The income opportunity that has been 15 years in the making

For a decade and a half, asset allocation was ruled by one acronym. TINA - or "There is No Alternative" - argued that equities were the only place to gain income and growth given central banks held then cut rates to near-zero levels. But 2022 changed all that.

Rapid rate hikes sent yields sharply higher. For the first time in 15 years, spreads and yields are competitive in both the government and corporate debt markets.

While rising rates weeds out the possibility of lower quality debt being issued, it also comes with the increased risk of defaults and a US-led recession. That's where a fund built on stability and consistency comes into play.

The NB Global Corporate Income Trust is designed to seek competitive yields without exposing its investors to unnecessary default risk. It does this by avoiding the hype (new issuances), sticking to high quality bonds (BB-rated or higher), and keeping a global mind when it comes to potential opportunities.

To discuss what's in the trust, the ideas it's finding right now, and the risks it's trying to avoid, I spoke to Joseph Lind, the senior portfolio manager and co-director for US High Yield at Neuberger Berman.

About the NB Global Corporate Income Trust

- Name of the fund and ASX ticker: NB Global Corporate Income Trust (ASX: NBI)

- Asset Class: Fixed Income, specifically corporate credit

- Year listed and size: Launched September 2018,

- Investment objective: Providing investors with a stable and consistent income stream with exposure to the high yield bonds of large and liquid companies globally.

- What is your strategy? Strong emphasis on capital preservation by focusing on credit quality.

Performance Chart

All about the fund

LW: How does your fund fit into the average investor's portfolio?

Lind: The trust provides investors with exposure to the high yield bonds of large and liquid companies globally, which we believe may be an attractive investment solution for investors seeking stable and consistent income.

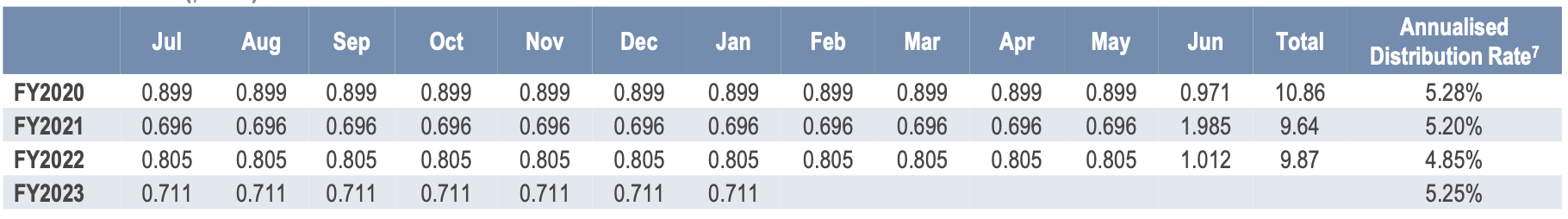

Distributions are paid out monthly. The table below shows the fund's historical distributions including the last severe downturn in 2020 where distributions to investors remained stable. The fund also increased its distribution rate earlier this month.

LW: What is the biggest opportunity and most pertinent risk facing your fund?

Lind: The fund provides an opportunity to participate in the global high yield bond market, actively managed by one of the largest, and most experienced global credit teams in the industry providing durable income, potential for attractive total returns and broad diversification from an issuer and geographic standpoint.

Pertinent risks would include recessionary conditions, more persistent than expected inflation in the U.S. or globally as well as the degree of openness of capital markets for refinancing Non-Investment Grade debt globally.

LW: What is unique about your investment process?

Lind: We have one of the largest global credit research teams in the industry to drive a bottom-up security selection process which narrows our portfolios down to best ideas. We utilise a proven framework to govern our research process, a system which was first put in place approximately 25 years ago.

Our rigorous research process allows us to seek competitive yield without sacrificing the default profile of the portfolio. We have achieved a track record of outperformance relative to the global high yield market and have demonstrated success in default avoidance relative to the market over short- and long-term timeframes.

About the Asset Class

LW: Are corporate fundamentals entering this economic downturn in a good position?

Lind: Fundamentals for the high yield market remain healthy and are starting this period of rising interest rates and slower growth with solid fundamentals. We can see this in the high-teens EBITDA growth, near-record high interest coverage and average leverage ratios across the Fund.

The default outlook for the high yield market (based on our bottom-up analysis) for 2023/2024 is below average to average, even assuming a mild recession.

This outlook is based on our bottom-up assessment of issuers, and driven by the higher-quality ratings mix in global high yield (over 50% of issuers with credit ratings of BB), less aggressive new issuance, fewer near-term maturities, as well as an energy sector that is far healthier than in the past few cycles.

LW: 56% of the portfolio is listed in the United States. How do you see a U.S.-listed recession impacting balance sheets in your portfolio?

