The lithium gravy train adds an M&A dining car

Most investment bankers I know do not have a lot of interest in rocks and likely won't get out of bed for less than 8% of at least ten million dollars, ideally a hundred million. However, the boom times of investing in disruptive technology have turned into a whole new hot mess of threats to professional service jobs from generative artificial intelligence.

In such times, it may be a good idea to learn what an LCT-pegmatite rock looks like.

LCT stands for Lithium-Caesium-Tantalum, the three primary elements associated with this form of mineralisation. There are others also, but they belong to a family of rocks that occur within granites, as the result of the melting of mica schists. The resulting deposits typically appear in so-called swarms, reflecting the intrusion of melted rock into a host rock.

Australia has a ton of prospective ground for pegmatite swarms. Furthermore, despite the scary name, it is quite safe to wander around the scrub looking for them. If you happen to locate a really good swarm it may bear a thickened pegmatite dyke. That is the paydirt.

Just don't step on a snake or run out of beer.

There is even a handy tour-guide, if the deal falls through, and you need to open a trendy shop in Byron Bay. The book was written by three doyens of Western Australian pegmatite geology. Some of these folks even run companies, so it is a good idea to look out for the names.

Suffice to say, the biggest boom of all in Electric Vehicle Battery Metals is on in Lithium. The purpose of this note is to survey the interactions between geopolitics; resource endowment; government policy; and corporate strategy. While our topic is mines and mining, the value clincher in this equation is optionality for downstream chemical processing.

I trained as a physicist, from which I learned:

After physics, it's all chemistry...

As an investor, I have had to learn a new refrain:

After rocks, it's all chemicals...

Indeed, once you have found the right rocks, it's all about the chemicals.

Read on to find out why we think that this boom has barely even started.

A Faster Energy Transition through Better Chemistry

The value of chemistry, particularly inorganic chemistry, is not widely appreciated by investors in Australia. Everybody is likely familiar with the petrochemical industry, which is built upon a huge family of products derived from fossil fuels. Perhaps because of this association, there may be a belief that chemistry is "Old Skool" and no longer relevant to our green future.

Nothing could be further from the truth.

While most ESG investors compile tick-a-box rap sheets to determine which companies they won't invest in, the energy transition is crying out for new and innovative chemical processes for the extraction, management, transformation and recycling of vital materials. Investment, not dis-investment, is the way.

The miracle of the last decade is why virtually no attention was paid to this pressing need.

China is now leading investment in the necessarily rethought process engineering of pretty much any material that goes into modern manufactures, and all future manufactures.

Whether by accident, or design, China is now successfully moving from a focus on building factories, and supplying products to Western specification, into the necessary deepening of their own domestic supply chain for the materials to keep those factories running.

Since much of the chemical industry got moved overseas, this aspect of the global industrial system is largely invisible to Western investors. Perhaps more damagingly, the reputation of chemical companies as polluters has blinded investors and policy makers on the shift in economic power that comes with knowing how to make something in the real world.

China used to worry about whether, and how soon, they might learn how to make a good car. Over time, they got there. The West must now worry about whether, and how soon, we can learn to make polysilicon, or rare earth magnet alloy, or battery grade lithium hydroxide.

The Predictable Rise of China in a Post-Petrochemical World

Almost no attention was paid to this in the West, which is why China has now assumed global leadership in a very wide array of industrial applications of inorganic chemistry. These are the key problems of our age: energy conversion; energy storage and fossil fuel replacement.

If we are to catch up, there is a great deal of investment that urgently needs to be done.

In a Western World that has become pre-occupied with trading carbon credits, China is moving forward to re-engineer entire industries on a different foundation of chemical engineering.

While this may not be comforting to acknowledge, it is the strategic fulcrum of our time.

Whereas Western economies ably rode the petrochemical age, and made strenuous efforts to control the production, processing and distribution of fossil fuels, we have simply ignored the emergence of a new global chemical industry founded in inorganic chemistry.

This has its own set of technologies, its own thrust of innovation, and its own splendid array of investment opportunities that most people have not ever heard of. These include innovations like Direct Lithium Extraction (DLE) using ion exchange resins. This method was pioneered in China and is now actively being emulated and developed by firms like Lake Resources.

Whereas the public conversation is about limiting Chinese access to Western technology, we appear to have entirely missed the need to pay attention to Chinese technology trends.

Such ideas do not play well in the salons frequented by Australian financial journalists.

However, we think that reflects naught but prejudice and ignorance, the result of too great a focus on Western leadership in glamour technologies like smart phones and semiconductors. These are vitally important technologies, but so are the mineral processing, materials science, and chemical engineering disciplines required to bring critical materials to market.

The situation can be aptly summed up in one spectacular investment theme:

The future of the energy transition entirely depends on which companies and which countries assume leadership in the chemical engineering transition: the way beyond petrochemicals. Whomever dares, will win, and some.

There is a clear historical precedent. In the nineteenth century, Great Britain led the industrial revolution in steam power, steel making, rails, ships and manufacturing. However, it was the German focus on chemistry that led to their rising power status by the end of the century.

Following the first World War, petroleum and fuel oil had established themselves as the new energy source for industry. The rich endowment of the United States of America, combined with a vibrant domestic scientific and business culture, soon gave rise to a dominant and rapidly growing petrochemical industry. Plastics soon followed, the green revolution of the fertiliser industry, and a wide array of downstream industries in manufacturing.

China is undergoing the same transformation today, but few have fully noticed where the innovation is happening. Electric vehicle penetration and sales are highest in China, as are popular eMobility solutions like electric scooters. While we may have witnessed a recent boom in venture capital financed scooter rental firms, the innovation for the eScooter originated in China, where most of the start-ups writing software sourced their physical scooters from.

One noteworthy example of this innovation trend is the recent visit by Elon Musk to the Tesla Gigafactory in Shanghai. Among the selfies and reassurances that Tesla would stay committed to China was one generally neglected announcement. The local Vice President proudly shared that the Shanghai factory was now 95% self-sufficient in domestic sourcing of components.

This was a management objective of Tesla, when they set up the first wholly foreign owned automobile manufacturing plant in China. They achieved their goal, well ahead of time.

Of course, Tesla designs are developed globally, and primarily in the United States, however the Chinese operation is mostly decoupled from US trade in every sense except licensing of intellectual property and shipping of the finished product.

In the new world, this arrangement works for China, since the intellectual property of method and process to supply needed componentry, or raw materials, stays in China. Increasingly, this takes the form of chemical process innovations, such as the Lithium Iron Phosphate (LFP) battery, or any of a vast array of minerals processing or metallurgical innovations.

The Chinese dominance of rare earth magnet manufacture is just one example.

While there is now significant activity in Europe, the USA and South Korea, alongside the traditional players in Japan, China continues to hold over 90% global market share.

Rare earth permanent magnets, particularly the sintered Neodymium-Iron-Boron (NdFeB) variety, are not easy to make. They require specialist master alloys, and a multi-stage labour intensive manufacturing process with up to a dozen stages, some of which must occur in a chamber that has had all oxygen removed, a so-called inert atmosphere.

It is easy to presume that market dominance is achieved by nefarious means, until you sit down and actually do the business case to build a rare earth magnet factory in the USA.

Thankfully, that is happening now, but it has been a slow and arduous process.

The Developing Focus on Critical Minerals and Critical Technologies

One thing about democracies is that, between chatter fests, you can do what you want, and maybe get something done. It is not necessary to seek approval from any supreme leader about what to do when, and on whose dime, and at whose personal expense.

The only problem is competition from whatever source of noise is promoting leisure activity.

Lithium is clearly important, but probably an easier sell for a wellness business in Byron Bay.

Lepidolite is one of the potential sources of Lithium that is widespread in Australian hard rock deposits. It does form up to 20% of domestic Chinese production, although the ore is hard to process, due to a significant mica content, which can lead to environmental problems.

Since all visible Western economic activity is driven by marketing, it is essential to tell the right story before anybody will pay attention to a pressing social need. In China, they have central political control, and so significant processing of lepidolite is tolerated, if not encouraged.

Here in Australia, it is possible to find spodumene rich pegmatite deposits. This is the primary source of Australian hard-rock lithium. Ideally, it is found with low impurity levels of iron and mica, such as might occur through other lithium-bearing minerals, like lepidolite.

