The future of flight: Recovery, growth and decarbonisation

As we return to the skies for that first face-to-face meeting, reuniting with family or taking that well-deserved holiday, the airports we pass through will be markedly different to what we knew before. These changes might not be immediately obvious as you pass through security, browse duty-free or board your plane; but the implications are significant for investors.

Will I ever see your face again?

Much has been made of the transformational impacts that the

pandemic has had on the way we work and communicate.

With an endless number of studies and surveys pointing to

varying levels of structural declines in business traffic as a result

of the rapid shift towards virtual communication.

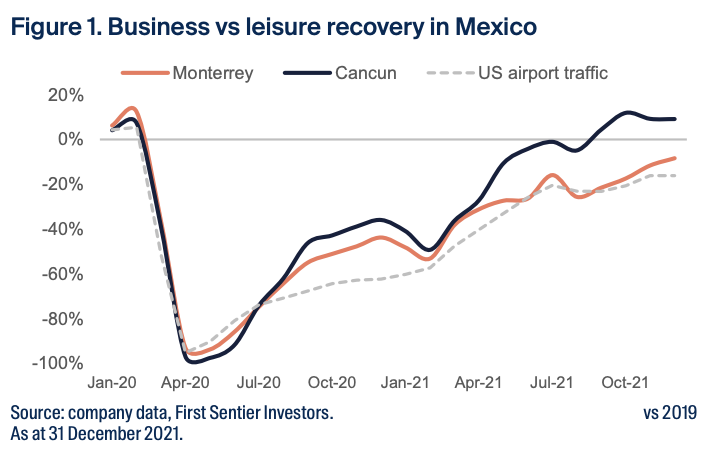

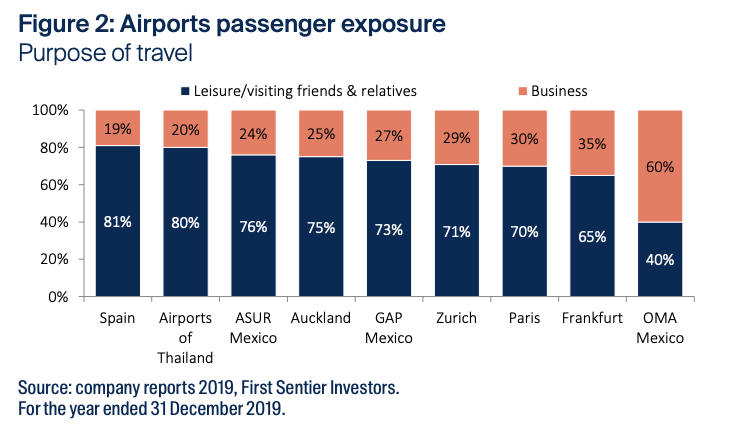

Anecdotally we can look towards Mexico for an indication of how

things might progress, with Mexican air travel now returning to

pre-pandemic levels we have seen some divergence in the

recovery based on the passenger mix of an airport.

As demonstrated below leisure exposed airports (such as

ASUR’s Cancun Airport) have seen a very strong recovery in

traffic as vaccination rates have increased, whilst more business

exposed airports have lagged in their recovery (such as OMA’s

Monterrey Airport).

Whilst the magnitude of the difference in Mexico is not necessarily

directly translatable to other parts of the world, with differences in

the purpose and distance of business travel being large factors in a

decision to travel, we believe the principle will broadly hold across

regions. This view is supported by a recent Bloomberg survey of

large US corporates that found 84% expect to spend less on travel

post-pandemic. A change that can largely be attributed to the

shift to virtual meetings, with Morgan Stanley finding that corporates

expect this to take 29% of volumes in 2022 and 19% in 2023.

We forecast a 20% structural loss in long-haul passenger travel as a

result of multiple headwinds, the largest of which is lower demand

for corporate travel. As a result, we favour more short-haul, leisure

exposed airports. Particularly European airports with large Intra Europe exposure, where the rigours of border restrictions are likely to

be less cumbersome. We expect to see a strong rebound in traffic

as travellers look to catch up with friends & family and take a holiday,

an investment thesis we have seen successfully play out in Mexico.

