The inflation hedge trading at a 23% discount

Property assets have been swept up in this year’s sell-off. On the face of it, it’s easy to see why. When rates go up, property assets get hit hard because property values go down and borrowing costs increase.

Global Real Estate Investment Trusts (G-REITs) haven’t escaped, with the FTSE EPRA NAREIT Developed Rental Index, Net (AUD Hedged)-29.0% this year.

But we’ve been here before.

In 2013, Fed Chair Ben Bernanke signalled an earlier-than-expected taper to the quantitative easing. It sent the the FTSE EPRA NAREIT Developed Rental Index, Net (AUD Hedged) Index falling 15.4% from its peak on May 21, 2013 to its 2013 low in September, 2013. Yet, the index bounced back to hit record highs in 2014.

Will the same happen this time around? Justin Pica, Global Portfolio Manager at CBRE, believes the decline in REIT prices is unwarranted. Rather, he argues that the asset class has appealing long-term fundamentals that make it well-suited for today’s outlook.

Pica runs the UBS CBRE Global Property Securities Fund. The Fund is an actively managed strategy investing in a portfolio of real estate equity securities across a range of geographic and economic sectors.

In this wire, Justin explains the reasons behind the sell-off in REITs, why this is unwarranted given the strong fundamentals, and also how REITs are uniquely positioned to hedge against inflation.

Why have G-REITs declined?

It’s a mistake to singularly associate market momentum with growth momentum. Indeed, today’s market is still driven by momentum, and lots of it. The only difference is that momentum has inverted.

This momentum, driven by inflation and the rate hikes that follow, has been bad news for REITs.

“When interest rates rise rapidly in a compressed time-period, real estate stocks have typically struggled,” says Pica.

This has been driven by lower economic and market growth expectations.

“Higher inflation, higher energy prices, a hiking cycle and the expectations around it, and let’s throw in a war in Europe to wrap it up."

However, Pica believes that the decline in prices is unwarranted.

“The appealing fundamentals that sit behind this make it attractive in the current market: the contractual nature of leases, steadily growing income, consistent dividends and a little bit of capital appreciation as well.”

It’s also important to underscore that REITs are not bond proxies.

“In the last 20 years, they’ve had a +0.3x correlation with global bonds. They’ve outperformed global bonds by 500 basis points annually over the last 20 years.”

Inflation play

REITs historically perform well during inflationary environments due to their capacity to pass on CPI increases via rent hikes.

“When looking at past hiking cycles, REITs have seen high teens total returns after the kick-off.”