In the spirit of the Western Way, you cannot market investment in any stuff we need without first making a shopping list so that investors will actually know that we need it.

What Australia has, in spades, is high-quality deposits of Critical Minerals. These are the feedstocks, the inputs for Critical Materials, that help us create Critical Technologies.

Yep, there are lists for all of those! Lithium is on the first list, whew! I can keep going...

In China, they have five-year plans. In the West, we have critical shopping lists.

Right now, there is $20M or more of money in Australia that is going into policy measures to improve our lists of things that we need to buy, sell, or figure out how to make at home.

I am all for this level of engagement because it makes my job easier to promote investment in the companies that are actually doing things, and the people driving their development.

The Emerging Global Electrochemical Industry

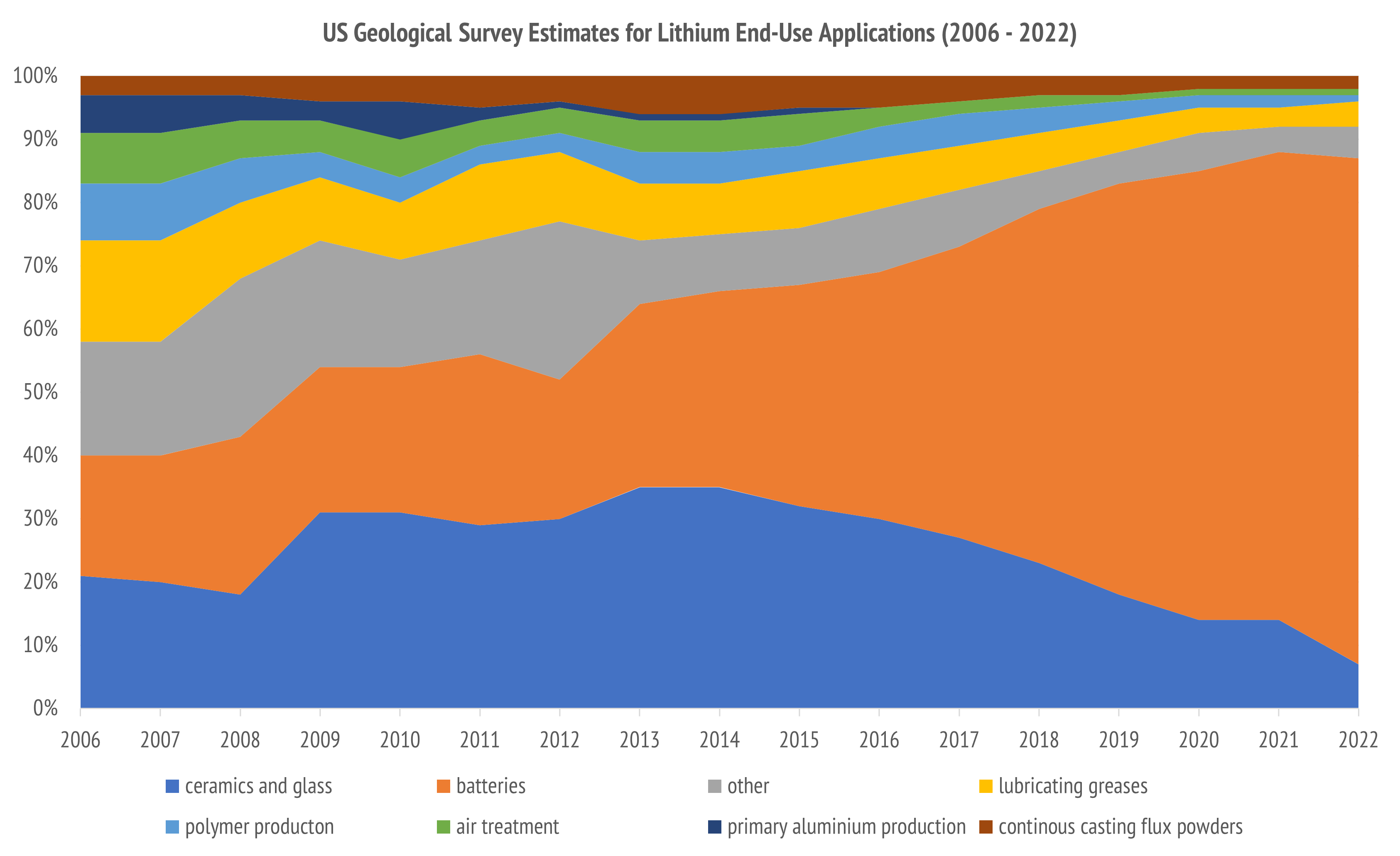

There has been a global market for Lithium metals and compounds for over a hundred years. However, it is the growth of the electrochemical industry which has really moved this once minor metal to centre stage. Lithium-ion batteries now account for an estimated 80% of global demand for lithium. This is up from 29% around ten years ago.

In the past, mining investors typically associated metals use with heavy industry or consumer durables markets, for products like steel, copper, lead, zinc and tin.

The emerging electrochemicals industry, which will increasingly supplant the petrochemicals industry, involves different elements, such as lithium, nickel, cobalt, graphite, copper, silicon, rare earths, tin, sodium, vanadium, manganese, iron and phosphorous, in a wide range of finished metal products and specialty alloys and chemicals.

These markets are not like the traditional minor metals markets.

There are now two distinct markets for nickel, the Class 1 market of 99.8% purity or higher, and the Class 2 market of purity less than 99%. The Class 1 nickel is in shorter supply and suited to high performance nickel alloys along with newly important materials like nickel sulphate, which is the feedstock of choice for manufacturing lithium-ion batteries with nickel in the cathode.

While we are used to thinking of mining as a commodity industry, this mindset can be rather misleading for specialty alloys and chemicals markets. The downstream processing of such materials is often know-how and capital intensive, with innovation driving returns.

It can literally take years for a new lithium brine player to qualify their material to meet the high quality standards demanded by downstream battery chemicals companies. Certainly, miners can run a Direct Shipping Ore (DSO) operation or ship a 5.5 to 6% lithia concentrate. This has been the dominant business model in Australia for decades. However, the future profitability of mining operations likely involves capturing more of the downstream value added.

