The local growth market offering sustainable income

Low volatility, capital protection, liquidity and regular income - four attributes that investors value in their fixed-income allocations. Now is a good time to be looking at credit markets, which are offering attractive yields against a backdrop of higher interest rates. We are also seeing rapid growth in the sustainable credits market so investors can align their beliefs with their investment objectives.

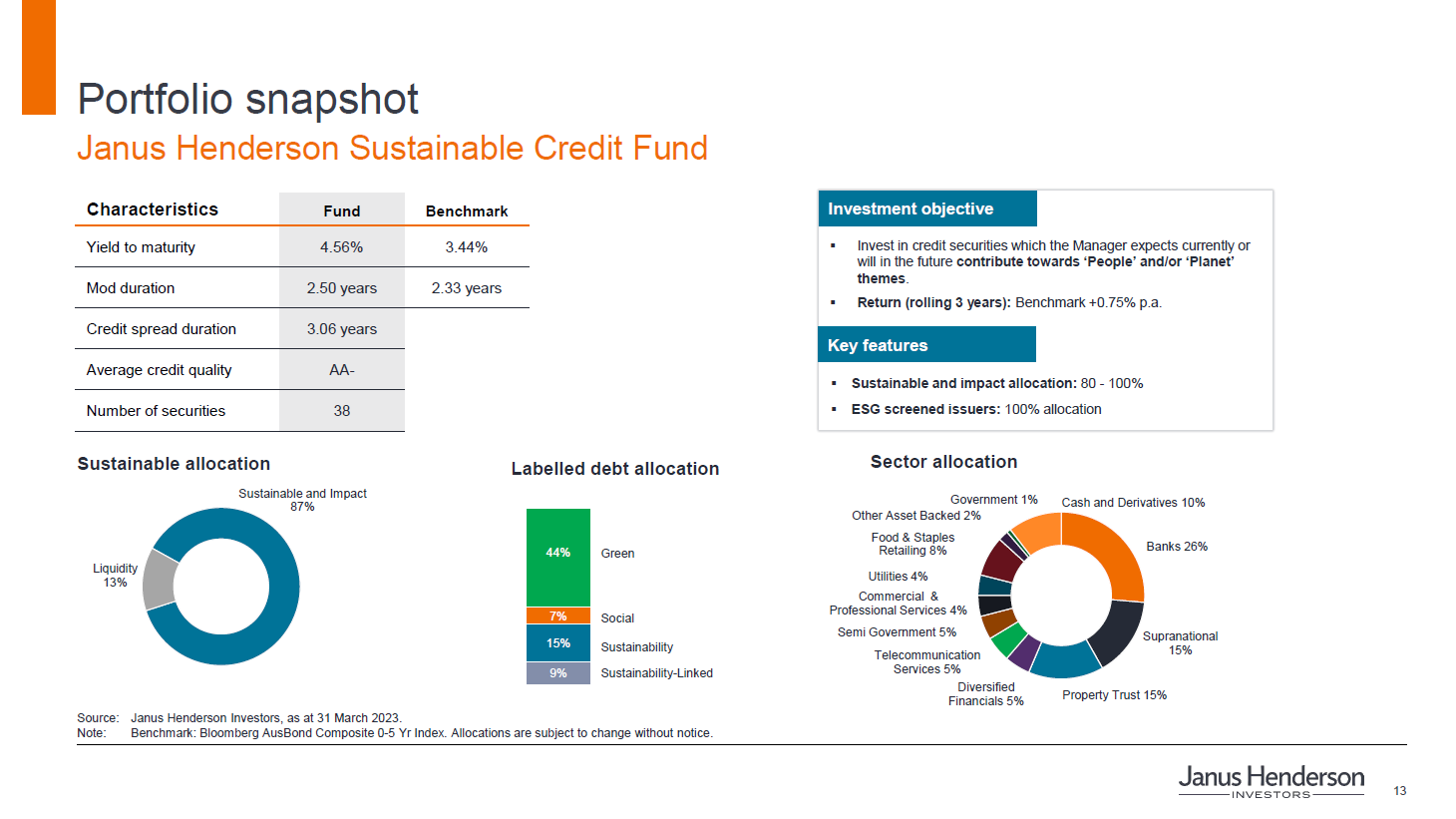

The Janus Henderson Sustainable Credit Fund (ASX: GOOD) currently has a yield to maturity of 4.56% (as at 30 April 2023), positioned in the sweet spot between traditional cash and fixed interest and more volatile asset classes. It's seeking to provide additional yield while retaining a focus on defensive characteristics, capital preservation, and liquidity. What's unique about the fund is that at least 80% will be allocated to sustainable and/or impact investments.

In this Fund in Focus, I provide an overview of the fund and how we invest. I also share two examples of the investments our team has uncovered.

Click on the player to watch the presentation or read an edited transcript below.

Edited Transcript

Hi, I'm Shan Kwee, a senior portfolio manager in the Australian Fixed Interest Team at Janus Henderson Investors, and I'm excited to introduce to you today our new Janus Henderson Sustainable Credit Fund, which launched in Q1 of 2023.

It was born from the belief that investing sustainably can generate attractive active returns for investors while doing good for the planet and the people who inhabit it. So, let me quickly introduce Janus Henderson first, and then we'll talk in a little bit more detail about the fund.

