The long-term prospects of natural gas and midstream assets

In October 2020 we published a Global Matters article, Decarbonisation and the infrastructure investment opportunity, in which we discussed how investors wanting to be part of the decarbonisation investment thematic should look to infrastructure as a means of participating. While the speed of ultimate decarbonisation remains unclear, there appears to be a real opportunity for multi-decade investment as every country moves towards a cleaner environment. That article was an introduction to the decarbonisation thematic, and set a framework for follow-on pieces exploring, in more detail, the infrastructure investment solutions in aspiring to global Net Zero emissions by 2050.

In this article, Peter Aquilina (senior investment analyst and head of ESG) analyses what this goal means for natural gas demand in the long term; and discusses how 4D analyses and values oil/gas midstream assets, considering both the risk and opportunity as we move towards Net Zero.

1. Paris Agreement commitments

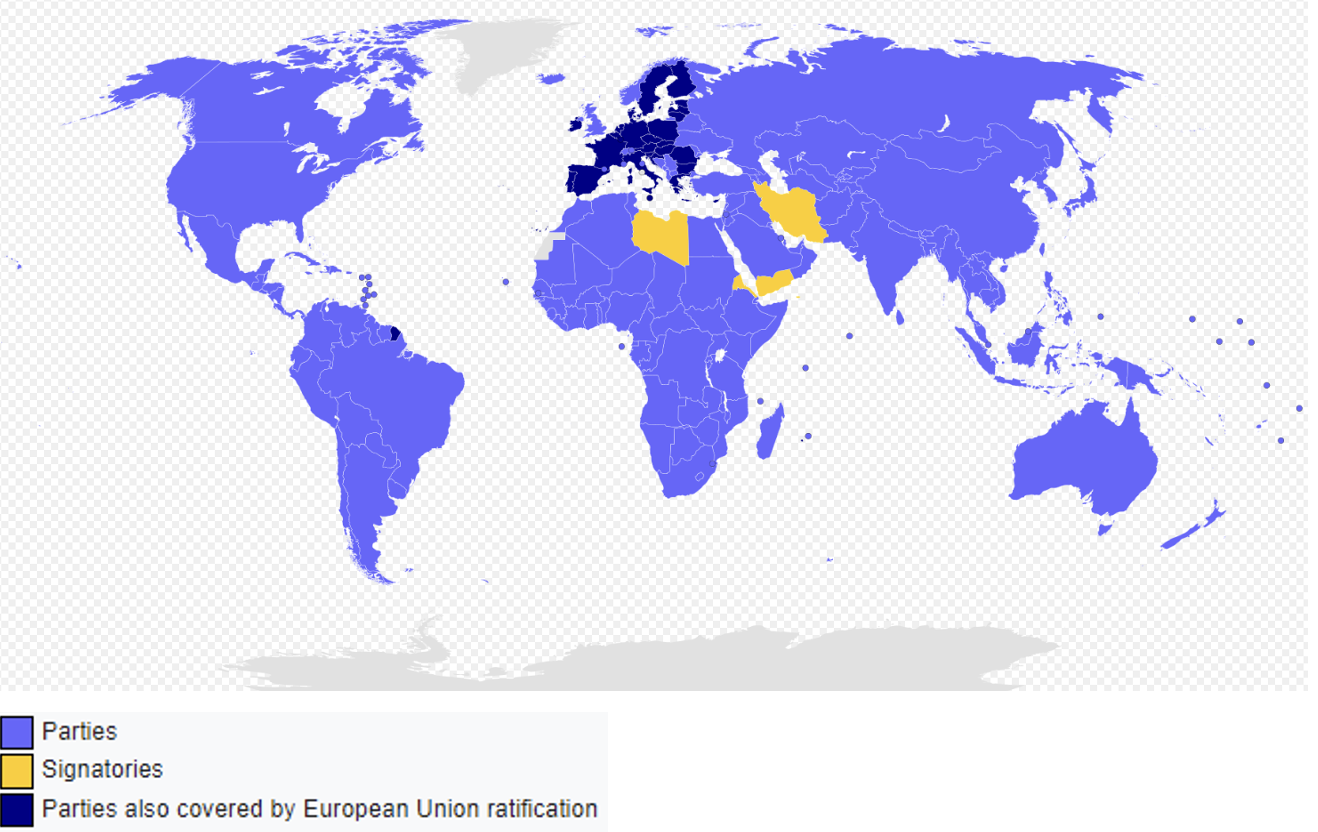

The headline goal of the Paris Agreement is to limit global temperature increases to well below 2°C, preferably to 1.5°C, compared to pre-industrial levels. To achieve this goal, parties to the Agreement aim to reach global peaking of greenhouse gas (GHGs) emissions as soon as possible, so as to achieve a balance between anthropogenic emissions by sources and removals by sinks of GHGs (1) in the second half of the century. Broadly speaking, signatories to the Paris Agreement are looking for Net Zero emissions by 2050.

As of November 2021, 193 states and the European Union are parties to the Paris Agreement (a further four countries are signatories, but are yet to ratify the agreement). These parties to the Paris Agreement cover approximately 98% of the world’s human-made emissions – a depiction is shown below.

Chart 1: Parties to the Paris Agreement

Source: Wikipedia, accessed 4 May 2022

Many countries outlined their current Net Zero plans at the recent UN Climate Change Conference (UNCCC) in Glasgow (GOP26) in late 2021. Within these plans, most countries also outlined interim decarbonisation commitments for 2030. These interim targets are intended to provide a more tangible medium-term target for countries to establish detailed plans and to indicate the pace of GHG emissions reduction.

Albeit the pace of decarbonisation between now and 2050 is still unclear, there seems to be widespread political support to achieve Net-Zero. This will no doubt create a strong push to decarbonise economies globally, providing opportunities and risks for investors, especially for certain infrastructure sub-sectors, such as midstream oil/gas.