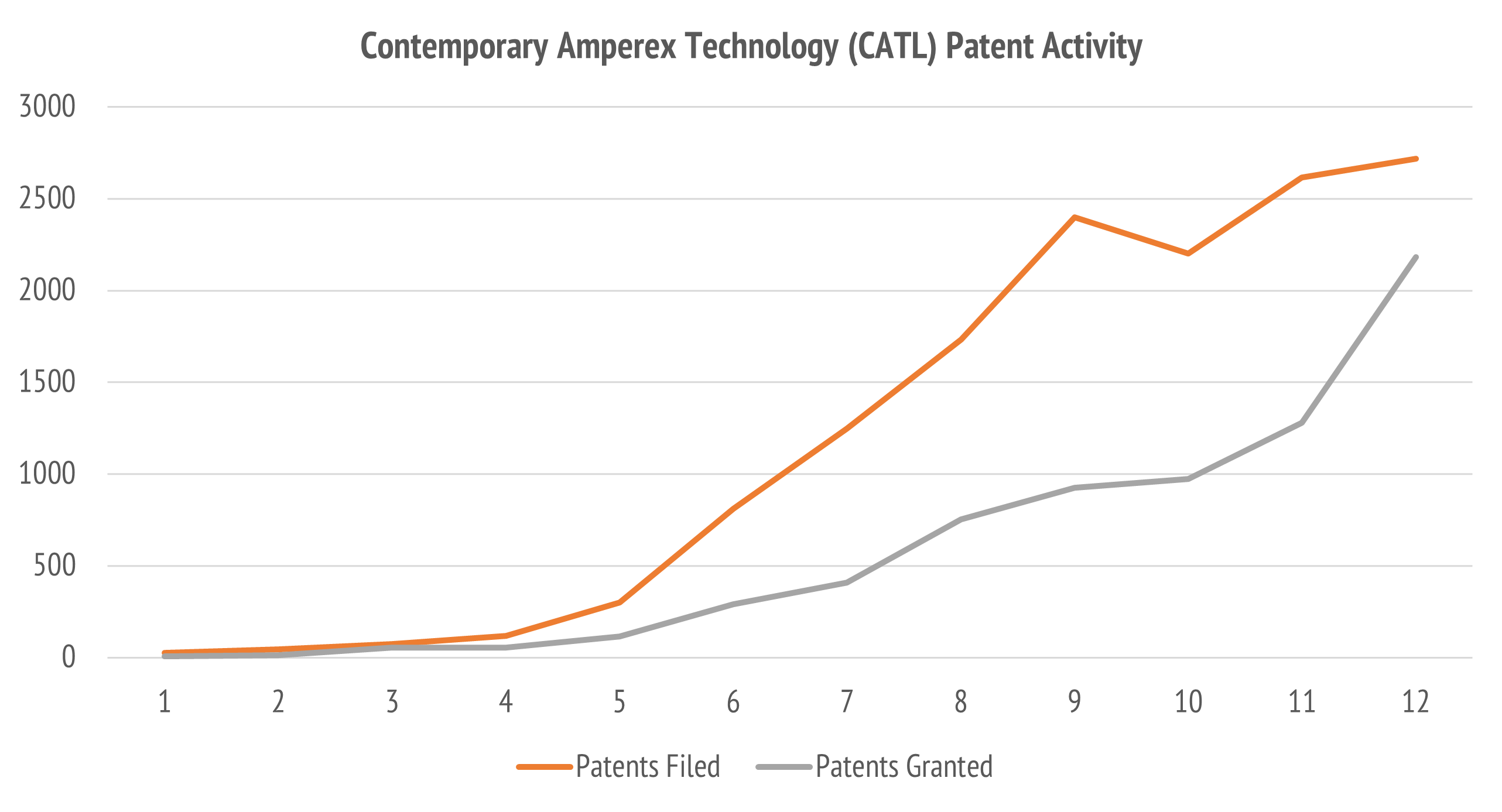

We should not underestimate the scale of the prize on offer. The Chinese firm Contemporary Amperex Technology (CATL) 300750.SZ controls around 33% of the global lithium-ion battery market. Since the battery commands 30-40% of the sticker price of an electric vehicle, CATL presently commands around 10% of the global value for EVs. It does not make any cars.

Some may think this is simply a story of low-cost Chinese labour and government subsidies.

This is not an accurate assessment of the Chinese position in battery technology. CATL is the acknowledged global leader in battery technology development, closely followed by BYD Co. 002594.SZ. Tesla TSLA.O has their own 4680 cell technology, but also works with Chinese firms on cheaper alternatives, such as the Lithium-Iron-Phosphate (LFP) battery.

This year CATL announced progress with their Sodium-Ion battery cell technology as an option to further ramp battery production in an era of scarce lithium supply. This is not intended as a replacement for lithium, but as an adjunct via cell-to-pack CTP, mixed-cell-chemistry designs.

Together with the BYD LFP blade battery, the Chinese market is rapidly innovating in vertically integrated battery design and manufacture using their own cathode and anode formulations to achieve the desired cost, safety, performance and scale trade-offs.

Tesla plays a key globe-spanning role in this race, being both the largest current pure electric vehicle manufacturer, and as a competitor to, and collaborator with, both CATL and BYD.

The Global Lithium Value Chain

While innovation proceeds apace in the downstream electrochemical industry, the pressing question for Australian investors remains the competitive position of Australian hard-rock lithium miners and their scope for forward integration into chemicals processing.

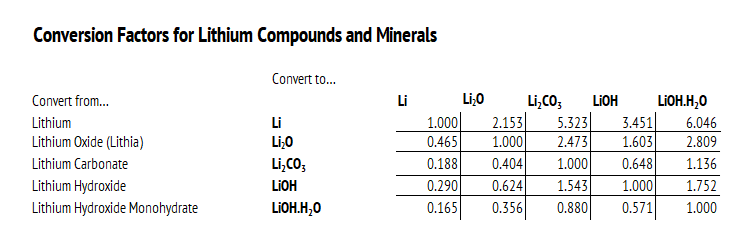

One very important gotcha for those new to specialty chemicals is the need to pay attention to making apples-to-apples comparisons of contained mineral resources and pricing. The weight of material, as a function of contained lithium, depends on the compound. While it is easy to calculate the conversion factors using chemical formulas, and atomic weights, there are some published data series which fail to take these conversion factors into account.

This matters because there are two basic types of lithium source. There are brines, which are the largest historically producing source in both Latin America and North America. Production from such sources usually involves evaporating a lithium rich brine to leave a residue of a salt such as lithium chloride LiCl, or lithium carbonate Li2CO3. This is typically purified to the more valuable hydroxide, which is sold in either anhydrous (LiOH) or hydrated form (LiOH.H2O).

For hard-rock mining, which is dominated by Australian miners, the primary product has been the concentrated mineral spodumene, which is a lithium aluminum silicate mineral. The pure mineral spodumene has a theoretical lithia content of about 8.03%. Lithia is the common name for lithium oxide, which is about 0.465 by weight of contained lithium.

You can see why it is important to keep a copy of the above table close at hand. It is common to see data series, even from respected sources such as the US Geological Survey series 140, which mix series of different types into a single aggregated number (not terribly useful).

The problem is even worse for estimates of material cost in batteries. It would be common, for example, to see the figure of 5-6 kg of contained lithium for a Tesla battery pack. The bill of materials for Tesla is not likely to be lithium, but lithium hydroxide. The pricing structure for this is very different from lithium metal, which has a very small global market.

Evidently, it is necessary to constantly adjust back and forth to make series comparable, and to properly estimate both costs and revenues. Two rules of thumb predominate:

- Geological resource grades are typically quoted as a lithia grade (LiO2)

- Global market value estimates are typically quoted in Lithium Carbonate Equivalent (LCE)

For historical reasons, the reliable USGS Minerals Yearbook and USGS Mineral Commodity Summaries estimates are in tons of contained lithium (Li).

The relevant conversion factors are:

- Li to LiO2: multiply by 2.153

- Li to Li2CO3: multiply by 5.323

- LiO2 to Li2CO3: multiply by 2.473

You will find such factors appearing in the footnotes of mineral resource statements.

The final gotcha of significance is that spodumene concentrate is rarely, if ever, at contained lithia grades much higher than 6%, and rarely below 5.5%, with different prices prevailing for concentrate, according to impurity levels. This is because spodumene needs to be converted into lithium carbonate, which requires a combination of heating to convert alpha-spodumene into beta-spodumene, followed by an acid treatment to crack the mineral to a carbonate.

The value chain for lithium thus involves several intermediates, with cracking and conversion spreads similar to what happens today in the petrochemical industry. The profitability of each step will depend on current pricing, current inventory levels, and corporate strategy.

There are several different chemical compounds that command different prices in the market, have different suitability for use in batteries, and contain different parts lithium by weight.