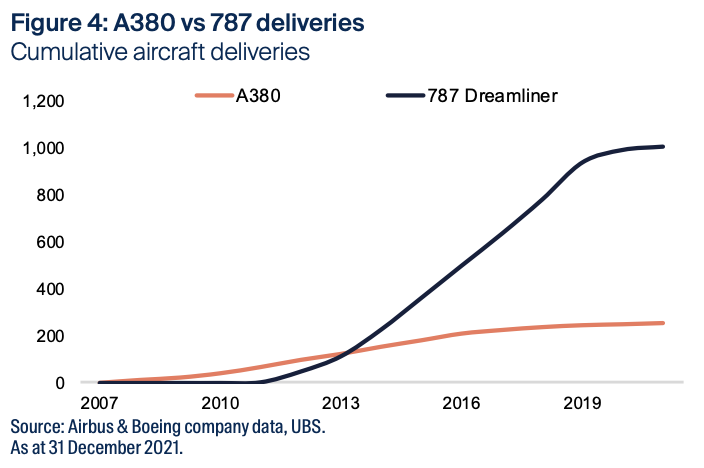

Goodbye to the big jet plane

The pandemic has seen hundreds of planes laying idle on airport

tarmacs and deserts throughout the world, waiting to return to the

skies. For some superjumbos that previously dominated the skies

like the Airbus A380, this day may never come. The impacts of the

pandemic and the changing economics of flying have led many of

the world’s airlines such as Air France, Lufthansa, Qantas, Qatar

and Singapore Airlines to significantly reduce or in some cases

even fully retire their A380 fleets.

Airlines are increasingly shifting their fleets towards smaller, more

fuel-efficient and more flexible aircraft for long-haul operations. The

clearest example of this is the shift from the ~550-seat Airbus A380

aircraft to the ~300-seat Boeing B787 Dreamliner. The implications

of this shift for airports are two-fold; the first consequence is that

more planes need to land and take-off to cater to the same number

of passengers as they did in 2019. This is posing a potential problem

for airports that suffer from runway capacity constraints and had

benefitted from the scale of the A380 as a result.

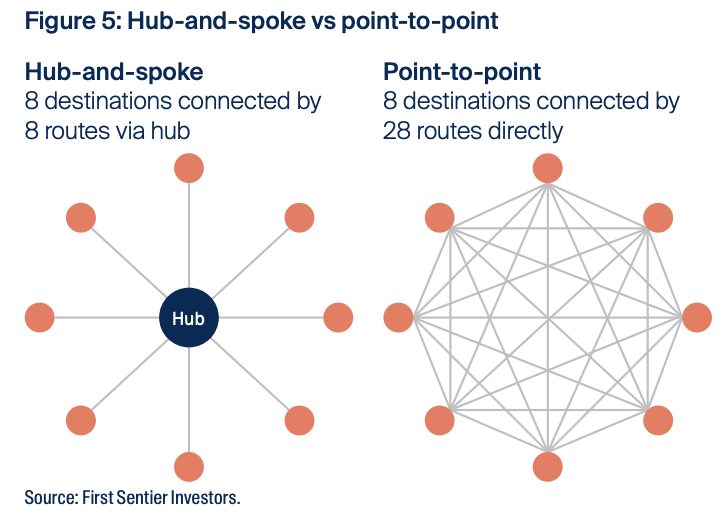

The second impact, which has more long-term and significant

consequences, is the shift that is slowly occurring in airline

route planning. With early signs of a transition in the global aviation

structure from the hub-and-spoke model favoured by most

long-haul airlines today to an increasingly point-to-point model.

In the hub-and-spoke model, airlines serve passengers by

filtering them to ‘hub’ airports and then connecting passengers on

to their final destination via large aircraft to create economies of

scale. Whilst under the point-to-point model the airline instead

creates more direct routes serviced by smaller planes to take the

passenger direct from point-A to point-B.

The implications of this are that airports which previously served

as these ‘hubs’ face the risk of large structural declines in this

portion of traffic that previously transited through their airport.

These passengers are referred to as ‘transfer’ passengers;

meaning that the airport is not their city of departure nor final

destination but rather where they connect on to an onward flight at

the airport.

