The good, the bad and the ugly stocks of the ASX

There’s a great divide within the ASX – Tech, financials and retailers are riding a roaring bull market, while energy and mining sectors have plunged into deep correction territory.

Despite this divide, the S&P/ASX 200 hit a fresh all-time high on Tuesday, as strength in non-resource sectors offset the weakness in the heavyweight mining and energy stocks.

This bifurcation is poised to persist, fuelled by ongoing economic growth concerns and mounting headwinds in China’s economy. The challenge for investors lies in navigating these opposing market forces.

On one side, the price charts for many tech, banks and retail stocks have gone nearly vertical, presenting a daunting entry point. On the flip side, the contracting resource sector presents its own risks, with an equally uncomfortable prospect of catching a falling knife and falling earnings.

The Australian equities panel at Livewire Live offered rich insights on the good, the bad and the ugly stocks of the market. So whether you're a growth-hungry investor or a deep-value seeker, you're sure to find something valuable in this wire.

The panel included the following guests and was moderated by Livewire presenter and Centennial Asset Management Portfolio Manager Matthew Kidman.

- Dushko Bajic, Head of Australian Equities Growth, First Sentier Investors

- Dr David Allen, Head of Long Short Strategies, Plato Investment Management

- Ben Griffiths, Portfolio Manager, Eley Griffiths

- James Hawkins, Head of L1 Capital Catalyst Fund, L1 Capital

The Good

Investors are often dissuaded from pursuing stocks with a high price-to-earnings (P/E) ratio. “There isn’t a whole lot of work or follow-through thereafter, which is disguising a great pool of investment opportunities,” said Bajic.

He favoured several growth-oriented names, including:

- Pro Medicus (ASX: PME)

- Xero (ASX: XRO)

- The ‘dearly departed’ Altium (ASX: ALU)

- Hub24 (ASX: HUB)

- SiteMinder (ASX: SDR)

“But the leading light here is WiseTech (ASX: WTC),” he said. “There are more negative columns devoted to WiseTech because of the valuation. And unfortunately, what a one-year P/E does is it stops at one year.”

Since Wisetech's debut in April 2016, its revenue has grown at a compound average growth rate (CAGR) of approximately 30% per annum. Over the years, its EPS has grown 15-fold from 8.5 cents in 2016 to $1.30 in 2024.

“When you can 15x your earnings per share over an eight-year period, and you’ve got prospects to continue to do that for the decade ahead, that’s essentially what you’re paying for. And that PE comes down pretty quickly when you’re generating that amount of cash flow and earnings," says Bajic.

Hawkins called out Bluescope Steel (ASX: BSL), describing it as a contrarian value pick given the challenges in the resource sector and macro backdrop.

“Why do we like it? It’s cheap, it’s growing its production through its Northstar facility in the US and it’s going to be nearly double digits free cash flow yield a couple years out,” he said.

“Critically, it’s a well-run company. The management team is led by Mark Vassella, who runs a top-class management team.”

The recent August reporting season highlighted some of the “most outstanding cost management trends,” according to Griffiths.

Cost-cutting efforts such as labour shedding, business optimisation and supply chain de-bottling helped a long list of companies deliver better-than-expected results, spanning from names like Coles (ASX: COL) to Lynas (ASX: LYC) to JB Hi-Fi (ASX: JBH).

As a small-and-mid cap manager, Griffiths highlighted Breville (ASX: BRG) as a “very, very astute cost manager” set for further upside after a robust FY24 result.

“Breville has been investing heavily in product development and we're now going to see the results of that investment in new product releases and launches.”

“The recent result was tremendous and the main focus of Breville is their growth through the United States, and their growth through Europe, where they're growing market share for new products. They'll enter new markets with new products.”

Dr Allen’s shocking prediction from Livewire Live 2023 was the end of obesity. “We spoke about the GLP-1 drugs last year that have been an absolute phenomenon,” he said.

Given this, his stock pick was the US-listed Vertex Pharmaceuticals (NYSE: VERV) – A US$124 billion market cap company developing therapies to address cystic fibrosis and other diseases such as chronic pain and osteoarthritis.

"Cystic fibrosis and acute pain treatment were once R&D graveyards," Dr Allen explained. "Vertex has largely cracked cystic fibrosis, and now they're tackling chronic pain."

"In America, for every 100 Americans, there are 40 opioid prescriptions still written to this day. It's a massive number, not because doctors don't realise how dangerous they are, but because there's no alternative. Vertex has developed a drug. It just passed the phase three trials. They're with flying colours and will be on sale next year is the expectation," he says.

The Bad

Bajic criticised two of Australia's most iconic listed companies: Woolworths (ASX: WOW) and CSL (ASX: CSL).

“The theme is to stick to what you’re good at. And when it comes to your hobbies, keep them for the weekend. Don’t bring them to the boardroom,” said Bajic.

“Woolworths should just be Australia’s best supermarket and preferably nothing else.” But the business is carrying extra baggage in the form of Big W and New Zealand Foods.

