The great Aussie house price correction has started: national prices fall in May for the first time since September 2020

The great Aussie house price correction has begun: the all-regions (ie, metro plus non-metro areas) national dwelling value index published by CoreLogic declined by 0.1% in May, which is the first time it has fallen since the short-lived, pandemic-induced correction that ended in September 2020. You can see the press release issued by CoreLogic this morning, an excerpt of which is enclosed below.

The real devil is in the detail, however, with much larger losses being recorded by Australia's two biggest cities, Sydney and Melbourne, where home values declined by 1.0% and 0.7%, respectively, in the month of May alone. Unsurprisingly, dwelling values also fell in contiguous Canberra in May, albeit by only 0.1%.

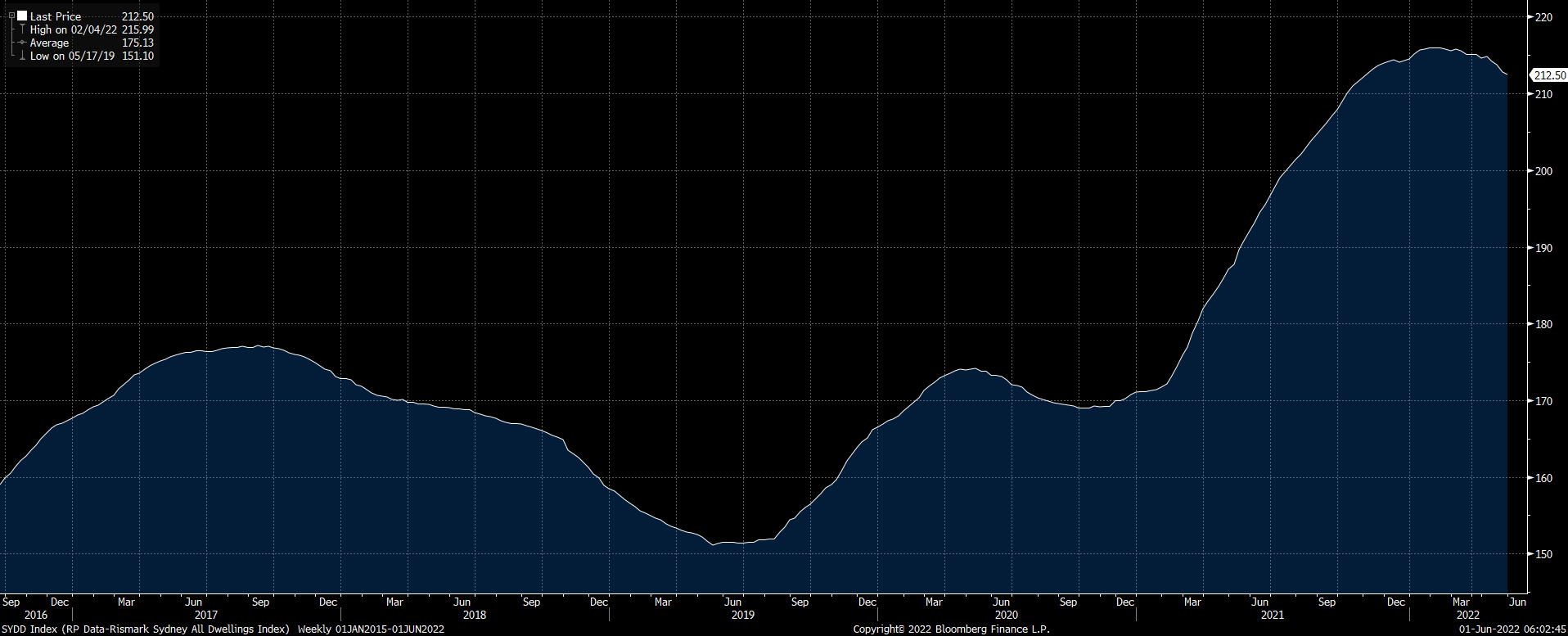

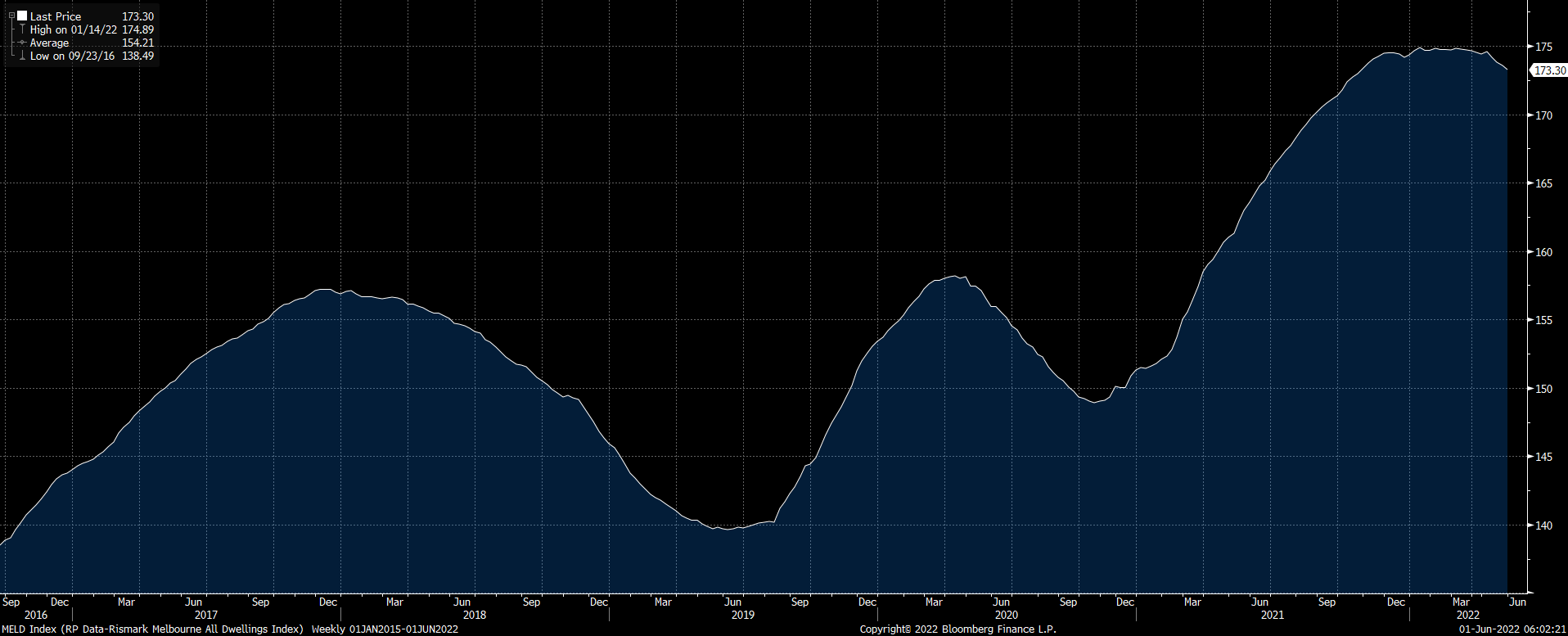

Sydney dwelling values have now dropped 1.6% since their technical peak in February 2022 (the market started flat-lining in November 2021). Home values in Melbourne have also corrected almost 1% since their own January apogee. In past cycles, we have seen the vanguard cities of Sydney and Melbourne lead the way. This is, once again, the prevailing dynamic: dwelling values in Brisbane, Adelaide, Perth, Darwin and Hobart continue to climb, although the Brisbane boom does appear to be grinding to a halt. The two charts below show the evolution of Sydney and Melbourne home values since 2016 using CoreLogic's daily hedonic index data.