Lind: In recent years, the high yield market has seen less aggressive new issuance, and is currently comprised of over 50% BB-rated issuers. The highly accommodative capital markets environment of 2021 allowed high yield issuers to term out their capital structures at a low cost of capital.

As a result, the favourable maturity profile of the high yield market is providing issuers with plenty of time to adjust to any challenges without the need to refinance maturities. Therefore, there are few near term maturities following two consecutive years of all-time record new issuance in 2020 and 2021.

Also, in aggregate, issuers have higher interest coverage and around average leverage, so the overall market is in a good position to weather a U.S. recession, if this occurs. We are projecting a 2–3% default rate in the US High Yield market during 2023, which is in-line with or moderately below the long-term average of approximately 3%.

LW: How has the opportunity set changed in the high yield market - and how do you expect it to evolve?

Lind: The structure of the high yield market has materially improved over the past 15 years. The percentage of BB-rated issuers has almost doubled since the Global Financial Crisis, while the percentage of CCC-rated issuers has declined significantly. New issue trends have also been constructive, with the use of proceeds for the majority of new issuance being directed toward refinancing with a greater skew toward higher quality ratings than in past periods of rising defaults.

We believe these trends have structurally lowered the default outlook for the high yield market, particularly relative to the 2001-2002 and 2008-2009 time period where these metrics were materially weaker.

In the recent market volatility, we are finding attractive income and total return opportunities in high yield. That said, we remain vigilant in mitigating credit deterioration and seeking to avoid default risk.

LW: Are you concerned about a rise in defaults? How do you mitigate that risk?

Lind: We expect defaults in the high yield credit market to increase from the exceptionally low levels experienced over the past 24 months, but to still remain in line with long-term averages and well below levels realised in past recessionary periods.

While above-trend inflation, higher interest expense and a slowing economy will likely be headwinds, high yield issuers are broadly well-positioned to navigate the current environment. As a result, our bottom-up default estimates for 2023 (2%-3%) and 2024 (3%-4%) resemble more of an average default year than the spikes experienced during prior recessions.

The Non-IG Credit team’s forward-looking default estimates are derived from a bottom-up process, which is conducted across the entire universe of approximately 900 U.S. High Yield issuers and 800 Developed and EM Market High Yield issuers. The credit research team utilises its sector and issuer-specific knowledge and expertise to identify issuers where a default is expected. The analysis of bottom-up factors such as industry, business profile, leverage, cash flow, liquidity and maturity schedule are fundamental to the process. This is in contrast to frequently used methodologies that rely on top-down assumptions and market trading levels to estimate forward looking defaults.

Our bottom-up approach to estimating defaults leverages our team’s credit research capabilities, and, in our view, provides greater depth and insight into the subject.

Under the hood of the fund

Although the fund has investments in more than 300 companies and tens of countries, only 0.1% of the fund is actually in Australian companies.

LW: Your fund has literally hundreds of holdings, with the largest weighting being just 1.5%. Are you concerned that you are too diversified to capture the upside of businesses that do particularly well?

Lind: In our view, diversification across credit ratings, regions and sectors is an appropriate and prudent approach to actively managing high yield portfolios. To put it in context, there are around 1,700 issuers in global high yield and the fund holds 369 issuers or approximately 22% of the available investable universe, which we believe provides ample room for security selection benefits.

Lind: We are looking to continue to rotate selectively into higher quality BB's and B’s (specifically rising star and next-up candidates) where prices remain attractive to underlying fundamentals and default expectations are low.

We think some of the dollar price discounts on selected BB and B issuers will provide an incremental 50-100 basis points of total return to investors versus the published yields on these instruments.

Our plan is to remain neutral duration relative to the index, centre the portfolio primarily around BB and B credit risk and position to be overweight in sectors that we view as resilient in the current environment such as telecommunications and services while underweighting sectors which may struggle such as retail and consumer goods.

LW: Could you provide the thesis behind a recent inclusion or high-conviction idea.

Lind: American Airlines (NYSE: AAL)'s BB rated bonds are a high conviction and top-10 holding in the fund. We recently added to the holding, specifically to bonds that are tied to the American Airlines loyalty mileage program which derives cash flows from consumer spending and general credit card purchasing trends primarily in the U.S.

As demand for air travel continues to improve, AAL management reiterated that they are on track to reduce debt by $15 billion by 2025 and have repaid over $8 billion to date since debt peaked in 2Q21. We are confident that the AAL issuer will show improvement, and also that the

specific structural advantages of the mileage program bonds that we purchased will generate stable income for our investor base.

Focus on downside protection

Investing in the Neuberger Berman Strategic Income Fund provides access to a diversified, multi-sector fixed income strategy that seeks high income and an attractive total return from flexible sector and intra-sector asset allocation across global fixed income markets. Learn more below.

3 topics

2 stocks mentioned

1 fund mentioned

2 contributors mentioned