The Global Lithium Market

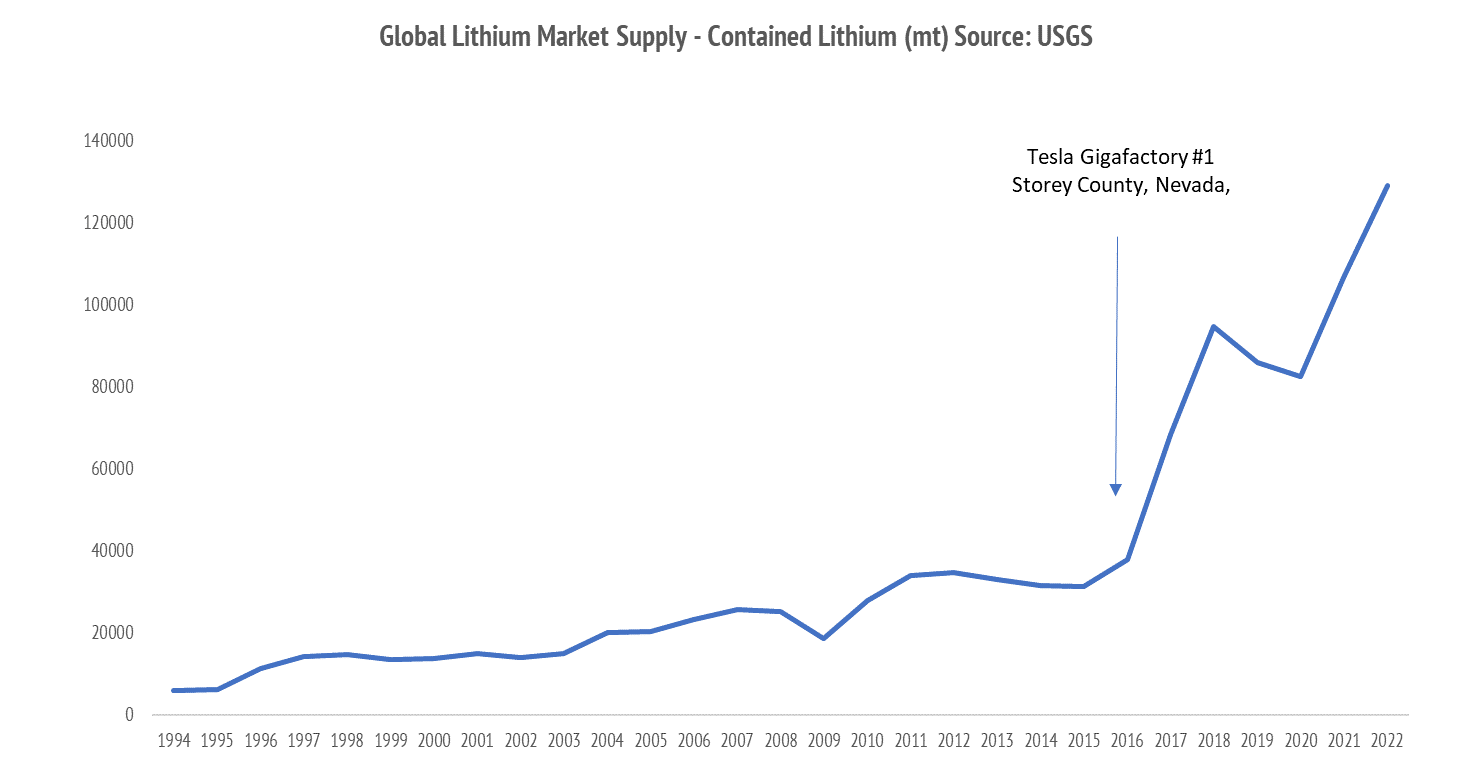

With these preliminaries out of the way, we can build some sound estimates for the state and trends in the global lithium market. Lithium-ion batteries have been around since the mid to late 1990s, but only began to dominate global usage of lithium around 2015. This has led to a marked acceleration in the industry growth rate since that time as battery gigafactories began to spread globally, along with electric vehicle uptake, post the first built by Tesla in 2016.

There has been a tendency for the popular press to focus on lithium pricing as the key market metric of interest. While this matters, it is the industry revenues that fund profits, and these are now growing substantially faster due to volume growth.

The lithium demand attributable to batteries has been estimated by the USGS to be around the 80% level, having increased market share rapidly since 2015. Not all of this is attributable to electric vehicles, as there are many uses of Li-ion batteries in consumer electronics, power tools and stationary power applications such as data centre back-up units.