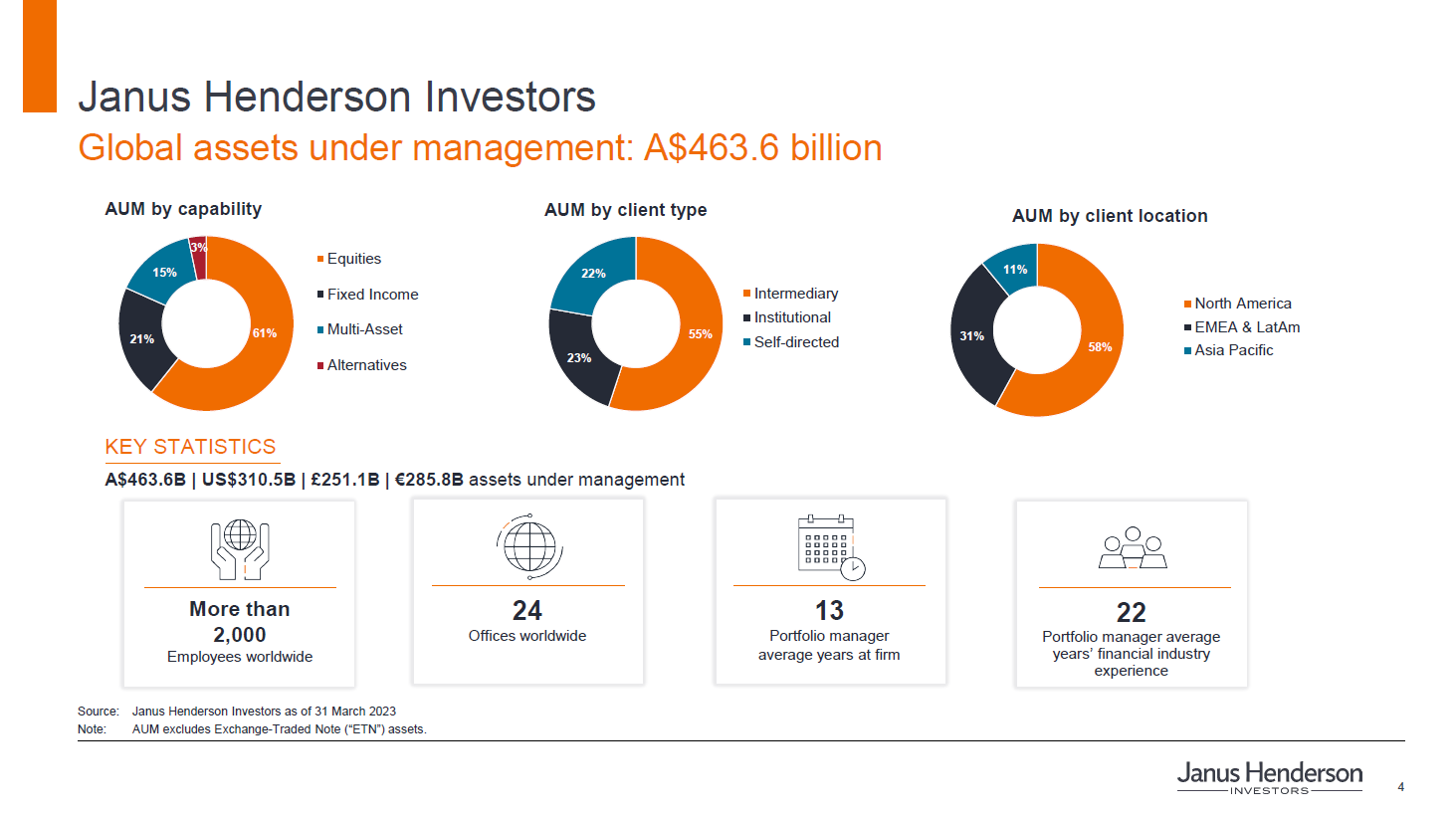

At Janus Henderson, we're a global active asset manager with strong representation across equities, alternatives, and fixed interest, including credit. We manage over $400 billion for clients around the world, and we recognise that this comes with important responsibilities. We know that clients want to invest in a sustainable manner into the future. And as a firm, we've been carbon-neutral for the last 15 years.

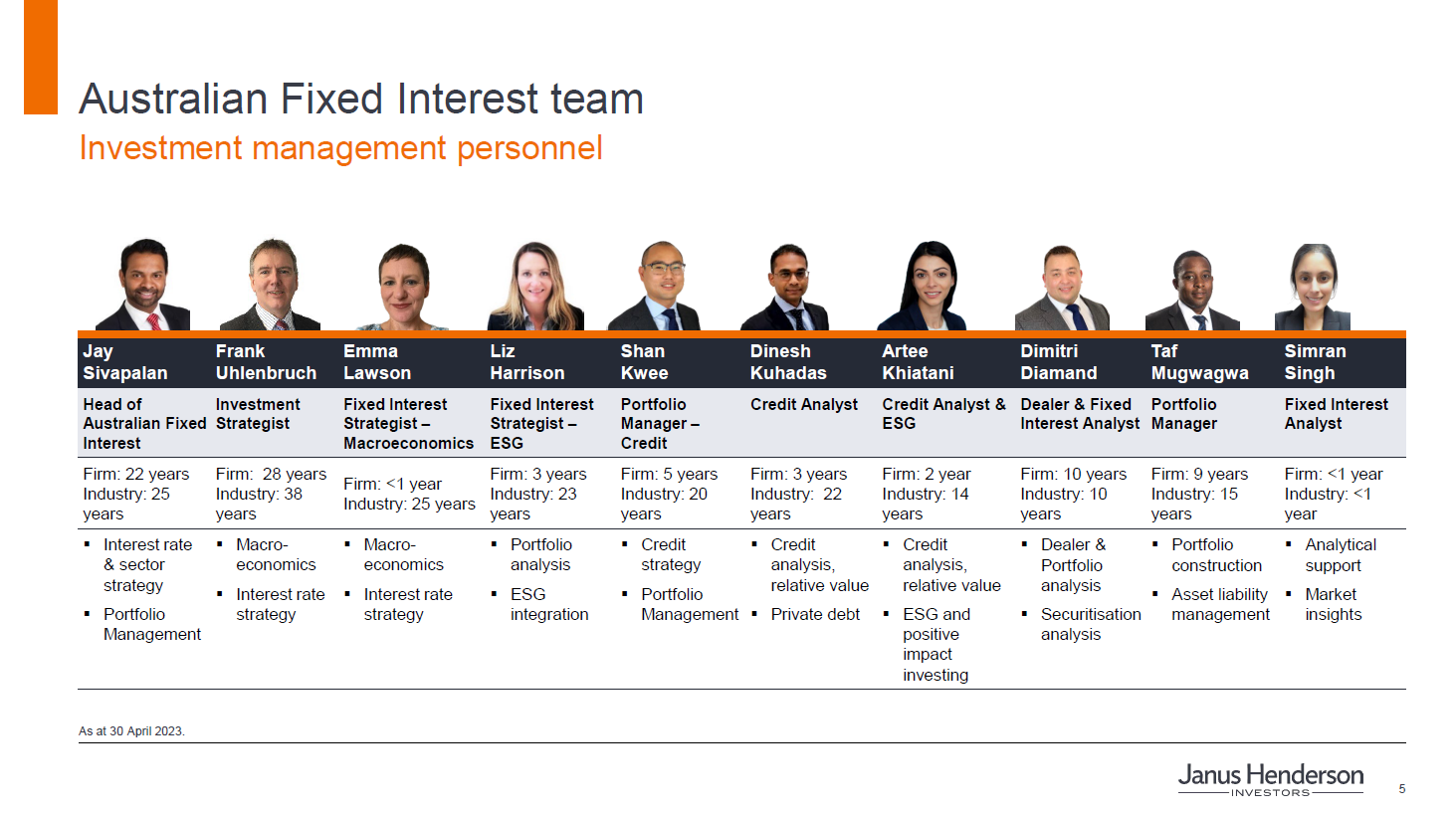

The investment team that's bringing you the new Sustainable Credit Fund is based here in Australia. Jay Sivapalan, head of Australian Fixed Interest, and I co-manage this fund. Both of us have been investing in the Australian and global fixed-interest markets for the past 20 years or more. And more recently, across the sustainable debt market as it has grown over the past decade.