The rest of this article looks at how 4D balances this opportunity with risk for this sector in particular.

2. Balancing conflicting challenges

With roughly 25% of all global emissions coming from electricity generation alone, it’s clear the energy sector is central to achieving a Net-Zero goal. However, this goal cannot be viewed in isolation, and energy market participants must balance carbon reduction strategies with other social obligations.

In summary, we believe there are three main targeted outcomes for energy market participants as they seek a balance between energy transition, political goals, and customer satisfaction.

- Power needs to be affordable to customers;

- The delivery of power needs to be reliable and consistent; and

- GHG emissions need to be removed or offset in the shortest time possible.

An additional consideration is to support economic growth, predominantly through employment and investment. The balancing of these factors may vary depending on the perspective of the individual or government. However, these three (or four) targets are typically prescribed by all energy market participants and stakeholders.

3. Benefits of natural gas to energy markets

Natural gas has inherent qualities which support the above targets of affordability, reliability and GHG reduction.

- Versatility – natural gas power generators can technically be turned on and off quickly as compared to other baseload power sources such as nuclear and coal. This makes peaking gas generators a strong complement to support renewable power generation and ensure the ongoing security of supply.

- Storable – natural gas can be stored in underground salt caverns in large volumes for long periods of time, which also makes it a strong complement for renewables.

- Transportable – natural gas can be transported within existing pipeline infrastructure, or can be converted into a liquid by cooling to -162 degrees Celsius and transported by ship/rail, even internationally.

- Plentiful – natural gas is relatively plentiful and available in many geographic locations, with the International Energy Agency (IEA) estimating that there are enough recoverable resources to last around 230 years.

- Affordable – according to Lazard investment bank research (2), the most efficient gas-fuelled power generator has an all-in cost (as measured by Least Cost of Energy (LCOE)) of between US$44 – US$73 / MWh, which is the lowest of fossil fuels (coal generation between US$65 – US$159 / MWh);

- Cleaner – burning natural gas results in fewer emissions of nearly all types of air pollutants than burning other fossil fuels. Natural gas generation releases about 117 pounds of CO2 million British thermal units (MMBtu) equivalent compared with more than 200 pounds of CO2 per MMBtu for coal, and more than 160 pounds per MMBtu for distillate fuel oil (3).

