The Goldilocks zone of ASX investing

The investment management industry has a liking for contests. Think domestic assets versus global assets, active versus passive, large cap stocks versus small cap stocks, equities versus fixed income, liquid assets versus illiquid assets, growth versus value investing, fundamental vs quant. You get the picture. The portrayals are always zero-sum.

Of course, the truth is that it’s not one versus others, rather it’s ‘all of the above’ to create strongly complementary, diversified portfolios. Well diversified portfolios will likely have exposure to a wide range of assets, investment approaches and styles. Each piece of the investment puzzle adds up to creating stronger total portfolios with potentially better risk-adjusted returns than those based on a single thematic.

This perspective informs our argument for investing in stocks outside the S&P/ASX 20 (ASX 20), that is, ASX 200 ex-20 or mid-cap stocks. Moreover, investments in the ASX 200 ex-20 arena can complement individual ASX 20 holdings, or ASX 20 stocks accessed via ETFs or Separately Managed Accounts. This underscores our argument that one set of investments is not in a zero-sum contest against others, but by combining with other well-chosen investments contributes to overall portfolio diversification.

Some consequences of ASX 200 benchmarking

Many investment managers benchmark their performance against Australia’s leading share market index, the S&P/ASX 200 (ASX 200). Because it is a capitalisation weighted index, it means these managers will naturally have exposures to its largest constituents.

We estimate the ASX 20 soaks up a touch under 60% of the ASX 200 index’s market capitalisation, leaving relatively little elbow room for active managers to add value through stock-picking from the remaining 180 companies in the index.

BHP, for instance, represents around 11% of the ASX 200 index’s market capitalisation and benchmark conscious investment managers are compelled to hold the stock, even if they may be unenthusiastic about the company’s outlook. Not holding BHP (ASX: BHP) would risk an investment manager blowing out a portfolio’s tracking error against the ASX 200.

To be clear, we are not arguing for reducing, let alone dropping ASX 200 related investing. Ours is not a zero-sum proposition. Rather, we believe Australian equity investing can potentially be more rewarding by going beyond the confines of the ASX 200 into the rich terrain on offer in the ASX 200 ex-20 world.

Outcomes from going beyond ASX 20

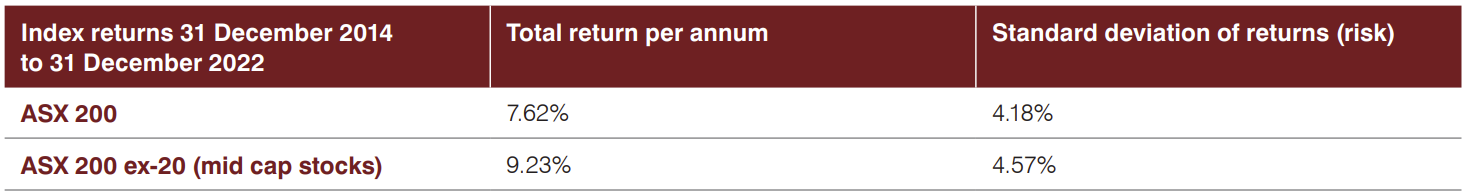

Now for some details and evidence. We think there is a strong case for adding mid-cap stocks to Australian equity portfolios as they have historically provided higher returns than the ASX 200, albeit with a little more risk, defined here as the annual standard deviation of returns (Chart 1).

Said differently, mid-cap stocks have historically compensated investors, willing to assume higher risk, by providing higher returns.

Theoretically, higher risk ought to be compensated by higher return, but that equation doesn’t always hold true. Higher risk isn’t always compensated by higher returns.

However, mid-cap stocks have historically been true to the higher risk/higher return equation.