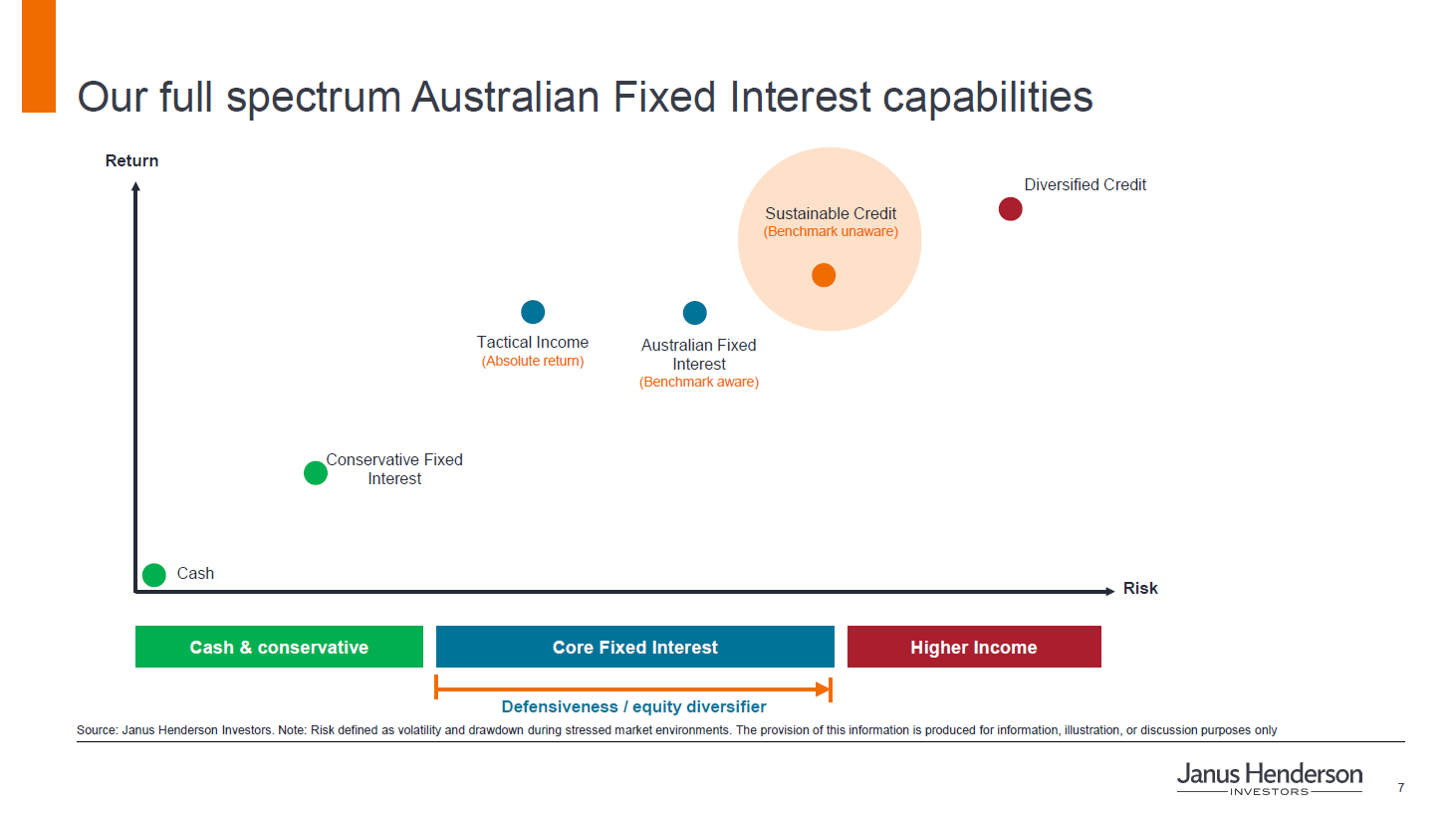

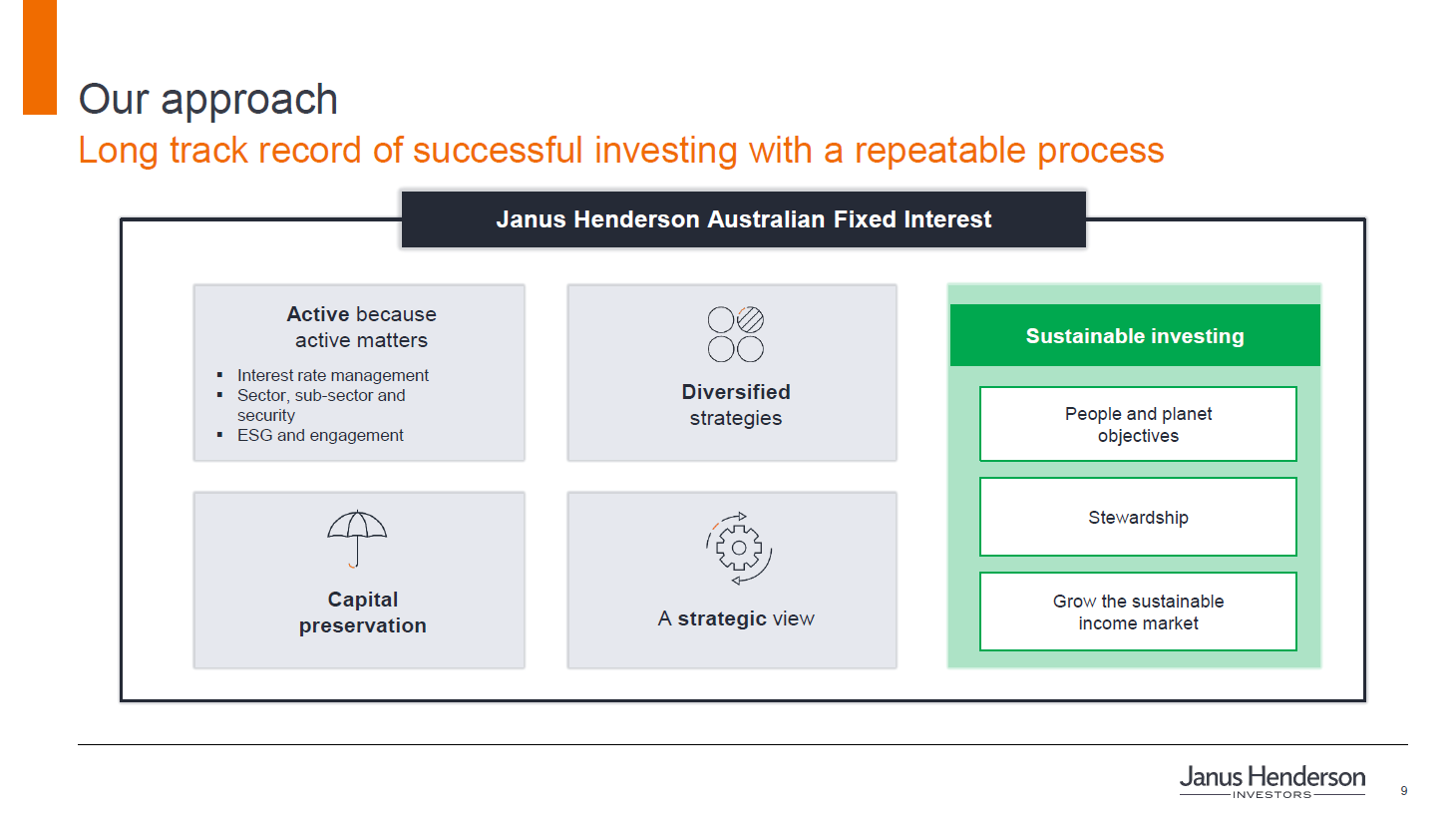

We're supported by a team of dedicated specialists, which includes senior economists, specialist local credit analysts, as well as ESG-dedicated experts. Our performance track record spans three decades, showing how we can deliver value for clients through active management across interest rates, credit and ESG through multiple market cycles. We integrate ESG management in all of our products, such as the Tactical Income Fund and the Australian Fixed Interest Fund. But the fund I'm going to introduce to you today really brings that to investors in a more focused way.

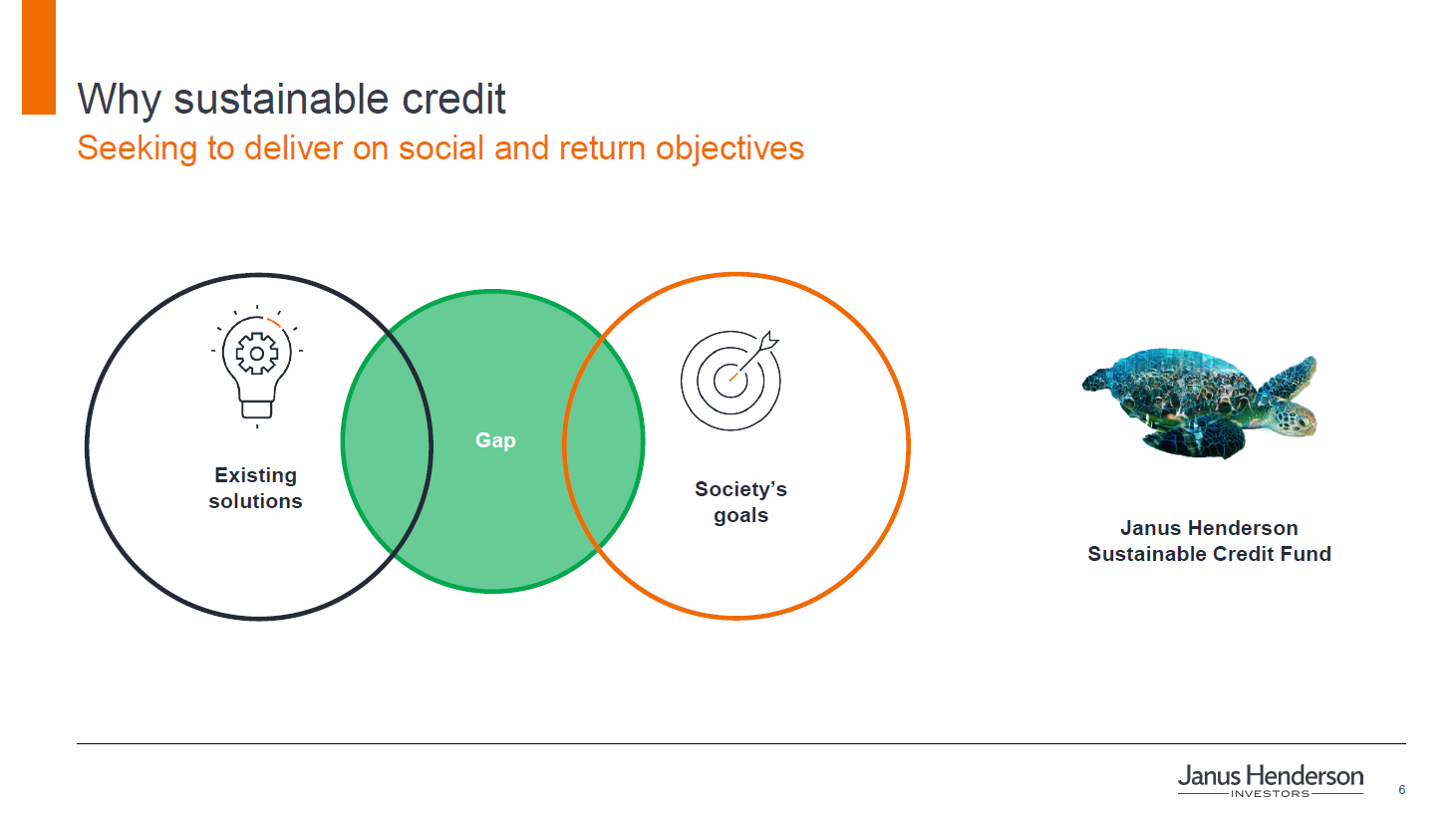

We're introducing the Sustainable Credit Fund to provide a solution to an issue that we face together in the future. Society's goals are evolving, and so too are those of consumers and investors. Investment solutions in the broader market are focused more on economic outcomes rather than a shared responsibility for societal outcomes. We've reached a critical juncture where investors, governments, and companies are looking for a sustainable and impactful way to dedicate their capital. We've identified that a gap in the market exists for a more focused and local solution. So we developed the Sustainable Credit Fund over the past few years to really harness these needs, and invest in a manner that meets both sustainable and defensive income objectives for our clients.