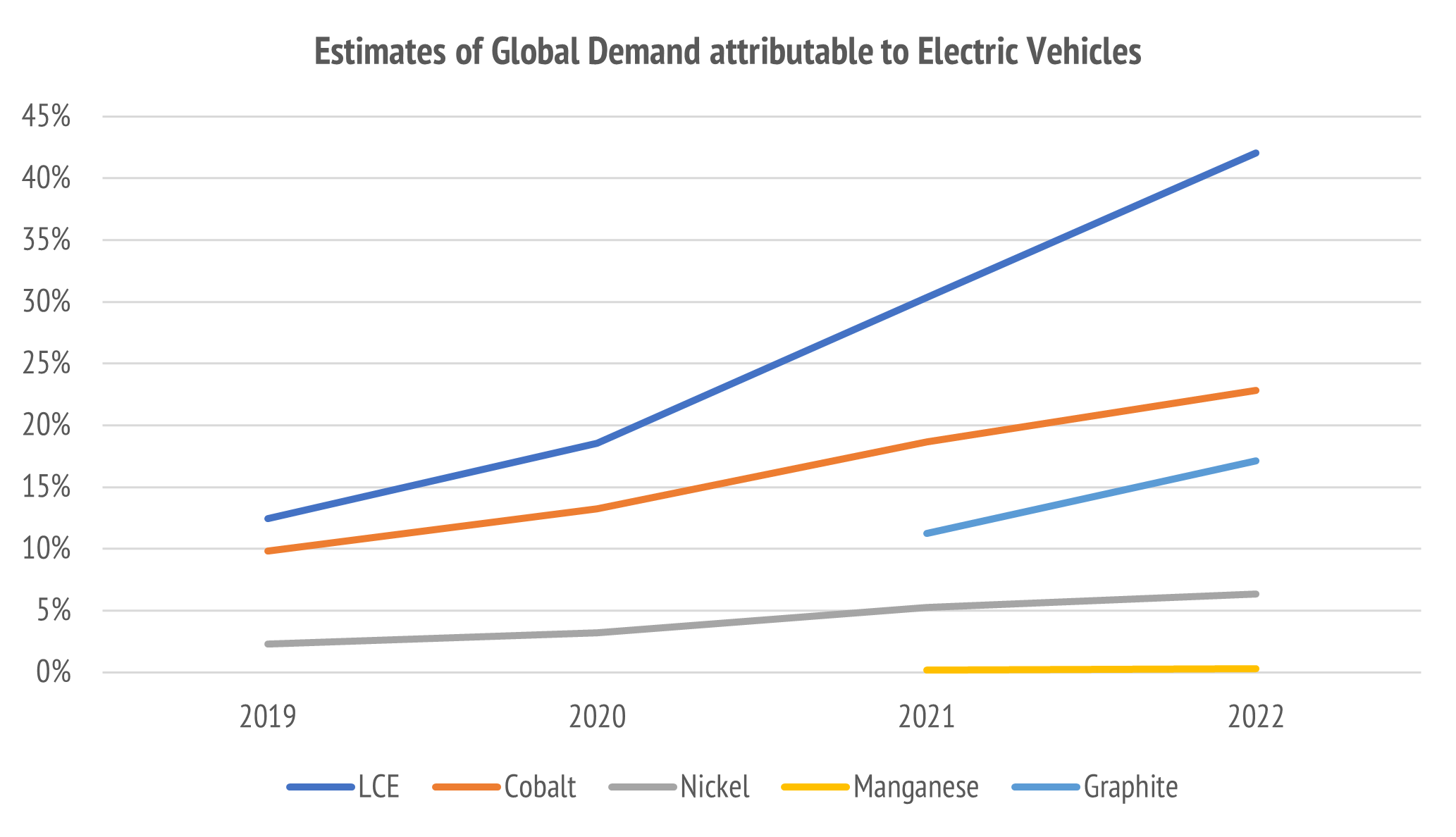

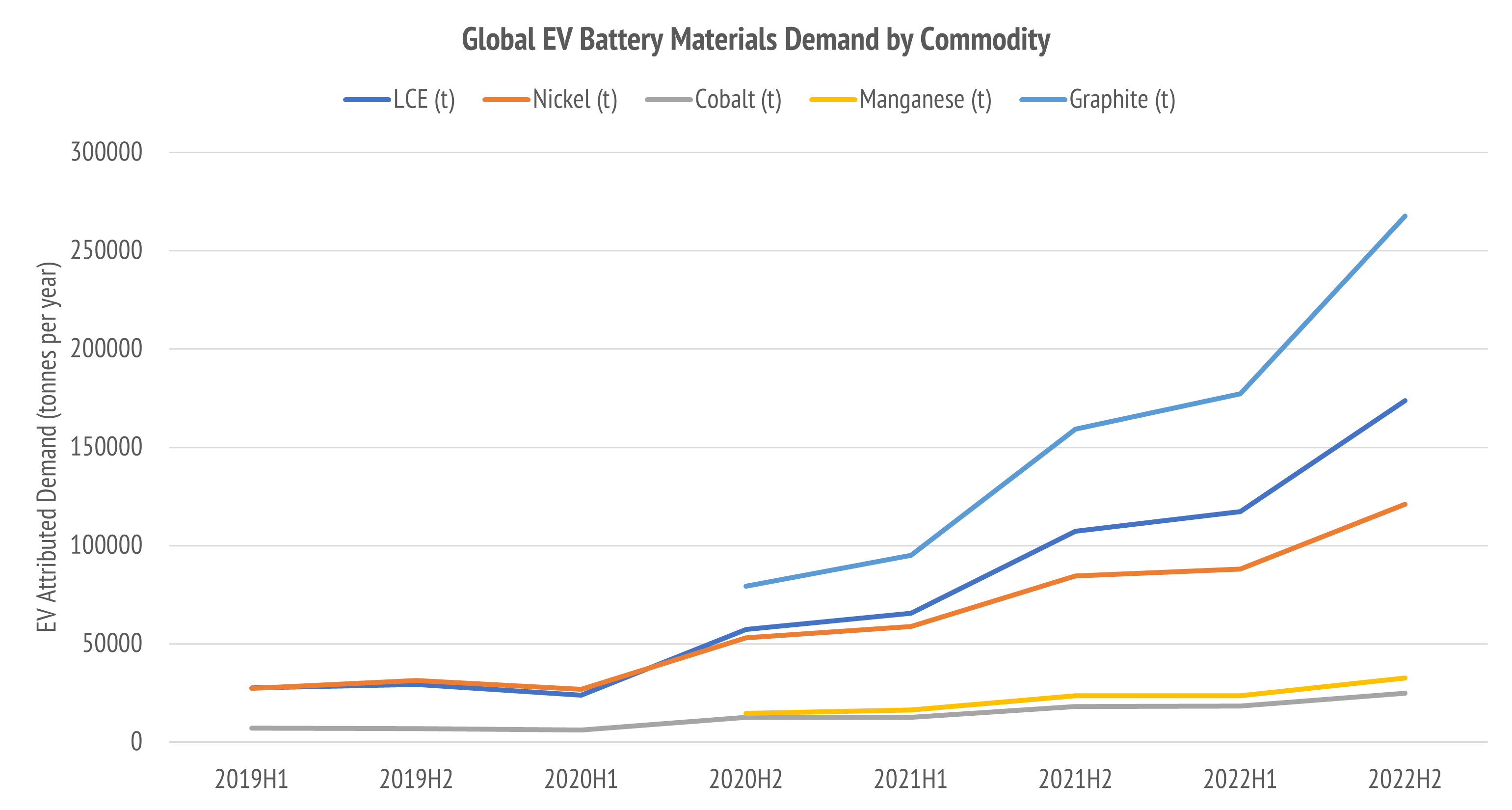

However, the research house Adamas Intelligence have published biannual estimates of the materials usage in electric vehicle batteries since 2019, via their State of Charge, reports.

Combining the USGS global supply data with the biannual Adamas imputed demand data, we can form a picture of the battery materials demand attributable to electric vehicles.

While the global demand for lithium attributable to batteries is now at 80%, only just over half of that appears to be attributable to electric vehicles. In short, the supply squeeze for lithium has probably not peaked yet, notwithstanding the recent price volatility.

Note that Manganese is barely affected by electric vehicles, while graphite is still an emerging story, since that market is dominated by China, with perhaps half of supply met by synthetic graphite, which is a byproduct of processing tar and coke from the petrochemical industry.

The global demand for battery materials continues to rise with EV deployment.

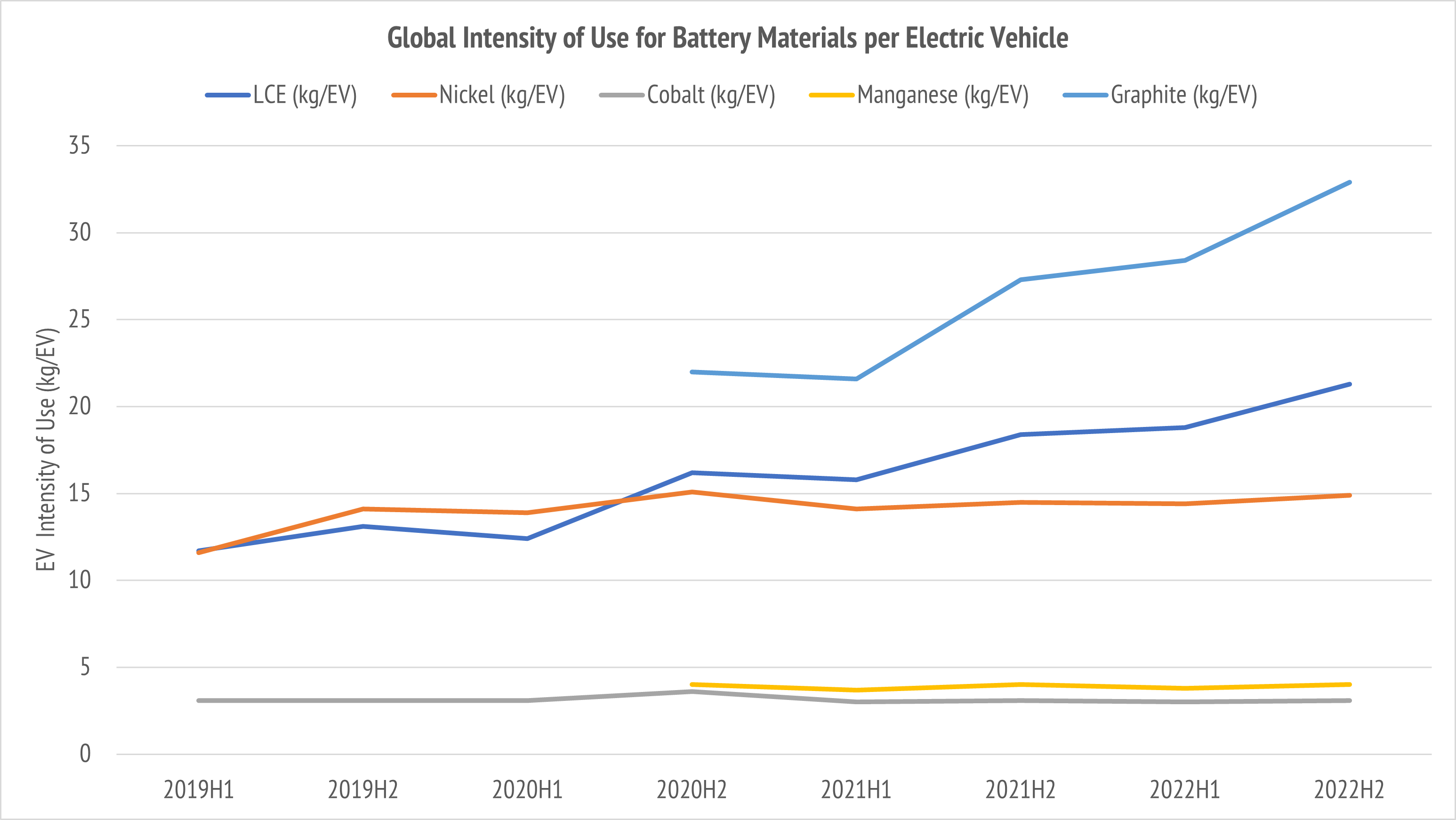

While the above chart is informative, the real story emerges when we examine the Intensity of Use (IOU) patterns revealed by the quantity of battery materials per vehicle.

In simple terms, the total materials demand is the product of the number of vehicles by the intensity of use for each vehicle. In the above diagram, the IOU for lithium and graphite has continued to rise, while that for nickel, cobalt and manganese has stabilized.

Wherever intensity of use is rising, the growth rate for usage of that material will be higher than the visible growth rate in electric vehicles.

Electric vehicles, considered as a rising population, are ever hungrier for lithium and graphite, less so for nickel cobalt and manganese. It will take much new capacity to fill this demand.

Graphite and lithium enjoy supergrowth rates over and above electric vehicle growth rates.

The Global Lithium Endowment

The best way we know to assess the likely outcome for future production profiles for any commodity is to examine the history of past production share.

