The insolvency framework becomes more important when the going gets tough

The normalisation of cash rates globally has seen the leverage ratios for many companies deteriorate as borrowing costs have increased. Adding to potential credit stress is the increase in cash rates which has been designed to slow economic growth and lower inflation which may result in credit conditions becoming tighter for corporations. As credit conditions become tighter the importance of the regulatory regime in which investors are lending increases given that ‘Europe’ is not a single regulatory regime.

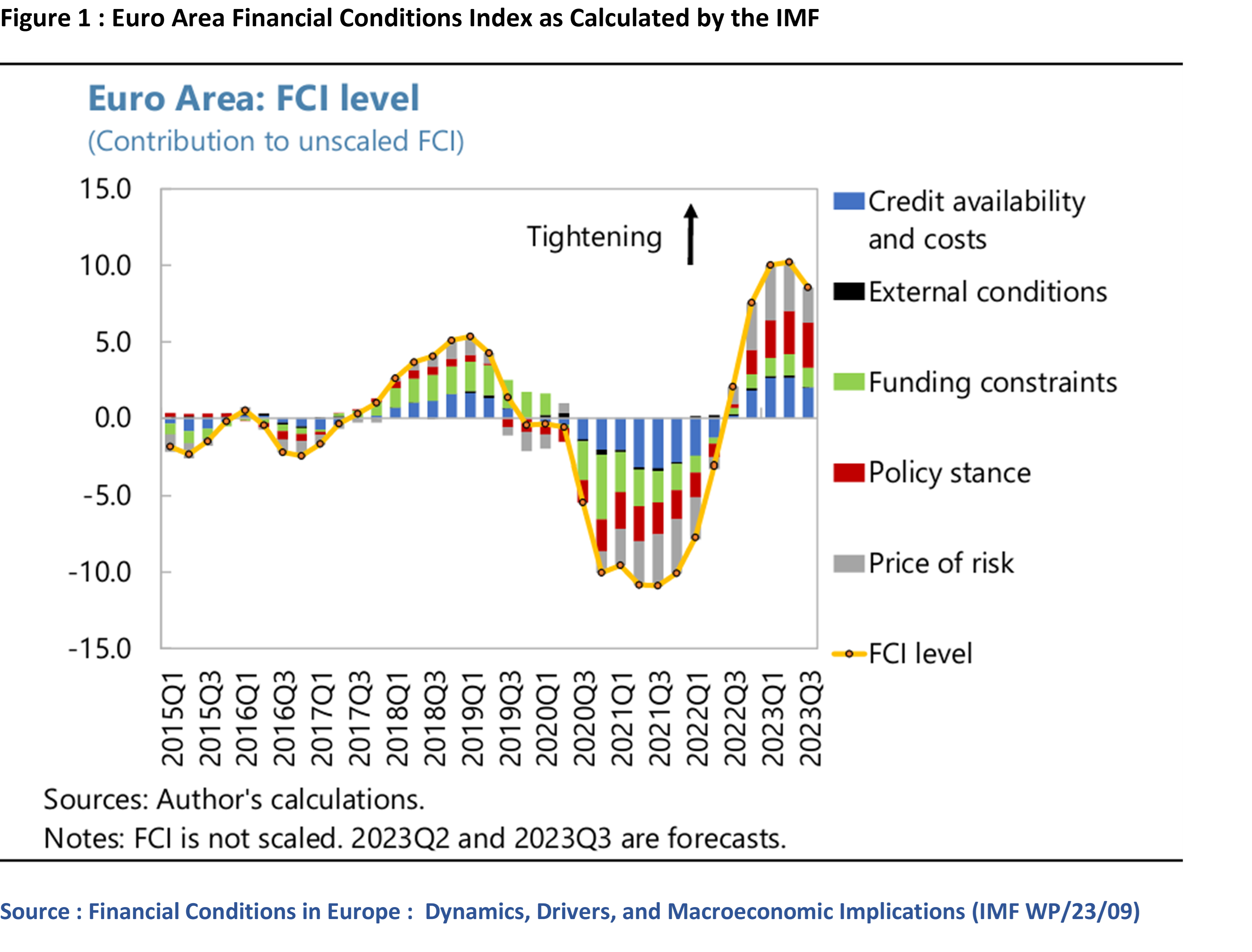

It should come as no surprise that financial conditions in Europe have tightened as central banks globally set out to ‘normalise’ interest from the lows set during the COVID impacted period of 2020-2021. A normalisation process which was itself sped up by the spike in inflation which occurred in 2022. More importantly it isn’t just the increase in official interest rates (referred to as ‘Policy Stance’ in the decomposition) which has brought about a tightening in financial conditions for companies.