So, what does the Sustainable Credit Fund seek to deliver? Investors have a need for defensive income and high-quality instruments that are efficient from a risk and reward perspective. The Sustainable Credit Fund is positioned in the sweet spot between traditional cash and fixed interest and more volatile asset classes. It's seeking to provide additional yield while retaining a focus on defensive characteristics, capital preservation, and liquidity.

We do this through actively managing predominantly a portfolio of Australian high-quality credit, but what's unique about the fund is that at least 80% will be allocated to sustainable and/or impact investments, with a focus on environmental and social themes that resonated most with the Australians' hearts and minds that we spoke to.

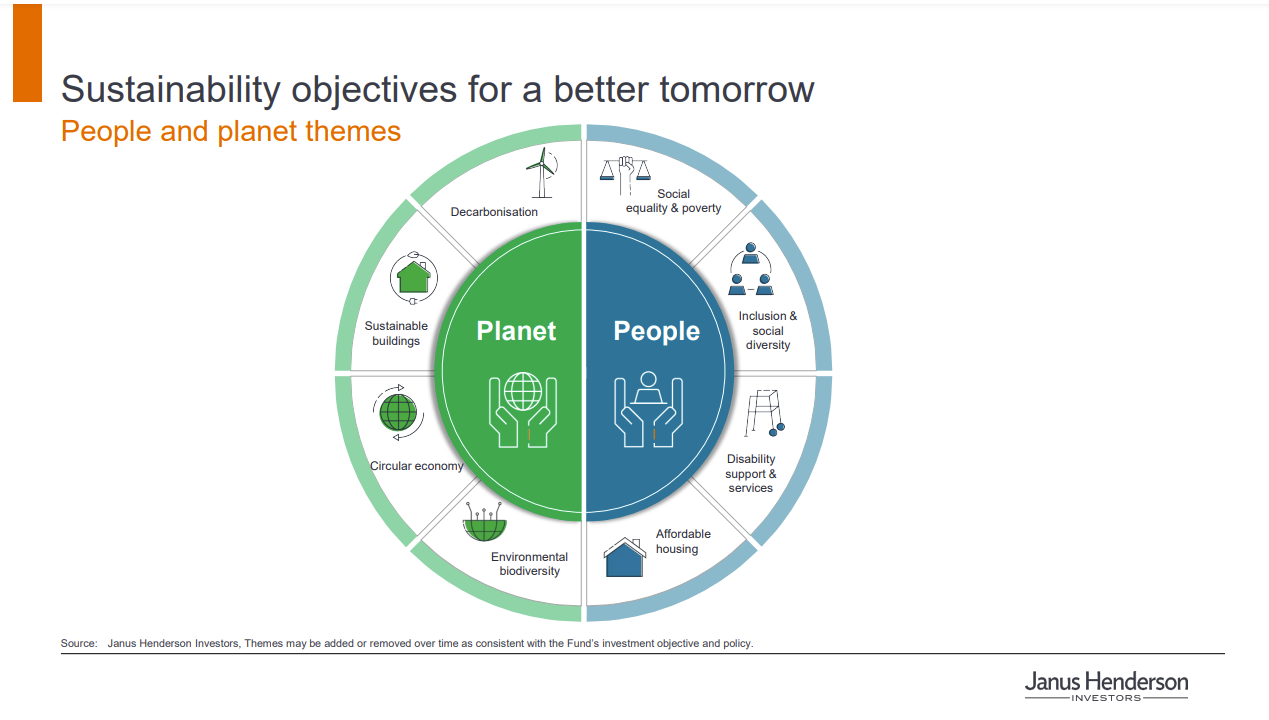

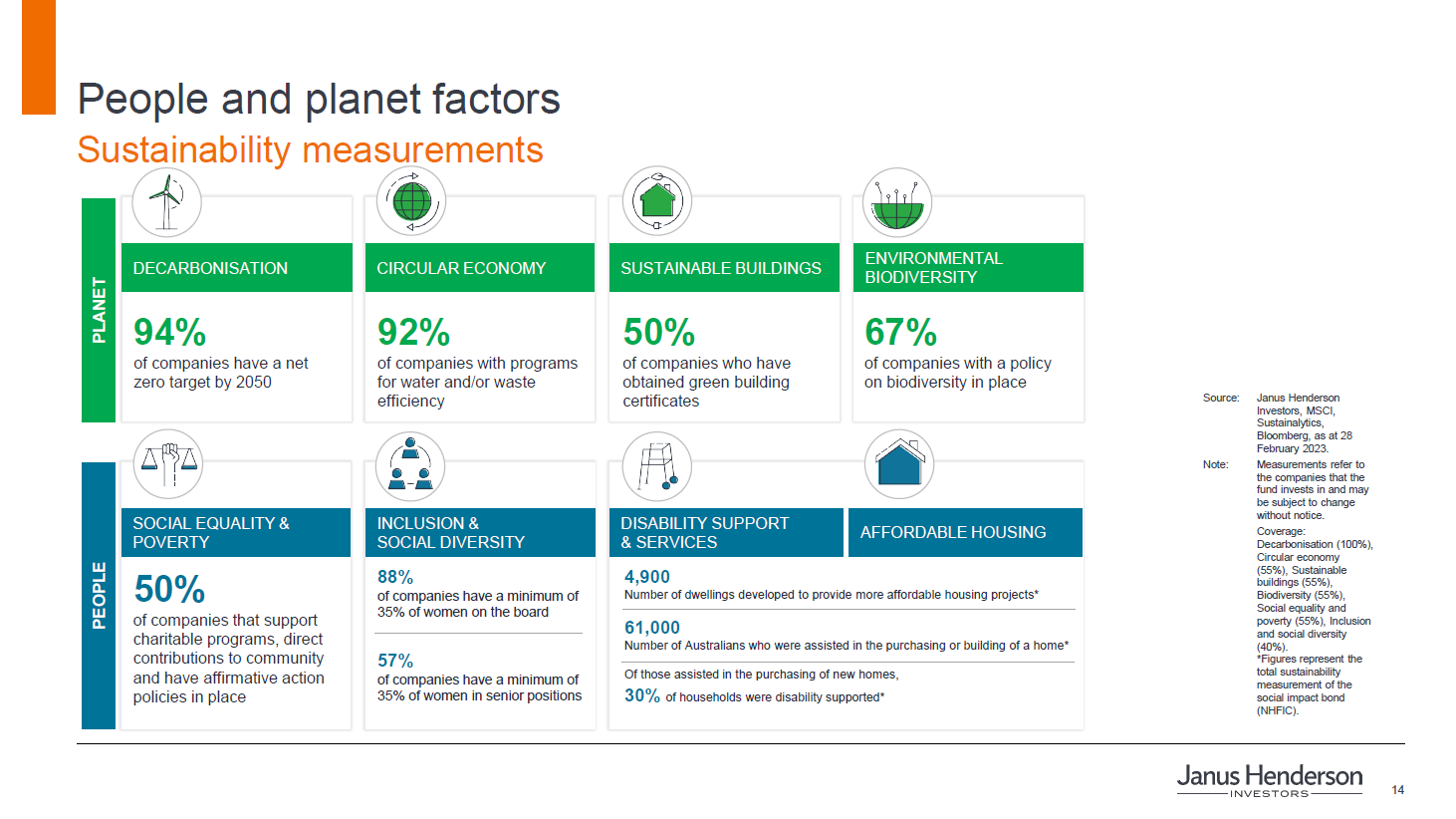

The fund invests in securities that aim to positively contribute to planet and people themes. These themes are currently focused on decarbonisation by targeting issuers that are pushing forward with the transition to net-zero by 2050. They also focus on sustainable buildings, which include the design, construction and operation, as well as the deconstruction of the built environment. We also want to aid the circular economy. We want to seek out companies committed to recycling, using recycled materials and sustainable materials, as well as reducing their waste to landfill and reducing their water usage. We also have a focus on promoting and protecting environmental biodiversity.

When we think about the people side, we're really looking to support social equality, as well as alleviating poverty. So this can be done by investing in social bonds or alongside issuers who are really addressing wealth, income, gender, or race inequality issues. This is often done through the provision of education, food security, water security, and access to shelter. We also want to encourage inclusion and social diversity as well as provide support for disability and services. And last but not least, as Australia suffers through a rental accommodation crunch, we really want to assist in promoting affordable housing.

So, this focus on sustainability is paired with our tried and tested approach to active fixed interest management. We really believe in being active and we've witnessed over multiple market cycles and decades the value that we can deliver for clients through active management. We understand the role that fixed interest plays in your portfolios, and we focus on quality and capital preservation. Each investment is vetted by our local investment team where we focus first on the return of your capital and then focusing on the return that we can generate on that capital. We also believe that diversified strategies and a medium-term strategic view provide clients with a smoother journey through the market cycle.

