The 'grey wave' creating compelling opportunities in the housing market

U.S. Seniors Housing is attracting increased investor focus due to an aging population which will provide landlords with a demand tailwind coupled with some insulation from short term economic cycles.

In just the past few years, the larger seniors housing landlords have recast the relationship with their tenants, and this has positioned those property owners to benefit from similar operational improvements already seen across many other commercial property sectors.

REITs comprise the largest landlord group in seniors housing, and they are well positioned to capitalise on these trends.

In 2024, U.S. seniors housing is at the front end of a multiyear demand super cycle.

The demographics of demand for seniors housing are turning strongly favourable as a key segment of the U.S. population is beginning to age into prime seniors housing tenant years. The industry is also emerging from the operational lows of the Covid pandemic which pressured occupancies and property level economics.

Unlike care homes in other regions, U.S. seniors housing is almost entirely paid for privately by tenants (~98%), with little funding from government reimbursement programs often seen in other developed markets. In the U.S., the operating lease structure enables landlords to participate in a property’s operational cash flows, both positively and negatively.

While several other markets share a similar demographic outlook with the U.S., the ability to pass through rent increases to the tenant and participate in the upside through operating leases enables U.S. landlords to more directly capture growth in the seniors housing sector.

Defining seniors housing

Seniors housing is a communal housing format for people typically in their retirement years. It is intended to provide a residential environment that is supportive of older residents’ changing needs for personal care and assistance with daily living activities.

It does this by incorporating two main components.

- Seniors housing is a residence where residents live as independently as possible given their needs and abilities.

- It includes a hospitality and care component whereby services and programming are provided for inhabitants to support their daily living needs. This includes dining and meal services, scheduled activities, laundry, and housekeeping, and it also includes personal care assistance for various need levels.

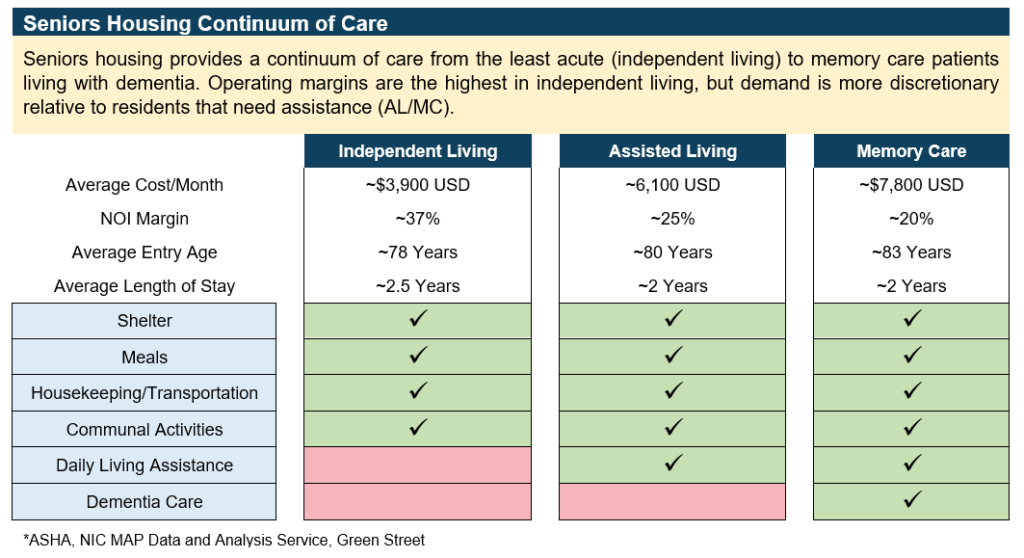

In order to address a wide range of resident requirements, seniors housing operates across a spectrum of service and needs levels.

The formats range from Independent Living (IL), which are properties where residents have limited service and support needs, to Assisted Living (AL), which involves increasing assistance in daily living needs, to Memory Care (MC), which is a secure environment for residents with dementia or other cognitive limitations.

It is important to note that seniors housing is not a rehabilitation facility in which residents are there temporarily to recover from medical treatment. Rather, seniors housing is a permanent housing setting for residents to support them as they age.

Private pay seniors housing is oriented to individuals and/or their families who decide to move to a dedicated residential setting for seniors.

In the U.S., it is a discretionary product that is funded almost entirely by the residents and their families. Unlike seniors housing in Europe and Australia, there is virtually no government sponsored funding for either the residential or the hospitality components. Residents (and their families) rely on their own resources, typically household wealth, such as from a home or other investments, to fund the cost of living in a seniors housing setting.