He says Big W has only recorded a handful of profitable years over the past decade. The most recent set of results delivered only $14 million EBITDA on $4 billion of sales.

The New Zealand supermarket business has seen its EBITDA margins erode from 5% to less than 1% over the past few years. "They were cleaned up by Pak 'n' Save, which is probably one of the most aggressive and successful retail operations in the world," he explains.

CSL echoed the same narrative of capital destruction and management distractions through its US$11.7 billion acquisition of Vifor in 2021.

“They expended US$12 billion for the acquisition and they’re only going to make an NPAT of around $400 million. That’s a 3.7% return on invested capital against CSL’s traditional 20%-plus return on invested capital.”

“It dragged the entire business down to a 10.5% return on invested capital and the stock has spent the last 18 months derating. From our calculations, it's probably cost $100 a share in its share price."

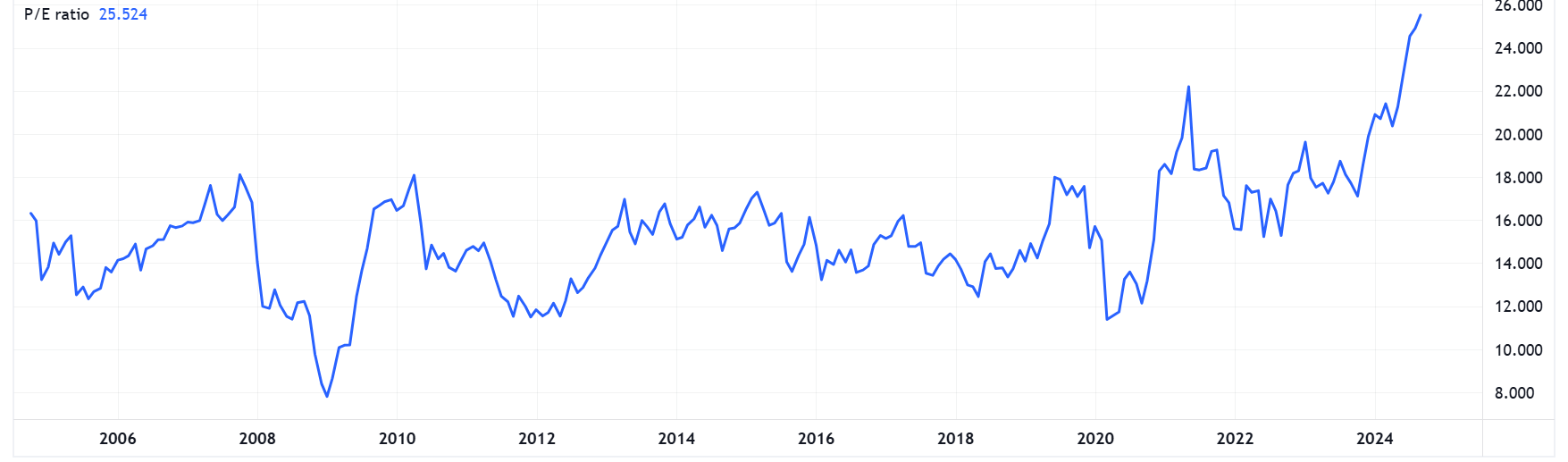

Commonwealth Bank (ASX: CBA) has been targeted by almost the entire investment community for its bubble-like valuation of 25x and poor growth outlook.

Hawkins offered a different perspective about its valuation: "On what reasonable basis should CBA be double the valuation of JP Morgan, the best bank in the world?"

"On what basis, when there's no EPS growth, should CBA's multiple be at two-decade highs? It's really hard, logically, to look our clients in the eyes and say, that's good buying at those values."

The Ugly

'The Ugly' seeks to target some of the most disappointing pockets of the market. For Bajic, that was Seek (ASX: SEK).

"Its EPS next year will be approximately 22% below what its earnings were ten years ago. When you look at REA, its EPS is three times higher next year than what it was ten years ago," he says.

"It's more than a lost decade, they've gone backwards. It's been a tale of misallocated capital."

From a valuation perspective, Seek has managed to trade at a P/E of 50x, higher than its peers REA Group and CAR Group, both of which are set to grow earnings next year.

China's economy has been a massive pain point for Australian investors, dragging key stocks like Fortescue (ASX: FMG) and BHP (ASX: BHP) down 40% and 20% year-to-date respectively.

But Griffith argues that the path of least resistance continues to be lower. "In China, we've seen about an 8% fall so far in new dwellings, and about 11% fall in existing dwellings. So, interpolating or overlapping the trends we saw in other major crises, we're not halfway done anywhere near that on price," he says.

"We are only four years into the Chinese property market debacle, which peaked in 2020. So, we are nascent in terms of where this crisis is going, and we're certainly nascent in terms of the price."

Previous housing collapses in the US, Ireland and Spain experienced drawdowns that spanned for approximately 10 years.

3 topics

18 stocks mentioned

5 contributors mentioned