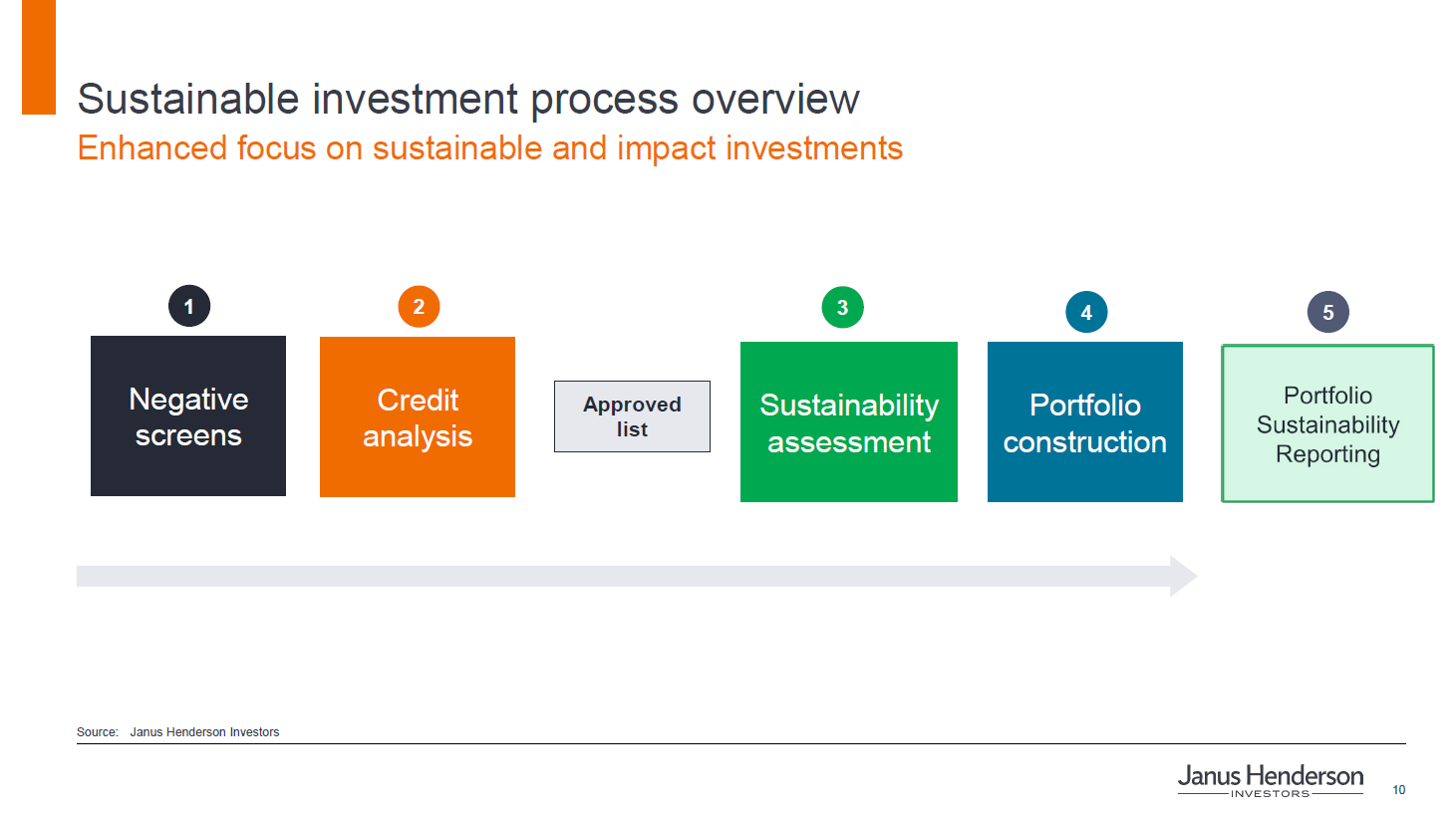

So, how do we do this? For this fund, we seek to avoid exposures in harmful activity, and this is achieved through negative screens on tobacco manufacturing, controversial armaments and adult entertainment. In addition, we use revenue-based screens if companies have 10% or more of their total or gross revenue that is sourced from controversial fossil fuels such as thermal coal, alcohol production, gambling revenues or operations, and tobacco distribution. Our focus on quality and capital preservation is really delivered by our bottom-up rigorous company analysis. We employ a hard-gated approach to inclusion in our investment universe, where we can only buy stable and sustainable credits for our portfolios. We believe this protects investors from downgrades and any potential losses from defaults.

We then perform a sustainability assessment that assesses the key industry ESG risks, the core product or service that the companies are offering, as well as the alignment of their activities and operations to our sustainability themes. Then, and only then, do we select for inclusion companies and securities that identify as having sustainable practices and/or the ability to have a net positive impact on our people and planet themes, as well as being able to generate excess returns.

