The impact of Covid-19 on Private Equity Markets

In a recent webinar hosted by Grosvenor Capital Management for the Right Issue Offer in the Pengana Private Equity Trust, the team provided insight into why (and how) Private Equity markets are ideally positioned to benefit from times of market dislocation.

The impact of COVID-19 on financial markets has been profound and, in most cases, has negatively impacted the value of assets and investment opportunities. However, as is the case in every major market disruption, some asset classes weather the storm better than others, with some ideally positioned to benefit from the dislocation. We believe Private Equity (“PE”) is such an asset class.

In general, private investments tend to be better insulated from overreaction caused by panic as PE managers do not have to respond to mass shareholder demands, and so are not worried about people trying to sell out of their fund/company, thereby affecting their share prices.

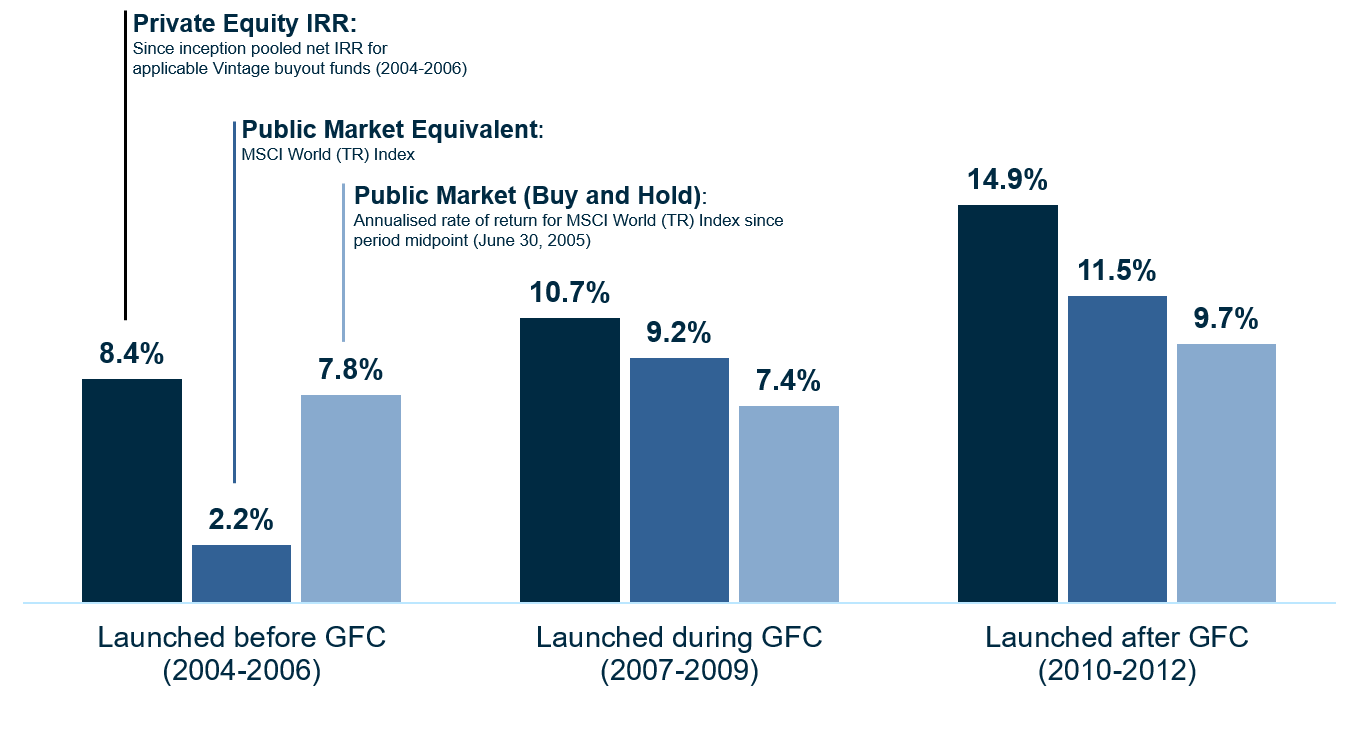

We also believe PE as an asset class is well placed to generate strong returns in the aftermath of the correction. This was evidenced in PE funds launched after the 2008 crash (in 2010-2012) which to date have returned 14.9% p.a. compared to the MSCI World public market equivalent which has returned 11.5% p.aa.

The current dislocation should create a similar abundance of high-quality opportunities for strong private equity managers who specialise in particular sectors and understand market dynamics.

Investors will be better positioned to weather the current crisis, and more likely to see excess returns over the long term, if they are partnered with cycle tested managers who have proven their ability to be successful over multiple economic cycles, and who have the appropriate levels of diversification in their portfolios.

As private equity assets are typically valued quarterly in arrears, the latest available valuations are as at the end of March - the time of peak uncertainty in the markets. In Q1 public markets fell precipitously with the S&P and Russel 2000, ~20% and ~30% respectively and, while PE is not perfectly correlated with listed equity markets, we expect March valuations to be substantially lower. However, PE is unlikely to fall as much as public equity markets and the quarterly valuations provided by PE1’s managers confirm that this has been the case.

As we see valuations reduce, we expect to have a greater ability to negotiate better deal terms. We also expect the pace of fundraising to decline for a short period of time as managers assess their existing portfolios to make sure they are sound, and then look for new opportunities as valuations are reset.

Private equity in different environments

If we look at pooled returns for funds formed across different market environments (before, during and immediately after the global financial crisis), not only does private equity hold its outperformance versus the public markets during a crisis, but it also continues to perform post crisisb.

We can debate exactly where we are in the environment at this point in time, but given the evergreen nature of our Trust, and the fact that it currently has so much capital left to invest, we believe PE1 is more likely to resemble the right side of the graph than the left, as it takes advantage of new opportunities that present themselves.

One other item to consider is that the dispersion in returns across Private Equity managers is much greater than what is illustrated on the above chart when investing with upper quartile performing managers.

We anticipate an increase in the value of our underlying investments over the coming months as valuations are updated to reflect the period post-March, where we have already seen a rebound in a number of them.

The full webinar is available HERE

5 topics

1 stock mentioned