The Japanification of The Global Economy: The End of Value Investing?

Hyperion

Structural headwinds

COVID-19 has wreaked havoc on the global economy, adding to a growing number of headwinds which include high levels of debt, an ageing population, technological disruption, and environmental disruption brought about through climate change.

While we expect COVID-19 to be relatively short-term, we believe these other headwinds are set to persist for an extended period. As such, we think the world is transitioning into a Japanese-style era of economic stagnation.

Since the 1990s, the Bank of Japan has engaged in aggressive balance sheet expansion and interest rate suppression to stimulate the economy, while the government issued bonds to finance economic stimulus measures.

While Japanese GDP growth was poor in the decade leading up to the GFC, aggregate corporate profit growth was strong, which enabled Value to outperform Growth as an investment style.

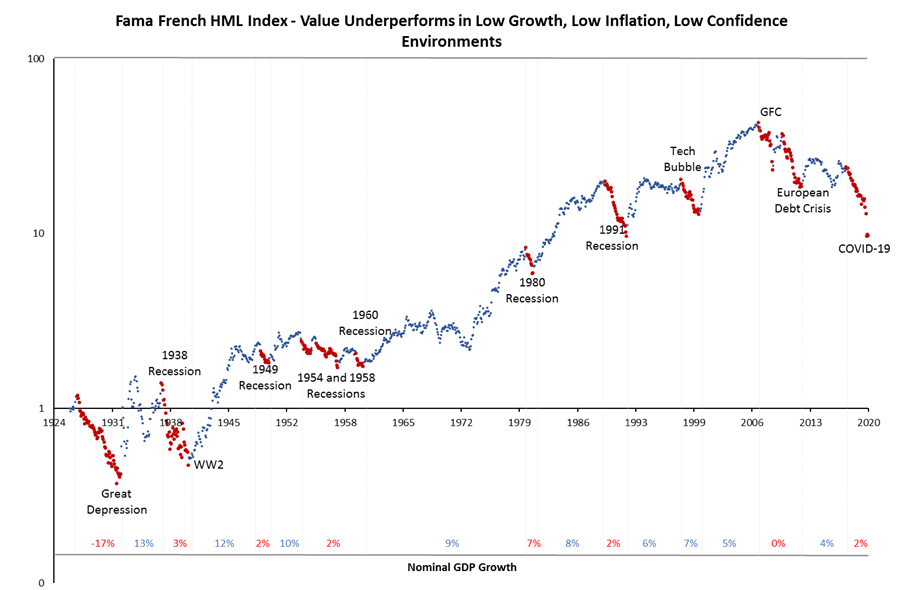

However, since the GFC Value has significantly underperformed Growth and this is primarily due to low levels of growth in both nominal GDP and aggregate corporate profits. We see this weak growth being likely to persist for the foreseeable future.

Figure 1: Value underperforms in periods of low nominal GDP growth

Source: Kenneth R. French; Hyperion Asset Management

Figure 2: Value has under-performed Growth in Japan post GFC

Source: MSCI, Bloomberg, Data compiled by Goldman Sachs Global Investment Research.

Disruptive companies of the future

With this outlook in mind, we have positioned our global and domestic portfolios accordingly to capture growth from high-quality businesses which have competitive advantages, allowing them to effectively take market share away from competitors and grow their underlying earnings irrespective of low nominal GDP growth.

Companies like Tesla and Amazon are modern businesses with strong value propositions, large and growing addressable markets and innovative cultures. Elite businesses like these are common in Hyperion’s portfolios and they are well placed to outperform in the future because they are aligned to various structural and prevalent themes. These include the shift from traditional retail to e-commerce, the shift from cash to electronic payments and the transition to sustainable energy and transport.

While some Value companies may look comparably cheap on short-term metrics, we think investors need to focus on the long-term fundamentals in order to ascertain if a stock is expensive or not. This is because in an increasingly winner-takes-all environment, under-pressure companies will likely continue to struggle in the absence of a growing economy.

Figure 3: Fama French Value and Growth – Value looks stretched relative to Growth

Source: Kenneth R. French, Hyperion Asset Management

Growth not value

Value as an investment style does not protect investors during difficult economic conditions, so while many of these businesses may look “cheap”, if you are exposed to businesses that are being disrupted and that are sensitive to economic growth rates, investors can easily lose a lot of capital.

We avoid average-quality old world businesses within industries which are in structural decline or are vulnerable to technological disruption. These include traditional retail businesses, commodity-based businesses, banks and other highly leveraged businesses.

In the end, good things happen to good businesses and while economic conditions will remain difficult overall, we believe a growth-based investment style will outperform Value over the next decade based on the likely outcomes from the Japanification of the global economy.

Having portfolio exposure to the right style and the right businesses has never been more important.

Written by: Mark Arnold (Chief Investment Officer) and Jason Orthman (Deputy Chief Investment Officer)

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

4 topics

Mark is a Senior Portfolio Manager at Hyperion. He has been a core part of the investment team since Hyperion’s inception in the 1990s and has been the Managing Director since 2019 and Chief Investment Officer since 2007. Mark has spent over 25...

Expertise

Mark is a Senior Portfolio Manager at Hyperion. He has been a core part of the investment team since Hyperion’s inception in the 1990s and has been the Managing Director since 2019 and Chief Investment Officer since 2007. Mark has spent over 25...