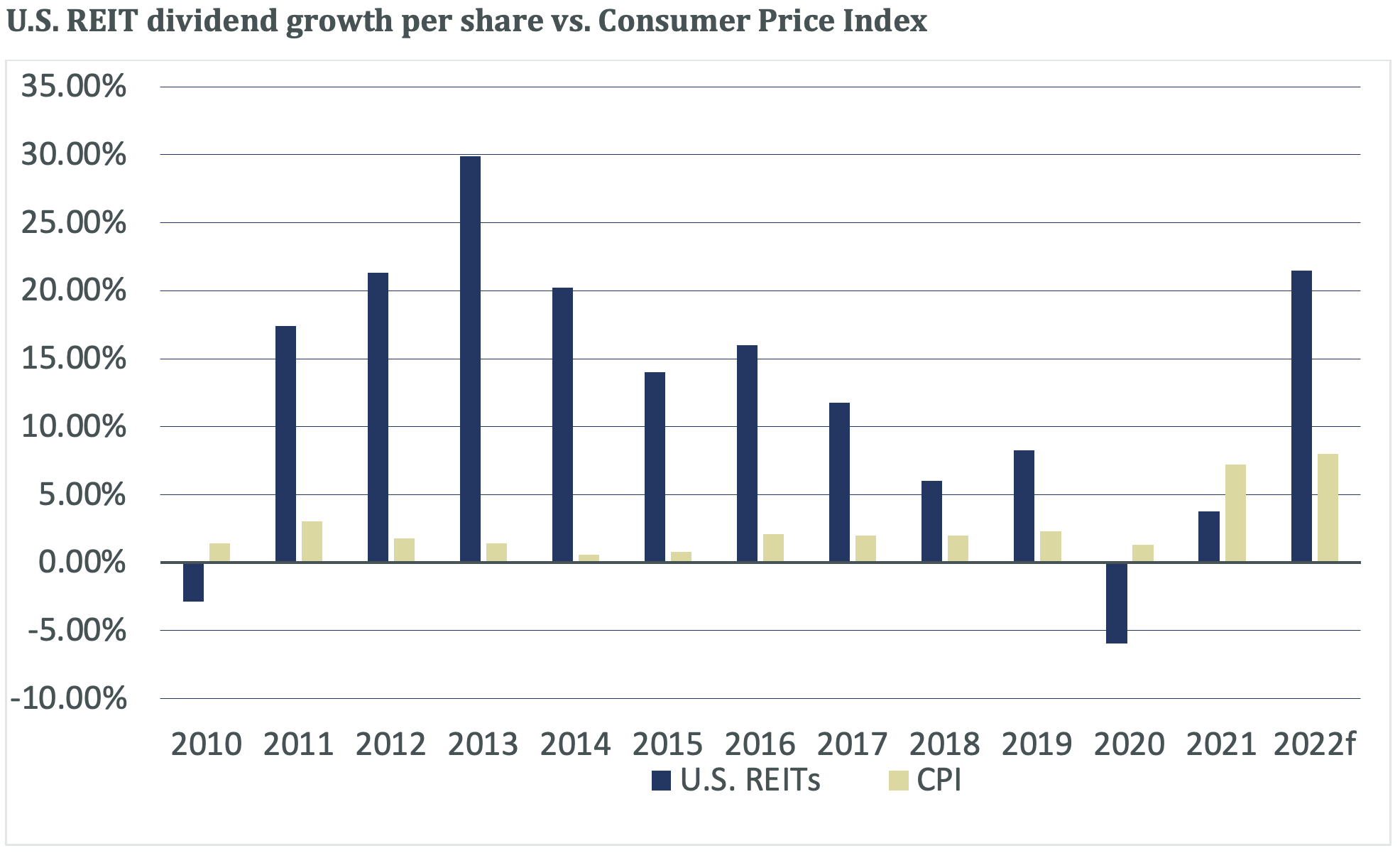

According to this chart from CBRE Investment Management, between 2010 and 2021, REIT income has outpaced inflation in nine of the past twelve years.

Sources: CBRE Investment Management as of 09/30/2022. U.S. Real Estate: FTSE Nareit Equity REIT Index and CBRE Investment Management, Consumer Price Index. “f” represents forecasts. An index is unmanaged and not available for direct investment. Past performance is no guarantee of future results.

“Unlike bonds, real estate is inflation protected with growing income streams,” says Pica.

Long-term leases typically have rent escalators built into the contracts, whereas short-term leases provide landlords with the opportunity to increase rent from one contract to the next.

Moreover, pricing power is currently at unprecedented levels.

"Prologis (a REIT based in San Francisco) has told us in their most recent reporting period that there is a >60%% gap in under-renting in their portfolios. The in-place rents they're receiving is 60% less than the marked-to-market value of those rents. In other words, they have tremendous cushion to continue to grow their average pricing."

For REITS, this translates into stable, growing, and attractive dividends.

“Forward FY23 yields in our G-REIT universe are around 4.7%, and dividends are growing at 10% per annum. That’s well ahead of inflation and is supported by cashflows.”

A place of strength

Pica says CBRE's G-REIT earnings expectations for 2022 remain healthy at +10%, up from 8% in 2021.

"The bottom line is that even assuming a recession for 2023, our earnings growth estimates will remain positive and very likely be in the mid-single-digit range," says Pica.

"We're in a better position than we were pre-COVID and we're in a better position than we were pre-GFC."

Why?

Balance sheets, for one, are in good shape.

"Learning valuable lessons from experiences during the Global Financial Crisis, REIT management teams have their balance sheets in better condition than ever."

REITs are seeing stronger cashflows, which provide a higher level of debt serviceability as interest rates rise, less debt maturing near-term versus previous cycles, and a greater capacity to fund rising dividends.

What's more, these companies are trading at a 23% discount to asset value.

"Traditionally, these levels of valuation discounts has generated strong double-digit forward returns in global REITs (of anywhere from 20-50% total returns) in 12–24-month periods," says Pica.

"This is a unique opportunity to invest in an asset class at a historic discount when fundamentals should be extremely differentiated to other asset classes."

An exceptional partnership

Uniting CBRE's position as a long-term real estate specialist in Australia and overseas, with UBS's global expertise and leadership in asset management and client service, has produced an exceptional partnership delivering quality outcomes for investors. Visit their website for more unique insights into global real estate.

1 topic

1 contributor mentioned