The production share is down to a combination of factors, including the natural resource endowment, the ease of mine development, and the nature of the mineralisation.

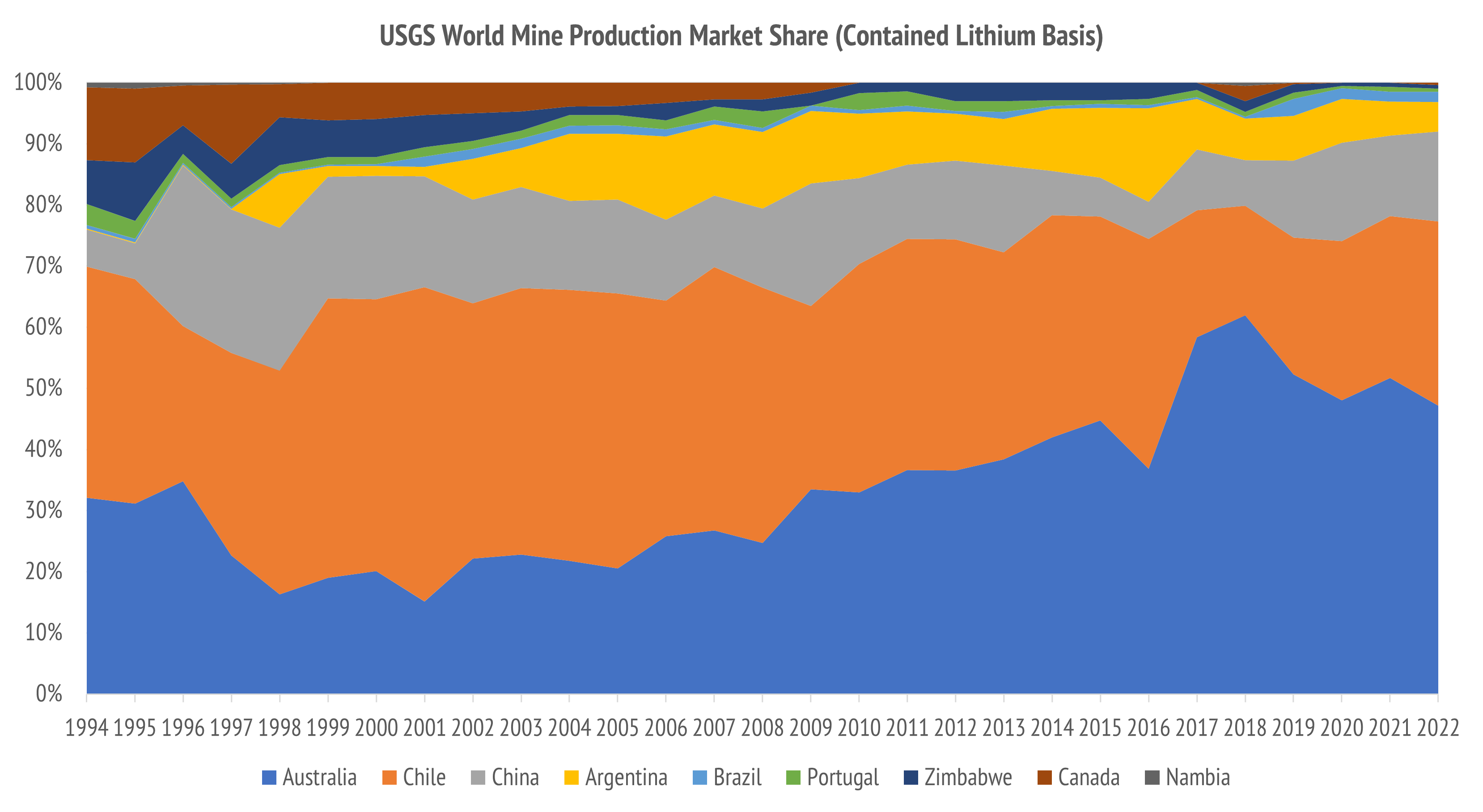

What is evident from the above chart is the dominance of Chile and Australia alongside the two major swing producers in Argentina and China. This is in spite of significant untapped reserves in Bolivia and Canada, plus one long-producing brine operation in the USA.

There are some exciting new operations planned for countries like Brazil, through the Canada listed entity Sigma Lithium SGML.V, and some high-grade discoveries in Canada, by Patriot Battery Metals PMT.AX. Canada has prospective ground but has not been a big producer at any time in the last twenty-five years. The failed Val d'Or operation in Quebec is now under restart by Sayona Mining SYA.AX (75%) and Piedmont Lithium PPL.AX (25%). Nemaska Lithium is another Canadian project restart, with 50% ownership by Livent LTHM.

Africa has promising spodumene projects. There is the Leo Lithium LLL.AX Goulamina project in Mali, and the Atlantic Lithium A11.AX Ewoyaa project in Ghana. Zimbabwe has produced at the level of 300-1000 t/pa for the past twenty-five years, but we have yet to see the really big breakthrough in African potential. There is the large high-grade resource at the Manono Project in the Democratic Republic of Congo, which was developed by AVZ Minerals AVZ.AX (suspended), but where their granted mining license is now in dispute.

Given the scale of lithium demand anticipated by bodies such as the International Energy Agency (IEA) in their 2021 The Role of Critical Minerals in Clean Energy Transitions report, it would seem improbable that global electric vehicle manufacturers will bet the farm on the opening of new mineral provinces with sometimes doubtful governance standards.

The Australian Lithium Endowment

In the growth market now in play, Australia and Chile are by far the biggest producers. Future investment in Chile is now under a cloud, due to talk of industry nationalisation. This has become an emerging trend for lithium rich provinces, after earlier action by Mexico.

Australia ranks highly in the annual Fraser Institute Surveys that focus on the investment attractiveness of different mineral provinces. In this age of ESG and increased public focus on the rights of First Nations people, such rankings are not the conclusive factor. However, it is noteworthy that Western Australia figured second on the most recent ranking, after Nevada, and has been the number one source of global lithium for each of the last six years.

Chile and Australia have been trading places as the #1 and #2 producers in every year since 2002. The other contenders have been China and Argentina vying for number #3 and #4.