Chart 1: Mid-cap stocks have delivered higher returns for higher risk…

Past performance is no guarantee of future results Source: Underlying data provided by Standard & Poor’s with Antares Equities analysis

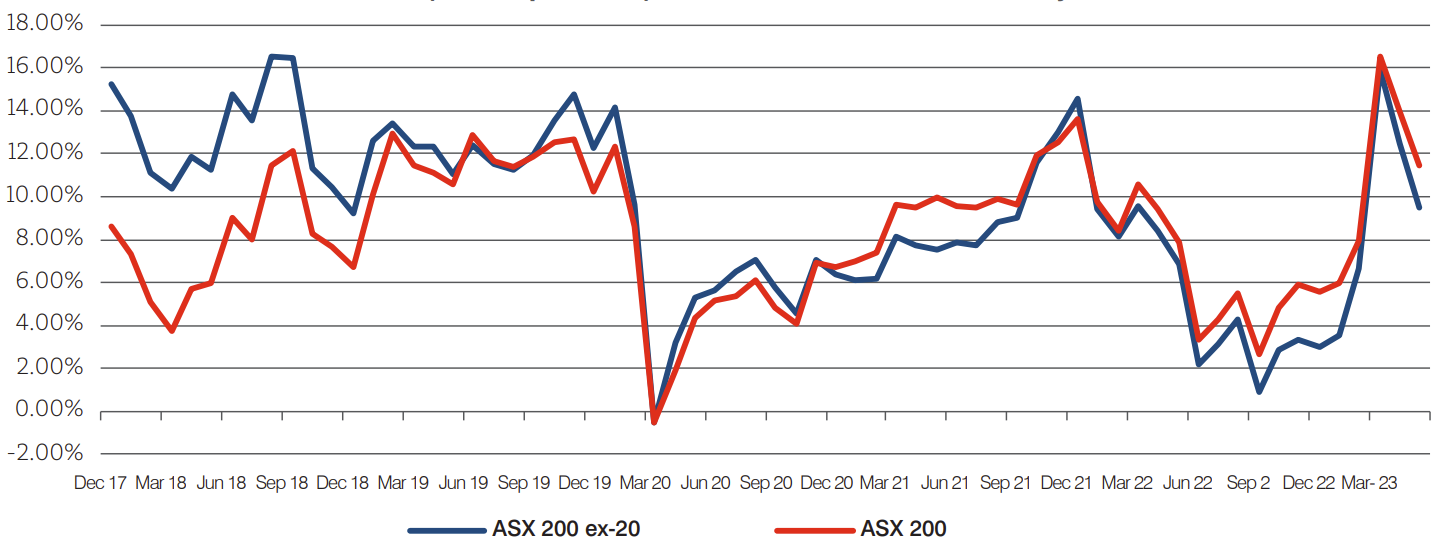

The historic return advantage provided by mid-cap stocks can be diced and spliced in other ways too, and generally results in similar outcomes, including the instance that they have often outperformed on a rolling 3-year basis (Chart 2, on next page) and driven higher capital returns through full investment cycles.

Chart 2: …and often outperformed over rolling 3-year periods

ASX 200 versus ASX 200 ex-20 (mid-cap stocks) returns: 29 Dec 2017 – 31 May 2023

Past performance is no guarantee of future results. Source: Underlying data provided by Standard & Poor’s with Antares Equities analysis

Investors mindful of potential drawdowns1 may also be reassured that mid-cap stocks’ peak-to-trough performances, relative to the ASX 200, over the period shown in Chart 2 are not wildly apart, another way of confirming their broadly similar historic risks.