The key drivers of the great Aussie house price correction include:

- A massive increase in fixed-rate borrowing costs with the typical 3-year fixed-rate jumping from circa 2% one year ago to 4.5% today. This process commenced in November last year as a result of the RBA suddenly dropping (1) its verbal commitment to not raise interest rates until 2024, and (2) its so-called yield curve target whereby it kept the interest rate on the 2024 government bond at 0.1% in line with its target overnight cash rate;

- Market perceptions that the RBA would start raising rates in 2022, which penetrated the popular consciousness in late 2021 after the RBA dumped its forward guidance about not hiking until 2024. A series of hikes in 2022 were fully priced by markets in November 2021, which was widely communicated by the media;

- The RBA commencing its monetary policy normalisation process with an inaugural 0.25 percentage point cash rate increase in May 2022 (one month ahead of the explicit plan it outlined in April that targeted a first hike in June), which resulted in variable rate home loan costs increasing by the same margin;

- The RBA's governor, Phil Lowe, advising the public in May that he expects to lift his target cash rate to at least 2.5%, which would mean that discounted variable-rate home loan costs will rise from circa 2% prior to the RBA's May hike to 4.5% once the cash rate hits 2.5%. Financial markets have a much more aggressive view: they are pricing in a terminal RBA cash rate of 3.6%, which would imply that discounted variable-rate home loans will increase to 5.6%; and

- Finally, there has been a generic increase in lenders' funding costs. This includes both banks and non-banks. Funding costs were unusually low as a result of the RBA lending the banks $188 billion at a super-cheap cost of between 0.1% pa and 0.25% pa. This facility is no longer available, and will have to be repaid over the next few years. Funding costs have as a consequence begun to mean-revert, and it is reasonable to assume that some of these expenses will be passed on to borrowers in the form of out-of-cycle hikes imposed by lenders. These should, however, be neutralised by the RBA: any extra hikes that lenders pass-on to borrowers are hikes the RBA will not need to impose itself (given the RBA is practically targeting a given level of borrowing rates).

Since late 2021 (see here and here), we have presented the following forecasts:

- We expected at least another 5% worth of capital gains at the national level before the Aussie housing market started to roll-over (CoreLogic's index delivered 5.4% between 1 November and 30 April);

- We expected the RBA to begin hiking in mid 2022 at the earliest (having planned to kick-off in June, they got the yips and started in May) with the first 100 basis points of RBA rate increases triggering a subsequent 15-25% correction in national home values, which would be the largest draw-down on record. Care of CoreLogic we now know that the great Aussie housing correction has indeed begun;

- And we've argued that there will be a compelling case for the RBA to stop or pause its hiking cycle after the shock of the first 100-150 basis points of cash rate increases.

While capital losses might suck for home owners, they have banked capital gains of 37% since the RBA first started cutting its cash rate below 1.50% in June 2019 (it is currently 0.35% after the 0.25 percentage point hike in May). If we are right and national values correct 15-25% over the coming years, it will be modest payback in the scheme of things. We further believe this correction will be orderly given the overall strength of the Aussie economy, which is likely to be supported by a number of factors, including:

- A low and competitive Aussie dollar, helping exporters and import-competing industries;

- Very strong population growth, powered by skilled and unskilled migration, which will in turn drive aggregate demand;

- A revolution in business borrowing as companies seek to invest in their production capacity given ongoing supply-side constraints coupled with a huge increase in res-shoring of supply chains as Western economies decouple from China;

- Elevated prices for all of Australia's key exports, including agriculture, iron ore, natural gas, and coal; and

- Ongoing fiscal stimulus as a result of structural deficits at the Federal level, which are being reinforced by the need to spend vast sums on national security, and ambitious infrastructure investment programs at both the Federal and State levels.

Access Coolabah's intellectual edge

With the biggest team in investment-grade Australian fixed-income and over $7 billion in FUM, Coolabah Capital Investments publishes unique insights and research on markets and macroeconomics from around the world overlaid leveraging its 14 analysts and 5 portfolio managers. Click the ‘CONTACT’ button below to get in touch.

2 topics