The Goldilocks zone for resource exploration (and four ASX companies nailing it)

Back in April, I hosted a series of Buy Hold Sell episodes down in Melbourne. The focus was on commodities and the guests were Rick Squire of Acorn Capital and John Forwood of Lowell Resources.

The conversation, as is typically the case with Buy Hold Sell guests, was fascinating – even if some of the ‘mining speak’ went over my head.

One line that didn’t came from Rick Squire, talking about the uranium-rich Athabasca Basin being a ‘geological freak’.

This got me thinking. What makes for a geological freak, who is looking for them and, perhaps more intriguingly – who has the capacity to mine them?

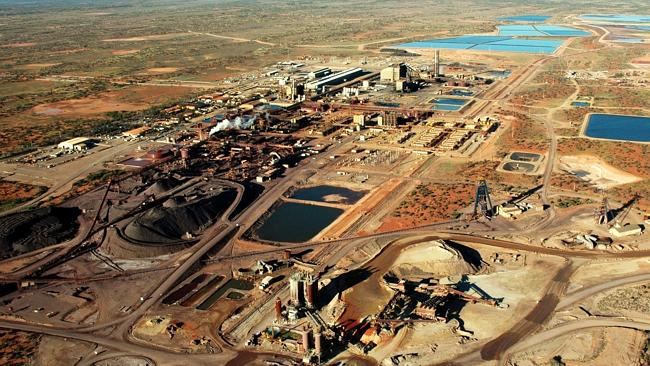

With all these questions swimming around in my head, I reached out to Squire - a geologist with over 25 years of experience in the resources industry, including nine years in mining finance and investment. He has kindly put together the following insights, focusing on Australia’s geological freak, the copper-gold-uranium deposit at South Australia’s Olympic Dam.

Here are some quick facts about Olympic Dam

- It is the fourth-largest copper deposit and the largest known single deposit of uranium worldwide.

- Copper is the largest contributor to total revenue, accounting for approximately 70% of the mine's revenue, with the remaining 25% from uranium, and around 5% from silver and gold.

- As of 2013, Olympic Dam is the second-largest uranium-producing mine in the world.

- It has almost 700km of underground roads and tunnels.

- BHP (ASX: BHP) has owned and operated the mine since 2005.

Are big copper discoveries worth finding?

The following was written by Rick Squire

.png)

Rick Squire, Acorn Capital

There are two types of geologists on Earth: one is motivated by the thrill of discovery; and the other just wants to make money. When investing in copper explorers, it is crucial that you know which type of geologist you are backing.

The holy grail for many resources investors is to back a tiny explorer who discovers the next Olympic Dam. The reason for the appeal is Olympic Dam in South Australia contains resources of copper, gold and uranium that are all among the largest on Earth. In fact, Olympic Dam is probably many times larger than the currently defined resource, but why would BHP bother with a heap more exploration when there is already enough mine life to see my son into retirement?

What could possibly go wrong?

The answer to this question lies in which type of geologist you are backing when investing in copper explorers.

If your explorer is run by a geologist motivated by the thrill of discovery, there is a risk they focus too heavily on finding the next Olympic Dam. Success is possible, but because Olympic Dam is a geological freak, the chances of finding another one are vanishingly low. This does not mean investors should play it safe and avoid companies seeking the biggest prizes. Rather, investors should look for explorers with geologists who understand the importance of risk-weighting in exploration and the need for a balanced pipeline of projects.

3 key features of targets

If your explorer is run by a geologist who is motivated by making money, the targets will have three key features.

- First, there will be a reasonable chance of success. Exploration is a low-probability game (albeit with potentially big rewards), so why make it even harder by targeting the lowest of the low?

- Second, the cost of exploration will be achievable for the size of the company. This is because drilling and geophysics are very expensive, especially for deep targets.

- Third, consideration must be given to the cost and timeframes to get a potential discovery into production. This is an important point that needs some elaboration.

Big copper projects can cost many billions of dollars to build and the timeframes to complete their enormous technical studies and complex permitting and financing requirements mean delays of up to 20 years are common from discovery to first production. This is a problem, because very few shareholders are willing to fund a project for so long and only a handful of mining companies are big enough to buy and develop such assets. For investors, this means the best discoveries are not the biggest deposits, but those that are large enough to be meaningful producers yet small enough to be developed reasonably quickly and at an acceptable initial capital cost.

What are money-making geologists looking for?

If discovering the next Olympic Dam is still on the list, the target should not be too deep and thus too expensive to drill. It must also be something that can be scaled up from a smaller not-too-expensive initial operation to something larger in the future. My preferred option is for smaller versions of the Olympic Dam deposit (a style known as Iron Oxide Copper Gold), such as Ernest Henry (Evolution Mining ASX: EVN) and Eloise (AIC Mines ASX: A1M) in Queensland. Other good targets are the volcanogenic massive sulfide (VMS) deposits, such as MATSA (Sandfire Resources ASX: SFR) and Green Bay (FireFly Metals ASX: FFM).

Projects to avoid, or follow cautiously, include porphyry copper deposits. There are a few porphyry copper deposits that have meaningful high-grade zones, but most are big and very low-grade and thus take decades to get into production. Sediment-hosted copper deposits are great in Poland and Central Africa if you have a high tolerance for jurisdictional risk, but elsewhere around the world are mainly big and low-grade. A nice exception is the Motheo Copper Mine in Botswana (Sandfire Resources ASX: SFR).

At the end of the day, it’s always important to remember that the good thing about exploration is ‘anything’s possible when the drill rig is spinning’.

4 topics

5 stocks mentioned

1 fund mentioned

1 contributor mentioned