Mid-caps are more diversified

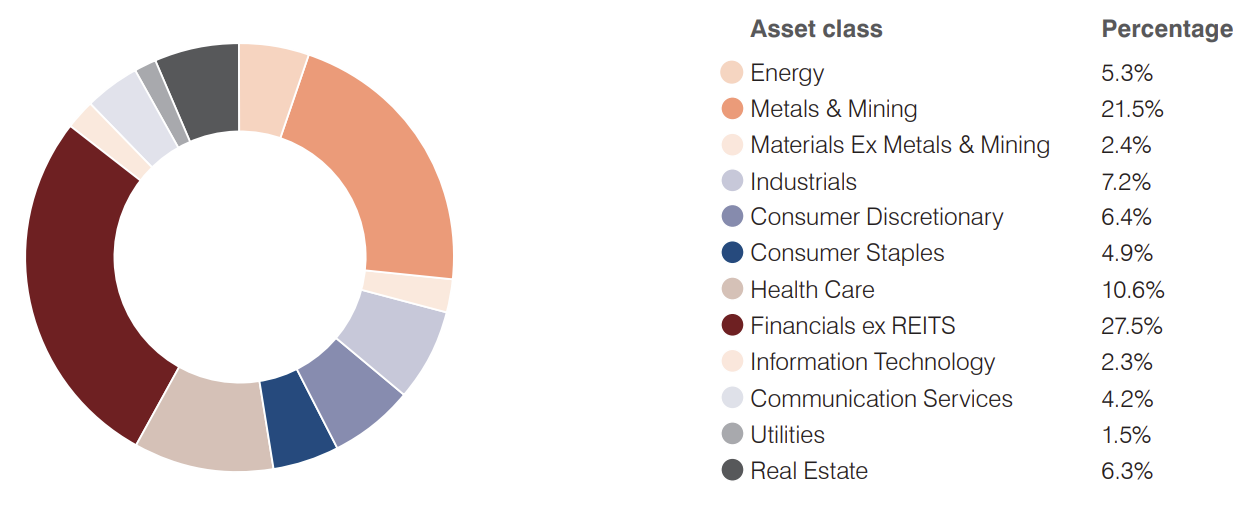

A snapshot at the ASX 200’s sector composition confirms what generations of investors have known — the Australian share market is very financials and resources heavy with the Financials ex REITS and Metals and Mining sectors, together, accounting for a touch under 50% of the broad index’s market capitalisation (Chart 3).

An upshot is that investors with Australian equity portfolios dominated by ASX 20 stocks, and benchmarked against the ASX 200, are tethered to the credit cycle, which is heavily property-driven, in the case of Financials ex REITS, and commodity price volatility, in the case of Metals and Mining (Chart 3).

Chart 3: Financials ex REITS and Metals and Mining sectors dominate ASX 200

Sector composition of the ASX 200 index

A drawdown is a peak-to-trough decline during a specific period for an investment, or fund. A drawdown measures the historical risk of different investments and compares performance. It is usually quoted as the percentage between the peak and the subsequent trough.

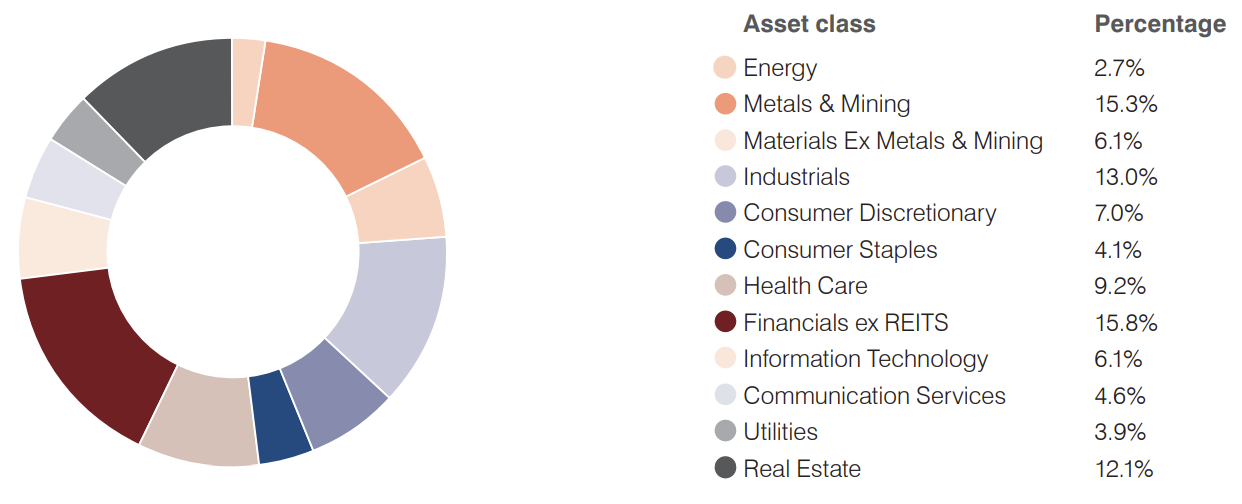

We think sector concentration risk can be muted by diversifying into the ASX 200 ex-20 universe where no sector is so toweringly dominant (Chart 4).

Chart 4: ASX 200 ex-20 has more even sector weightings, relative to ASX 200

Sector composition of the ASX 200 ex-20 (mid-cap universe)

As of 31 May 2023 Source: FactSet

An absence of sector over-domination in the ASX 200 ex-20 empowers investment managers to scour the market for attractive stocks across industries, rather than fretting over the risks associated with drifting too far from benchmark sector weights, which is such an issue in the ASX 200.