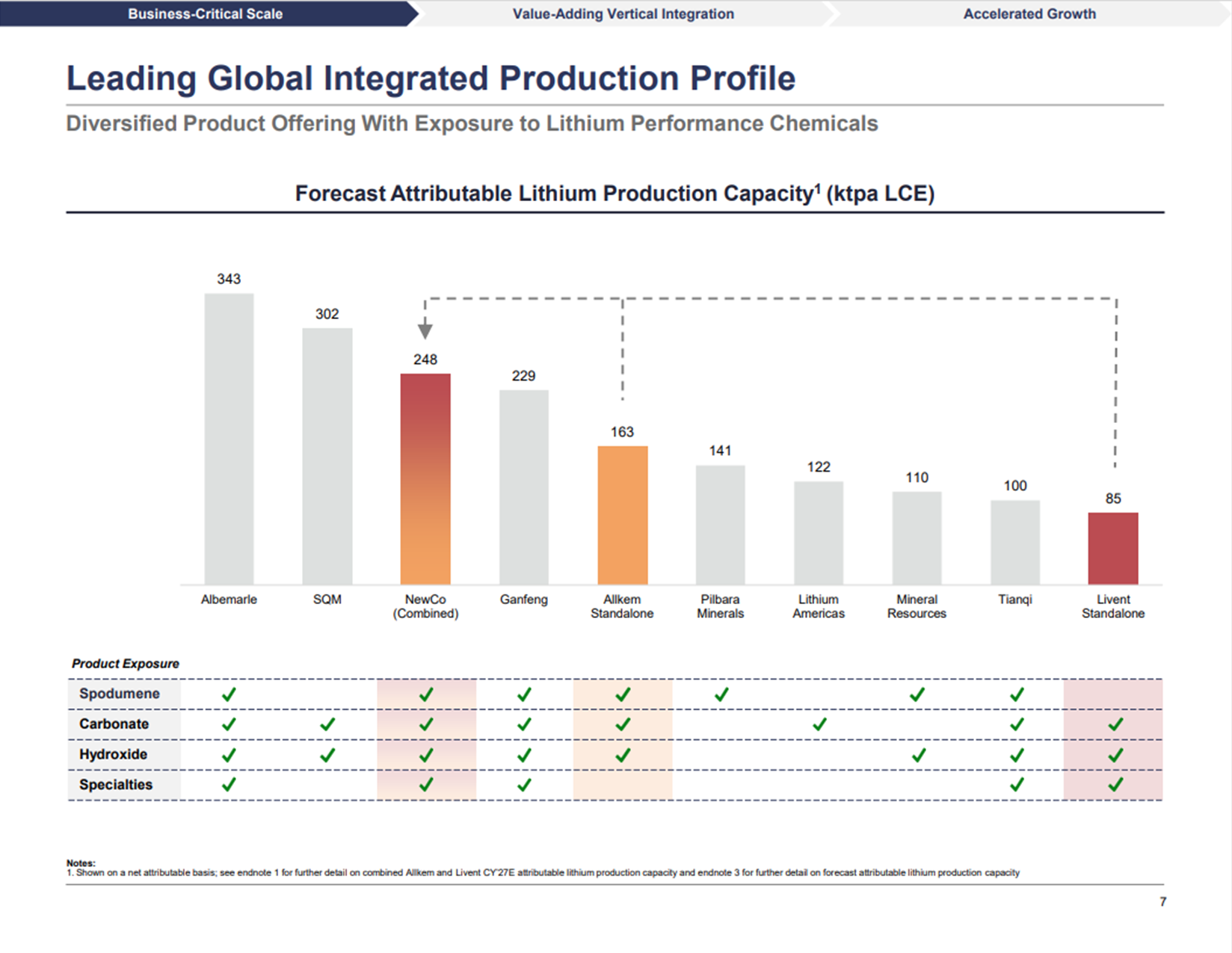

With the scale of production across these four jurisdictions, this dynamic will likely persist for some time. Even more important is the incumbent position of downstream convertors. The recent merger announcement between Allkem AKE.AX and Livent LTHM, highlights the competitive pressure to achieve scale through mergers-driven vertical integration.

While this merger attracted attention, the key message is vertical integration. The above slide is from the Allkem presentation describing the merger logic. We mentioned that lithium is a global electrochemical industry. The market power goes to those who are integrated.

Right now, that is just four companies globally:

Albemarle ALB.N

Allkem AKE.AX and Livent LTHM via the post-merger New Co

Ganfeng Lithium 002460.SZ

Tianqi Lithium 002466.SZ

Waiting in the wings are:

Sociedad Quimica Y Minera SQM.N

Mineral Resources MIN.AX

Pilbara Minerals PLS.AX

with others, not mentioned, such as Wesfarmers WES.AX.

All of the mentioned companies have active plans to move downstream and are doing so through deals with China-based convertors, and upstream via stakes in explorers.

Azure Minerals AZS.AX does not yet have a maiden resource at their Andover LCT-pegmatite project, but that did not stop SQM from assuming a 19.99% blocking stake.

The local financial press may be full of idle chatter about the course of the lithium price over the next week, but the smart money is actively placing bets via strategic stakes, and doing so with the long-term perspective that comes from being market players for decades.

The M&A Gravy Train is rolling out of the station, and you want to be seated in the buffet car. That is where all of the deal making will take place, and most of the seats are spoken for. Forget the price of lithium in June.

That is the clear message of this market.

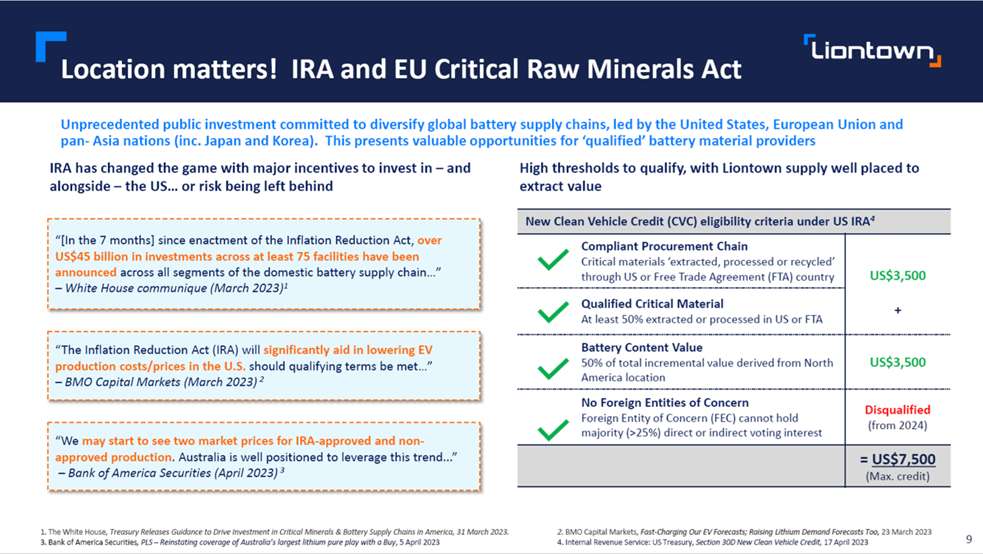

The Inflation Reduction Act (IRA) Wildcard

If mergers and acquisitions are to be the hot trend, then why now? Surely market players have known of the underlying structural trends in electric vehicle demand. What should cause the market to suddenly fixate on M&A, and why should vertical integration be the buzz phrase?

In the fullness of hindsight, we believe that US President Joe Biden's Inflation Reduction Act of 2022 will prove to have been the proximate catalyst. While the Act itself is old news, the effect of the legislation has taken some time to clarify. This is due to the complex rules that govern eligibility for tax credits in the electric vehicle supply chain. At the outset, it was very unclear which US-made or assembled vehicles would qualify for the Clean Vehicle Tax Credit.

This has since been clarified, by later announcements, and amendments to eligibility criteria. Tesla was initially lukewarm on the measures but has since become enthusiastic about the Clean Vehicle Tax Credit program. Enthusiasm for legislative changes generally follows the money, and this time is no different as all Tesla Model 3's now qualify.

The recent Bloomberg headline:

“Telsa Price War Padded By $1.8B Windfall from Biden’s IRA”,

makes clear the scale of support on offer.

This all comes down to two factors: eligibility for the

Clean Vehicle Credit; and the delivery format of support via tax credits. These

are up to $35 USD per kWh of battery that rolls off a US Tesla-Panasonic

production line. This could include a whole bunch of new ones!

Let's do some numbers.

Tesla Model 3 batteries range from about 60 kWh capacity to 82 kWh, which gives a benefit of between $2,100 USD to $2,870 USD for production of qualifying batteries on US production lines. The exact bill of materials for Tesla depends on a host of factors, but we can get some ballpark estimates from current lithium carbonate prices, at around $40 USD/kg.

Taking estimates of between 5 and 8kg of contained lithium and bulking that up by the LCE factor of 5.323, there is around 25 to 50 kg of LCE, or $1,000 to $2,000 USD of material.

These estimates do not account for any nickel or cobalt content. The Adamas figures listed above suggest perhaps 15 kg of Nickel and 3 kg of Cobalt. Current prices for Nickel metal are around $20 USD/kg, and Cobalt is around $30 USD/kg. That amounts to $400 USD total.

The dual motor Tesla Model 3 has one front induction motor, and one rear permanent magnet motor, with perhaps 500g of Neodymium-Praseodymium (NdPr) in 1.5kg of magnet alloy. The current price of NdPr oxide is around $150 USD/kg, with some premium for metal. However, the materials cost is still likely under $100 USD per motor, for the rare earth content.

Even though these estimates are very rubbery, and the true numbers are proprietary to Tesla and thus secret, we can guesstimate a total critical materials cost to Tesla which is within the scope of the IRA production tax credit of $35 USD/kWh for qualifying battery production.

Since materials sourced from US Free Trade Agreement partners are eligible for US production tax credits, and both Chile and Australia have such FTAs in place, we think Tesla should be able to fully qualify its US production lines for lithium and nickel. It may prove harder for cobalt and rare earths, but the eligibility criteria do not appear to disaggregate materials and are on a sliding scale of qualifying content. In short, not all materials used need to qualify at the outset.

