The holy grail of high growth assets

In today's investment landscape, where portfolio diversification is a standard strategy, the demand for high-growth assets to enhance overall performance is increasing. However, identifying reliable structural stories (with low variability in outcomes) poses a significant challenge, as many tend to be short-lived or deliver inconsistent returns over the long term. Securing a high-growth asset that consistently performs well and offers robust statistics to complement a diversified portfolio is becoming increasing scarce / narrow.

Performance

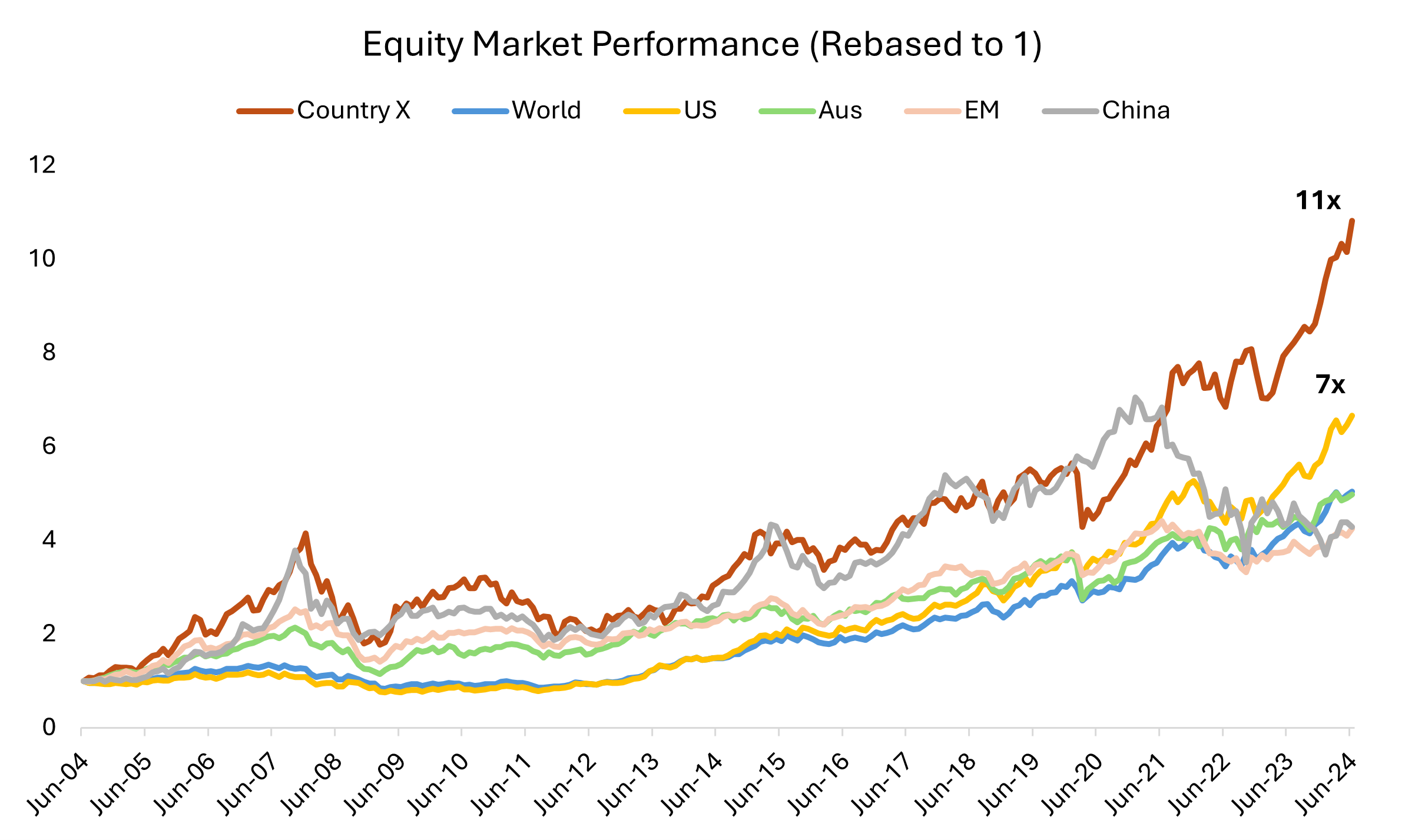

When investors think about which country to allocate funds to maximise growth on a long-term basis, the US is at the forefront of every investor’s mind. Until recently, China also stood out as a prime destination for high-growth investments, following an impressive decade from 2010 to 2020. However, beyond the radar of many mainstream investors lies a country that has not only outpaced the U.S. over the past 20 years but has also matched its Magnificent 7 propelled returns. Introducing Country X — a region that has consistently delivered superior returns, even during the peak performance periods of other nations. Over the last two decades, Country X has achieved an 11-fold increase in growth, leaving the U.S. trailing with a comparatively modest 7-fold growth.