We think this is good for investors as it puts the onus on the active managers they hire. Stock selection is what professional investment managers should ultimately be judged on, less so on whether they stick close to sector benchmarks.

Wider return dispersion emphasises greater active management opportunity

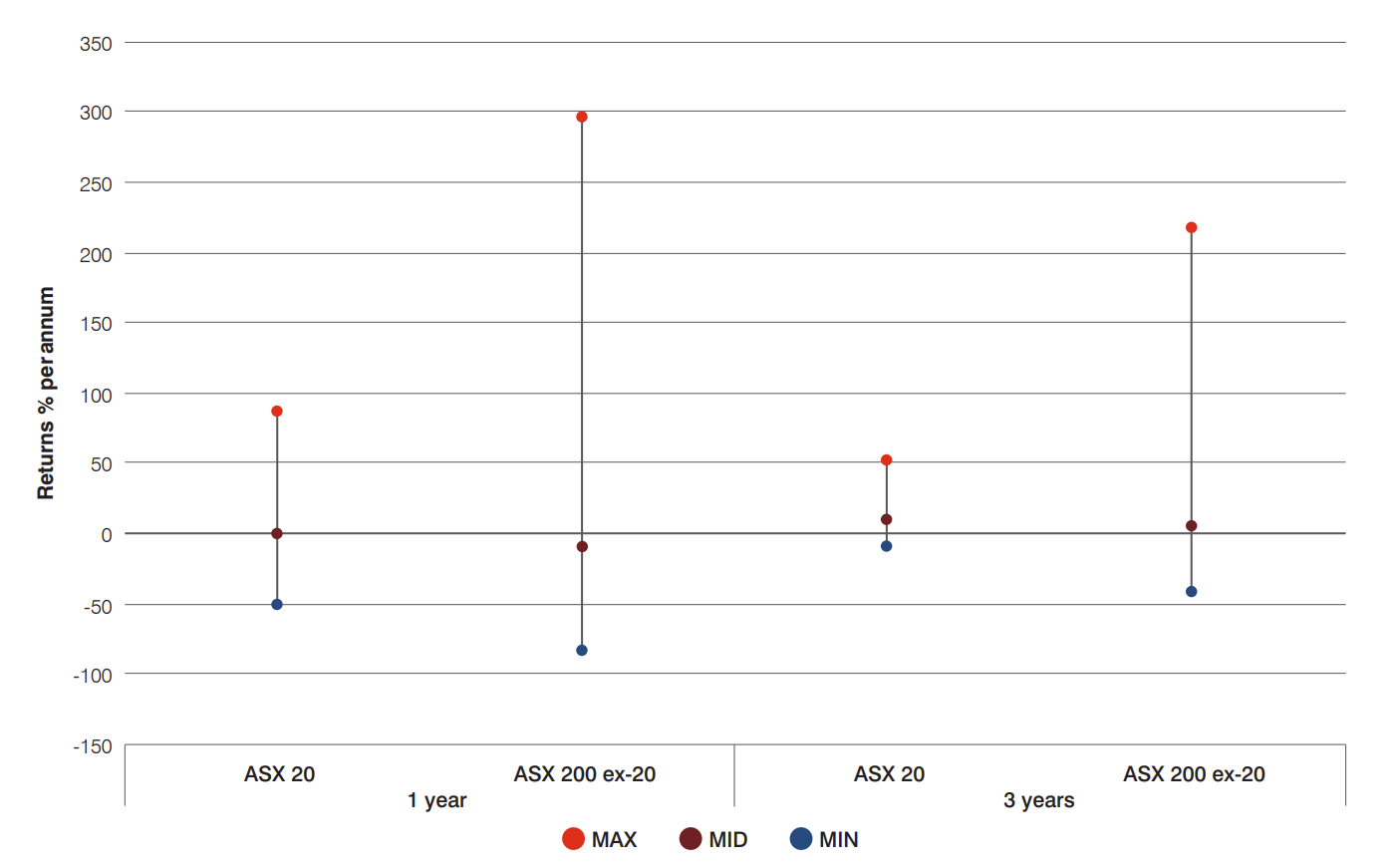

We believe the active investing case is also boosted by the wide dispersion of returns in the ASX 200 ex-20 universe versus the ASX 20 (Chart 5) over one year as well as three years.2

Chart 5: Wide return dispersion creates greater scope for active management

Dispersion of returns ASX 20 versus ASX 200 ex-20 universe for one and three years to 31 December 2022

Past performance is no guarantee of future results As of 31 December 2022 Source: Underlying data provided by Bloomberg with Antares Equities analysis

Over one year to 31 December 2022, there was around a 400% difference between the best and worst performing ASX 200 ex-20 stocks. Over three years to 31 December 2022, there was an almost 250% difference between the best and worst performing ASX 200 ex-20 stocks.

