. through a significant spike in unemployment), then small and mid-cap equities will benefit. Luckily for share market bulls, history is on their side.

"The resilience of the US economy historically bodes well for equity markets. However, given the somewhat elevated valuations of large caps, we could see a broader rotation to mid and small caps driving the next leg of the market rally," McCormack said.

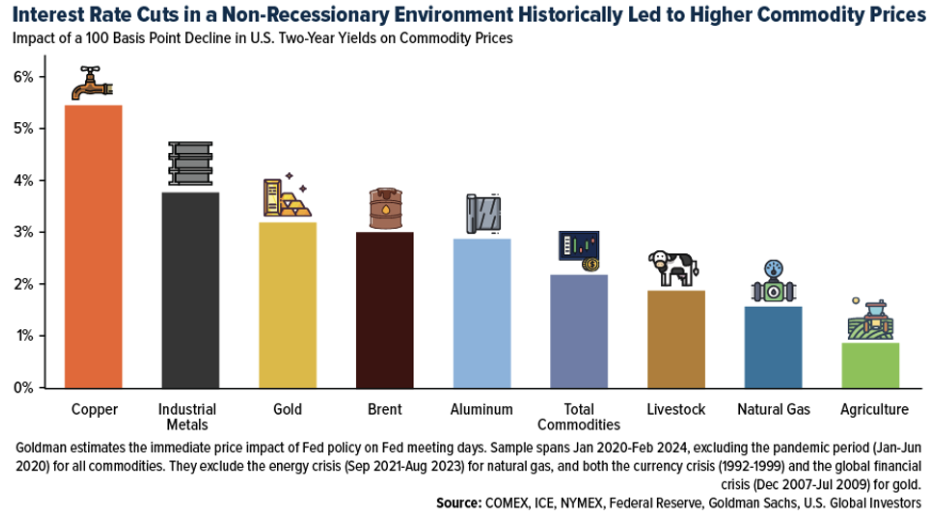

The last asset class that usually experiences a boon during rate cut cycles is commodities - and specifically, metals. Think about it, gold does not pay you an income but the loading up of rate cut bets has caused a significant rally in gold prices - to all-time highs in some cases. The same theory also flows through to copper and even crude oil (providing demand picks up again.) You can see this in the following chart from Goldman Sachs:

If there is a 50bps cut at next week's meeting, look to gold in particular for outperformance.

Don't forget the bigger game at play

Finally, and this is worth remembering, this is just one meeting. Yes, it is significant because markets have been screaming for these cuts for a long time. But in the grand scheme of things, it is one cut. What is far more important is the magnitude of future cuts, the pace at which it is delivered, and how that flows through to markets.

My colleague Chris Conway conducted a superb interview on this subject with Janus Henderson's Jay Sivapalan. You can watch that interview in the link below:

4 topics

4 contributors mentioned