The above attributes make natural gas an important transitory energy fuel in maintaining reliability and affordability for customers as the world transitions away from GHGs. It is on this basis that we expect to see significant ongoing global demand for natural gas and the assets that transport it.

4. Long-term prospects for natural gas

Forecasts of the pace of GHG emissions reduction, and demand for natural gas in the long term, can be fraught with error and/or bias. A number of stakeholder groups have commissioned their own studies and forecasts from various consultants, which may cynically have a pre-determined goal that needs to be supported by the analysis. It is impossible to determine which, if any, forecast will be correct, and it is often difficult to understand if any particular forecast has inherent bias assumed within it.

Based on the views and forecasts of independent industry agencies and energy consultants, we are confident that natural gas will have a role to play in the energy mix in the very long term. Based on our review of a number of forecasts and studies, we are of the view that:

- Achieving Net Zero emissions AND maintaining global temperature increases to 1.5°C by 2050 is becoming optimistic, if not unrealistic, due to the limited progress in setting and/or achieving national short/medium-term decarbonisation targets.

- There could be some decline in natural gas demand by 2050, although the magnitude varies widely between decarbonisation forecasts. A more aggressive, yet reputable Net Zero scenario developed by the International Energy Agency (IEA) implies a 39% reduction in volume demand compared to 2020, while others assume very little demand erosion.

- There is unlikely to be a significant reduction in natural gas demand by 2030.

5. What does this mean for the long-term prospects of the midstream sector?

At 4D Infrastructure, we define the ‘midstream’ sector as the infrastructure used in the transportation, storage, extraction and refining of natural gas, natural gas liquids (NGLs) and crude oil. Midstream is the ‘glue’ between upstream E&P and downstream distribution.

With the transportation of oil and gas remaining the core business of midstream companies for the reasons discussed above, we see a longer ongoing demand profile for those transporting gas. However, there are also potential future opportunities for companies to re-use (and re-purpose) their assets and expertise in a Net Zero world. The expertise of midstream management teams in managing energy infrastructure is easily transferable to no/low carbon fuels. In addition, the prominent position of terminals in industrial hubs and pipeline assets in connecting demand centres provides a good basis for utilisation for low/no carbon fuels such as hydrogen, CO2 from CCUS, renewable natural gas (RNG), and other biofuels.

Taking all of the above into consideration, we believe the core business for the midstream sector in transporting oil/gas is almost certain to be maintained through the period to 2030. Further to that, even assuming aggressive decarbonisation scenarios, there is still likely to be utilisation of select midstream assets in 2050 and beyond.

Beyond this, there is the opportunity for companies to reposition their business and re-use their assets and skills for low/no carbon fuels. Midstream assets connected to oil/gas basins with economic and geographic competitive advantages, and to demand centres (domestic and international), are likely to be heavily utilised in the long term. This doesn’t consider the potential for assets to be repurposed to carry low/no carbon fuels such as hydrogen, CO2 from CCUS, renewable natural gas (RNG) and other sustainable biofuels.

6. 4D’s approach to investing in midstream gas assets

We believe that midstream companies satisfy our definition of infrastructure, although their specific characteristics could put them more at risk of being stranded in the very long term (> 2050) under some aggressive Net Zero scenarios. However, even under aggressive decarbonisation scenarios, midstream companies with strategically placed assets connecting the lowest breakeven cost, natural gas basins are likely to be heavily utilised in 2050 and beyond.

Some of the due diligence and valuation considerations adopted by 4D in selecting the best midstream names in the sector and valuing them appropriately include:

- Adopting a base case in valuation models assuming that Net Zero is achieved to some degree by 2050 (global temperature growth is maintained at or below 2°C).