By contrast, return differences between the best and worst performing stocks in the ASX 20 were far narrower over the same periods.

In other words, picking the best performing stocks in the ASX 200 ex-20 universe provides potentially greater rewards than stock picking in the ASX 20. This is because when investing with an active manager, the best chance for returns which are materially different to those of the benchmark come when the investment universe generates highly heterogeneous returns, as with ASX 200 ex-20 stocks.

More even spread of stock specific risks and opportunities in mid-cap arena

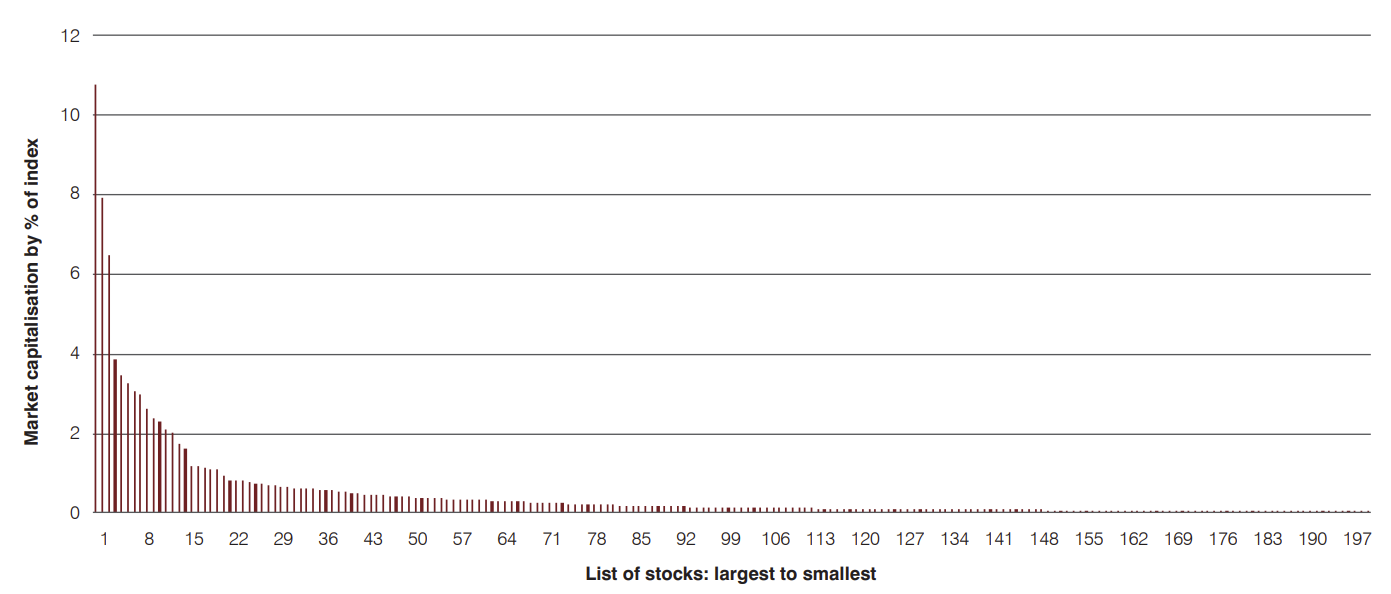

Another way of digging into both the richer stock picking opportunity set in the ASX 200 ex-20 domain, as well as its more even spread of stock specific risks, is to do compare with the ASX 200.

In the ASX 200, investment managers quickly run out of potential choices as it is so large cap dominated (Chart 6). The likes of BHP (ASX: BHP), CBA (ASX: CBA) and CSL (ASX: CSL), to name some, are such great parts of the ASX 200 index’s market capitalisation that they represent acute stock specific risks within the benchmark, as well as blocking out the sum, from a stock picking perspective.

