The hitchhiker’s guide to responsible investing in fixed income

During the last few years, responsible investing has grown in scope from being a niche investment philosophy to a rapidly growing segment of global financial markets, attracting billions of dollars of capital. Global investment practices have responded to the challenges and consequences of climate change, social inequalities, and lapses in corporate governance.

Businesses that do not take environmental, social and governance (ESG) issues seriously or merely pay lip service to ESG factors, face an increasing risk of reputational damage and regulatory scrutiny1,2. This is resulting in an increasing number of investors choosing to invest in portfolios aligned with responsible investing principles.

While incorporating ESG factors into equity investing has become mainstream, there is a growing recognition among investors that responsible investing principles can be applied to fixed income securities. Traditionally seen as providing “defensive benefits, bonds can be a reliable and stable income investment, providing a relatively high level of capital stability alongside meaningful diversification from growth assets such as equities.

As an asset class, bonds are usually issued by governments and government agencies to fund public services and infrastructure, and by large corporations to fund business projects. This offers unique opportunities for investors to participate in the creation of public goods, infrastructure, and long-term corporate assets.

However, the unique features of fixed income securities present both opportunities and challenges for implementing responsible investing strategies.

Why fixed income?

Fixed income consists of bonds and other debt instruments issued by a wide range of institutions, including national and local governments, quasi-governmental bodies, public and private corporations, and large non-profit organisations. The fixed income market, encompassing trillions of dollars in global securities, presents a compelling avenue for responsible investing:

- Bonds are favoured for their inherent long-term income stream, which aligns neatly with responsible investing’s similarly durable view.

- Bondholders can wield considerably more influence over corporate behaviour compared to shareholders with voting rights. The covenants embedded within bond contracts can be used to urge issuers to adopt sustainable practices.

- Sustainable bonds, green bonds and social bonds allow investors to back critical societal projects including affordable housing and renewables.

- The fixed maturity profile of bonds offers investors a clear timeframe to be able to assess and measure impact, increasing the accountability and transparency facets of such instruments.

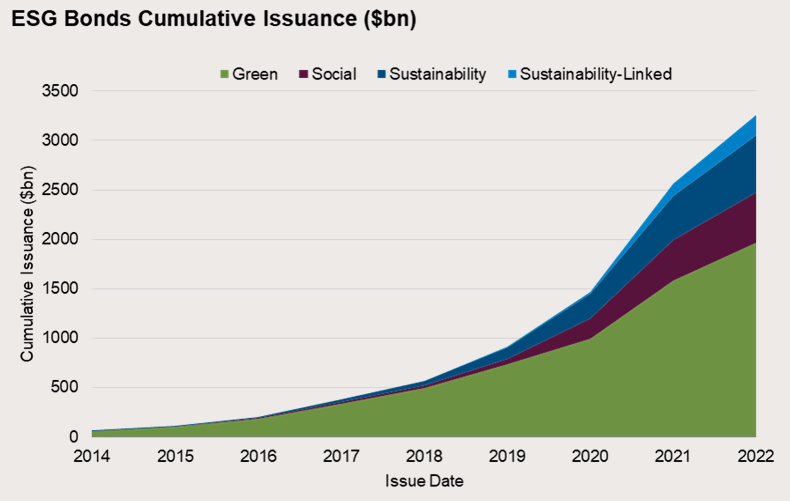

Since the first green bond was issued in 2007-083, the ESG bond market has grown exponentially. Issuance of ESG bonds has grown over the years, with total cumulative issuance passing the US$3 trillion mark as of 30 September 2022, which is only about 3% of the global bond market4,5.

Shades of green – demystifying the types of sustainable bonds

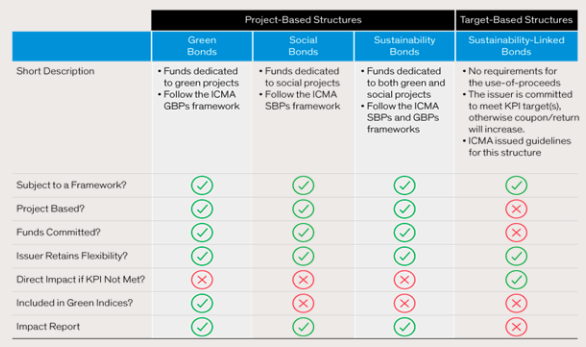

Green bonds

Green bonds are bonds where the use of proceeds is ring-fenced to finance or re-finance projects promoting progress on environmentally sustainable activities. Examples of projects that could be classified as eligible use of proceeds include renewable energy, energy efficiency, clean transportation, green buildings, wastewater management, and climate change adaptation.

Social bonds

The proceeds of social bonds, as the name suggests, must be used to finance, or refinance social projects or activities aimed at achieving positive social outcomes or addressing social issues. Food security and sustainable food systems, socio-economic advancement, affordable housing, access to essential services, and affordable basic infrastructure fall within this sub-segment of sustainable bonds.