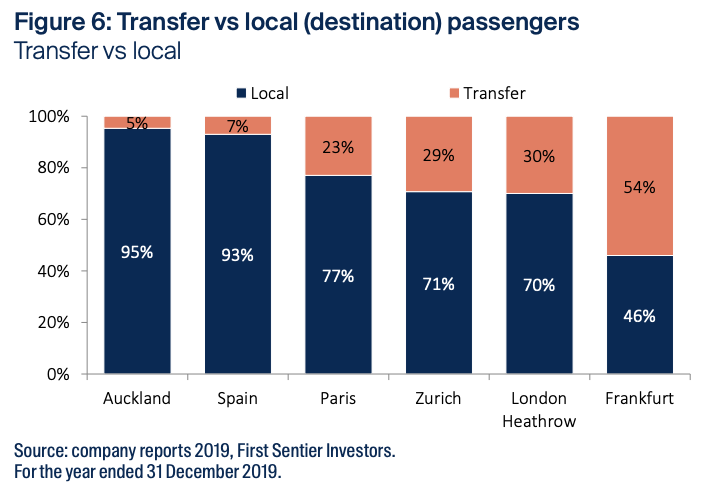

As a result of these risks, we favour those airports with more limited exposure to transfer passengers. Preferring ‘destination’ airports whose traffic is driven by economic or tourism factors that necessitate travel to that specific airport. An example of this is Aena, the owner and operator of 46 airports and two heliports throughout Spain. This includes airports in destinations such as Barcelona, Madrid, Mallorca and Ibiza. As a result, Aena’s airports are the initial departure point or final destination for 93% of their passengers.

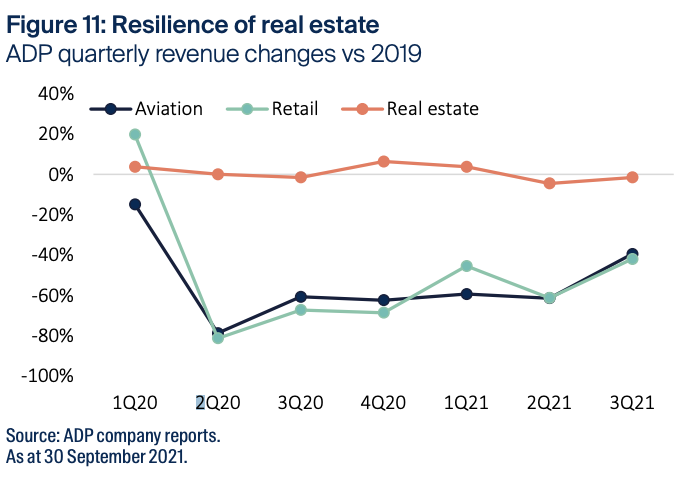

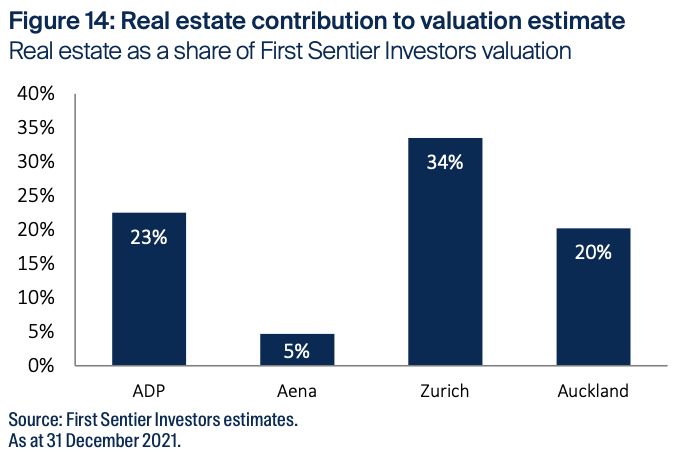

More than just terminals & runways

One of the bright spots for airports during the pandemic has been

the real estate segments of a number of the listed airport

companies. These assets have provided a steady stream of

income with little-to-no correlation to the suppressed passenger

traffic, with many airports benefitting from the increased demand

for cargo/industrial from e-commerce tenants in response to the

boom in online shopping as a result of the pandemic.

Airports typically sit on substantial land banks to facilitate airfield

growth and protect residents from noise intrusion. These landholdings have allowed airport operators to develop this surplus

land into substantial property portfolios, which typically

incorporate a mix of commercial, industrial, hotel and

retail tenants.

The pandemic has accelerated this trend toward real estate, with

airport groups increasingly focusing on these activities.

Many airports have sought to establish joint-ventures with major

real estate firms, allowing them to monetise this land without

significant capital outlay being required.