Since Tesla is already vertically integrated, to a large extent, they can likely flex some of their manufacturing activities to garner the full production tax credit benefit.

The Biden IRA looks to be a huge shot in the arm to expand US battery production.

The Australian Angle to the US Inflation Reduction Act

The US IRA will likely spur a new wave of US battery gigafactories which aim to friend-source critical materials from qualifying sources, such as Australia. Due to the tax credit structure of the US incentives, there is a clear benefit to profitable incumbents, such as Telsa, which can offset raw materials costs via a direct deduction against current US income.

Effectively, the cost of raw materials is close to free for Tesla, as long as they configure their US supply chain to be free of Foreign Entities of Concern (FIC), meaning China. This requirement will not hurt Tesla since their Chinese operations do not export to the USA, and the 4680-cell technology used by Tesla in the USA is developed and controlled by them. They may need to tweak their strategy on Lithium Iron Phosphate (LFP) cells, using China-origin intellectual property, but that is a licensing transaction, which appears to be fine under IRA rules.

Once we take full account of the US IRA incentives, it is clear why Allkem and Livent moved quickly to consummate their merger and create a US-based vertically integrated firm. This further clarifies why Albemarle has Liontown Resources LTR.AX in their sights.

Argentina does not, at present, have a Free Trade Agreement with the United States, and Chile is toying with nationalising its lithium resources. Since Australia does have an FTA with the US and it is the largest source of lithium in the world, why would you not want more?

This explains the wave of foreign mergers and acquisitions interest.

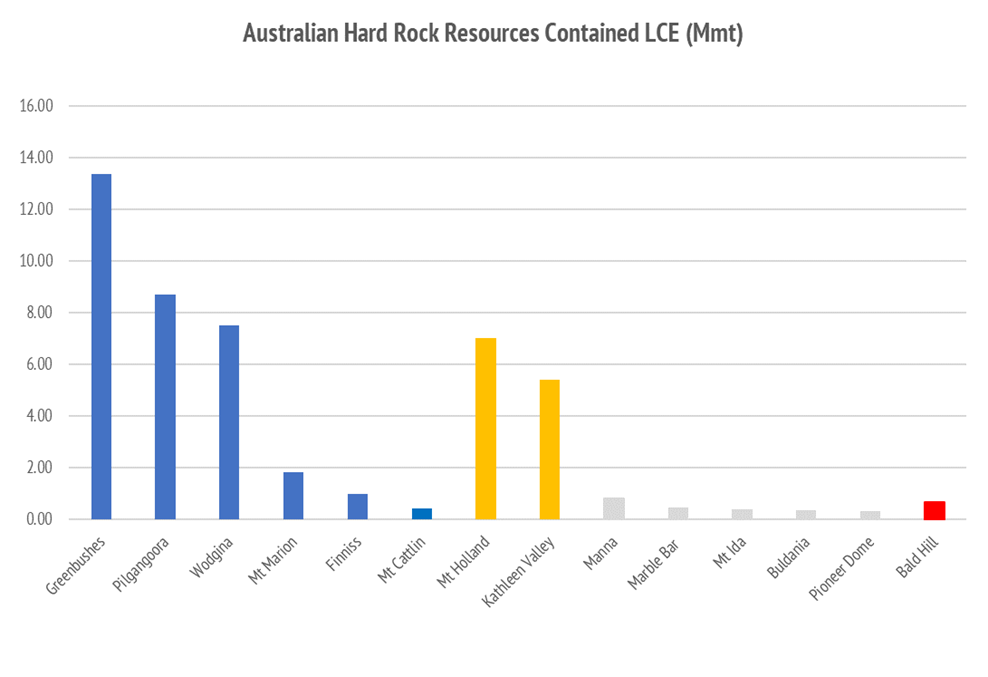

If you go through the full list of Australian companies active in the Western Australian lithium business, there are just fourteen JORC resources.

The point to note is that only Mt Holland (JV 50% SQM and 50% Wesfarmers), and Kathleen Valley (100% Liontown Resources) have significant scale compared to the big three.

Recall that Greenbushes is the oldest continuously operating mine in Western Australia, and the largest hard-rock operating lithium mine in the world. Pilgangoora continues to expand as Pilbara Minerals PLS.AX beds down their processing operations. Mineral Resources MIN.AX continues to develop their JV business model with Wodgina (60% Albemarle: 40% MinRes) and Mt Marion (50% Ganfeng: 50% MinRes), plus downstream investments in China based convertors. When you set this against the rationale for the Allkem-Livent merger, one can see echoes of the Seven Sisters of Big Oil, which dominated the global oil industry.

What is missing from this picture?

Well, for starters, there is no BHP Group BHP.AX nor RIO Ltd RIO.AX.

Once the momentum of the US IRA builds, along with the future pipeline of investment in the needed gigafactories, we expect further industry consolidation.

The global electrochemical industry is forming before our very eyes.

Control of the supply chain, through vertical integration, limits the impact of price volatility in upstream segments, while also retaining chemicals processing knowledge in house.

This process may have started with China Inc., but clearly the strategy of vertical integration is one for the times. It is the logical response, and Joe Biden's IRA just lit a fire under that.

The reason is that tax and production credit incentives clearly favour the vertically integrated and profitable incumbent. Grants invite allcomers, but tax credits boost incumbency.

Our Simple Call

Our Magnificent Seven Critical minerals buy list already includes Pilbara Minerals PLS.AX and Allkem AKE.AX, along with Mineral Resources MIN.AX in our Australian Iron Ore thematic.

Strategically, a vertically integrated acquirer will rationally target resources in the ground and pay some premium for past development undertaken with further upside potential. On the back of that JORC resources chart, there are only two belles dressed for the ball, and one is already spoken for, being locked up in the Wesfarmers-SQM JV at Mt Holland.

The crude resource values, on an enterprise value dollar-per-LCE-tonne basis are:

- Finniss: Core Lithium CXO.AX $1922/t

- Pilgangoora: Pilbara Minerals PLS.AX $1377/t

- Kathleen Valley: Liontown Resources LTR.AX $1057/t

- Mt Ida: Delta Lithium DLI.AX $707/t

- Manna/Marble Bar: Global Lithium Resources GL1.AX $266

Liontown Resources LTR.AX is well advanced on mine construction for mid-2024 production. Even after 3 bids, with one mystery offer, we rate it a buy. Look out also for exploration success at Delta Lithium DLI.AX and Global Lithium GL1.AX. Joe Biden has painted a big target on all of them. The bottom line is this:

All eyes are on the USA, and Australia has spodumene in spades plus an FTA.

It is that simple, so cue further M&A.

BUY Liontown Resources LTR.AX

Watch these names for exploration progress and likely Direct Shipping Ore (DSO) options:

Global Lithium Resources GL1.AX

Delta Lithium DLI.AX

Azure Minerals AZS.AX

Closing Note on our Australian Thematic Portfolio Research Series

As explained further in the attached research note, this will be our last Australian-focused thematic research note. In the past year, we developed and tracked these four themes:

- Australian Critical Minerals (ACM)

- Australian Rare Earths (ARE)

- Australian Iron Ore (AIO)

- Australian Sustainable Portfolio (ASP)

We have updated the performance of these, for the last time, in the note below.

While we have enjoyed bringing you this research, the Australian market is too narrow for the themes in question. We prefer to return to our roots in global investment and to construct globally diversified exposures to the themes and trends we think are most powerful.

As part of that journey, we will offer some new informative product for self-directed investors who want to take positions in global markets but are unsure of how to proceed.

The good news is that the mechanics of this are now straightforward.

This change will enable us to offer insights on renewable energy technology, semiconductors, luxury stocks, robotics, artificial intelligence, and other current trends.

It is better to go global and train your accountant on how to do the tax return than to sit on the sidelines and watch splendid opportunities pass you by.

Adieu, and see you in our next product incarnation!

Photo by Michal Matlon on Unsplash Venice-Simplon Orient Express.

Make mine a Select 1920 Spritz, with Beluga cicchetti!

The Banker Quiz

You now know what to do, and you know who to call.

Here is the quiz, to see which bankers have been paying attention.

Should you buy?

A good boom ought to be a ton of fun.

There is money to be made.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

3 topics

8 stocks mentioned