Statistics

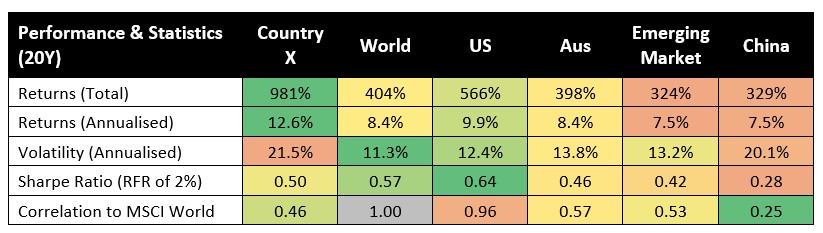

As pure performance alone lacks the complexity and dimensions needed to determine an asset’s viability in a portfolio, a more comprehensive analysis of statistical measures offers deeper insights. When comparing Country X to other regions, several key observations emerge:

- Country X boasts the highest annualised returns compared to other countries and regions.

- Country X also exhibits the highest annualised volatility among its peers.

- Country X ranks 3rd in its Sharpe Ratio relative to other regions (US and World are basically an overlap in any case).

- Additionally, Country X has the 2nd lowest correlation to global equities.

When

analysing the data, Country X emerges as an optimal high-growth asset,

offering significantly higher returns while maintaining a competitive Sharpe

Ratio compared to other countries and regions. Furthermore, its low correlation

to global equities makes Country X an ideal addition to the global

equities’ component of a diversified portfolio.