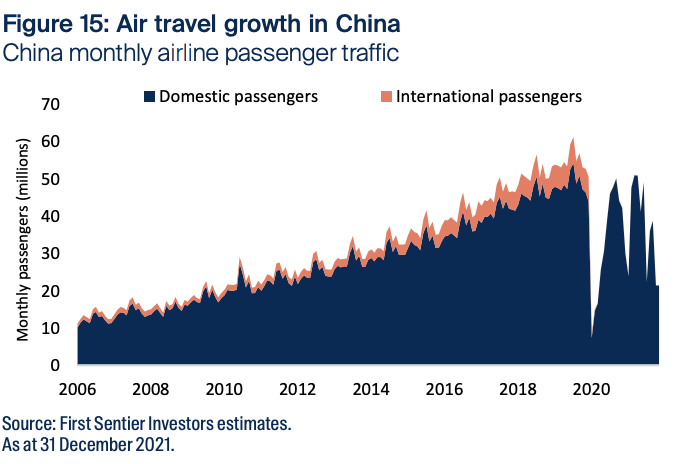

China reopening tailwinds or is the growth engine slowing?

China has been a key source of growth in the aviation industry for

the past 20-years, with the expanding middle class in China

leading to a 12% compounded annual growth rate in air travel

between 2006 and 2019.

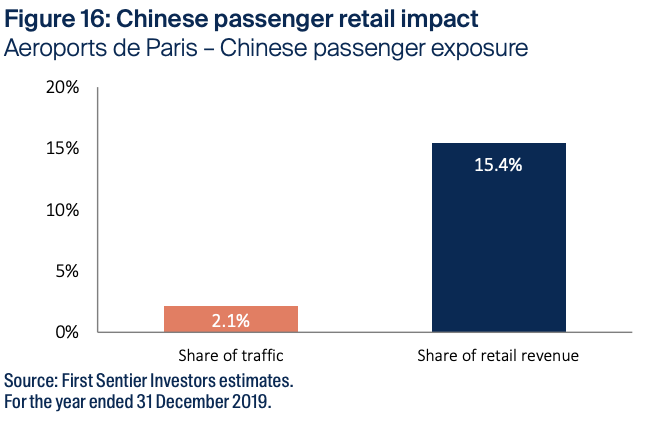

In addition to the growth benefits that the aviation industry has

seen from this evolving market, airports have further benefited

from the high retail spend rates from these passengers.

We estimate that Chinese travellers spend 4-5x that of the

average passenger, meaning that any change in traffic has a

disproportionate impact on earnings for the airports.

However, the pandemic has seen China’s borders shut for over two years, adopting a zero-COVID approach whilst the rest of the world seeks to find a way to live with the virus. The Chinese Government is yet to provide an indication of when these border restrictions may ease, although we can look towards events in 2022 that provide insight into a potential timeline. In February 2022, Beijing hosted the Winter Olympics, whilst in October the communist party will hold its twice a decade party congress.

We believe it is unlikely that a widespread reopening will occur prior to these events, with our assumption being that a meaningful reopening will commence from late-2022.

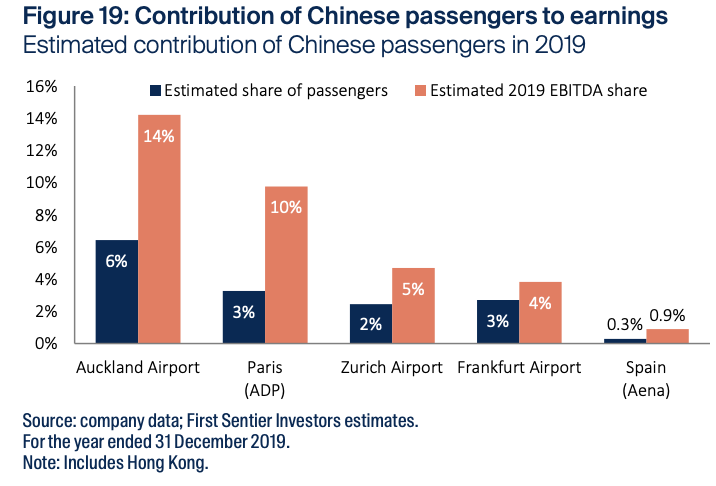

Taking this analysis one step further and considering how

significant this is from an earnings perspective we estimate that

Chinese travellers were responsible for as much as 14% of

pre-COVID EBITDA in the case of Auckland Airport. Whilst at the

other end of the scale we estimate that this market contributed

less than 1% of pre-COVID EBITDA for Spain’s Aena.