Chart 6: Concentration of stock specific risks in ASX 200

ASX 200 by member market capitalisation weight

As of 31 May 2023 Source: Underlying data provided Bloomberg with Antares Equities analysis

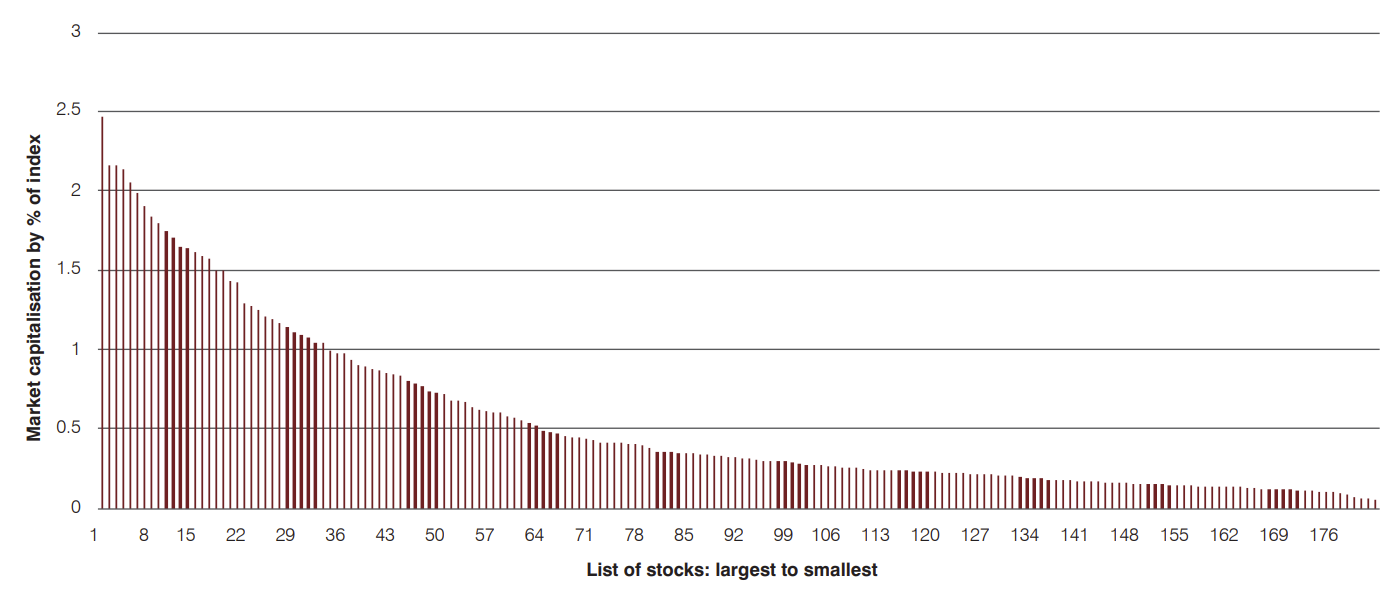

Contrastingly, there is a more even spread of stock-specific risks in the ASX 200 ex-20, as there are significantly more mid-cap stocks at varying market capitalisation amounts (Chart 7, on next page).

The mid-cap arena truly is a stock pickers’ happy hunting ground!

Chart 7: More even spread of stock specific risks in ASX 200 ex-20

ASX 200 ex-20 by member market capitalisation weight

As of 31 May 2023 Source: Underlying data provided by Bloomberg with Antares Equities analysis

We end as we started. Serving investors well is more likely to be achieved by helping them to build well diversified portfolios with exposure to a wide group of assets, investment approaches and styles. It’s not about pitting one asset class against another, or one investment approach against another.

It certainly doesn’t involve decrying investing in ASX 20 stocks versus other parts of the local share market, including the ASX 200 ex-20 universe.

There are good arguments for investing in both. As we see it, the ASX 200 ex-20 universe’s mix of higher potential return coupled with higher risk, diversification attributes, and greater opportunity for stock selection, make it worthy of investors’ consideration.

A portfolio of tomorrow's leaders

The Antares Ex-20 Australian Equities Fund is an actively managed, concentrated portfolio of Australian equities that have the potential to offer significant long-term capital growth. For more information, please visit the fund profile below.

3 stocks mentioned

1 fund mentioned