We do not view seniors housing as being age-restricted rental apartments, also known as multifamily in the U.S. The physicality of the properties is quite different. Seniors housing has smaller unit sizes and more communal activity areas, including various levels of dining/communal kitchen facilities, libraries, and activity rooms.

Moreover, seniors housing has much higher staffing levels to assist residents with daily needs.

Often seniors housing properties have fewer residents than most institutionally owned multifamily properties, typically approximating 75-100 residents as compared with 200+ units in a purpose-built rental apartment property.

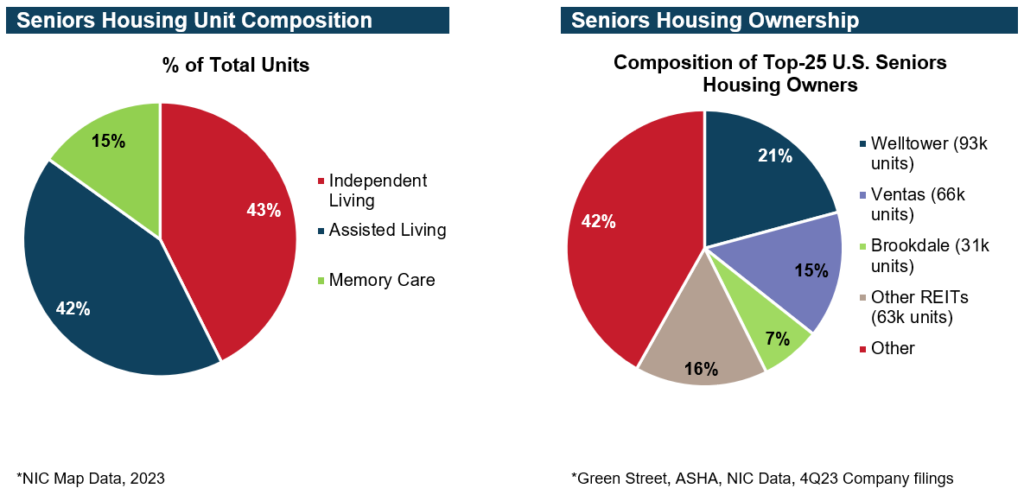

Ownership of seniors housing is fragmented nationally. The National Investment Center (NIC) estimates there are 1.14 million seniors housing units in the U.S. across Independent Living, Assisted Living and Memory Care formats.

The 25 largest institutional portfolios own about 445,000 units, or 39% of the total.

REITs comprise the largest ownership segment with nearly 230,000 units or 20% of the total private pay seniors housing market. Welltower (NASDAQ: WELL) is the largest owner with 127,000 wholly-owned units across three countries, including 93,000 in the U.S., followed by Ventas (NASDAQ: VTR) with 82,000 wholly-owned units, including 66,000 in the U.S.

Together these two REITs account for nearly 70% of REIT owned seniors housing assets.

Within seniors housing, independent living and assisted living comprise the majority of units nationally (~85%).

The smallest segment, memory care, is typically a component of a larger seniors living facility, usually found alongside assisted living. As their needs evolve, tenants can transition from independent living to assisted living, and ultimately to the memory care wing if required.

Utilisation of memory care facilities is less discretionary, has higher levels of acuity, lower operating margins, and often, a shorter average length of stay.

Historically, REITs owned seniors housing properties and leased them to non-affiliated operators on a triple-net (NNN) basis, which allowed the landlords to receive a net rent. This was in accordance with the original U.S. REIT legislation in the early 1960s that prohibited healthcare REITs (and hotel REITs incidentally) from operating the properties they owned.

In the triple net lease structure that ensued, the operator, not the landlord, was responsible for all aspects of property level operations including the running costs and general upkeep. The landlord received a rent that was net of the property operating expenses which the operator funded directly, including real estate taxes, property insurance and utility costs.

Over time, rent coverage settled at about 1.3x – meaning a property’s EBITDAR (EBITDA before rent expense) was 130% of the rent payable to the landlord. If property level EBITDA grew, the operator benefited, while the landlord received the contracted rent.

However, when operators ran into trouble and EBITDAR coverage fell below 1.0x, REIT landlords often shared the pain by way of reduced rents. Pressure on EBITDAR coverage could result from a variety of factors, such as reduced occupancy, lower rents and/or higher operating costs.

In 2007, the rules changed when the REIT Investment Diversification and Empowerment Act (RIDEA) permitted healthcare REITs to have direct operational exposure to seniors housing properties.