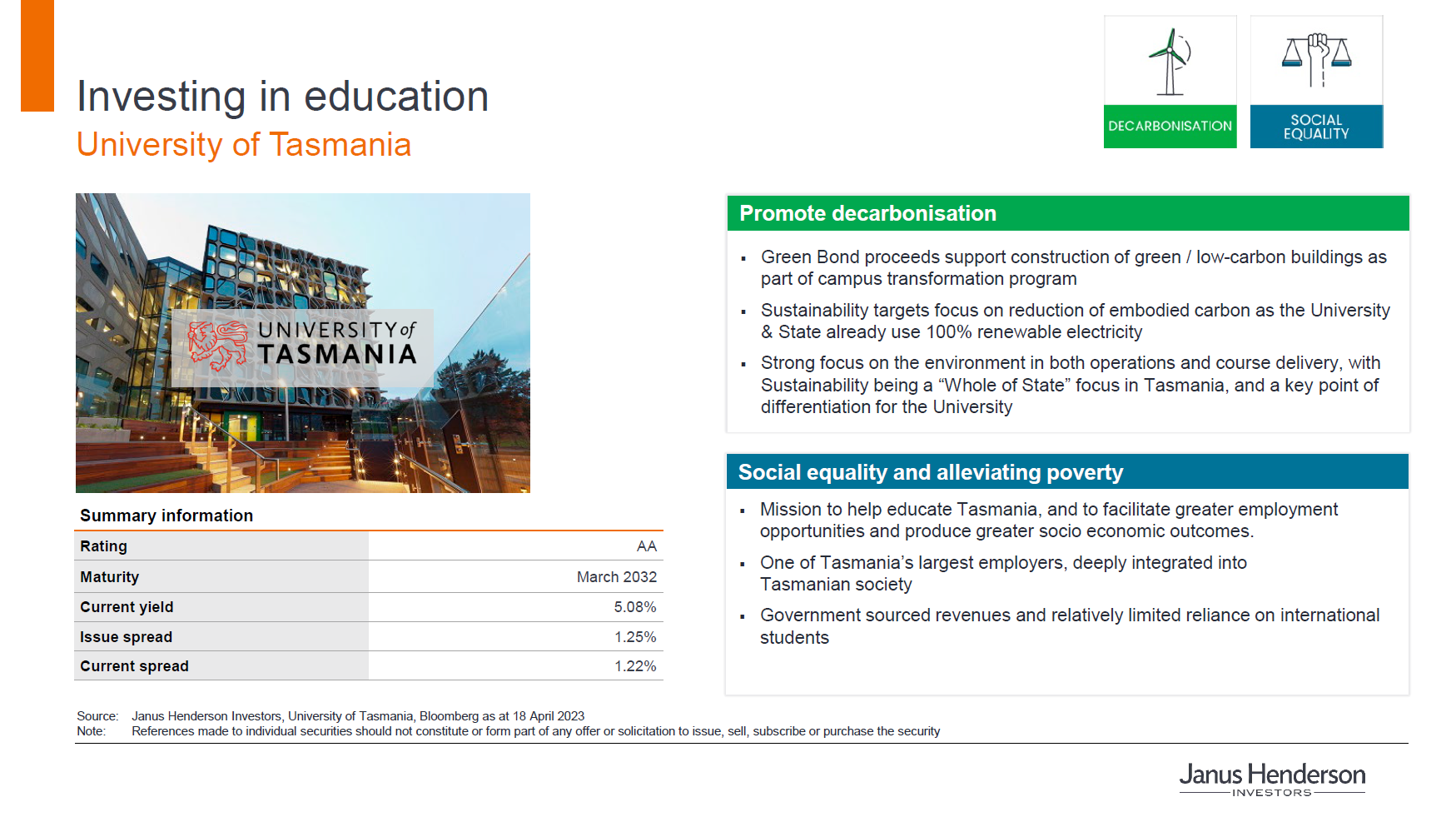

So, let's bring this to life with one of the fund's favourite investments, which is in the University of Tasmania, via one of their green bonds. Now, the University of Tasmania has a mission to educate the state. It's traditionally a state with lower socioeconomic outcomes and has suffered higher periods of unemployment. It has a AA-rated credit quality, so it is of high quality, and it has government-sourced revenues. And it's integral to the Tasmanian state as one of their largest employers and educators. This bond provides investors an attractive all-in yield as well as a pickup versus government bonds. But what we really liked when we engaged directly with the university is they've demonstrated cultural alignment to our sustainability themes.

If we think about the people perspective, during COVID, when there were mass job layoffs across the sector, this university chose to retain all of their key education staff. Those staff then in turn contributed and donated part of their salaries to help support those in need at the time, be it students who were locked in from border lockdowns or just those in the local community who needed support. They also opened the doors to their student accommodation to those in need of shelter.