A flight path to net-zero

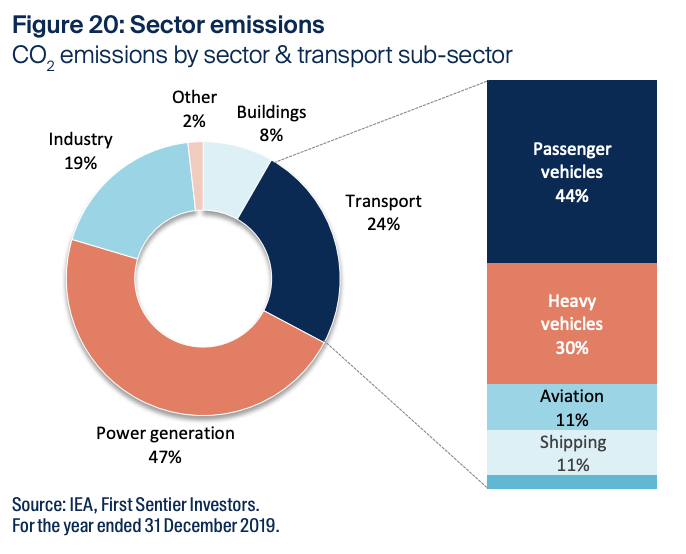

Greater action on climate change is a positive not only for the planet, but also for the infrastructure asset class. Presenting opportunities for a number of our portfolio companies to help facilitate this decarbonisation process. However, careful consideration should be given to the pathway to net-zero and the impact this will have on airports and their operations. Whilst airports do not directly produce significant amounts of carbon themselves, their facilitation of air travel leads to material carbon emissions.

Collectively the transport sector accounts for ~24% of global anthropogenic CO2 emissions, with aviation responsible for ~11% of transport emissions or ~3% of total emissions.

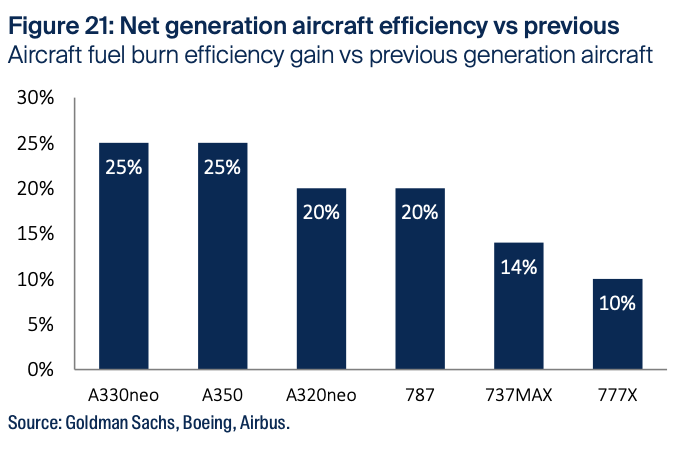

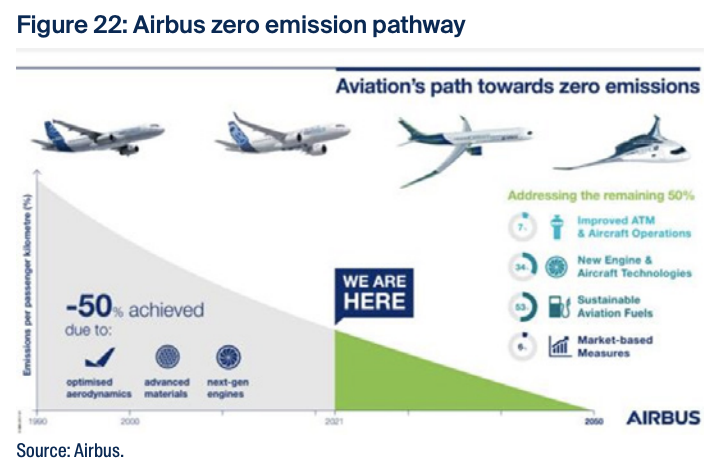

The path to decarbonisation for the aviation sector is a process of

gradual improvement that can be thought of in three distinct

phases. The first is the improvement in aircraft efficiency, the

evolution of aircraft since the start of the jet-age has seen

significant advancements in jet engine design and composite

fuselage materials for improved fuel burn efficiency.