Under a RIDEA era lease, rents to the property owner were not set at a prescribed amount, but rather they were directly linked to a property’s revenues. A RIDEA lease enabled landlords to hire seniors housing operators to run the properties, and these operators (who were no longer tenants) were paid a percentage of revenues, much akin to the hotel industry.

In the nearly 15 years since RIDEA changed the rules of the game, Green Street estimates that Seniors Housing Operating (SHO) leases have come to comprise 75% of REIT-owned seniors housing properties.

At this point, most new seniors housing leases are SHO not NNN, and this provides REITs with greater operational exposure to seniors housing cash flows, both to the upside and to the downside, as was seen during the Covid pandemic.

Portfolio exposure

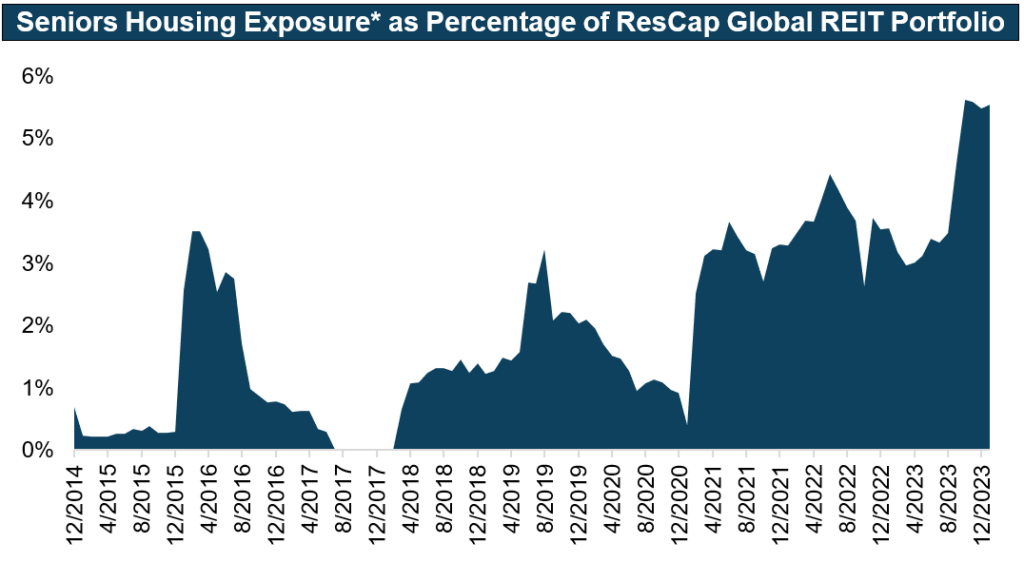

Resolution Capital’s portfolio exposure to seniors housing has increased significantly over the past several quarters, as illustrated in the graph below.

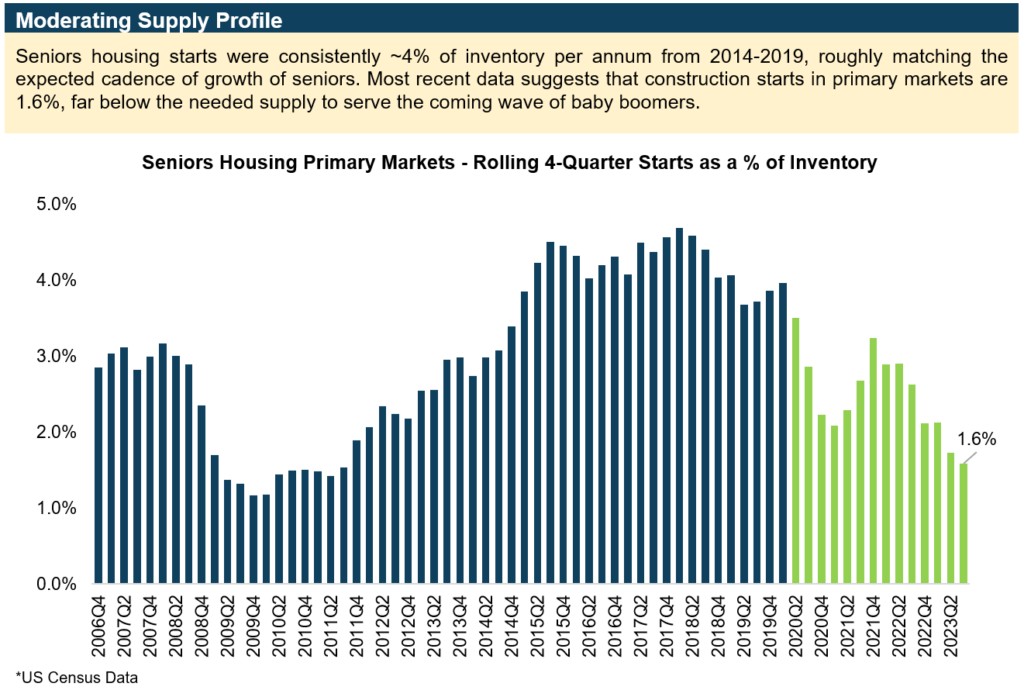

The portfolio had limited exposure before the pandemic when construction activity for seniors housing was elevated as developers anticipated the baby boomer generated wave of demand. Pre-pandemic, annual supply growth hit 4% nationally, and new competitive stock weighed on both occupancy and market rents.