- Strong preference for midstream companies that operate in natural gas directed basins – natural gas is often a by-product of exploration & production (E&P) companies drilling for crude oil. The decision around continued production is based on the economic value of crude, so this production is often cut when the economics for crude production are not satisfied.

- Adopt conservative assumptions – only incorporate growth assumptions for contractual price uplifts and associated with development projects that have been secured by management. Do not include any market growth associated with long-term forecasts.

- Not valuing ‘blue sky’ opportunities – opportunities for midstream companies to re-purpose assets for utilisation with low/no carbon fuels is only in its infancy, and although a great opportunity, it is not currently being significantly valued in our models.

- Conservative terminal value assumptions – acknowledging the uncertainty for growth associated with any fossil fuels beyond 2050, and its impact on earnings of midstream assets, we adopt conservative terminal value assumptions.

- Scenario analysis – run scenario analysis within models to determine the impact on valuations under a number of different decarbonisation trajectories.

- Due diligence for competitive advantages – develop a strong understanding of the competitive advantages of the various gas supply basins and which are likely to continue to be economic for E&P producers in a potential low demand, low price environment. This provides confidence in utilisation post-2030, as gas prices potentially decline in line with reduced demand.

Alternatively, we look to understand which arterial pipelines are likely to be utilised in connecting demand centres and export terminals in the long term. Interconnection of assets from the wellhead to demand centres and export terminals ensures utilisation throughout the value chain. Quality assessment – we undertake a detailed quality assessment, which incorporates an assessment of the quality and competitive advantages of company assets (point above), but also contractual defensiveness, ability to transition the business model into low/no carbon fuels, management quality, and financing position. This all provides insight into the sustainability of the business model.

7. Preferred names in the midstream sector

Taking the above points into consideration, 4D has a preference for midstream names, such as Williams Co (WMB-US) in the US, and Snam SpA (SRG-MI) in Italy.

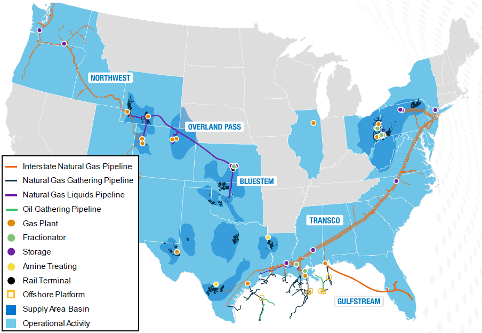

Williams Co

Williams is a major midstream company in the US primarily focused on transporting and processing natural gas and NGLs. The key competitive dynamic of Williams is the location and interconnectivity of its asset base, which connects some of the most economically advantaged natural gas supply regions in the world to US domestic and global markets. This asset base is depicted below.

Chart 2: Asset map for Williams Co

Source: Williams Co website

This broad asset footprint is expected to drive significant organic growth in the short to medium term while management are identifying investment opportunities that support the energy transition to a low carbon future – investing in renewable energy, RNG and exploring hydrogen. Management has communicated short-medium term growth in EBITDA of 5-7% driven by investments, but 4D assumes no growth thereafter, except that incorporated in contracts.

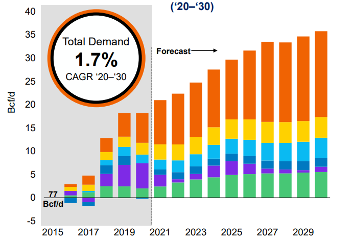

The competitive advantages of assets, and interconnectivity through the value chain, combined with contractual protections provide Williams with strong earnings resiliency. Operating in economically advantaged basins also means that as gas demand and price reduce post-2030 in a Net Zero scenario, the volume demand from these basins is unlikely to be impacted with less economic supply de-commissioned first. These combined traits provide strong volumes protections for Williams in a Net Zero scenario over the long term. Below is a depiction of the drivers of natural gas demand in the US to 2030 developed by Wood Mackenzie, which shows healthy growth for the next decade at least.