Rolling Returns

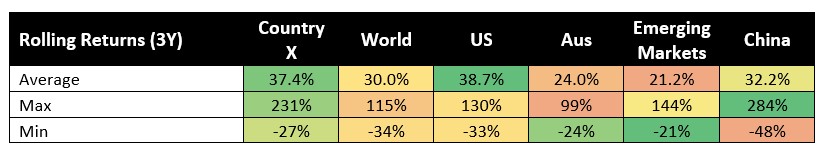

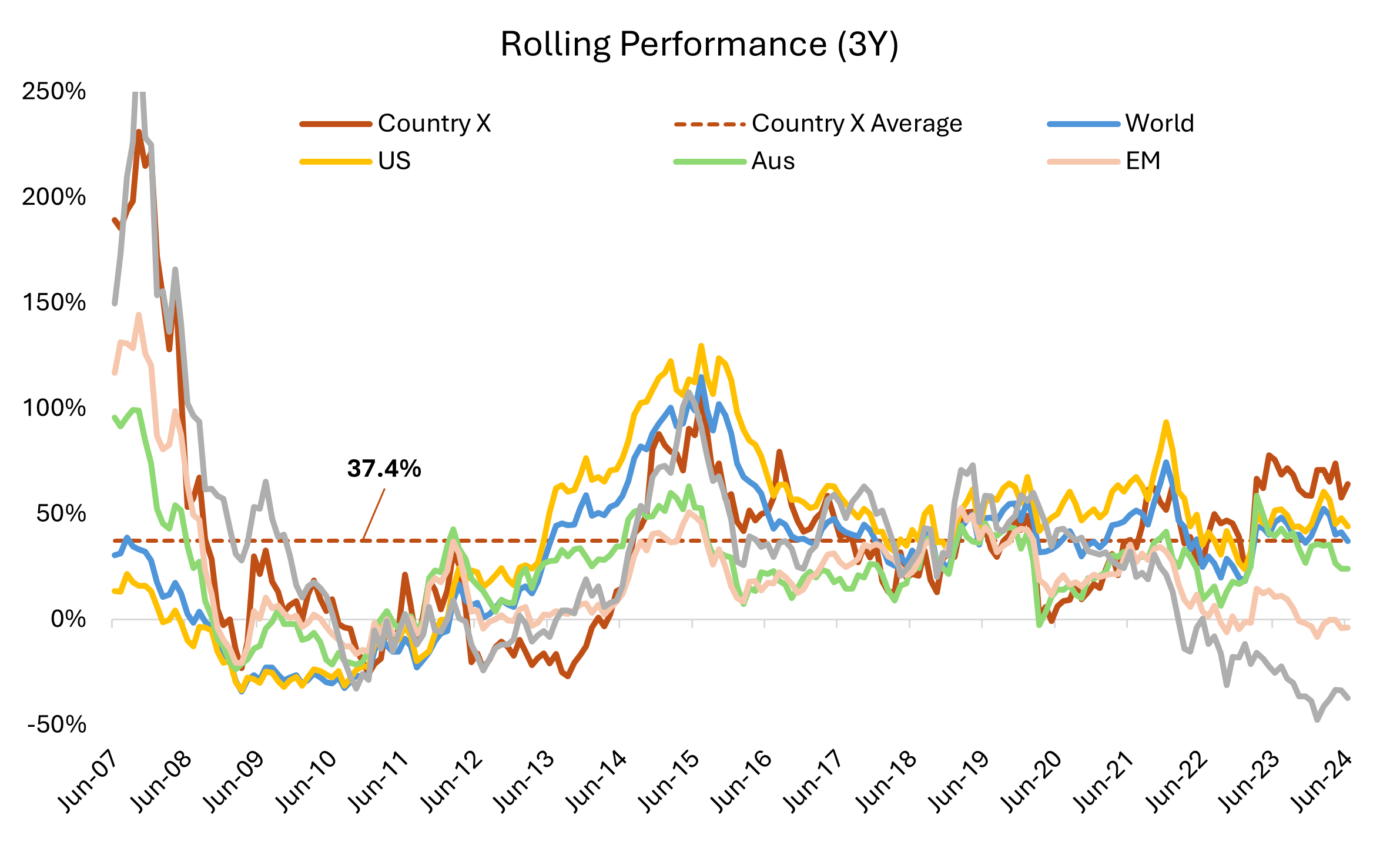

When dealing with higher-risk assets, investors typically adopt a longer time horizon. To account for this, we conducted an analysis of rolling 3-year return statistics, comparing Country X to other countries and regions. The findings reveal:

- The consistency of Country X’s rolling performance, having the 2nd highest average rolling 3Y returns.

- Country X having the 2nd highest maximum 3Y rolling returns, rewarding long-term investors.

- The reduction of risk as we increase the horizon for Country X, with its minimum 3Y rolling returns at -27%, the 3rd highest despite having the highest volatility on an annualised basis.

Overall, Country X’s performance, statistical metrics and rolling returns demonstrate its robustness as a high-growth asset that is able to complement other equity allocations in an existing portfolio. While this may seem too good to be true, the country in question is indeed real — India.

What about Alpha

With India’s equity market fitting the bill of a perfect high-growth asset, one must ask if it's best to gain exposure through passive or active investment. As we can see below, not only does the average Indian fund manager generate a much higher alpha, but India also has 3 times as many fund managers who are able to outperform the benchmark relative to the US and Australia.

Unlike most developed markets, there is sustainable value addition from active investing in India over long-term periods due to factors such as information asymmetry, high corporate ownership held by founders, low coverage of mid/small-cap stocks, rapidly developing addressable market and an improving corporate governance framework across public companies.

For investors seeking to partake in India’s high-growth narrative, having exposure through active management provides an enhancement of performance on top of an already robust return profile.

5 topics