In addition, the operational intensity of the business (25-30% NOI margins) and misaligned management contracts (incentives paid on revenues not on profits) led to choppy operational performance.

The Covid pandemic was another major hurdle for the industry as elderly residents were particularly vulnerable to the virus and new move-in activity was halted.

However, the poor performance of seniors housing in 2020 and 2021 led to supply growth abating, just in time for the coming demand wave. The struggles that operators faced during the pandemic also enabled landlords to restructure leases to improve alignment and to enable landlords to more readily replace underperforming operators.

Looking ahead, what was once an uninspiring real estate segment is now poised to benefit from both a cyclical rebound in operations as well as favourable near and medium-term demand/supply dynamics.

Pandemic low gives way to cyclical rebound

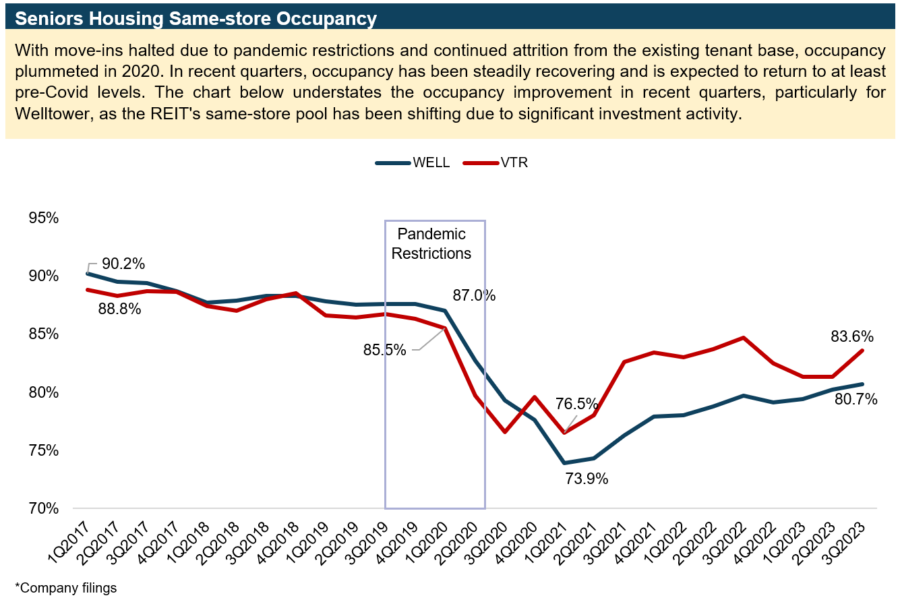

During the Covid pandemic, seniors housing industry operations weakened significantly as occupancy plummeted nearly 1000 basis points in 2020-early 2021, per NIC data.

The seniors housing industry had never experienced this level of rapid occupancy loss before, and indeed, it was virtually unprecedented across other property sectors as well.

In early 2020, soon after the pandemic started in the U.S., many seniors housing properties were forced to indefinitely halt new resident move-ins due to concerns about safety for existing residents and staff. Move-ins only gradually resumed in early 2021, following discovery of a vaccine and when the elderly received priority vaccinations.

During this time, move-outs inevitably continued due to health and life cycle events.

As background, the average resident stay in an assisted living facility is typically about two years, and this means that about 4% of residents move out each month. Given the age profile of residents, many move-outs (an estimated 60-70% of assisted living and memory care units) become vacant due to the death of the resident.

Because move-outs continued even when move-ins had paused, occupancy in seniors housing facilities dropped rapidly through early-2021. For the Welltower portfolio, occupancy fell 1,300 basis points in 12 months through March 2021, when it troughed at ~74% (see chart below).

Property level operating margins were devastated during the pandemic. Revenues plummeted with occupancies, and costs skyrocketed across the board. Food costs rose. Preventive items, such as face masks, gloves, and cleaning materials were in short supply and available only at high prices.