Chart 3: Natural gas demand drivers in the US

Source: Wood Mackenzie 1H21

The combination of opportunities for organic, strong return growth; long-term earnings protection; a strong management team; and opportunities to participate in energy transition makes Williams a high-quality investment opportunity for 4D. Incorporating conservative base-case assumptions, Williams’ strong five-year IRR valuation in the mid-teens (based on a share price of USD 34) and its EV/EBITDA discount to peers make it an attractive investment proposition for 4D.

Snam SpA

Snam is the owner of Europe’s largest gas transport and storage network, and one of the largest globally. Its transport network extends over 41,000km, including international assets and ~20bcm of storage capacity. Its main asset is the Italian gas transmission network, which is regulated given its monopoly position. The company benefits from a supportive regulator, high inflation-protected regulated returns vs continental peers, minimal volume exposure and long-term visibility on investment plans.

In its most recent strategic plan, the company forecasts a 6-8% EBITDA growth rate out to 2030, with RAB growth accelerating in the latter half of the decade, from >2.5% to 2025, to >3.5% from 2025-30.

SNAM has been the most prominent advocate of hydrogen (and other green fuels such as biomethane) in Europe over the last few years. Their RAB growth acceleration in the back half of the decade (to >3.5%) is attributed to expected approved investment, related to the national Italian plan for hydrogen called ‘the Hydrogen Backbone’. Given green hydrogen’s dependency on low-cost renewable energy, SNAM benefits from its Southern European position close to North Africa, where the region’s excellent solar resource could make it one of the most competitive green hydrogen production areas for European consumption. Ultimately, the hydrogen backbone would allow low-cost green hydrogen to be transported to those areas with the highest demand, such as Germany.

Amidst the recent Russia / Ukraine conflict, and subsequent RePower EU plans (to wean Europe off Russian gas), the long-term competitive positioning of SNAM’s assets has strengthened, given its ability to diversify European natural gas supply from MENA and Central Asia via its pipelines, as well as using its LNG import infrastructure.

Given our conservative approach to valuation, these additional opportunities outside of core regulated investment are generally excluded from our base-case assumptions, until regulatory approval is provided or final investment decisions are undertaken. The company already has an attractive fundamental cash flow valuation, which means these opportunities represent potential upside to our current forecasts.

8. Conclusion

There is significant uncertainty as to whether the globe will be able to maintain global temperature increases to ‘well below’ 2°C in line with the Paris Agreement. Despite the communicated target of most countries, the challenges to achieving this goal are great.

Irrespective of the world’s long-term carbon trajectory, most industry forecasts assume that natural gas has a role to play in the long-term global energy mix. Even assuming aggressive GHG reductions are achieved, and the globe is able to maintain temperature increases to below 2°C, natural gas volumes are still expected to be significant in the longer term.

This is because 1) developing nations will still likely utilise natural gas after 2050 for energy production, and 2) natural gas will be used in combination with CCUS, carbon sinks and in the creation of blue hydrogen.

Therefore, based on the continued demand for natural gas, the business model of midstream infrastructure names focused on processing and transporting natural gas is likely to be maintained. There is further potential upside from repurposing midstream assets for use with hydrogen, CCUS, RNG, biofuels and other renewable fuels, which many companies are starting to explore.

4D adopts a cautious approach to investing in midstream oil/gas companies. We undertake significant due diligence regarding the quality of companies and their competitive advantages in the processing and delivery of natural gas. We also adopt conservative base case assumptions with regard to growth and terminal values and undertake scenario analysis to understand the breadth of potential valuation outcomes. They also must adhere to strict ESG standards and stack up against their infrastructure peers on an overall quality basis. In doing this, we believe the investment proposition of specific midstream names is attractive.

Invest across the globe

4D Infrastructure, a Bennelong Funds Management boutique, invests in listed

infrastructure companies across all four corners of the globe. For more

insights on global infrastructure, visit 4D’s website.

2 topics

1 fund mentioned

1 contributor mentioned