The game-changer for residential property

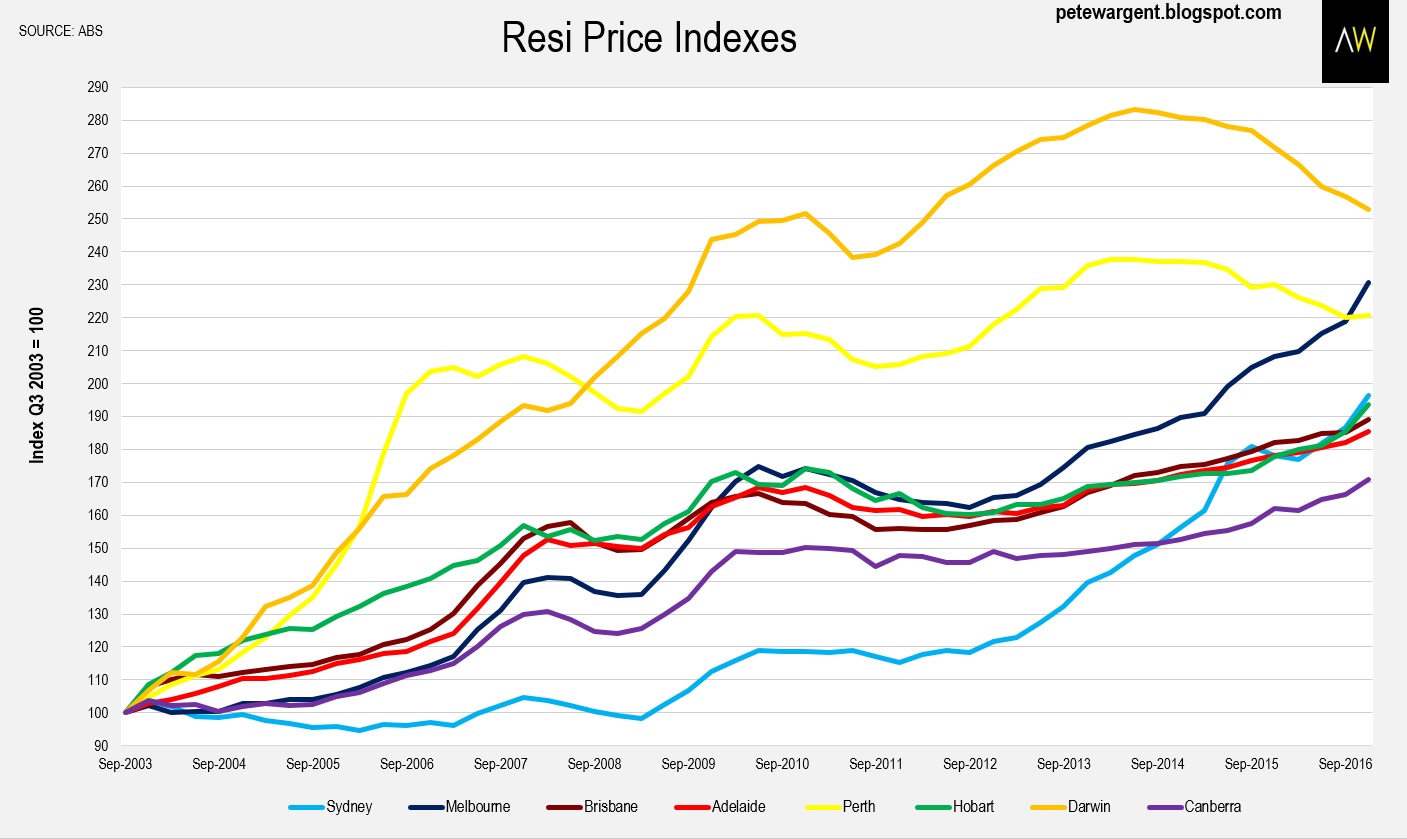

Expectations for Australian residential property prices have been tempered recently by Governor Lowe’s presentation, data including soft wages growth and slower price growth, and the proposed bank levy. Given this backdrop, Livewire reached out to three experts for their perspectives on the market, asking: What data point, or event, in the last month could potentially have the biggest implications on housing, and why?' Exclusive responses below on the game-changer for housing, a key metric at a 5-year high, and APRA's new 'speed limit, from Daryl Wilson at Affluence Funds, Nicholas Sproats from Fortius Funds, and Pete Wargent at Wargent Advisory.

The game-changer for residential property

DARYL WILSON, Affluence

The Federal budget announcement that deductions for travel costs and certain depreciation allowances will no longer be available to landlords of residential property is a potential game-changer. These changes, combined with other changes to curb foreign buyer demand, are relatively small in terms of their market impact. But make no mistake, this represents a profound shift in thinking and action from the Government.

For over 30 years, fiscal policy has been relentlessly supportive for residential property prices. Now, the Government is signaling for the first time that it will take measures to actively slow demand for housing. This is an acknowledgment that we have backed ourselves into a corner on residential house prices, and that we must now find ways to stifle future price growth without causing a substantial correction.

It's a very fine line to walk. A major fall in house prices would be very destabilising for our economy. Labour's response, with mooted changes to negative gearing, is even more profound and would likely have a much larger negative impact on the markets.

Property inventory now at 5-year high

NICHOLAS SPROATS, Fortius Funds

From my perspective there’s no ‘Aha!’ statistic, or ‘bucket of dead canaries’, it’s really just looking at first principles of supply and demand. Last Monday CoreLogic released figures that showed that across Australia’s capital cities there are 4.4 months’ worth of properties for sale.

Now, that figure in an absolute sense isn’t particularly important, but its relative level versus history gives us insights into its future levels and a potential trend. At 4.4 months, that’s more than it has been at this time of year since 2012. Are we at the meniscus point where the bucket is full?

For societal functioning reasons I would hope so… for now. But price cycles are fairly predictable, 3 or 4 years of rising, 3 or 4 years of stagnation. The question this time is only: will the very steep interest-rate-driven price-rises now cause a price-slide?

It's all pretty dependent on interest rates, and if you are the RBA the last thing you want is a price crash. So, I find it hard to see how the RBA wraps their head around raising rates.

The brakes are going on for interest-only mortgages

Peter Wargent, Wargent Advisory

By far the most stirring news in recent weeks has been the announcement by APRA of a new 'speed limit' on interest-only mortgages in Australia, with the regulator now aiming to limit the flow of new interest-only loans to 30 per cent of total new residential mortgage lending.

Although the share of interest-only loans had already pulled back from the astonishing 2015 peak, in aggregate lenders will need to tighten up further to meet the proposed cap, while strict internal limits will be required for interest-only loans at loan-to-value ratios (LVRs) of above 80 per cent.

Henceforth, new owner-occupiers wanting to use this type of loan product may be given their marching orders, and possibly aged borrowers too.

Some Australian banks have been rolling over interest-only loans quite effortlessly at the end of the interest-only period, and these lenders will almost certainly now require a far more stringent assessment, while some investors may be offered incentives to switch to principal and interest mortgages.

The Federal Budget papers also proposed some unwelcome changes for landlords, with the Government limiting plant and equipment depreciation deductions to only those expenses directly incurred by investors, while travel costs will also be disallowed prospectively. These may prove to be sound measures which improve the integrity of negative gearing claims.

In an environment where both wages and rental price growth are tracking at multi-year lows, diminished after-tax cash flows could prune the investor segment of the market at the margin.

3 topics

3 contributors mentioned