Labour, typically accounting for 60% of operating costs, was thrown into disarray as staff contracted Covid. Over time, properties relied on expensive agency labour as a staffing stop gap. Agency labour is essentially skilled, temporary workers, and it typically would cost 2.5-3x regular staff wages. As a result, labour costs soared in 2021 and into 2022.

Most operators required some rent relief from landlords during this period, and this enabled landlords to restructure seniors housing leases. In exchange for rent abeyance, Welltower was able to modify its operator leases to reorient operator incentives towards maximising property level EBITDA and not just revenue. The lease restructuring that occurred due to operator stress throughout the pandemic has led to a better alignment of incentives between operators and landlords, with Welltower benefiting from enhanced emphasis on efficiency from its operators.

The occupancy and expense headwinds that depressed operating margins during the pandemic are reversing now, and they present significant cyclical upside for seniors housing operators today. In the Welltower portfolio, occupancy is about midway through a multiyear rebuild to the pre-pandemic level of 87%, which we expect to be reached by early 2026.

Furthermore, that 87% pre-Covid occupancy had already come off its peak due to an increase in supply following robust construction activity in 2014-2019. Looking forward, structural occupancy could very well reach or exceed 90% in a more benign supply environment. Notably, profitability is returning with occupancy and rental rate improvements benefiting Welltower’s same-store NOI margin, which, after declining from 31% in 1Q20 to 19% by 4Q21, has since recovered to 26%, with further upside still to come.

In recent quarters, expense growth has also become less of an operational cost headwind.

The use of agency labour reduced significantly in 2023, with some landlords citing a 50% reduction.

In contrast to other property sectors that face elevated expense growth stemming from payroll costs pressures, seniors housing operators now face easier year-over-year comparable metrics as labour pressures recede. In the fourth quarter of 2023, Welltower reported 1.7% expense growth per occupied room (ExpPOR) on a year-over-year basis, the lowest in company history.

Aging demographic drives structural demand shift

Seniors housing is positioned to benefit from an upward shift in demand as the Baby Boomer generation (those born between 1946-1964) ages into prime seniors housing rental demand years.

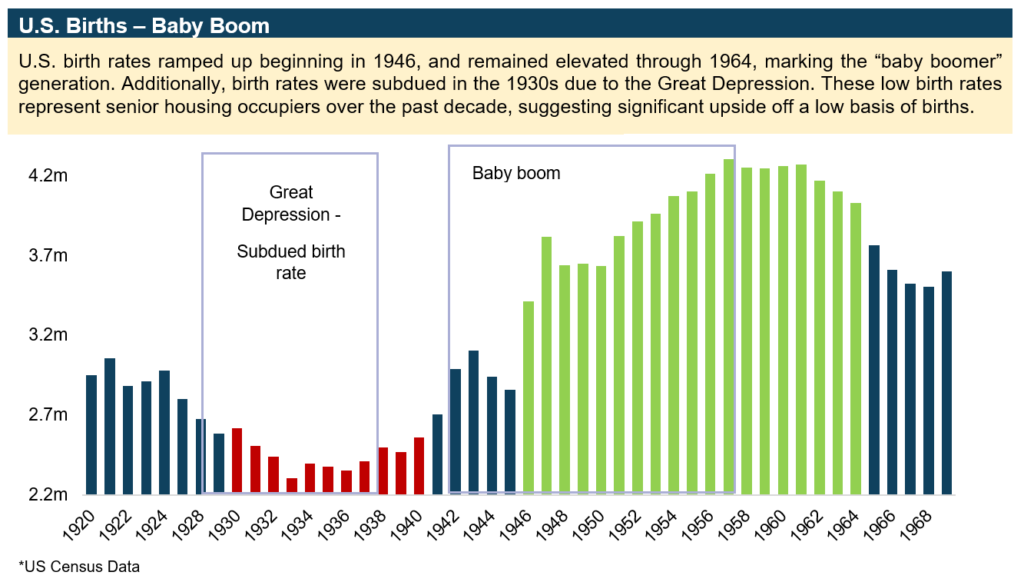

Growing economic prosperity coupled with an increased sense of security in a post-war environment led to a marked increase in the U.S. birth rate, as seen in the chart below. The Baby Boom generation was a period when the birth rate reached ~2.7%. This was well ahead of the Great Depression’s below-trend ~1.9% birth rate in the preceding decade.

The Baby Boom, and improvements in medical research, has resulted in a surge in the over-80s age cohort today.

In seniors housing, demographics drive demand, and 2024 is on the front end of a demand uplift due to the aging of the baby boomer generation. Seniors housing residents typically enter facilities at about 80 years old, which skews slightly younger for independent living (78-80) and slightly older for assisted living (80-82).