The IMF’s decomposition of Financial Conditions highlights the ‘tightening’ has occurred across a range of factors including ‘Credit Availability and Costs’ and ‘Funding Constraints’ which encompass restrictions to financial intermediation. The significance is the risk of insolvency will increase as corporates not only finding the cost of accessing credit is higher but also the ability to access credit full stop is materially more difficult (blue and green bars in Figure 1).

As managing the risk of insolvency becomes more important a key consideration is the efficiency of the credit system that is being lent into. In turn, for creditors, a major consideration in determining the efficiency of credit systems is the insolvency framework which defines the procedures for dealing with insolvent debts. While the definition of insolvency will differ between regulatory regimes broadly speaking it involves the situation where an individual or business is in a state of financial distress and is unable to fulfil their obligations. Often the definition of insolvency includes reference to ‘obligations as they fall due’ but this risks overlooking that different timeframes can be utilised when determining insolvency. The inability to fulfil obligations can be assessed over the short term as obligations fall due or in the medium term where assets do not cover liabilities or both. Importantly the insolvency framework or regime operating within a country sets out the conditions for initiating insolvency procedures aimed at redressing a situation of insolvency.

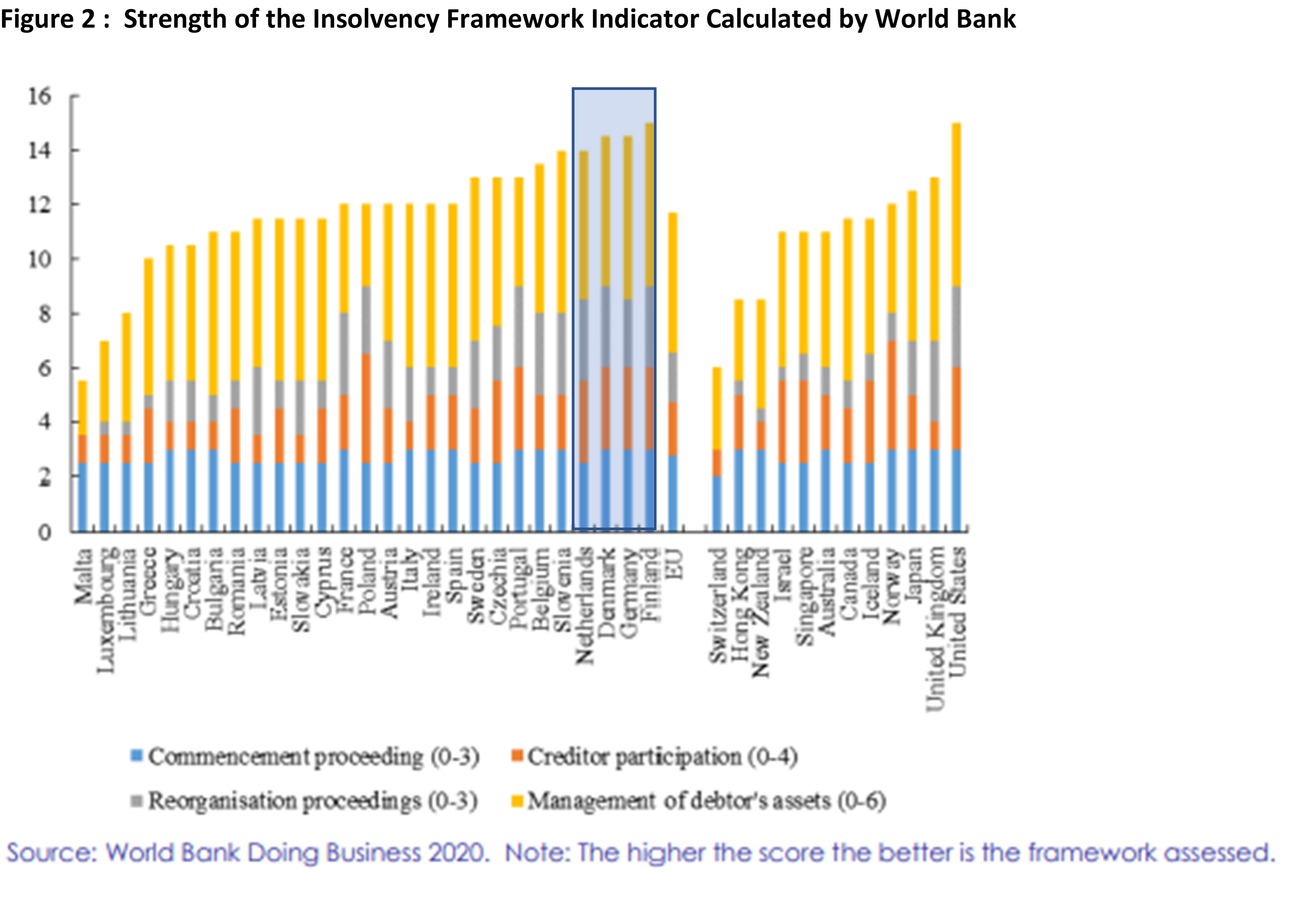