On the planet side, the university has been certified carbon-neutral since 2016, and sustainability is a core part of the coursework that they offer their students. And via their green bond, they committed to the next step, which is promoting the use of sustainable building materials and practises, the reuse of existing building elements, as well as sustainably-sourced materials. So on the planet side, you can see how this aligns with decarbonization and sustainable buildings. And on the people side, you can see how they are focusing on social equality as well as alleviating poverty.

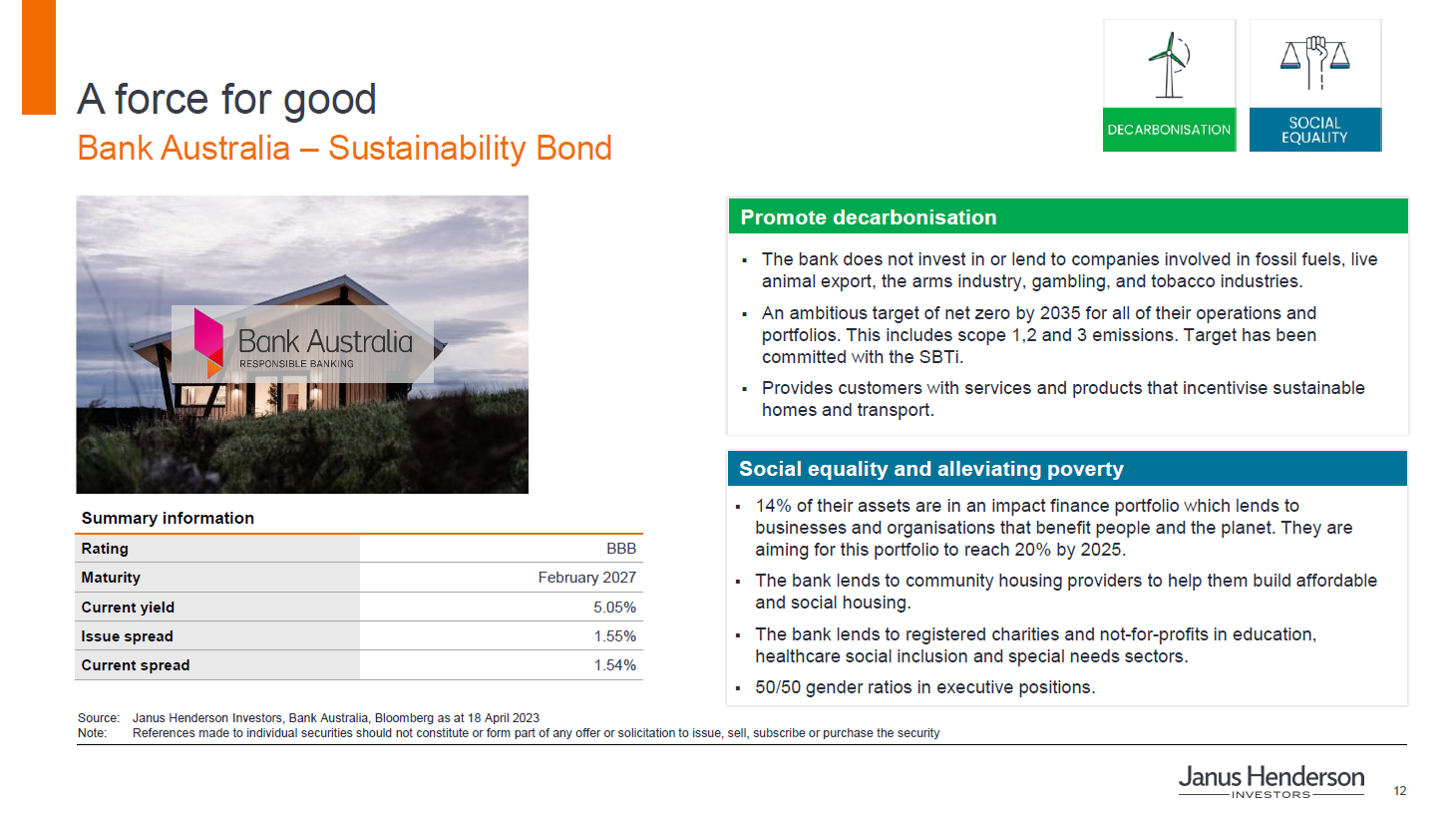

Now our next example, despite bank bashing being a national sport in Australia, we still think we can invest within the banking sector while promoting sustainable finance. And one of the examples we're going to use is via Bank Australia, which has the vision to be a force for good. The bank does not invest in or lend to companies involved in fossil fuels, live animal export, the arms industry, gambling, or tobacco production. It also has an ambitious target to be net-zero by 2035 for all of its operations as well as its portfolio assets. Importantly, this includes scope one, two, and three emissions. The bank lends to community housing providers to help them build affordable and social housing, as well as the not-for-profit sector in education, healthcare, social inclusion, and special needs sectors. They also have an impact finance portfolio, which really incentivizes sustainable homes as well as sustainable transport, and they're targeting 20% of their portfolio to be in this by 2025.

Now, also as a mutual, the bank does not pay dividends. It returns its profit to customers via the form of more-competitive rates, as well as fairer fees, and I'm sure that's something we could all appreciate right now. Meanwhile, investors can generate higher yields on these sustainable bonds above and beyond what other major banks and other regional banks are paying.

So these are just two examples of the fund's investments, but if we look more broadly, what do investors end up with? They get a diversified allocation to high-quality credit, which has been screened for harmful activities. Investments are vetted for strong credit quality as well as their sustainability credentials. We'll have a minimum of 80% allocation to sustainable and impact securities as assessed by our experienced team and aligned with our sustainability objectives. It also offers a healthy yield advantage above market benchmarks, and you'll be guided by a manager who's navigated through multiple market cycles.

We'll also collate and report the relevant sustainability metrics as it relates to our planet and people themes. This may include company net-zero targets, portfolio carbon intensity, measures of diversity, and support generated for affordable housing and disability services.

So, in summary, we've addressed a need in the market for a sustainable credit solution, which provides attractive levels of income while aligning with social goals. We think the time is right in the market with attractive yields now on offer for investors, as well as the growth of the sustainable debt market evolving. You're also investing with a proven investment team with a successful and long track record. The fund can be found on the ASX, listed under the ticker GOOD, as well as an unlisted managed fund. If you'd like to find out more, please contact your Janus Henderson sales representative or visit our website, janushenderson.com/GOOD, and let's invest in a brighter future together.

3 topics

1 fund mentioned

1 contributor mentioned