The looming French presidential election & what it means for global infrastructure

The French presidential election is underway, with a first-round vote on Sunday 10 April and the run-off between the top two candidates on Sunday 24 April. In a likely replay of 2017, the polls suggest incumbent President Emmanuel Macron will face far-right candidate Marine Le Pen in the run-off.

In this piece, Gaspard Bidot (Investment Analyst at 4D) considers some of the key issues at play and the implications for us as infrastructure investors.

Meet the candidates

From far-left to far-right, there are 12 official candidates for the election.

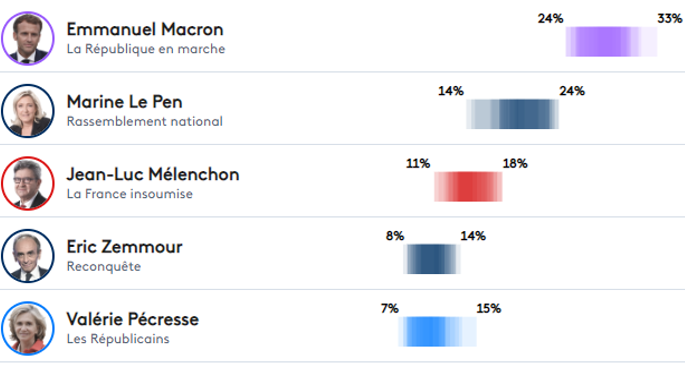

As of 2 April, opinion polls are placing Emmanuel Macron ahead with 24% to 33% of vote intentions, with the other candidates fighting for the runner-up position.