Allowing airlines to reduce not only their fuel costs to make

aviation more affordable, but improve the impact that these

operations have on the environment. Developments have

accelerated in recent years, with the latest aircraft up to 25%

more fuel burn efficient than the previous generation aircraft.

The second stage is the broader adoption of sustainable aviation fuels (SAFs) by airlines. SAFs are developed from renewable sources such as cooking oil, municipal waste and woody biomass, serving as an alternative to conventional jet fuel. These alternative fuels are estimated to reduce aircraft lifecycle emissions by up to 80%. However, at present the cost of SAFs is 3-4x that of conventional fuel, with SAFs only accounting for 0.1% of all jet fuel consumptions as a result. Significant investment is required to increase the supply of SAFs to make the technology more affordable and allow greater adoption.

The third and final stage is the development of new zero-carbon

impact propulsion technologies. These include the development of

electric and/or hydrogen propulsion systems. These technologies

are required in order to achieve the ultimate goal of net-zero

emissions from the sector, however it is important to note that

these technologies are unlikely to reach widespread adoption

before 2040. As a result, the immediate focus is undoubtedly on

promoting the use of SAFs in order to ensure the sector can

continue to grow in a decarbonising world.

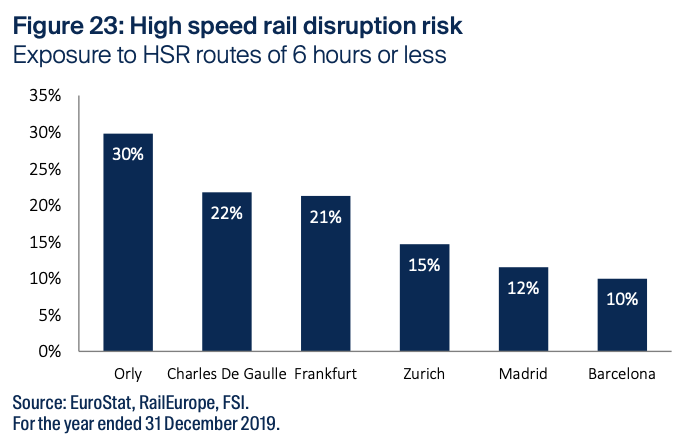

The more immediate impact of this decarbonisation process for

airports is the push towards high-speed rail as a lower carbon

footprint transport alternative to air travel. We are increasingly

seeing governments introduce measures to encourage

high-speed rail via cost incentives and increased investment to

reduce travel times on key routes. We consider any journeys

which can be completed via rail in six hours or less to be at risk of

disruption from these measures.

As a result, we favour those airports that serve populations that have limited or no high-speed rail alternatives. We see these airports as not only serving a vital social need to connect communities, but also at a lower risk of having their traffic disrupted by high-speed rail competition.

Conclusion

Whilst the pandemic continues to impact the way we live our lives, the clouds are slowly clearing on a path towards a return to some form of normalcy.

As this situation continues to develop we maintain our preference for short-haul, leisure exposed airports. Seeing fewer structural risks for these assets, with permanent traffic losses more limited and a greater number of positive catalysts for growth in the medium-term.

Looking beyond this recovery story we believe it is important to consider the lessons and changes for airports that have occurred as a result of the pandemic. As these developments will have significant impacts on the way these businesses operate and grow in 2022 and beyond.

The sector provides many opportunities for investors to gain exposure to multiple economic and social growth drivers in both developed and emerging markets. We are particularly optimistic about the growth potential of the real estate assets held by these companies, with these land parcels being highly valuable in an e-commerce economy that requires increased air freight and intermodal facilities.

However, investor caution is required when considering the

impacts of developments in the decarbonisation of the

transportation sector and structural changes in China’s duty

free market. Navigating these challenges will become increasingly

important as air travel returns to some semblance of normality.

We believe that the portfolio’s current position provides positive

exposure to the structural growth in global air travel, whilst

ensuring that these sector risks are managed appropriately.

Note: You can find the full report in the attachment below

Learn more

We invest in shares of infrastructure companies around the world, including operating assets from the transport, utilities, energy and communications sectors. The assets held by these companies typically offer high barriers to entry, pricing power, and structural growth. For further information, please visit our website.

5 topics