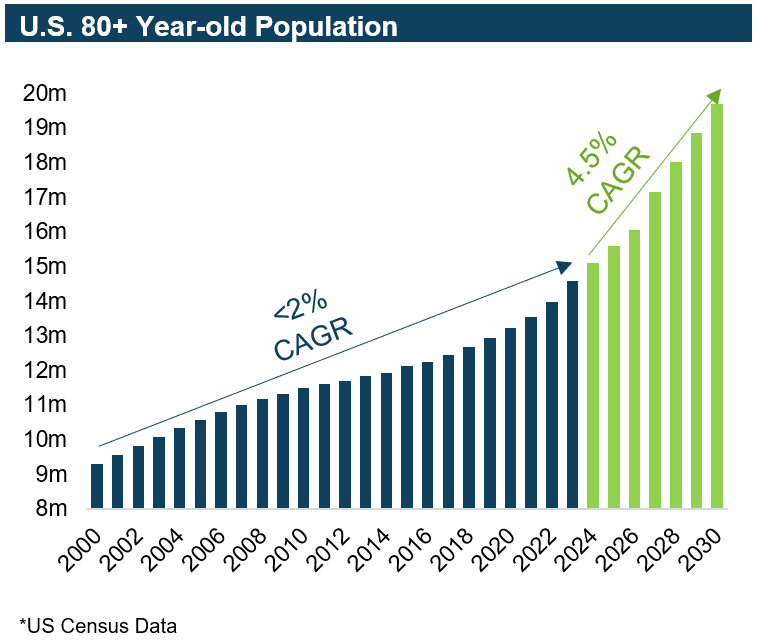

Current demographics suggest an unprecedented demand wave for seniors housing, as those 80 years of age or older are expected to grow above 4% annually through 2030 (see chart below), more than double the growth seen in the past two decades. These demographic tailwinds should persist for the next 20 years when the youngest baby boomers turn 80 in 2044.

Also, the sheer size of the baby boomer generation will dwarf the availability and affordability of alternative options to seniors housing (i.e. in-home care). The demand surge by seniors will feel like an even greater departure from recent experience because it follows relatively subdued demand levels resulting from the smaller Depression era cohort.

The population of >80 year-old citizens is expected to grow over 4% annually from 15m in 2024 to nearly 20m in 2030.

Supply Outlook – benign

Construction starts in seniors housing were elevated from 2014-2019 as the promise of baby boomer demand was enticing for both developers and capital providers.

As mentioned previously, rapid supply growth exceeding 4% limited rents and pressured occupancy levels prior to the pandemic. However in the past two years, the supply landscape has changed significantly to become more landlord friendly.

Seniors housing should experience muted supply growth in the near term due to the operational struggles endured during Covid and financing challenges impacting commercial real estate more broadly.

Even though seniors housing operations began to recover in 2022, occupancy today remains well below pre-Covid levels and property level cash flows do not yet justify new development, particularly when considering limited and expensive construction finance that is not widely available along with elevated development costs.

As a result, the appetite for breaking ground on new projects is greatly reduced. In 2023, seniors housing construction starts totalled 14,000 units or 1.3% supply growth, well below the pre-pandemic trend.

Looking ahead, a robust supply response remains a key future risk for strengthening operations in seniors housing over the medium and long term.

We expect new development will eventually increase as the operational rebound continues and when construction finance becomes more accessible. For the next several years however, supply growth should be notably low as it will take 3-5 years for construction activity to resume at scale and for projects to then be delivered to the market.

In 2024, it seems unlikely for the construction lending environment to improve materially, suggesting clear skies for existing seniors housing for the next several years.

Affordability remains strong

The demand/supply dynamic in seniors housing is compelling, but limited supply is not a guarantee alone of strong operational performance for seniors housing which has a significant discretionary component.