Yet determining the efficiency of an insolvency framework is less than straight forward and involves assessing a range of factors. To provide an insight into what factors can be considered the risk assessment model utilised by the World Bank will be referenced. There are a range of key factors the World Bank considers when assessing the ‘strength’ of an Insolvency Framework of which some of the more relevant for creditors are :

- Early identification of corporate debt distress : Early identification assists in preserving the value that can be recovered by creditors.

- Availability of early restructuring procedures : Facilitates the reorganisation of corporate operations and debt restructuring as a going concerns and may yield superior returns to creditors over the piecemeal liquidation of assets.

- Availability, accessibility and affordability of insolvency procedures : Ensures that insolvency procedures are easy to start for both debtors and creditors on the basis of clear criteria.

- Allowing distressed debtors a genuine fresh start : Increases incentives for distressed debtors to work with creditors

- Clear rules on cross-border insolvency : Clarity in the way cross-border insolvency cases are handled helps with a quick and efficient resolution in the event of bankruptcy.

Fortunately, these factors have been assessed by the World Bank and brought together as a ‘Strength’ of Insolvency Framework Indicator. It is worth noting that the ‘Indicator’ applies to corporate insolvency only and so personal insolvency regimes may differ.

Notably within the assessment the Nordic countries and Germany score well above the EU average. These regions have ‘Strong’ Insolvency Frameworks which are on a par with the US and ahead of the UK.