Sustainability bonds

Sustainability bonds are bonds where the proceeds are used to finance or re-finance a combination of green and social projects or activities, rendering these securities a blended version of green and social bonds.

Sustainability-linked bonds

Sustainability-linked bonds are bonds linked to the achievement of climate or environmental goals, through a covenant tied to the coupon (interest rate) on the bond. Progress, or the lack thereof, towards the specified goals, could result in a decrease or increase in the bond’s interest rate, thereby incentivising or penalising the issuer.

ESG bonds landscape

Source: AllianceBernstein

Note: KPI denotes key performance indicators; ICMA denotes International Capital Markets Association; GBP denotes Green Bond Principles; and SBP denotes Social Bond Principles

Equities vs bonds – unpacking the ESG dynamics

While the principles supporting responsible investing are applicable across various asset classes, the nuances of implementing these principles in equities and fixed income are quite different. Here’s a closer look at the differences:

Responsible Investing: Equities vs Fixed Income

| Point of difference | Equities | Fixed Income |

| Investment vehicle | Public or Private businesses | Public or Private businesses, Sovereign, Supranational and Agency issuers (SSA) |

| Ownership status | Shareholders with voting rights | Bondholder with covenants |

| Time horizon | Indefinite – equities can be held indefinitely, allowing for a long-term approach to influence ESG strategies within a company. | Defined maturity – bonds have a set maturity date, providing a specific timeframe for any ESG impact. |

| Engagement | Equity investors can exert influence through proxy voting and shareholder resolutions. | Bond contracts can include clauses enforcing ESG actions, offering a different form of influence. |

| Capital allocation / Use of proceeds | Equity investors implicitly support a company’s capital allocation decisions including any ESG initiatives. | ESG-linked bond issuances contain use of proceeds criteria linked to specific ESG use cases. |

From green bonds to grey areas: The challenges of incorporating ESG in fixed income

Fixed income, unlike equities, is a diverse and somewhat fragmented asset class — spanning corporate bonds, sovereign, government-related, and securitised bond issuances. Getting ESG right relies heavily on transparency, standardisation, and access to quality data. Three key challenges present themselves here:

- Coverage: Publicly listed companies have good coverage of ESG data and metrics and to a certain extent, this data can be transposed to carry out ESG analysis at the issuer level for corporate bonds. However, in the context of other bond issuances including private debt, sovereigns, and government agency debt, data coverage can be poor or nonexistent6. While data coverage is steadily improving, it is barely keeping pace with green bond issuances.

- Approach: ESG considerations in corporate credit differ from sovereign bonds – the first sub-segment is associated with companies, while the second is more complex as it relates to governments. The source of ESG-related information in sovereign debt is typically different from corporate credit. Furthermore, the consideration of ESG criteria to analyse countries is often different for developed vs emerging market sovereigns.

- Standardisation: Governments across the world are developing sustainable finance taxonomies. Europe has taken the lead towards standardisation of green bond terminology through its adoption of the EU Taxonomy framework, while Indonesia is considering including financing of coal-fired power plants in its sustainable finance taxonomy7. Furthermore, the use of proceeds reporting and impact data for sustainable bonds has been hard to monitor and aggregate for portfolio-level reporting.

- There are several reasons for this: issuer impact reporting may not be necessarily aligned with financial reporting timeframes, the use of bespoke metrics and methodologies makes aggregation challenging, and there are difficulties around the attribution of impact to a specific bond. Variable reporting and a lack of common terminology and metrics can make it hard to measure impact and compare investments8.

Looking ahead – returns and responsibility, the future of fixed income investing

A responsible approach to fixed income securities, accounting for ESG risks and factors, can support an investor’s financial and sustainability objectives. While this trend has been gaining momentum during the last few years, there is still work to be done to refine what this means in practice.

Fixed income markets encompass a wide range of issuers and instrument types. While the basic principles of a responsible investment approach remain consistent across them, the practical implications tend to be different. Much of this is down to the availability of good quality data which is still more accessible at a corporate level. Overall, investors are still at the beginning of their journey concerning integrating a responsible investment approach into fixed-income portfolios.

As investor practices evolve, the focus on ESG risks and sustainability factors could provide investors with further opportunities to build portfolios targeting both financial and sustainability goals with greater precision, resulting in better outcomes for all stakeholders.

The Betashares Sustainability Leaders Diversified Bond ETF – Currency Hedged (ASX: GBND) aims to track the performance of an index (before fees and expenses) that comprises a portfolio of global and Australian bonds screened to exclude issuers with material exposure to fossil fuels or engaged in activities deemed inconsistent with responsible investment considerations (other than sovereign bond issuers).

At least 50% of GBND’s portfolio is made up of “green bonds” (using the definition applied by the Climate Bonds Initiative), issued specifically to finance environmentally friendly projects.

References

1. (VIEW LINK)

2. (VIEW LINK)

3. (VIEW LINK)

4. (VIEW LINK)

5. (VIEW LINK)

6. (VIEW LINK)

7. (VIEW LINK)

8. (VIEW LINK)

3 topics

1 stock mentioned

1 fund mentioned