Key policy positions

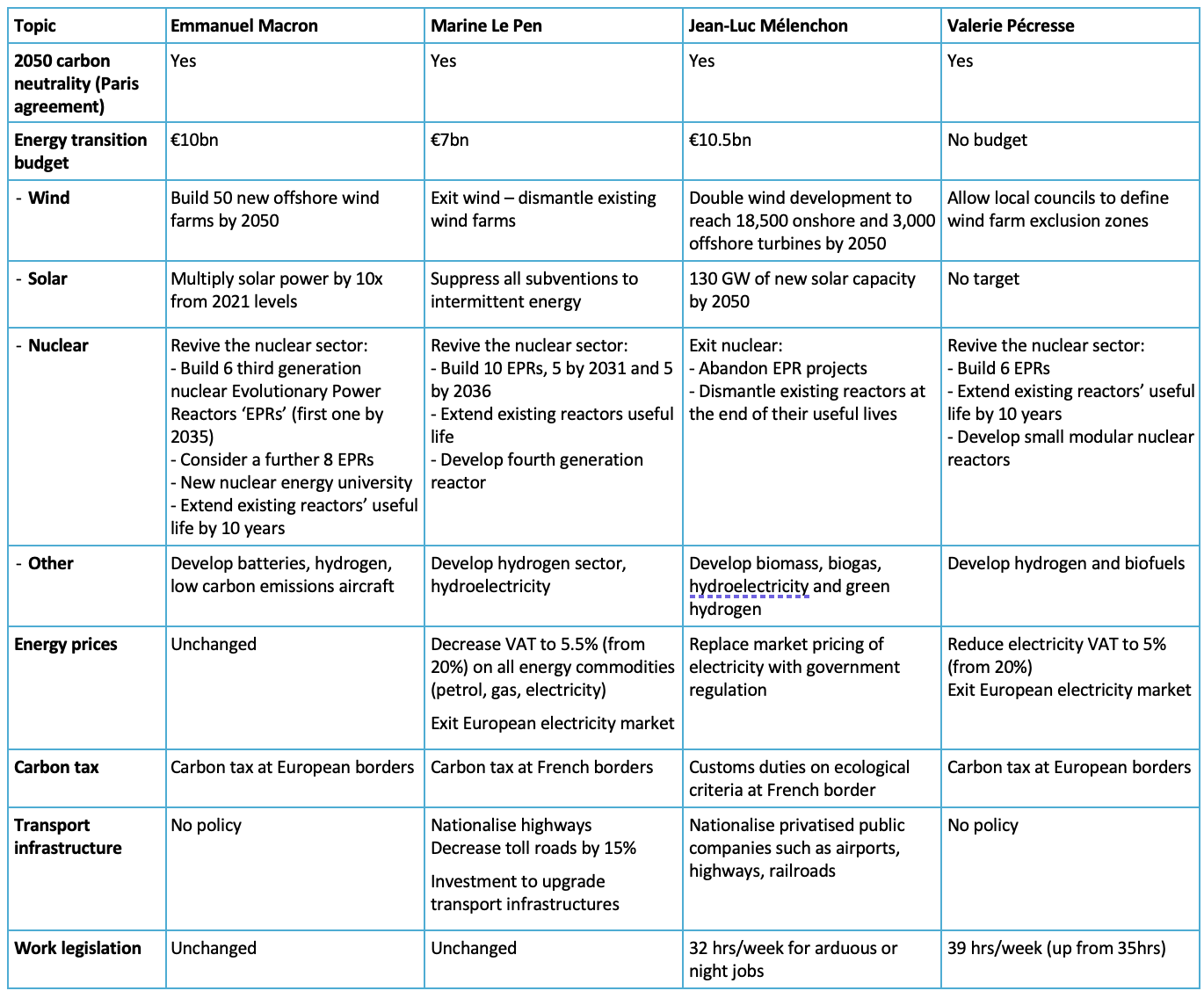

The table below summarises the key policy positions of the four leading candidates and how they may impact the current and potential future infrastructure investment environment.

Impact on infrastructure investment

In terms of sector specifics, energy/climate policies have dominated the campaign with all candidates expressing a view – albeit quite different ones – around need, support, funding and timing of the energy transition. These policies represent potential head and tail winds for the infrastructure sub-sectors exposed, but overall it means significant investment in the sector, potentially creating many future private sector investment opportunities.

Outside the energy space, the argument of private versus public ownership of the transport sector has again come into play and could have ramifications for those stocks exposed, such as Vinci, Atlantia and ADP.

A second Macron term

A Macron win would not alter the fundamental outlook for the infrastructure sector relative to today. However, it will cement a positive infrastructure investment cycle with more than €10bn of investment towards energy transition and Russian gas independence.

The pace to renewable energy as base load power could also accelerate and benefit renewable operators such as Neoen, Voltalia, Orsted. We would expect further integration with Europe in terms of security of energy supply benefiting the integrated players.

We have also seen a shift in thinking around nuclear. We expect Macron, in a second term, to revive what had been an out-of-favour sector with important investment packages to both extend the life of existing plants and develop new generation reactors (to the benefit of Engie, EDF or Vinci).

Outside the energy sector, we believe the current motorway network concessions could be extended in exchange for capital expenditure commitments, supporting improved motorway efficiency and growth profiles of the key players such as Vinci or Atlantia.

A Le Pen win

Le Pen has dropped her controversial proposal to exit the euro, which we believe reduces the risk to the overall French economy relative to 2017.

Due to the extreme nature of her economic positions, a Le Pen victory would lead to clear winners and losers in the infrastructure space.

The biggest threat from a Le Pen victory would be the nationalisation of assets of listed entities with toll roads and airports clear targets, which would be detrimental to domestic listed players such as ADP and Vinci as well as foreign players with exposure to French infrastructure. Regardless of whether nationalisation is a serious threat (legally or otherwise), it would be a clear overhang for the sector – much like a potential Jeremy Corbyn victory was for the UK in 2019. Even without nationalisation, in a Le Pen victory the infrastructure sector will likely experience stricter sector regulation (as far as it is possible within the concession construct).

Positively, Le Pen has expressed a willingness to pursue the energy transition. However, certain sectors are definitely not in favour (wind), and she would push for limitation of the EU influence on French energy policy.

Conclusion

We are expecting a Macron/Le Pen run off with Macron ultimately re-elected for a second term. However, unless Macron can also win a majority in the parliament, we could see a fragmented legislature with increased difficulty in policy execution stalling reforms. Regardless of who wins, we see continued positive momentum in energy transition and investment as all parties work towards this common goal, and more of a status quo for the transport names with existing earnings underpinned by long-term concessions. Should Le Pen win, we would revisit our transport exposure in the near term.

Invest across the globe

4D Infrastructure is a Bennelong Funds Management boutique that invests in listed infrastructure companies across all four corners of the globe. For more insights on global infrastructure, visit 4D’s website.

3 topics

1 contributor mentioned