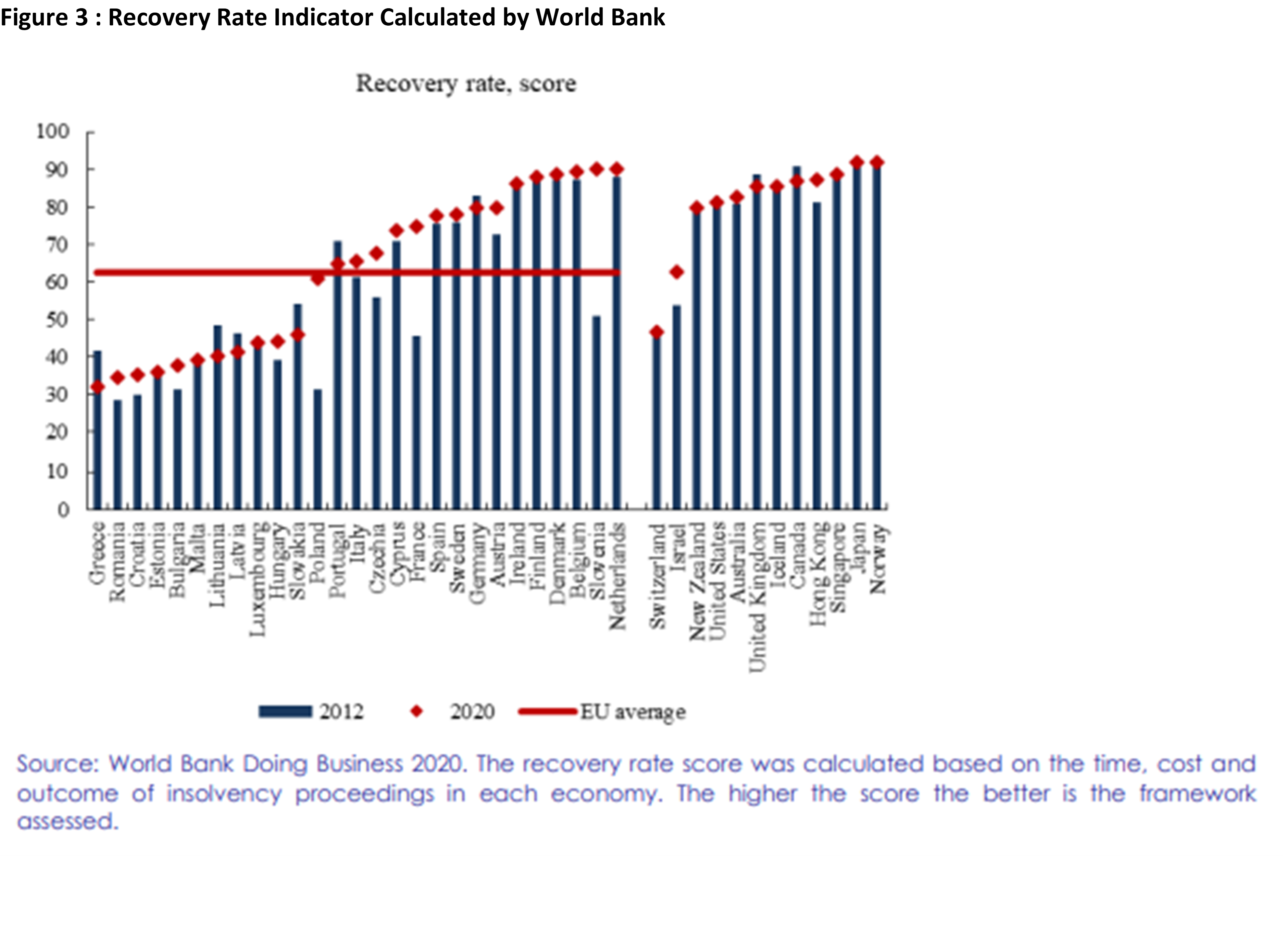

All this sounds interesting but is only relevant if it results in superior outcomes for creditors in the event of insolvency. To assess this the World Bank’s Recovery Rate Indicator will be utilised. The Recovery Rate Indicator aims to reflect the ‘effective recovery rate’ and so doesn’t just reflect the absolute dollar amount recovered but also the length of time and cost associated with the recovery.

There are several points worth highlighting when considering the Recovery Rate Scores. Firstly, those countries with ‘stronger’ Insolvency Frameworks tend to also exhibit higher Recovery Rates for creditors. Secondly, though there is a material dispersion between countries, amongst the largest European economies there has been a bias towards convergence post 2012. Most noticeable has been the improvement in France’s score in the period from 2012 to 2020. Thirdly, the Nordic countries and Germany come out as again being materially ahead of the EU Average. Finally, unlike some other countries, such as France, the insolvency environment for the Nordic countries and Germany has been stable exhibiting little change in the periods between 2012 and 2020. For creditors not just a strong but stable Insolvency Framework is important to provide confidence regarding the ability to recover on longer term loans in the event of insolvency.

Often investors focus on the type and level of collateral behind the private loans in which they are investing. Unfortunately, often overlooked is the regulatory regime as investors think in terms of a geographic/regulatory entity referred to as ‘Europe’. Yet within Europe there is a wide dispersion in regulatory regimes impacting on the ability of creditors to efficiently enforce their legal rights in the event of insolvency. While such differences can easily be overlooked during periods of buoyant financial conditions they become more important when solvency deteriorates. In such situations countries with ‘stronger’ insolvency regimes, such as the Nordic region and Germany, provide scope for higher returns via materially higher recovery rates. For investors wary of the economic outlook and its impact on the returns from private credit tilting towards such regions may provide scope for superior returns in the event of heightened insolvency rates within Europe.

2 topics

Clive Smith is an investment professional with over 35 years experience at a senior level across domestic and global public and private fixed income markets. Clive holds a Bachelor of Economics, Master of Economics and Master of Applied Finance...

Expertise

Clive Smith is an investment professional with over 35 years experience at a senior level across domestic and global public and private fixed income markets. Clive holds a Bachelor of Economics, Master of Economics and Master of Applied Finance...