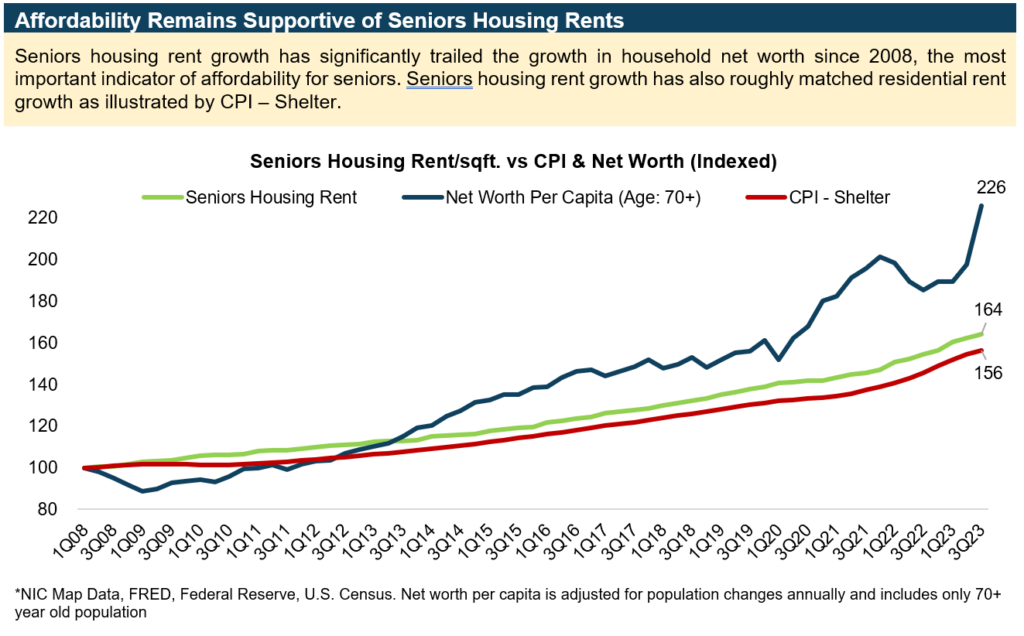

Rents for prospective tenants must be achievable and competitive with alternatives such as in-home care. For private pay seniors housing, Net Worth is a better indicator for the spending power of prospective tenants than income, which is the typical affordability metric for all-age rental housing.

Simply put, seniors rely on savings, home sales, and retirement benefits more than employment income to fund their rental expenses, and this provides some protection, albeit not perfect, in various economic environments.

Over the past several years, growth in rents for seniors housing has trailed net worth by a wide margin providing ample room for future rent growth without risking utilisation rates (see chart below). In the past three decades, household net worth has increased 5% annually, well ahead of U.S. wage growth and also increases in seniors housing rents.

In fact, seniors housing rents would need to grow more than 9% annually to catch up with the growth in net worth by 2030. In this scenario, we do not see affordability as being a material constraint on demand for seniors housing in the next several years.

Strong historic growth in net worth should provide a tailwind for pricing power. This is particularly relevant when comparing seniors housing to residential sectors that are more reliant on wage growth.

Operating Outlook – onward and upward

In the near-term, occupancy is forecast to continue to recover to pre-pandemic levels by 2026, which equates to about 200 bps of annual occupancy upside.

Beyond 2026, occupancy is projected to continue to improve into the low-90%, returning to post Global Financial Crisis (GFC) occupancy levels prior to the last supply cycle.

A benign competitive supply environment resulting from limited development activity is an important factor underlying our constructive view on seniors housing operations over the medium term. Meanwhile, rent growth in the sector has been elevated, with reported RevPOR (Revenue per Occupied Room) of 7% in 2023. This is expected to gradually moderate toward 4% over the next several years.

Robust revenue growth, complemented by high operating leverage (low margins), has led to strikingly buoyant same-store NOI growth.

The two largest REIT owners of seniors housing, Welltower and Ventas, experienced 2023 same-store NOI growth which exceeded 24% for their respective U.S. segments. The growth outlook for Welltower’s seniors housing portfolio remains somewhat stronger than Ventas’ following years of aggressive asset rotation, lease restructuring and focused operational improvements. Our current forecasts of seniors housing same-store NOI growth for Welltower and Ventas is 15-23% and 12-16%, respectively, through 2026.

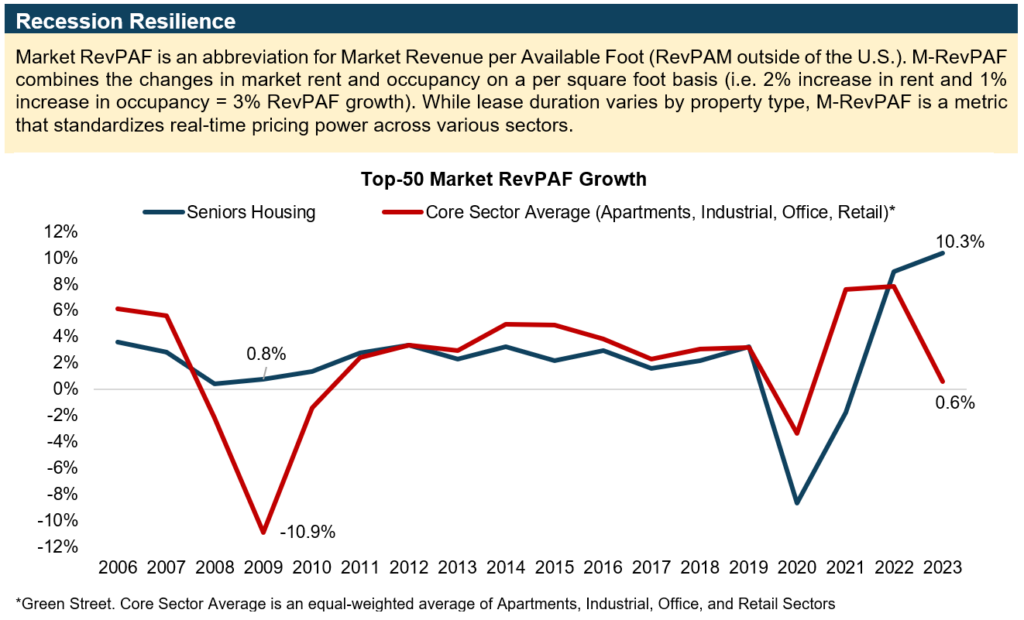

Healthcare is seen as a needs-based property sector where demand activity is driven more by demographics than by economic cycles.

Accordingly, seniors housing demand appears to have a limited relationship with macroeconomic shocks.

Life events are agnostic to market cycles, and seniors housing has historically displayed recession resilience. During the GFC, seniors housing market rents and occupancy barely broke its trend, unlike the sharp drops in market rents and occupancy seen in other property sectors.

The Covid pandemic proved to be a glaring exception to seniors housing stability, but in the absence of regulatory restrictions on tenant move-ins, seniors housing should provide stability in periods of economic turmoil.

The restructuring of leases during the pandemic has incentivised seniors housing operators to work collaboratively with property owners to improve operating efficiencies.

Because operators in the new lease structures are remunerated based on property level profitability targets rather than just collecting a percentage of revenues as had been the case previously, there is a more intensive focus on all aspects of property level operations.

Exiting the pandemic, there has been a clear move toward industry best practices regarding leasing, rental rate changes, staffing, and a variety of back-of-house operations. It is early days in this process, and thus far, it remains more hope than proven practice.

Concentrated ownership and aligned operator interests are causing an objective assessment of longstanding industry practices. For instance, a property’s rental profile could be enhanced if room rates were not set uniformly across a property as they commonly are today, but if they instead reflected various amenities and enhancements.

This logic suggests a room with a superior location (premium view, proximity to common areas, etc.) should command a higher rent than an inferiorly located room. We think there is opportunity for the industry to advance beyond pricing units as a utility for seniors and more as a crucial amenity for seniors.

Best practices will also likely include taking a more strategic approach to timing rent reviews. Whereas the industry standard currently is for most seniors housing operators to reset rents on January 1st, this is a seasonally slower leasing period following the holidays when fewer people move.

Multifamily operators learned decades ago to cluster their leasing to peak seasons when demand is seasonally stronger. We expect similar and other improvements for seniors housing as operators focus on improving on historic practice.

Over time, margins should benefit from strong pricing power and structural improvements to the industry as it is brought into the modern data-driven era.

Conclusion

In our view, seniors housing will continue to benefit from a recovery in occupancy and an improvement in operating margins leading to pronounced cash flow growth due to high operating leverage.

The ongoing recovery will be further bolstered by historic strength in demand stemming from the aging baby boom generation. Meanwhile, rents remain affordable for prospective tenants due to surging household net worth in the past decade.

Supply growth remains the biggest potential risk to strong operating performance, but the near-term outlook for supply is insufficient to accommodate the growth in seniors.

It will likely be several years before developers will be able to deliver adequate levels of new construction, and until then, existing landlords should experience a pricing power tailwind. For the next several years, seniors housing is uniquely positioned to provide outsized growth.

U.S. seniors housing, with REITs at the forefront, is earning a larger footprint in institutional investor portfolios. Compelling demographics underscore accelerating demand, which coupled with limited supply, is leading to NOI growth and profitability that are standouts in a broader real estate context.

Invest in global real estate with Resolution Capital

Resolution Capital provides investors exposure to some of the world's best property. The highly-rated and experienced investment team has decades of experience investing in Australian and global REITs and real assets.

The Resolution Capital Global Property Securities Fund (Managed Fund) (ASX: RCAP) can be accessed as an active ETF on the ASX under the ticker RCAP.

More information: (VIEW LINK)

1 topic

3 stocks mentioned

1 fund mentioned